- Top

- Column list

- You can raise money right away! Thorough explanation of the topic "factoring"!

すぐに資金を調達できる!

話題の「ファクタリング」を徹底解説!

How to raise money. It is no exaggeration to say that SME Even though it is in the black, it is difficult to payment, but it is not possible to receive loans or capital increases, and there are many companies that close their crying businesses. If I could raise the funds ... "Factoring" is a service that responds to the voices of such managers. There are plans to amend the law, and it is expected to be a financing method in the Reiwa era, but what kind of service is it? This time, I will thoroughly explain the factoring that is the topic now.

What is factoring?

finance service in which a factoring operating company purchases accounts receivable held by a company against a business partner, deposits the receivables earlier than the payment due date, and collects the receivables. I will. Accounts receivable are the right to charge for the goods and services provided. In Japanese business practice, "margin trading" is common, that is, the composition is such that goods and services are provided first and the price is paid after a certain period of time has passed. There are many things such as "payment at the end of the month following the end of the month, payment at the end of the month after the end of the month", and the longer the period from the closing date to the payment date, the more "the price has not been collected even though we provided the goods and services". The situation will continue, and companies without financial resources will struggle to raise funds. If you do not get cash immediately, you will not be able to pay labor costs and outsourcing costs because you do not have working capital, and even if you are in the black, you may go bankrupt. "Factoring" is a service that has attracted attention to overcome this situation. With factoring, you can raise money when you need cash right away.

Factoring mechanism

The main factors for factoring are "two-party factoring" and "three-party factoring".

・ Two-party factoring

This is a factoring service based on contract between a company that uses factoring and a company that provides factoring.

・ Three-party factoring

This is a factoring service based on contract between a company that uses factoring, a factoring provider, and a business partner (business partner).

In the case of "three-party factoring" including accounts receivable, the fee for using factoring tends to be lower than that of "two-party factoring". It cannot be denied that there is a risk of deterioration. For this reason, "two-party factoring" has recently been attracting attention. "Two-party factoring" allows you to conclude contract to transfer receivables only by the company that wants to use factoring and the factoring provider. The biggest feature of "two-party factoring" is that the accounts receivable are not involved in the contract There is no need to notify the accounts receivable that the receivables have been transferred.

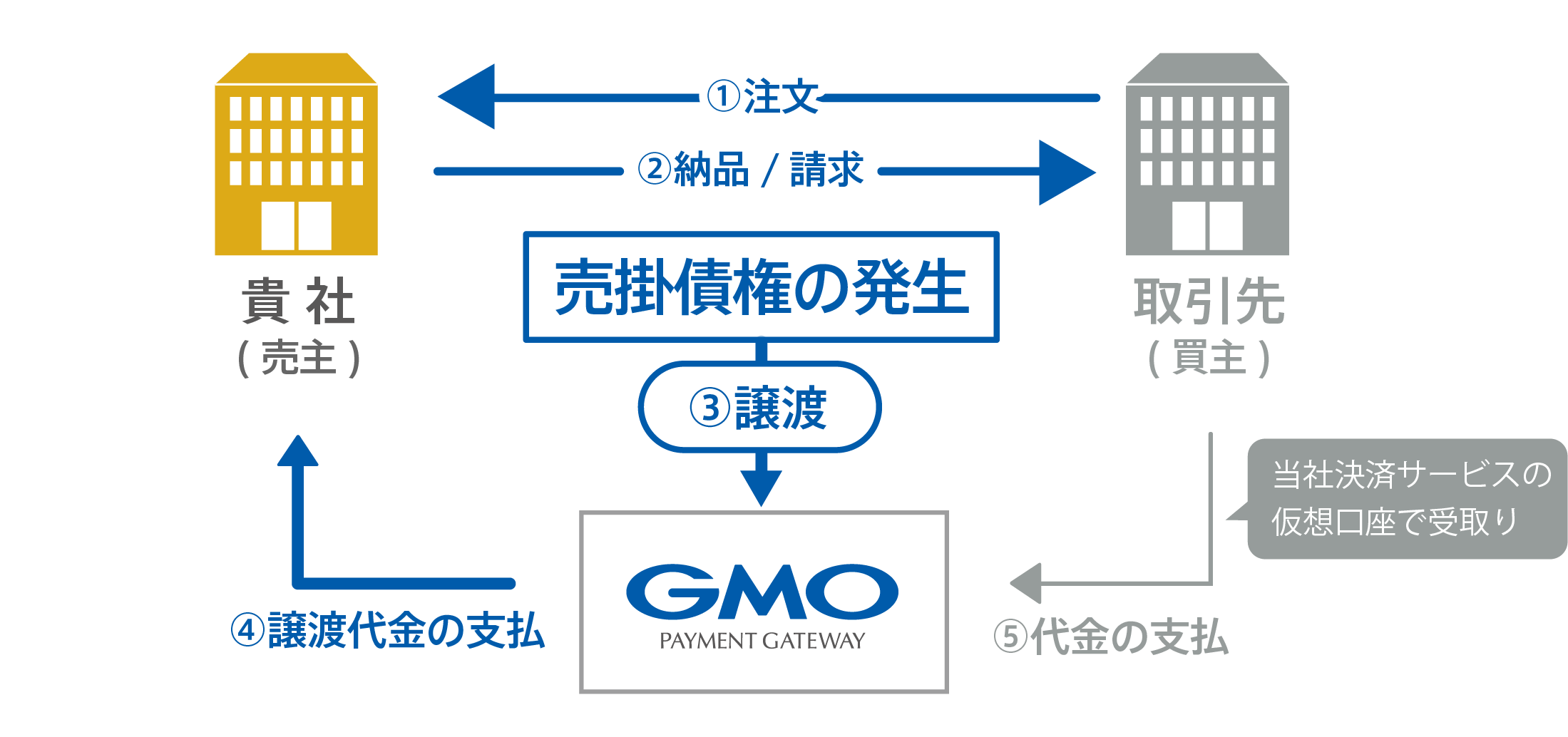

Factoring flow

- ① Accounts receivable are generated

- (2) Transfer the accounts receivable to the factoring provider ⇒ Monetize the accounts receivable

- ③ The accounts receivable pays the factoring provider

なお、GMOペイメントゲートウェイのファクタリングサービス「GMO BtoB早払い(ファクタリング)」なら、万が一、売掛先(取引先)が倒産したり支払遅延などで未払いになったりしても、代金回収はGMOペイメントゲートウェイが行うため、未回収のリスクは軽減されます。

Is factoring safe?

It is said that the current awareness of factoring is about 20%, and there is a survey result (*) that about 80% of them "do not have a good impression". This seems to be largely due to the fact that there are many cases in which the "special agreement prohibiting the transfer of claims" is included in the contract book as a Japanese business practice. However, such a situation is scheduled to change after April 1, 2020. In May 2017, the Civil Code, which was significantly revised for the first time in 120 years, finally came into effect. It clearly states that the non-transferable special provision is invalid. Of course, even at present, it is possible to transfer credits in principle and there is no legal problem, but there were circumstances in which it was difficult for companies to use factoring due to the “special provision prohibiting transfer of credits”. With the major revision of the Civil Code in 2020, factoring is expected to be a new financing method for the coming era.

(*) Source: Infomart Corporation November 2018 Questionnaire Survey Results

The main benefits of factoring

・ Easy to raise funds

金融機関の融資と異なり、資金繰り表や事業計画書の提出、保証人、担保が不要なほか、審査通過も銀行融資と比べると通過率高く、比較的簡単かつスピーディーに資金調達することができます。GMOペイメントゲートウェイのファクタリングサービス「GMO BtoB早払い(ファクタリング)」なら、売掛債権を譲渡してから最短2営業日で入金されます。

・ Cash flow can be normalized

By transferring accounts receivable, accounts receivable can be cashed at an early stage, which makes it possible to deal with sudden shortages of expenses and payments.

・ The balance sheet can be slimmed down

While borrowings from financial institution are recorded in liabilities accounts receivable and cash and deposits, so the balance sheet (B / S) is slimmer than borrowings. It leads to improvement of credit from financial institution

Main disadvantages of factoring

・ In the case of "three-party factoring", it is known to the accounts receivable.

As mentioned earlier, in the case of "three-party factoring" that includes accounts receivable, the accounts receivable will be informed of the use of factoring, which may hinder subsequent sales activities. However, "two-party factoring", in which only the company that wants to use factoring and the factoring provider make a contract, can eliminate the risk known to the accounts receivable.

・ Factoring fees tend to be higher depending on the contract

financial institution it tends to be set higher than the borrowing interest rate in general.

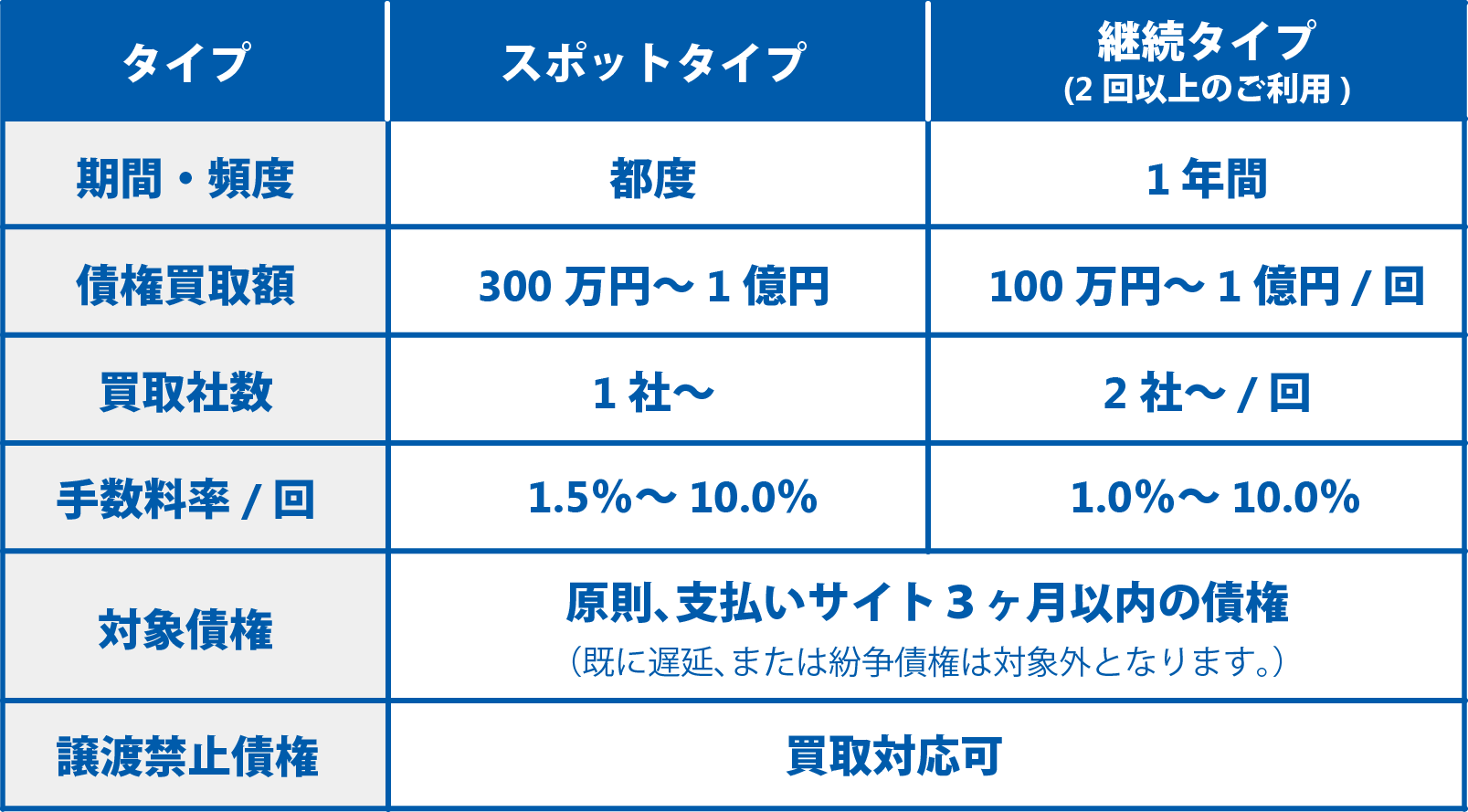

ちなみに、GMOペイメントゲートウェイのファクタリングサービス「GMO BtoB早払い(ファクタリング)」(2者間)の手数料は、ご契約タイプにより異なり以下のとおりです。

GMO Payment Gateway offers factoring services with a fee of 1% to 10%.

financial institution lending and capital increase

Now that we've seen the pros and cons of factoring, let's take a look at how it differs from other funding methods to better understand it. The comparison here is "financial institution loan" and "capital increase".

<Characteristics of financial institution

| Main benefits | Low interest rates, can handle not only short-term funds but also long-term funds |

|---|---|

| Main disadvantages | Examination takes time and effort |

| Fees / interest rates | cheap |

| Examination period | long |

| Collateral / guarantor | Many cases are required |

| Obligation to repay | necessary |

<Characteristics of capital increase>

| Main benefits | You can use your money freely. Suitable for long-term funds because there is no repayment obligation |

|---|---|

| Main disadvantages | It is difficult to receive a capital increase |

| Fees / interest rates | No |

| Examination period | long |

| Collateral / guarantor | Not required |

| Obligation to repay | No |

<Characteristics of factoring>

| Main benefits | Can be cashed immediately |

|---|---|

| Main disadvantages | Fees are high, only short-term funds are supported |

| Fees / interest rates | High |

| Examination period | short |

| Collateral / guarantor | Not required |

| Obligation to repay | No (by transfer of accounts receivable |

・ Comparison with financial institution

The most popular method of raising funds, "financial institution financing," is attractive because of its low interest rates, but it must pass rigorous screening in order to obtain a loan. business plan, prepare collateral and guarantors ... Anyway, the disadvantage of financial institution If you want money right away, it's not so easy.

・ Comparison with capital increase

A capital increase is a method of raising funds by issuing shares of a company instead of obtaining funds. There are various types of capital increases, such as public offerings, shareholder allocations, and third-party allocations, but in any case, you can see the current state of the company, its future potential, its vision, and the personality of its manager. The funds obtained can be used freely and there is no obligation to repay them, but it is not straightforward to receive a capital increase, it takes time, and the procurement cost will increase depending on contract

As mentioned above, the general factoring fee is set as high as 10% to 20% (in the case of two-party factoring, according to our research). Even so, factoring, which has a short examination period because it is a transfer of receivables to be transferred to a factoring provider and can obtain funds quickly without the need for collateral or a guarantor, can be said to be an effective method of raising funds.

Companies that should use factoring

Factoring is available to any company that generates accounts receivable By the way, accounts receivable is particularly high, but they are influenced by the following characteristics unique to the industry.

・ Companies with long payment periods for accounts receivable

accounts receivable deposit site, the harder it is to raise money in the meantime, of course.

・ Companies with high labor costs and material costs

In addition to the above, accounts receivable, various expenses such as high labor costs and material costs must be prepared separately, and there may be a temporary shortage of funds.

・ Companies that suddenly need to raise funds

Factoring is also used in industries that often suffer from sudden shortages of funds due to equipment and equipment failures and seasonally inevitable off-seasons.

For companies that need to raise funds early, factoring, which allows them to quickly monetize their accounts receivable, is an encouraging ally. In addition, companies that cannot receive new loans from financial institution due to reasons such as "risk (change / postponement of repayment conditions)" or "no collateral / guarantor" should consider using factoring.

Know by example. Cases where factoring is often used

Let's take a look at the actual case of GMO Payment Gateway to see why factoring is used.

(1) Dispatched labor business * Amount of receivables sold: 70 million yen

Reasons for using factoring ⇒ Although there is a demand for funds due to business expansion, there is a shortage of unsecured borrowing financial institution Despite the recent increase in sales, traditional financial statement-based screening did not allow it to receive a loan, but factoring funding has allowed it to expand its business.

(2) Food manufacturing industry * Amount of receivables sold: 30 million yen

Reasons for using factoring ⇒ We started trading with major companies, but the deposit site was long and there was a demand for funds. financial institution was already insufficient due to the use of equipment funds, factoring was used to cover the shortage of working capital, and sales are further increasing.

③ Transportation business * Amount of receivables sold: 10 million yen

Reasons for using factoring ⇒ Due to the rapid expansion of the business, there was a demand for working capital after raising a large amount of equipment funds. financial institution is already insufficient, and factoring is used to cover labor costs and funds to be paid to subcontractors.

④ Machine manufacturing industry * Amount of receivables sold: 10 million yen

Reason for using factoring ⇒ It was necessary to pay the outsourcing fee, but the deposit site was long and it was not possible to make financial institution Expanding business using factoring.

Precautions for using factoring

It's a very convenient factoring, but there are some caveats when using it. Let's not fail in factoring so that we can fully enjoy the benefits.

・ Check factoring fees!

Fees vary by provider. Therefore, it's a good idea to check your fees carefully and choose a provider that isn't too expensive.

・ Check the homepage of the factoring provider!

Please check the homepage of the provider company to confirm the reliability of the company. We also recommend that you talk face-to-face with the person in charge.

・ Be sure to check the details of the contract

contract is full of difficult words and I can't understand it, but be sure to check the contents of contract

If you don't understand a word, check its meaning.

Check the amount of the cost.

Confirm the payment date of the transfer price.

Check which of the target accounts receivable.

Check what happens if there is no payment from the accounts receivable.

Please keep the above in mind.

How to choose a factoring provider

・ What kind of debt do you currently have?

In the case of receivables called industry receivables such as medical receivables and construction receivables, the amount that can be purchased may vary greatly depending on the factoring provider. Let's find a company that is good at the loan.

・ How long does it take to procure?

Fees may be higher for plans such as same-day deposits and speed deposits. Let's apply for factoring with plenty of time based on the deadline when you absolutely want funds.

・ What is the reliability of factoring providers?

There are tons of companies offering factoring services. The question is reliability. Choose a safe and secure factoring provider so you don't get into trouble. These facts, such as "everyone knows" and "listed," are also factors that support high reliability.

About general factoring review

The required documents differ depending on the factoring provider, but the following documents are generally required for all companies. Basically, you will be asked for documents related to the accounts receivable to be transferred.

・ Transaction contract

- purchase orders, quotations, invoice, delivery notes, acceptance certificate, etc.

・ History matter certificate

・ Seal certificate

In addition to this, you may be required to submit financial statements, but the factoring service is characterized by the ease and speed of examination compared to financial institution The GMO Payment Gateway factoring service business plan, guarantor, real estate collateral, etc., and is independently examined. Results will be available in a minimum of 2 business days.

Factoring deposit flow

ここでは、GMOペイメントゲートウェイのファクタリングサービス「GMO BtoB早払い(ファクタリング)」の入金フローをご紹介します。

① Inquiry

First of all, please contact us from the "Inquiry" button on the homepage. The person in charge of GMO Payment Gateway will contact you separately.

② Examination request

Please fill in the details of accounts receivable in the prescribed form and request an examination.

③ Condition presentation

GMO Payment Gateway will show you the amount of money you can buy, fees, etc.

④ Application for use

Please submit the usage application after agreeing to the presented conditions and terms of use.

⑤ Assignment of receivables

Please transfer the receivables you hold to GMO Payment Gateway.

payment to your company

All from GMO Payment Gateway to your designated bank account payment will be.

Strengths of GMO Payment Gateway Factoring Service "GMO B2B Early Payment

・東証プライム上場企業だから安心!

金融機関提供のファクタリングは売上規模が10億円といった大企業向けのものが多く、健全な一般的な中小企業が少額でのファクタリングを希望する場合、安心して利用できるファクタリングが少ないのが現状でした。GMOペイメントゲートウェイが提供するファクタリングなら、100万円からの売上債権から買い取り可能で、東証プライム上場の信頼性もあるので、初めてのファクタリング利用も安心です。

・ Two-party factoring

We have adopted "two-party factoring", in which the use of factoring is not known to accounts receivable.

・ Low fees

2者間ファクタリングの手数料は20%ほどが相場ですが、「GMO BtoB早払い(ファクタリング)」の手数料は1%~10%です。

・ Easy purchase execution procedure

Once the factoring contract is completed, the procedure for executing the purchase is simple and speedy. If you have a purchase order, invoice and acceptance slip, you can purchase it, and you do not need to stamp special documents.

・ Easy to consult with a person in charge

If you have any questions or concerns, a specialist will be available to help you, so you can feel free to consult with us.

Factoring services support companies struggling with cash flow

What did you think? This time, we introduced the features and benefits of factoring services. "There is a concern that the accounts receivable will know the use of factoring" was a concern of the conventional "three-party factoring", but the receivables are transferred only by the company that wants to use factoring and the factoring provider company. If you use "two-way factoring" that connects contract, that anxiety will be dispelled. In addition, "two-party factoring" tends to have higher fees than "three-party factoring", but in addition to the merit of "not known to accounts receivable", it is far more than financing and capital increase. If you can raise funds quickly and easily, there is no reason not to consider it. Factoring services that monetize accounts receivable are expected to become more and more popular as a savior for companies struggling with cash flow.

This service is applicable when the introduced EC site is operated by a corporation.

If the introductory EC site is operated by an individual, please check here.