Solutions for payment processing business

GMO-PG

Processing

platform

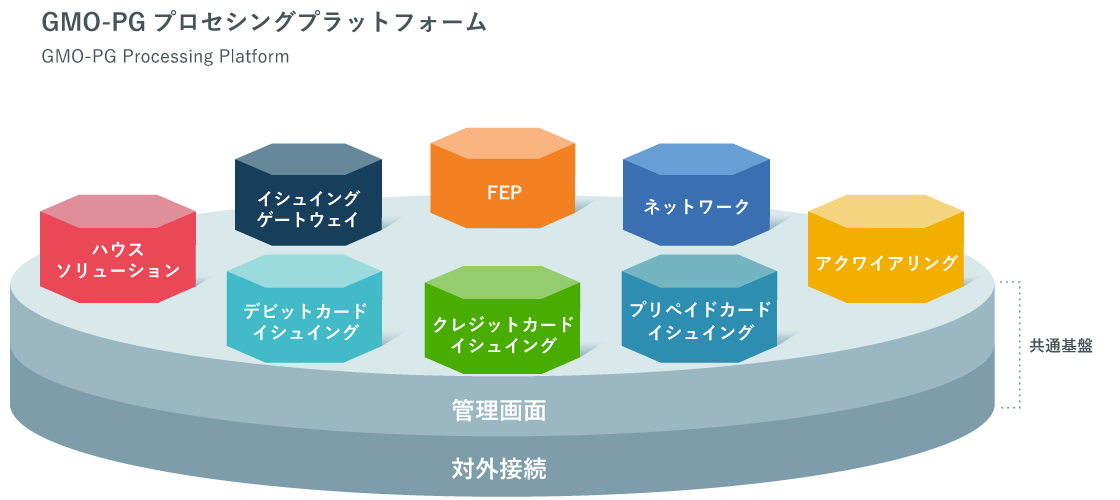

financial institution and finance service providers are in the business of issuing credit, debit, prepaid house cards and merchants Easy, flexible, and efficient when developing new payment processing business such as merchant businesses that require functions of contract management, merchant settlement, and card transaction processing. It is a platform that provides various services at once so that you can build a infrastructure of payments.

In addition, since each service can be centrally managed on one management screen, it is possible to improve operational efficiency in terms of operation.

Challenges like this can be overcome.

It can be solved

- I want to promote operational efficiency through DX

Platform overview

|

Features/Services |

Ishing Support |

acquiring Support |

Ishing |

FEP |

network |

|||

|---|---|---|---|---|---|---|---|---|

|

credit |

Debit |

Prepaid |

house |

|||||

|

Managing screen |

○ |

○ |

○ |

○ |

○ |

○ |

○ |

○ |

|

TRX Processing |

○ |

○ |

○ |

○ |

○ |

○ |

○ |

- |

|

membership management Features |

○ |

○ |

○ |

○ |

- |

○ |

- |

- |

|

Merchant Management |

- |

- |

- |

○ |

○ |

- |

- |

- |

|

Credit Management |

○ |

- |

- |

○ |

- |

- |

- |

- |

|

Value Management |

- |

○ |

○ |

- |

- |

- |

- |

- |

|

Accounting Connections |

- |

○ |

- |

- |

- |

- |

- |

- |

Key points of GMO-PG Processing Platform

-

Providing the best service for each customer

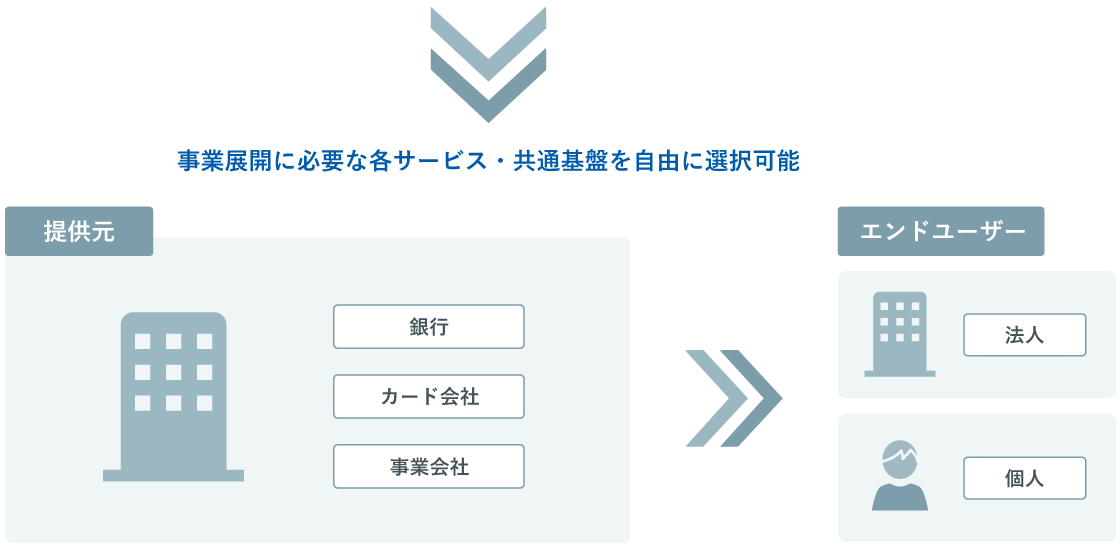

Rather than providing a uniform system, it is possible to freely select and use the services and common infrastructure necessary for the customer's business development.

-

Ready for all payment scenes

Regardless of the real or EC area, it supports all payment scenes. It is also possible to provide marketing functions such as OMO *1, points, and coupons.

-

Provision of services via API

Since each service is provided by API, we will realize easy, flexible, and efficient service introduction.

-

Providing services that only PG can do

By utilizing the payment know-how and Actual that we have cultivated in our payment processing company business, we have built a comprehensive platform that enables the development of a variety of payment method services.

Service overview

Overview of each service

(1) Credit card ishing *2 support service

APIs provide the functionality required to issue internationally branded credit cards and process their transactions.

By linking with financial institution's existing system, we realized the speedy introduction of a credit card issuance system.

【Main functions】

- membership management: Application acceptance and admission screening, card issuance, member master management, member information inquiry/change (web page for card members), in-progress credit, loss or theft

- Transaction management: authorization * 3 Sales processing, limit management, usage notification, billing management, delinquency and late charge management, brand report creation, management screen

- Other: Apple Pay, Google Pay compatible

(2) Debit Card Pursuing Support Service

Provides the functionality required to issue internationally branded debit cards and process their transactions via API.

It is possible to respond to requests such as virtual card issuance, immediate issuance, corporate card issuance, etc.

【Main functions】

- membership management: Application acceptance, card issuance, member master management, member information inquiry/change (web page for card members)

- 取引管理:オーソリゼーション・売上処理、オーバードラフト※4対応、オーソリ代行、利用通知、ブランドレポート作成、管理画面

- Other: Apple Pay, Google Pay compatible

(3) Prepaid Card Hunting Support Service

Provides the functionality required for the issuance of internationally branded prepaid cards and their transaction processing through APIs.

It is possible to respond to various charges at credit cards, convenience stores, etc. and point linkage.

【Main functions】

- membership management: Application acceptance, card issuance, member master management, member information inquiry/change (web page for card members)

- Transaction Management: authorization & Revenue Processing, Value Management, Overdraft Response, Usage Notifications, Brand Reporting, Extranet

- Other: Apple Pay, Google Pay compatible

(4) House Solution Support Service

The API provides the functions necessary for issuing house-type credit cards and prepaid cards that are not attached to international brands, managing merchants, and processing their transactions.

【Main functions】

- membership management: Acceptance of applications, issuance of cards, management of member masters, setting of conditions of use, confirmation of usage history (web page for cardholders)

- Transaction management: Transaction data processing, point management, transaction master management, credit line and value management, usage notification

- 加盟店管理:加盟店マスタ管理、加盟店精算用レポート作成、精算情報管理、個別取引照会※6(加盟店向けWEBページ)

(5) acquiring*7 Support Service

The API provides functions necessary for merchant contract management, merchant settlement work, payment and telegram processing of various cards.

【Main functions】

- 加盟店管理:加盟店登録・管理、加盟店審査・管理、加盟店マスタ管理、加盟店精算、精算情報管理、個別取引照会(加盟店向けWEBページ)

- 取引管理 :オーソリゼーション・売上処理、国際ブランド精算、チャージバック対応、ブランドレポート作成、ACQ向け管理画面

(6) Pursuing Gateway Service

A service that provides card number management and brand network connection functions on the premise of using the company's own system infrastructure and finance functions.

【Main functions】

- membership management: Application acceptance, card issuance, member master management

- Transaction Management: authorization & Settlement

- Other: Apple Pay, Google Pay compatible

(7) FEP Service

We provide external connection systems necessary for card transactions, etc.

【Main functions】

- Telegram processing: transfer function, telegram exchange / reception, authorization / sales processing, authorization agency, IC processing, negative registration, external connection function

- Credit information inquiry: credit information inquiry, user registration

- Bank account deposits and withdrawals: Deposit/withdrawal telegram processing

(8) Network Services

It provides the network necessary for finance business development and the function of connection with related service providers (issuer, acquirer, international brand, credit information agency, bank, printing company, TSP, etc.).

【Main functions】

- Telegram processing: transfer function, telegram exchange and reception, external connection function

- Service Offerings:

- financial institution External system connection (CD/ATM, overseas ATM network [PLUS, Cirrus])

- authorization processing and sales transmission between large-scale merchants and card companies

- Connectivity with international brands (VISA/Mastercard/JCB, etc.)

- Connecting with credit bureaus

- Connecting with a printing house

common infrastructure

Managing screen

Possession of databases (members, merchants, various transactions), reference to browsing transactions, creation of various settlement reports

External connection

Connections with financial institution, international brands, FinTech companies payment

*1 OMO: Online Merges with Offline is a concept of building a marketing strategy that does not separate online and offline so that customers can receive services without being aware of the difference in channels.

*2 Issuance: The business of recruiting cardholders, issuing cards, providing services to cardholders, and billing card usage fees.

*3 authorization Activation: Checking the validity of the card used (confirmation of cancellation, loss, etc.), credit inquiries such as confirmation of transactions within the account balance (debit card), credit limit (credit card), and charge balance (prepaid card).

*4 Overdraft: Usage that exceeds the balance of a bank account or a prepaid charge.

*5 House style: Limited to use at member stores contract by the card issuing company.

*6 Individual transaction inquiry: An inquiry of the details of each transaction.

*7 acquiring: The business of recruiting merchants, managing and settling the contract of the merchants, and processing the payment of card transactions.

Application / Introduction flow

1. Inquiries from the inquiry page

2. Contact from the person in charge

3. Hearing customer requests

4. We propose the best service to our customers

5. Meeting for the introduction of the service

6. Service Release

* The period until the service release will be determined through a meeting with the customer.

If you have any questions or consultations about our services, please contact us.

Please feel free to contact us from the following.