法人間取引における未回収リスクを防ぐ

GMO BtoB売掛保証

GMO BtoB売掛保証とは、法人間取引における未回収リスクを予防するための与信管理強化サービスです。取引先の倒産・支払遅延により未回収が発生した場合に、GMOペイメントゲートウェイが保証履行金を支払い売掛金を保証いたします。※

※ご利用についてはGMOペイメントゲートウェイ所定の審査がございます。

審査の結果によってご利用できない場合があります。

このような課題を

解決できます

- 資金面のサポートを受けたい

売掛保証で安心のお取引を。

GMO BtoB売掛保証が選ばれる理由

-

信用力

東証プライム上場企業によるサービス提供で安心してご利用いただけます。

-

利便性

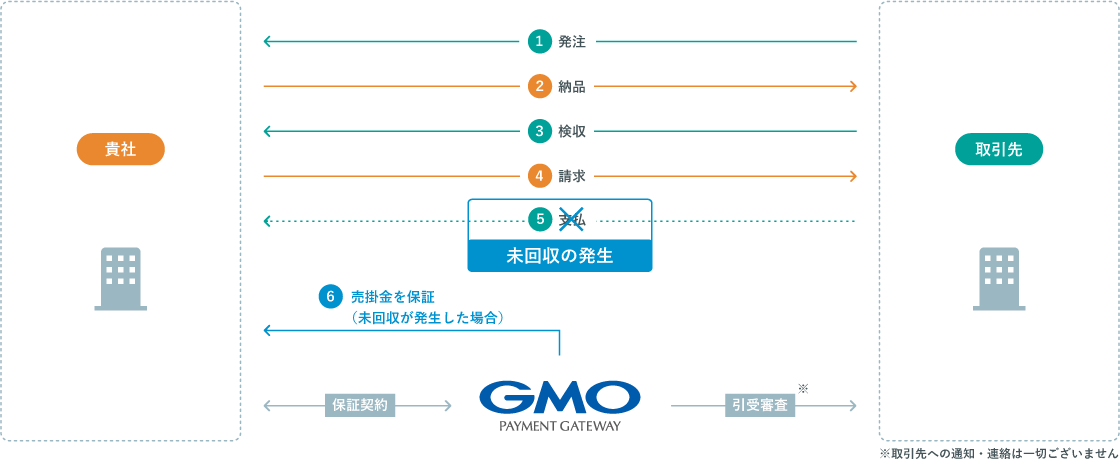

審査に際し、取引先への連絡・通知は一切ありませんので、保証を掛けることは知られません。

-

スピード

お申込み後の審査が通れば、すぐにお取引できます。

※ご利用についてはGMOペイメントゲートウェイ所定の審査がございます。審査の結果によってご利用できない場合があります。

GMO BtoB売掛保証で実現する5つのメリット

-

貸倒れ損失発生の予防

貸倒れが発生した場合、経営状況に悪影響を及ぼすこともあります。

この保証をご契約いただくことで、保証履行金で損失を埋めることが可能となり、回収労力の軽減、資金繰り悪化防止を図ることができます。 -

与信管理の強化・充実

取引先の信用状況について、自社調査のみで常時かつ的確に把握するには限界があります。

当社による審査を併用することで、貴社与信管理とのダブルチェックが可能となります。 -

損失の平準化

貸倒れ損失が発生すると、企業の決算に非常に多大な影響を及ぼします。

損失を保証履行金でカバーすることで、不足かつ巨額な損失をある程度平準化することが可能です。結果的に利益水準の平準化にもつながります。 -

信用力の向上

保証で債権が保全されることにより、取引先をはじめ、ステークホルダーに対する信用力も大幅に向上します。

-

キャッシュフローのサポート

取引先の倒産だけでなく、資金難などによる支払遅延も保証履行の対象となるので、貴社は営業活動へ専念できます。

「GMO BtoB売掛保証」の流れ

GMO BtoB売掛保証は最短2営業日の審査で新規取引先などの未回収リスクを軽減できます。

貴社にぴったりのプランをチェック

ご契約タイプ

月額定額プラン

毎月一定の安い保証料で売掛保証をかけたい場合に最適

|

タイプ |

月額保証料 |

保証上限額 |

1社あたり |

対象債権 |

保証対象銘柄の |

契約期間 |

保証料のお支払方法 |

|---|---|---|---|---|---|---|---|

|

タイプS |

9,800円 |

1,000万円 |

50万円 |

支払期日が |

可 |

半年以上 |

半年分前払い |

|

タイプM |

29,800円 |

3,000万円 |

500万円 |

||||

|

タイプL |

59,800円 |

5,000万円 |

500万円 |

カスタマイズプラン

大きな取引金額、特殊なスキームで売掛保証をかけたい場合に最適

|

タイプ |

保証料率 |

保証額 |

保証社数 |

対象債権 |

保証対象銘柄の |

契約期間 |

保証料のお支払方法 |

|---|---|---|---|---|---|---|---|

|

個別型 |

保証額に対して |

1,000万円 |

新規取引先 |

支払期日が180日以内の売掛債権 |

可 |

1年 |

審査を通して決定 |

|

包括型 |

年率1.0%~ |

5社~ |

追加のみ可 |

1年分前払い |

導入事例

広告代理業

与信限度額を上回る取引先との取引拡大の需要を受けて検討開始

社内で定める与信管理規程に対し、与信限度額を上回る取引先との取引拡大の需要を受けて、取引先が担保設定や預り保証、支払サイト短縮などの他手段に応じて頂けない様な場合の対応として検討しました。

卸売業

信用不安に陥る懸念先の保全強化を図るため

調査機関で詳細がつかめない先の与信判断の参考になり、人的保証に頼らず実効性のある保全強化が図れます。利用する中でイレギュラーな事象にも柔軟に検討してもらえます。

お役立ちコンテンツ

オンラインセミナー

売掛保証の利用で後悔しないために

売掛保証をはじめとする売掛金保全サービスは、サービスの種類だけでなく提供する企業ごとでも細かな内容が変わってきます。本セミナーでは売掛保全サービスの失敗しない選び方についてのポイントを解説します。

お役立ち資料

与信の上限額を上げる手段とは

社内与信が厳しく、顧客与信上限額が低いがために新規契約の機会を損失した、与信不安により取引停止となってしまった、といったご経験はございませんか?本資料では、リスクヘッジしながら事業を伸ばすためのヒントとして、顧客与信上限額を上げるための方法をお伝えいたします。

FAQ

GMO BtoB売掛保証の他社との違いは?

下記が相違点となります

- 新規のお取引先の場合は1社から保証が可能です。

- お客様の取引習慣やご要望に応じたプランのご用意がございます。

- 他の保証会社をご利用の取引先でも保証が可能です。

どんな会社が利用していますか?

企業間(BtoB)取引で売掛金が発生する企業様に広くご利用いただいています。

1社から保証を利用できますか?

新規のお取引先の場合は1社から、既存のお取引先の場合は3社からのご利用が可能です。

審査にかかる時間はどのくらいですか?

審査依頼をいただいてから、最短で2営業日以内にご回答いたします。

保証対象外の債権はありますか?

以下の債権は保証対象外となります。

- 金銭消費貸借契約に基づく債権

- 業法違反契約、実体を伴わない仮想取引、反社会的勢力との間の契約に基づく債権

- 支払い期日の延長を認めた又は認める可能性のある債権

保証の期間は?

月額定額プラン、カスタマイズプランともに保証開始日から保証期日までとなります。

保証料率は?

0.1%~2.5%/月となります。

保証料率は弊社で審査の上、ご提示致します。保証可能金額は?

保証合計額1万円~1億円までお引受けが原則可能です。

* 保証先の審査内容によります。保証の支払いの対象となる時はどんな時ですか?

倒産(破産、民事再生)はもちろん、ただの支払遅延が発生した場合でも、お支払いすることができます。

保証履行に必要な書類は?

保証対象債権の内容を確認できる書類(請求書・納品書など)、取引実績・入金履歴がわかる書類(売上帳簿・通帳など)のコピーに関して、直近1年分ご提出をいただきます。

保証履行金の受領のスケジュールは?

上記必要書類をご提出いただいた前提で、約20営業日以内にお支払いします。

サービスについての質問・相談は

下記よりお気軽にお問い合わせください。