- トップ

- サービス一覧

- PGマルチペイメントサービス

- クレジットカード決済

クレジットカード決済

クレジットカード決済は、オンライン決済の中でも最も利用頻度の高い、売上アップに必要不可欠な決済手段です。

GMOペイメントゲートウェイのクレジットカード決済なら、高機能・安全なカード決済サービスを簡単に一括導入いただけます。

ECサイト・ネットショップ構築のご相談から決済導入時までお客様を安心サポートいたします。

5大国際ブランド(Visa、MasterCard、JCB、AMEX、Diners)のほか、日本国内の各種クレジットカード会社発行のクレジットカードに対応しております。

クレジットカード決済が選ばれる5つのポイント

- ・クレジットカード会社ごとの煩雑な事務手続きをお任せいただけます

- ・事業運営に役立つきめ細かなカスタマーサポートが受けられます

- ・売上の早期回収サービスをご利用いただけます

・早期入金サービス - ・業界トップクラスの安定稼働と信頼性を誇る決済サービスをSaaSとして導入できます

- ・国際基準に準拠したセキュリティ環境でECを運営できます

・3Dセキュア(本人認証サービス)

・セキュリティコード

・チャージバック補償団体保険

・トークン決済

決済代行サービスで当社が選ばれる理由

複数のクレジットカード会社との加盟店契約手続きを全てお任せいただくことができるため、煩雑な事務手続きにかかるコストを省き、ECサイトの設計、構築に集中いただくことが可能になります。また、料金回収についても「早期入金サービス」で未回収リスクを抑えるなど、クレジットカード決済をはじめとしたあらゆる決済手段において、貴社サイトの開設~運用までを安心サポートいたします。

さらに弊社決済サービスのPGマルチペイメントサービスなら、クレジットカード決済、コンビニ決済、PayPal、Pay-easy、口座振替、代引といった各種決済手段を、追加したいときにいつでも簡単に設定可能。多様化する決済ニーズにお応えします。決済手段だけでなく、継続課金、会費徴収、支払期限設定などの豊富なサービスも一つの管理画面で一元管理。使い勝手をとことん突き詰めた決済サービスです。

私たちは業務の効率化をお手伝いし、決済にかかるコストを細かな点から全体に関わる部分まで分析・検討し、削減に繋げられるよう、各サービスを用意させていただいております。

事業内容や目的に応じたクレジットカード決済3つのプラン

専任の担当営業がご案内いたします。お気軽にご相談ください。

| Entry Plan | Standard Plan | Advanced Plan |

|---|---|---|

| 高機能なのに簡単導入。はじめてのクレジットカード決済におすすめ。 | クレジットカード番号登録機能によりリピート顧客を増やせます。 | 継続型の月次課金機能で安定した売上が得られます。 |

| おすすめの事業 | おすすめの事業 | おすすめの事業 |

|

|

|

Entry Plan

高機能なのに簡単導入。はじめてのクレジットカード決済におすすめ。

おすすめの事業

- ・インターネット物販

- ・モバイル通販

- ・カタログ通販

- ・コンテンツ販売

Standard Plan

クレジットカード番号登録機能によりリピート顧客を増やせます。

おすすめの事業

- ・インターネット物販

- ・モバイル通販

- ・カタログ通販

- ・コンテンツ販売

Advanced Plan

継続型の月次課金機能で安定した売上が得られます。

おすすめの事業

- ・保険販売

- ・頒布会

- ・プロバイダー

- ・ケーブルテレビ

最適なクレジットカード決済運用方法をご提案いたします

多彩な決済機能から主なモデルケースをご紹介します。

Entry Plan : 都度決済対応

購買者様が商品やサービスを購入する度に、都度カード情報を入力いただくことで決済する方法です。

1-1. 物品販売でのクレジットカード決済ご利用例

ステータス管理を行うことで、商品が届いていないのに購買者様へクレジットカード会社からの支払い請求が届いてしまうといった事象・トラブルを防ぐことができます。

都度決済 + 仮・実運用

- ・受注のタイミングで「仮売上」、商品発送後に「実売上」という商品ステータス管理・変更が可能です。

- ・キャンセル時の「取消」「返品」処理も簡単です。

1-2. デジタルコンテンツ販売でのクレジットカード決済ご利用例

購買者様が音楽データやゲームアプリのアイテムなどのデジタルコンテンツ購入時でのカード決済が可能です。すぐにサービスを購買者様に提供することができます。

都度決済 + 即時運用

- ・受注のタイミングで即時に「売上」ステータスへ。

- ・キャンセル時の「取消」「返品」処理も簡単です。

Standard Plan: 会員ID決済対応

会員ID登録により購買者様が購入の度にクレジットカード情報を入力する手間を省きます。購買者様の囲い込み・リピート顧客化による売上の向上が期待できます。

2-1. 物品販売でのカード決済ご利用例

購買者様が購入の度に氏名、クレジットカード情報といった個人情報を入力する手間を省きカゴ落ちや離脱を防ぐと同時に、リピート購入率を高める効果があります。

会員ID + 仮・実運用

- ・初回購入やお申し込み時にクレジットカードの「有効性チェック」を行い、有効であった場合に「会員ID」をシステム的に付与します。

- ・受注時に「仮売上」、商品発送後に「実売上」というステータス管理機能を活用。都度決済での運用と同様に商品未達トラブルを防ぎます。

2-2. デジタルコンテンツ販売でのカード決済ご利用例

購入頻度の高いゲームアプリのアイテムなどのデジタルコンテンツ課金に最適です。クレジットカード情報入力の手間を省き、すぐにサービスを購買者様に提供することができます。

会員ID + 即時運用

- ・初回購入やお申し込み時にクレジットカードの「有効性チェック」を行い、有効であった場合に「会員ID」をシステム的に付与します。

- ・受注のタイミングで「売上」を確定します。

Advanced Plan: 洗替機能対応

月額課金タイプの事業に適しています。毎月所定のデータをいただくことでカード情報の有効期限を更新(洗替)しながら決済が可能となり、課金の確実性と運用効率を高めます。

プロバイダー・保険販売・定期便・頒布会などの月額課金型事業でのカード決済ご利用例

購買者様が購入の度に氏名、クレジットカード情報といった個人情報を入力する手間を省きカゴ落ちや離脱を防ぐと同時に、リピート購入率を高める効果があります。

洗替運用+会員ID決済

- ・初回購入やお申し込み時にクレジットカードの「有効性チェック」を行い、有効であった場合に「会員ID」をシステム的に付与します。

- ・課金・継続時に「洗替」「売上」処理を行います。

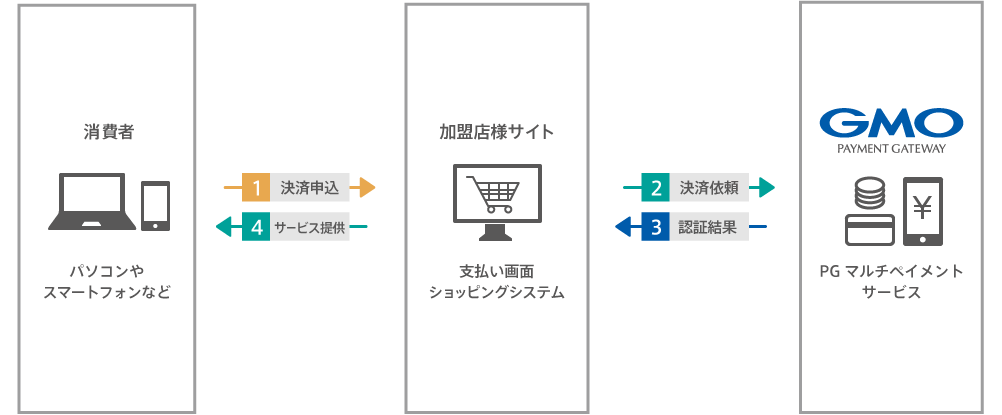

サービス運用の流れ

「PGマルチペイメント・フレームワーク」は、高機能で簡単導入を実現する「SaaS」として、多様な決済機能を統合した総合決済サービスです。加盟店審査や加盟店契約といった手続きだけでなく実際の導入から運用までを当社がワンストップにご提供するため、スムーズな決済サービスの導入が可能です。

ご利用可能なクレジットカード会社

主要国際ブランドのクレジットカード決済を一括導入いただけます。

5大国際ブランド(Visa、MasterCard、JCB、AMEX、Diners)のほか、日本国内の各種クレジットカード会社発行のクレジットカードに対応しております。

※詳しくは下記「クレジットカード会社一覧」をご覧ください。

クレジットカード会社一覧

貴社と弊社だけの契約で、複数のクレジットカードブランドが利用できるサービス

ECサービスのお支払い手段で、複数のクレジットカードブランドを利用できるようにするには、事業者様とクレジットカードブランド会社が直接、個別契約を行う場合、導入したいクレジットカードブランドの数だけ複数契約する必要があります。

弊社の「代表加盟サービス (加盟店契約一括サービス)」をご利用いただくと、事業者様と弊社間のみの一契約で、複数のクレジットカードブランド加盟店との契約が可能となり、貴社におけるクレジットカード売上の管理を効率化できます。

新規でオンラインショップやインターネット通信販売を開始される事業者様、少人数で効率よくクレジットカード決済情報の管理を行いたい事業者様におすすめです。

- ・弊社との契約のみで複数のカードブランドをご利用いただけるようになります

- ・入金日・手数料が一本化され、入出金管理を容易にできます

- ・オプションサービスの利用で入金早期化も図れます

代表加盟契約

弊社が加盟申請をクレジットカード会社に行う

ご留意事項

加盟店審査について

本サービスはインターネット通信販売向けの加盟店契約代行サービスとなります。

お取扱い商品およびクレジットカード会社・収納代行会社の審査によってはご利用いただけない場合、およびご利用いただけるクレジットカードブランド・決済手段が限定される場合がございます。

※詳しくはお問い合わせください。

クレジットカード決済の支払方法について

ご利用いただけるお支払方法は「一括払い」です。

ご要望により「リボ払い」・「分割払い(3回以上)」をご提供させていただきます。

※事業者様がお取扱いの商材により、ご要望に添えない場合がございます。クレジットカード会社と直接加盟店契約を保有され、その契約と弊社代表加盟契約との併用利用をご希望の場合は、弊社代表加盟契約で利用可能な支払方法を適用させていただきますので予めご了承ください。

ご入金について

売上代金のご入金の際に生じる金融機関への振込手数料は貴社の負担となりますので、予めご了承ください。

売上金額よりも売上取消金額が多い場合は弊社へご入金いただく場合がございます。

クレジットカード決済の不正利用発生時について

万一第三者による不正利用が発生し、クレジットカード会社側が不正取引と認めた場合は、「売上の差し戻し」「債権買取の拒否(チャージバック)」が発生する場合がございます。その対策として3Dセキュア(本人認証サービス)のご利用を推奨しており、不正利用の発生を最小限に防止する事が可能となります。

※VISA / MASTER / JCBが対象となり、その他カードブランドは対象外となります。

サービス導入までの流れ

1.お問い合わせ・資料請求

まずはフォームまたはお電話にてお問い合わせください。お客様に最適なサービスをまとめた資料を無料でお送りいたします。また、お問合せいただいた内容は担当者より折り返しご連絡させていただきます。

なお、お申し込みから審査、ID発行と御社システムへの組み込みの期間を含めまして、最短3週間~2ヶ月程度でご利用を開始いただけます。

決済サービスについての詳細なご相談やご希望等も承っております。お気軽にお問い合わせください。

テスト環境のご利用・仕様書のダウンロードも可能です

「PGマルチペイメントサービス」導入にあたり、事前にテストを実施していただく環境です。 仕様書、マニュアル、各種決済処理(テスト運用)に必要な管理画面一式をご提供いたします。

2.貴社よりお申し込み

お申し込みにあたって以下の書類をご提出ください。

代表加盟サービス(加盟店契約一括サービス)ご利用の場合

- ・PGマルチペイメントサービス利用申込書

- ・登記簿謄本(コピー)

- ・販売商品資料

- ・特定商取引法に基づく表示内容

- ・各管轄官公庁への届出書及び許可証

- ※Webページが公開されている場合は一部書類が不要となります。

- ※詳しくは営業担当までご連絡ください。

直接加盟契約の場合(カード会社と直接ご契約がある場合)

- ・PGマルチペイメントサービス利用申込書

3.弊社にて加盟店審査・登録

代表加盟サービス(加盟店契約一括サービス)ご利用の場合は、弊社を経由して各決済事業会社にて審査を行わせていただきます。

4.弊社より本番環境をご提供

決済事業会社と弊社にてシステム設定を行い、本番環境設定内容をメールにて送信いたします。

5.貴社にて本番環境での接続テスト

本番環境での接続テストを行っていただきます。

6.貴社にて運用開始

運用を開始いただきます。

- ※運用開始までの期間は、貴社での開発内容により変動いたします。

- ※PayPal(ペイパル)決済導入時は一部導入手順が異なります。加盟店審査承認後、PayPal社から確認メールが届きますので認証コードを入力の上ご返信ください。その後、本番環境のご提供となります。

当サービスは導入ECサイトが法人運営の場合が対象となります。

導入ECサイトが個人運営の場合はコチラをご確認ください。