債権買取でキャッシュフローを改善

GMO BtoB早払い

(ファクタリング)

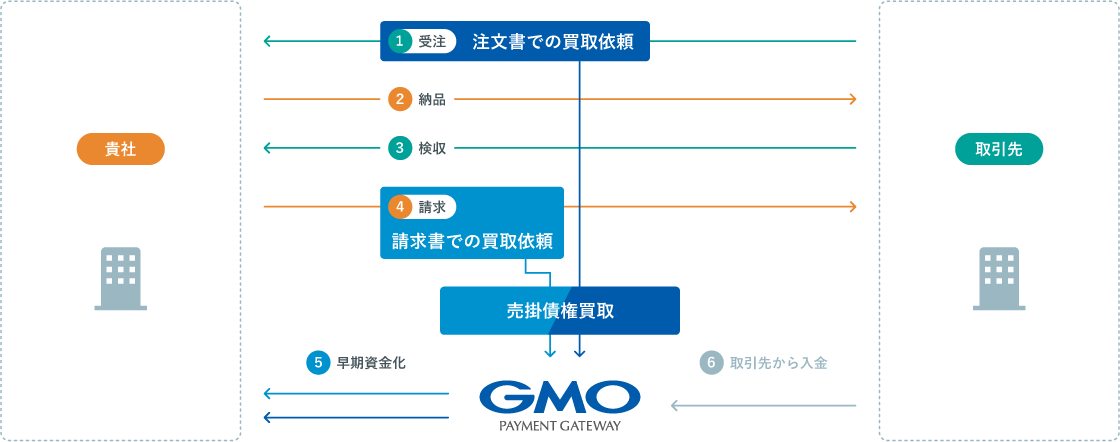

貴社が取引先に対して保有する債権を、GMOペイメントゲートウェイが買い取ることにより、早期に資金化するサービスです。

このような課題を

解決できます

- 資金面のサポートを受けたい

「GMO BtoB早払い」の特長

-

信用力

東証プライム上場企業によるサービス提供で安心してご利用いただけます。

-

利便性

債権の流動化を活用することで資金調達手段の多様化が図れます。

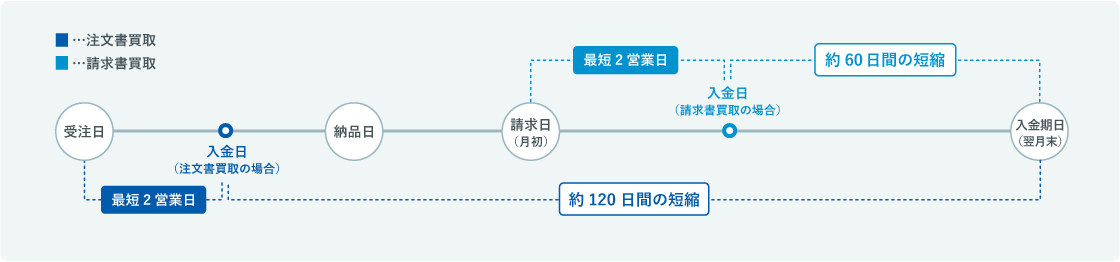

請求書発行段階で買い取る「請求書買取」の他、オプションとして受注段階で買い取る「注文書買取」もご利用いただけます。 -

スピード

債権買取を実行されてから、最短2営業日で入金されます。

※ご利用についてはGMOペイメントゲートウェイ所定の審査がございます。審査の結果によってご利用できない場合があります。

貴社のメリット

-

キャッシュフローの改善

債権買取により、売掛金を早期に資金化できます。

-

未回収リスクの軽減

万が一、買い取られた債権が取引先の倒産や支払遅延などで未払いになっても、代金回収はGMOペイメントゲートウェイが行うため、未回収は軽減されます。

-

手続きが簡単

銀行融資と異なり、資金繰り表や事業計画書の提出、保証人、担保が不要です。

-

財務諸表のスリム化

売掛金と現預金で仕訳されるため、貸借対照表がスリムになります。

売掛債権買い取り査定シミュレーション

「GMO BtoB早払い」の流れ

入金までの期間の短縮化

よくある質問

どのような会社が利用していますか?

企業間取引(BtoB取引)があり、債権を有する会社様に広くご利用いただいていますが、法人のみ対象としており、個人事業主様はご利用いただけません。

買い取りの対象となる買主は、どのような会社ですか?

法人のみ対象です。個人向けの債権は買取対象外となります。

入金までにかかる期間はどのくらいですか?

利用審査が完了している売主は、最短2営業日後にご入金いたします。利用審査が完了していない方はまずお申し込みをお願いいたします。利用審査の結果は最短2営業日後に回答いたします。

利用審査に必要な書類はありますか?

売主の決算書2期分と試算表、買主の審査依頼書、取引基本契約書等が必要になります。

買取実行に必要な書類はありますか?

見積書、発注書、請求書・納品確認書(検収書)などが必要になります。

買取できない業種はありますか?

現在、一部業種にて買取を控えております。詳細はお問合せくださいませ。

赤字、債務超過でも買取はできますか?

赤字、債務超過だけで、買取をお断りすることはございません。税金や社会保険料の未納があり、分納手続きをしていない場合は、買取はお断りしています。

税金や社会保険料の未払いがあるが、買取はできますか?

税金や社会保険料の未納がある場合は、原則買取はしておりません。ただし、分納されている場合は、買取できる場合もございます。

金融機関の融資を断られていても利用できますか?

ご利用可能なことがあります。弊社独自の審査となりますので、お気軽にご相談ください。

GMO BtoB早払いは融資とは違うのでしょうか?

異なります。GMO BtoB早払いは、企業間取引における債権を弊社が買い取らせていただく資金調達手法です。

買取手数料率はどの程度ですか?

注文書買取:2%~12% 請求書買取:1%~10%となります。手数料率は弊社で審査の上、ご提示いたします。

利用限度額を教えてください。

請求書あたり数万円からご対応可能です。

但し、買取1回あたりの合計金額は100万円以上(スポットタイプの場合300万円以上)でお願いしております。取引先への通知は必要でしょうか?

取引先への通知は原則不要です。

買取時の登記は必要ですか?

原則登記はしておりません。※詳しくはお問い合わせください。

二者間契約で、代金の受取りの仮想口座の利用は必須ですか?

原則、ご利用を前提としたサービスとなりますが、審査結果次第で利用不要となるケースがございます。

買取を実行していない売掛金が仮想口座に入った場合はどうしますか?

最短2営業日後にご指定の銀行口座へ振り込みいたします。

利用申し込みに関するプライバシーは守られますか?

ご安心ください。法令等を適切に遵守しております。

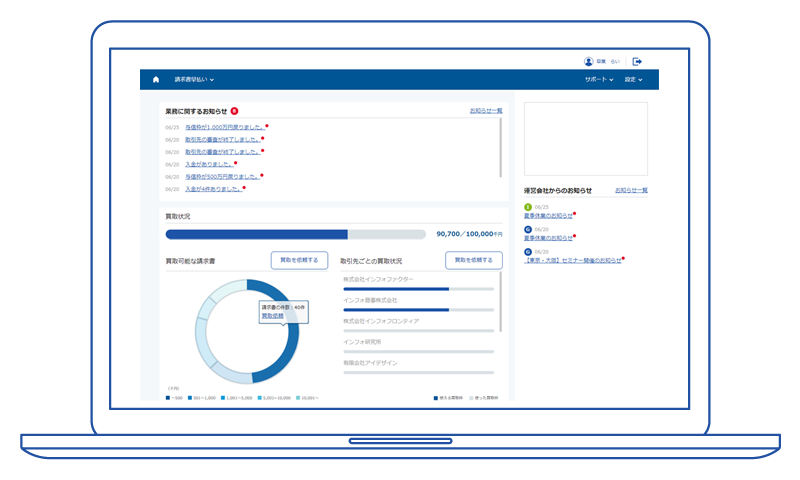

「電子請求書早払い」

請求書をワンクリックで資金化できる「電子請求書早払い」の提供を、株式会社インフォマートと当社の協業で2020年1月より開始いたしました。

「電子請求書早払い」のご利用により、入金期日よりも早く請求書の売掛金を資金化できるため、資金繰りの改善が可能となります。

特設サイト:https://www.infomart.co.jp/hayabarai/index.asp

請求書で素早く資金調達

「電子請求書早払い」は、従来の金融機関からの調達に頼らず、インフォマートが運営するBtoB プラットフォーム請求書から資金調達ができる企業向けのファイナンスサービスです。

GMOペイメントゲートウェイ株式会社は、ファクタリングの自主規制団体「OFA」の認定事業者です。弊社が順守する自主ガイドラインについてはこちらのOFA公式サイトをご参照ください。

サービスについての質問・相談は

下記よりお気軽にお問い合わせください。