Accelerate your business with improved payout cycles

Early Payment Service

加盟店様が、自社の資金繰りに適した入金サイクル(締め回数・締め日・締め日から入金までの日数)を設定できるサービスです。

「PGマルチペイメントサービス(代表加盟店サービス(※1))」をご利用の事業者向けのオプションサービスです。(※2)

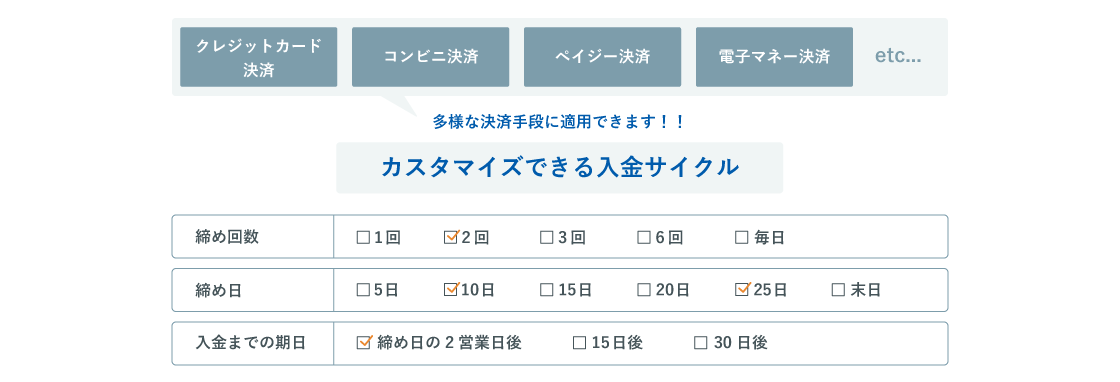

クレジットカード決済はもちろん、コンビニ決済・Pay-easy決済・PayPayや楽天ペイといったコード決済など、各種決済手段での入金サイクルに適用されます。

In addition to providing a payment system to merchants and connecting them with payment data between merchants and each payment processing business, GMO-PG concludes a contract agreement between merchants and payment processing business parties in a lump sum, and the payment of sales proceeds to the merchants is also undertaken in a lump sum on behalf of the merchants.

(*2) Screening prescribed by the Company is required for use.

Challenges like this can be overcome.

It can be solved

- I want to receive financial support.

Benefits of our Early Payment Service

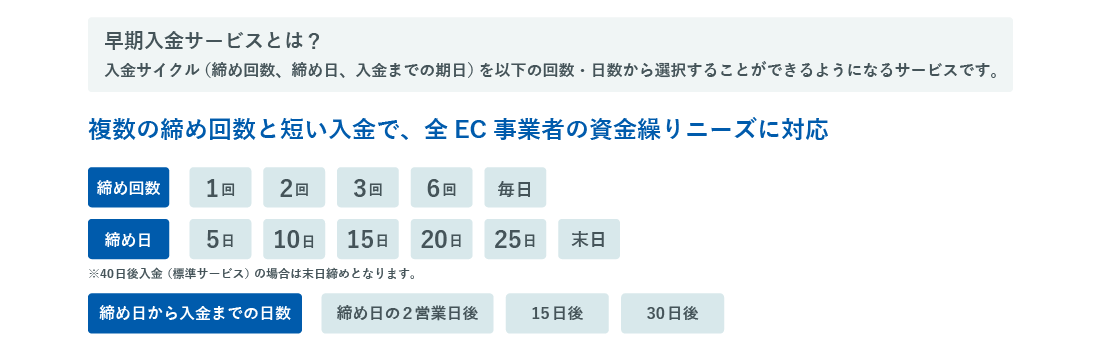

Merchants will be able to set up a deposit cycle that suits their cash flow.

Since it often takes several days for sales proceeds to be deposited into e-commerce businesses, cash flow at the time of demand for funds such as working capital and sales promotion expenses is one of the e-commerce management issues for e-commerce businesses.

Since Early Payment Service allows e-commerce businesses to freely select the payment cycle of "number of closings," "closing date," and "due date until payment," e-commerce businesses can set a payment cycle that suits their own cash flow needs, and they can operate their online stores without worrying about cash flow.

<Setting the optimal payment cycle>

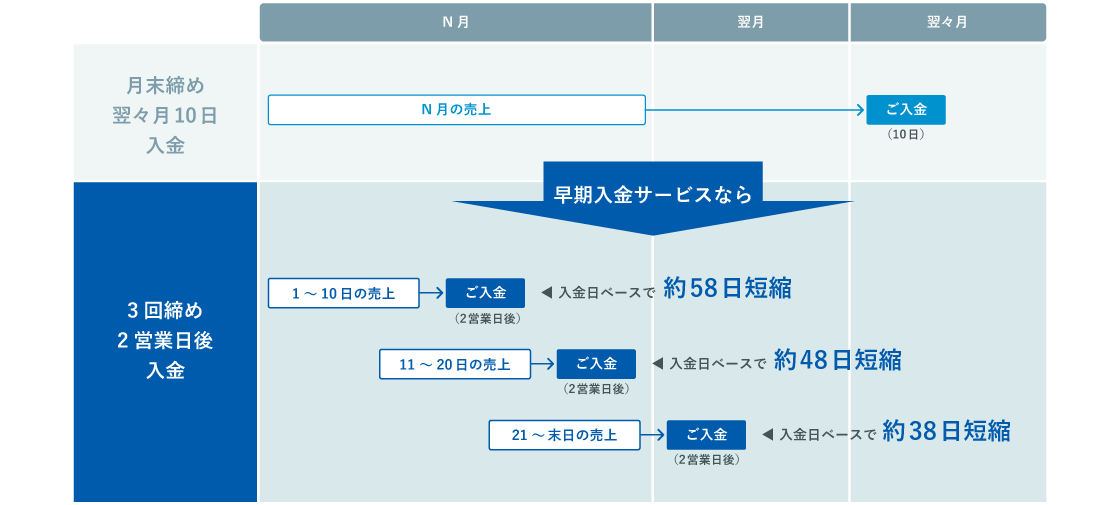

Deposit image when using the Early Payment Service

It is possible to shorten the time required for payment by up to 2 months.

Specific example: Image of deposit after 3 times tightening 2 business days

If you have any questions or consultations about our services, please contact us.

Please feel free to contact us from the following.