Prevent fraudulent transactions with machine learning

Fraud prevention service (Sift)

Sift, a fraudulent transaction prevention service that utilizes machine learning, is provided as a Optional Services of PG Multi-Payment Service.

By using machine learning to tune fraud rules, which used to be done manually, it is possible to identify suspicious transactions while reducing costs and operational burdens.

It provides (1) a function to collect various data such as device information, (2) an automatic learning function for fraudulent trends using machine learning, and (3) a smart management screen suitable for analyzing fraud factors.

Challenges like this can be overcome.

It can be solved

- I want to take security measures

Benefits of Fraud Prevention Services (Sift)

- By referring to the judgment score, chargeback contributes to the reduction of risk.

- By leveraging machine learning, you can reduce operational burden and significantly reduce traditional fraud costs.

- By embedding JavaScript and APIs of the PG multi-payment service specification, it is possible to reduce the development burden and other installation costs, and it can be easily introduced.

- With the automatic learning function of fraud trends by machine learning, transactions and chargeback information that are judged to be fraudulent are linked and automatic tuning is implemented.

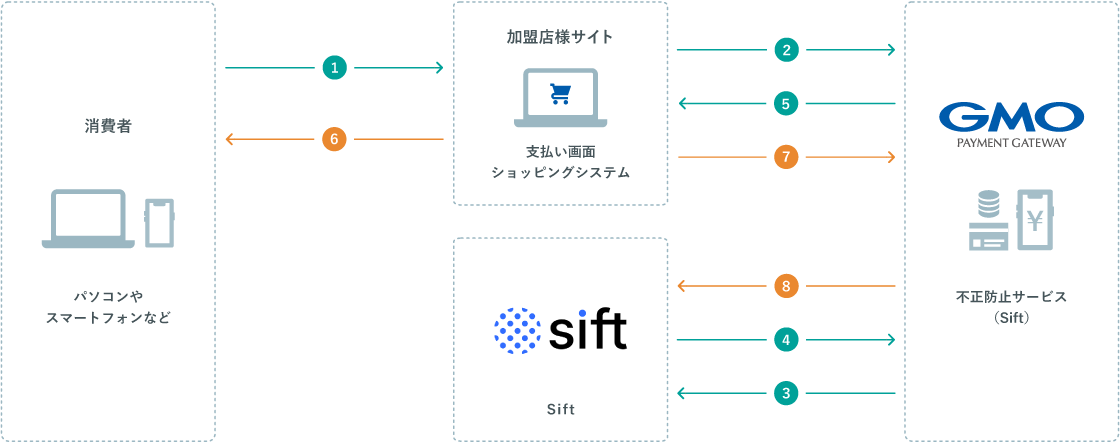

Service operation flow

- ... Information required to return scores

- ... Information required for tuning

- Enter customer information at the time of purchase

- Send detection data

- Link detection data

- Score return

- Score return

- Judgment of product shipment based on the result

- Link judgment results and fraudulent information

- Link judgment results

Important point

- It is not a service that guarantees 100 % prevention of fraudulent transactions.

- This service is for merchants who are using the PG Multi-Payment Service Credit card payment.

If you have any questions or consultations about our services, please contact us.

Please feel free to contact us from the following.