サイバー攻撃からビジネスを守る保険

サイバープロテクター

情報漏えいやサイバー攻撃による事故により企業に生じた賠償損害をはじめ、事故対応等にかかる費用損害や自社の利益損害を包括的に補償する保険です。

簡単なお手続きで多彩なニーズに応えるプランをご選択いただけるほか、標的型メール訓練サービス、専用コールセンターやサイバー事故発生時の専門事業者紹介サービスなど、充実した付帯サービスもご提供いたします。

※サイバープロテクターの引受保険会社は三井住友海上火災保険株式会社であり、GMOペイメントゲートウェイ株式会社はその保険代理店です。

※このWebページは保険の特徴を説明したものです。詳しくは、パンフレットをご確認ください。

このような課題を

解決できます

- セキュリティ対策をしたい

サイバー保険が必要とされる背景

サイバー攻撃が多発し、個人情報保護法等の法制はますます厳格化される社会情勢の中で、企業は更なる情報セキュリティへの危機管理対応が求められています。

-

サイバー攻撃の増加・攻撃手法の高度化

・日本国内のネットワークに向けられたサイバー攻撃関連の通信は2020年からの3年間で約3倍に増加(※)

・攻撃の標的は、「機密情報等を持つ官公庁や大企業」から「すべての企業」

(※)出典:国立研究開発法人情報通信研究機構 NICTER 観測レポート 2023 -

社会のデジタル化

・テレワークやWeb会議の普及

・IoT/キャッシュレスの進展 -

情報漏えいやサイバー攻撃により企業が負うリスクの存在

・賠償リスク:お客様の情報漏えいや、サイバー攻撃によるシステム停止により損害賠償請求を受けるリスク

・費用リスク:情報漏えいやサイバー攻撃の原因や被害範囲の調査費用、コールセンター設置費用などが発生するリスク

・利益リスク:サイバー攻撃により自社の営業が停止し、喪失利益が生じるリスク

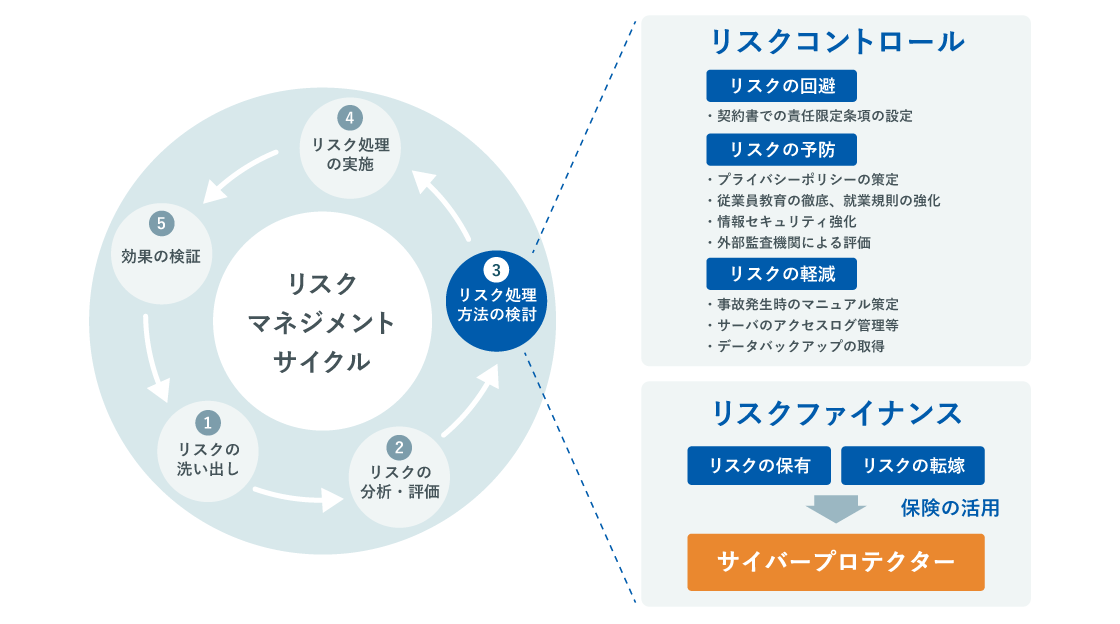

サイバー攻撃に対するリスクマネジメント

サイバー攻撃の巧妙化や情報漏えい事故が多発している昨今の状況において、いまや自社だけでは保有しきれないリスクを抱える可能性があります。 万が一の場合に備え、リスク転嫁の1つの選択肢として、サイバー攻撃や情報漏えいに起因する損害等を補償する「サイバープロテクター」の活用をご検討ください。

※弊社取扱い商品の引受保険会社である三井住友海上火災保険株式会社のWebサイトに遷移します

サイバープロテクターの特徴

-

サイバー攻撃から社員の過失による事故まで幅広くカバー

サイバー攻撃・ハッキング等による不正アクセス等の外部起因リスクのほか、貴社の過失や社員の犯罪等の内部起因リスクまで幅広くカバーします。

-

サイバー攻撃等の対応費用を手厚く補償

情報漏えいまたはその"おそれ"に加えて、コンピュータシステムの所有・使用・管理や電子情報の提供によって他人の業務を休止・阻害した場合の広告宣伝活動費用、コンサルティング費用や事故対応費用等を補償します。

(ベーシックプラン・ワイドプランで対象となります。) -

被害者への見舞金・見舞品購入費用も補償

情報漏えい等が発生した場合に、被害者に対する謝罪のための見舞金費用または見舞品の購入等の費用を、被害者が法人の場合には1法人につき5万円、被害者が個人の場合には1名につき1,000円を限度に補償します。

(ベーシックプラン・ワイドプランで対象となります。) -

海外で提訴された損害賠償請求も補償

海外でのサイバー事故により海外で損害賠償請求を受けた場合の損害賠償金や、現地で事故対応に必要となる各種費用が補償の対象となります。

(ワイドプランで対象となります。) -

充実の補償に加えてサイバー事故対応サービスもご提供

サイバーセキュリティの向上に資する「MS&ADサイバーセキュリティ基本態勢診断」や「標的型メール訓練サービス」、サイバー事故が発生した場合に専門の事業者をご紹介する「専門事業者紹介サービス」、サイバープロテクター専用のコールセンターの提供が可能です。

プランと補償範囲のイメージ

お客さまのニーズにあわせて3つのプランをご用意しております。詳細はパンフレットをご確認ください。

|

エコノミープラン |

ベーシックプラン |

ワイドプラン |

|---|---|---|

|

賠償損害のみを保証 |

賠償損害に加えて費用損害も補償 |

サイバー攻撃全般を含めた幅広い補償 |

業種別の保険料例

保険料は事業内容によって異なります。

製造業(印刷・同関連業を除く)年間保険料(一時払)

|

エコノミープラン |

ベーシックプラン |

ワイドプラン |

|---|---|---|

|

60,000円 |

66,090円 |

99,620円 |

卸売業(飲食料品卸売業、食料・飲料卸売業を除く)年間保険料(一時払)

|

エコノミープラン |

ベーシックプラン |

ワイドプラン |

|---|---|---|

|

60,000円 |

71,330円 |

109,140円 |

小売業(百貨店、総合スーパーを除く)年間保険料(一時払)

|

エコノミープラン |

ベーシックプラン |

ワイドプラン |

|---|---|---|

|

60,000円 |

132,450円 |

203,090円 |

契約条件

【共通】:賠償損害

- 支払限度額 : 1請求・保険期間中1億円

- 免責金額 : なし

- 売上高 : 5億円

- 割引確認シートによる割引 : 30%適用

【ベーシックプラン・ワイドプランの場合】:費用損害

- 支払限度額 : 1事故・保険期間中5,000万円

- 免責金額 : なし

※弊社取扱い商品の引受保険会社である三井住友海上火災保険株式会社のWebサイトに遷移します

業種別のサイバー事故事例

下記のサイバー事故事例は新聞やメディア等で報道されている内容に基づいたものです。

|

年月 |

業種 |

内容 |

|---|---|---|

|

2021年5月 |

通信販売事業者 |

通販サイトの脆弱性が原因でサイバー攻撃を受け、ユーザーのクレジットカード情報約2,000件が流出および不正利用された可能性があると発表。 |

|

2021年3月 |

食品製造 |

サーバが不正アクセスを受け、商品購入者、取引先、従業員などの個人情報約65,000件が流出した可能性があると発表。 |

|

2020年11月 |

電気メーカー |

クラウドサーバへのサイバー攻撃により、取引先の金融口座情報約8,500件が外部流出したと発表。 |

|

2020年9月 |

不動産 |

社内システムがランサムウェアに感染し、個人および法人情報や金融機関情報約1,000件が暗号化されたと発表。 |

|

2019年8月 |

スポーツ用品販売 |

顧客管理システムがパスワードリスト型攻撃を受け、最大約4万件のアカウントに不正ログインが発生、また最大約43万ポイントの不正利用被害が生じた可能性があると発表。 |

|

2019年5月 |

不動産 |

医師のPC端末に対する不正アクセスによりメールアカウントが乗っ取られ、マルウェアが添付されたなりすましメールが送信されたと発表。患者や医療関係者などの個人情報の流出の可能性もあるとしている。 |

承認番号:A24-102224

承認年月:2025年3月

※弊社取扱い商品の引受保険会社である三井住友海上火災保険株式会社のWebサイトに遷移します

サービスについての質問・相談は

下記よりお気軽にお問い合わせください。