銀行向けスマホ決済基盤システム

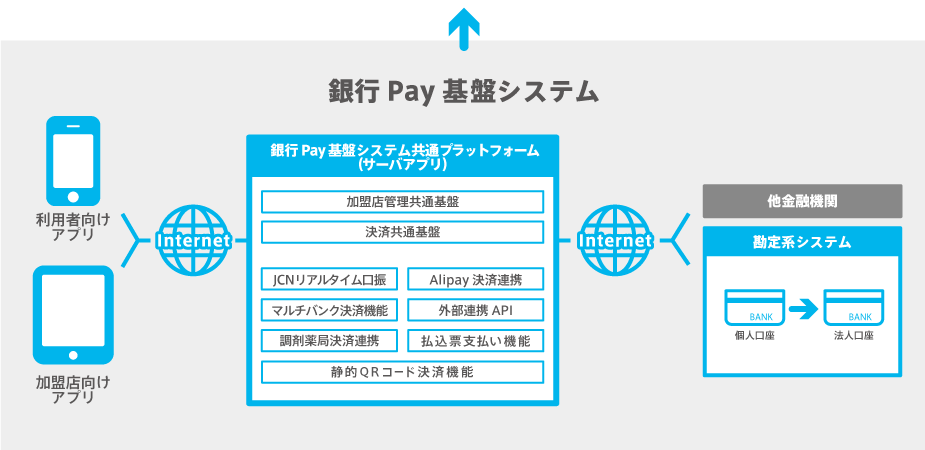

銀行Pay基盤システム

スマホアプリから即時に銀行口座の引き落とし等による支払いができるサービスです。

銀行は、「銀行Pay」の基盤システムを活用した独自のスマホ決済サービスを展開できるだけでなく、導入銀行間の相互連携を可能にするマルチバンク決済機能(銀行間の相互乗り入れ)により、銀行や地域を越えて利用できるサービスとして提供することが可能です。

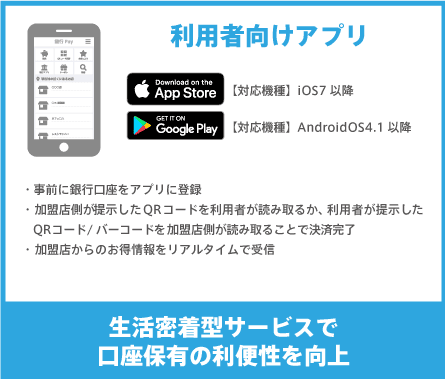

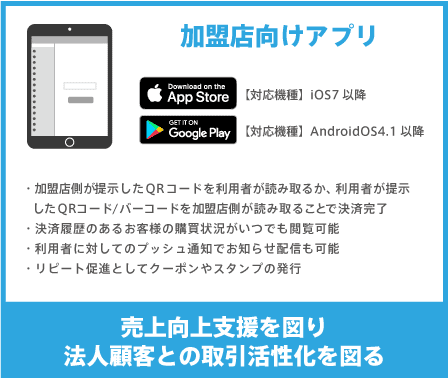

「銀行Pay」を導入している銀行に口座を持つ利用者は、利用者向けスマホアプリをダウンロードし、自分の口座を事前に登録しておくことで、加盟店でのお買い物の際、QRコード・バーコード決済により、銀行口座から代金が直接引き落とされ支払いが完了します。

GMO-PGは、銀行Payの基盤システムを提供しています。

このような課題を

解決できます

- DXで業務効率化を推進したい

銀行Pay 基盤システム

導入銀行

本ページでは、GMO-PGのプレスリリース発表順に導入銀行を記載しております。(※1)

(※1) 2024年11月1日現在

主な機能

マルチバンク決済機能(銀行間の相互乗り入れ)

銀行間の相互連携を可能にする機能です。

本機能を導入いただくことで、該当銀行の独自スマホ決済サービス利用者は、本機能を導入した他銀行の独自スマホ決済サービス取扱加盟店(※2)でもご利用いただくことが可能になります。

■マルチバンク決済機能対応済みの銀行(※1)

横浜銀行、ふくおかフィナンシャルグループ(福岡銀行・熊本銀行・十八親和銀行)、ゆうちょ銀行、沖縄銀行、広島銀行、三井住友銀行(※3)

(※2)一部店舗でご利用いただけない場合がございます。

(※3)三井住友銀行は、事業者が自社のスマホ会員アプリ等でユーザーに決済機能を搭載できるサービス「事業者型Pay」を提供しています。

対面QR決済機能

銀行Payの加盟店の支払いにおいて、QRコードを利用したスマホ決済サービスが行える機能です。

払込票支払い機能

払込票(※4)の支払いを銀行独自のスマホ決済サービスで行える機能です。

本機能を導入いただくことで、該当銀行の独自スマホ決済サービス利用者は、払込票に印字されたQRコード・バーコードをアプリで読み取ることで、銀行口座から代金が引き落とされ支払いが完了します。

■払込票支払い機能対応銀行(※1)

横浜銀⾏、ふくおかフィナンシャルグループ(福岡銀⾏‧熊本銀⾏‧⼗⼋親和銀⾏)、ゆうちょ銀⾏、沖縄銀⾏、広島銀⾏

(※4)電算システム、CNS、PayB またはゆうちょ銀⾏が発⾏する払込票が利⽤できます。対応可能な払込票は各行によって違います。(銀⾏Payに係る特約を結んだものに限ります)

ことら送金機能

スマホアプリから「携帯電話番号やメールアドレス等を指定し、安価な手数料で10万円以下の個人間送金が可能」な機能です。

ことら送金サービスに対応している銀行に口座を持つ利用者との間において、通常の金融機関口座指定送金のみならず、携帯電話番号やメールアドレス、バリューIDなどを指定して簡単に便利に個人間の送金が実施できます。携帯電話番号やメールアドレス指定の場合、送り手に送金メッセージも送付可能です。

■ことら送金機能対応済みの銀⾏(※1)

横浜銀⾏、ふくおかフィナンシャルグループ(福岡銀⾏‧熊本銀⾏‧⼗⼋親和銀⾏)、広島銀⾏

ことら送金のサービス概要は、以下ことら社のHPをご参照ください。

https://www.cotra.ne.jp/p2pservice/

ことら税公金機能

スマートフォンで地方税統一QRコードを読み取り、税・公金の納付ができる機能です。「eLマーク」表示がある納付書のQRコードを読み取ることで、納税者がお好きな時間に銀行やコンビニに出向くことなく、税・公金の納付が完了します。

■ことら税公金機能対応済みの銀⾏(※1)

横浜銀⾏、ふくおかフィナンシャルグループ(福岡銀⾏‧熊本銀⾏‧⼗⼋親和銀⾏)

ことら税公金の概要は、以下ことら社のHPをご参照ください。

https://www.cotra.ne.jp/ltaservice/

[オプションとして提供している機能]

-

タッチ決済向け連携機能

銀行Payアプリから「バーチャルプリペイドカード」を発行して、非接触で決済を完結できる「タッチ決済」機能です。銀行口座からのバリューへのチャージや、ID加盟店・VISAご利用店舗において、タッチ決済が可能となります。

-

地域・自治体との連携機能

各種自治体が推進する「キャッシュレス・消費喚起事業」のサポートを目的として、地域振興券の取り扱い基盤・QRコード決済サービスを提供する機能です。

-

EC口座直接決済機能

オンラインショッピング等の支払いにおいて、既存のクレジットカードやコンビニ払いに加え、銀行口座から直接決済が可能な機能です。

サービスについての質問・相談は

下記よりお気軽にお問い合わせください。