May 30, 2023

GMO Payment Gateway, Inc.

Develop comprehensive payment-related services and finance-related services within the GMO Internet Group GMO Payment Gateway, Inc. (TSE Prime Market: Securities Code: 3769, President & Chief Executive Officer:Issei Ainoura GMO-PG) Major update of Online Payment Service "PG Multi-Payment Service" payment method From Tuesday, May 30, 2023, we will start providing a new connection method "OpenAPI Type" that reduces the additional cost to one-tenth (*1) of the conventional one-tenth (* 1).

This will improve the convenience of online operators when implementing payment services, and will also improve the convenience of Japan enterprise companies and Japan that have previously felt hurdles to adding payment method due to the cost load. Global companies that want to introduce smartphone-based payment and CVS Payment can easily You can add payment method.

- *1 Based on our research.

【Background and Summary】

Although the cashless ratio of Japan is steadily increasing year by year, it will be 36.0% in 2022, which is lower than other countries (*2), and the Japan government is promoting cashless payments with the aim of reaching about 40% by 2025 and 80%, the world's highest level in the future. Among them, not only conventional Credit card payment and CVS Payment, Own smartphone-based payment, buy now pay laterpayment Japan etc. payment method are diversifying. There is a high need for payment method that can be used both online and offline in EC payment, and the "PG Multi-Payment Service provided by GMO-PG The number of payment method is diversifying, with the number of compatible payment method exceeding 30 at the start of 2008.

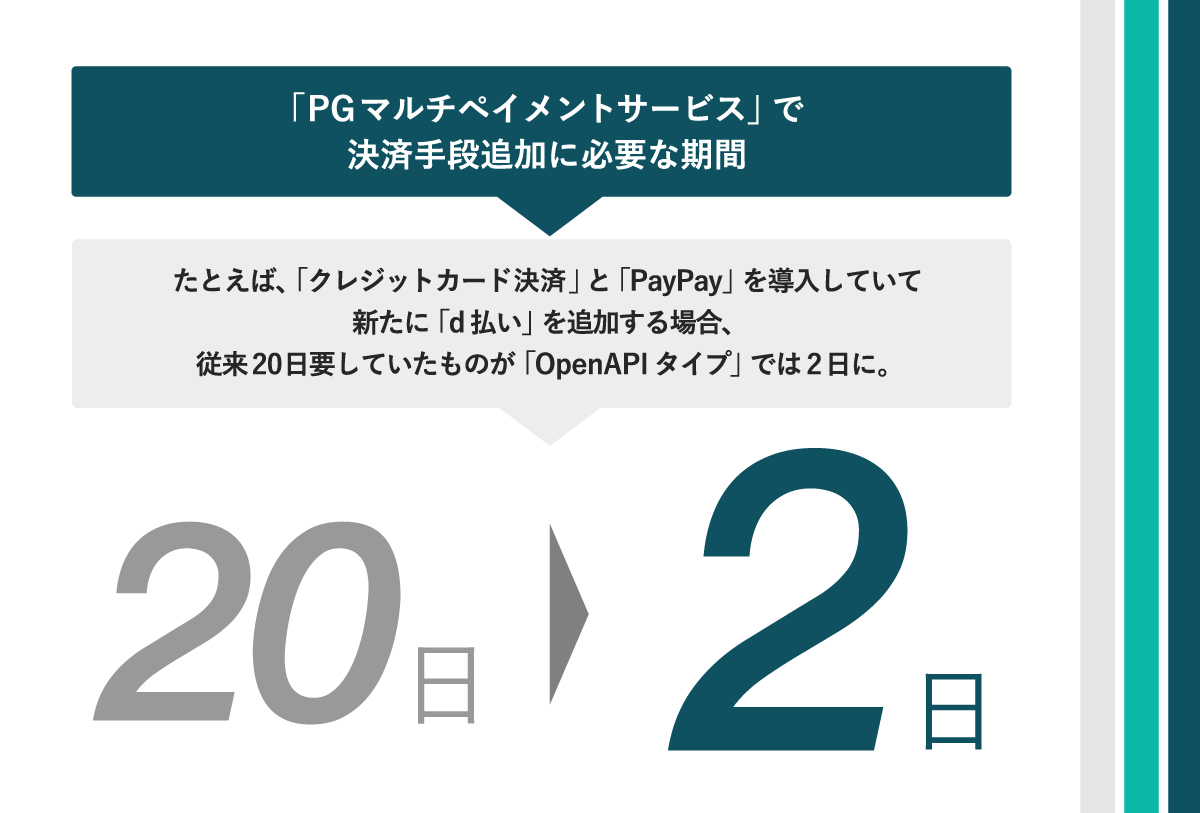

Therefore, businesses that conduct online business in Japan are required to introduce various payment method to meet the needs of consumers, but to introduce more than one payment method Since individual development is required for each of them, it is currently expensive and man-hours. Therefore, GMO-PG has revamped the connection method of the comprehensive payment service "PG Multi-Payment Service", We will launch a new connection method "OpenAPI type" that reduces the additional cost of payment method to one-tenth (*1) of the conventional one.

- (*2) Announced in April 2023 by the Ministry of Ministry of Economy, Trade and Industry, "Cashless payments in 2022We calculated the ratio."

(URL:https://www.meti.go.jp/press/2023/04/20230406002/20230406002.html) - (*3) Announced in March 2023 by the Ministry of Ministry of Economy, Trade and Industry "Study Group on the Future Vision of Cashless (Summary Version)"

(URL:https://www.meti.go.jp/shingikai/mono_info_service/cashless_future/pdf/20230320_2.pdf)

【About "OpenAPI Type"】

(URL:https://www.gmo-pg.com/service/mulpay/connection-types/openAPItype/)In the new connection method "OpenAPI Type" of "PG Multi-Payment Service", each payment method APIs are provided in APIs that are aggregated into several groups, and the connection specification of the world-standard OpenAPI Specification (OAS) realizes payment method additional cost reduction. GMO-PG leverages the knowledge and technology of a leading company that has been providing comprehensive payment services for more than 25 years, and is suitable for the diverse payment method of the Japan EC market. The payment method is a card system and smartphone-based payment We have developed a structure that groups them into systems and connects them via API. In addition, the connection specification uses the world-standard OpenAPI Specification, which is expected to improve the efficiency of the quality control process by improving the learning cost of engineers, development man-hours such as coding and testing, and code maintainability and reusability.

As a result, online operators using "PG Multi-Payment Service" can do one development for the aggregated group. This makes it possible to reduce the additional development cost of payment method to about one-tenth (*1) compared to the past. Cost reduction can also be reduced for development by diverting common parts of the developed group. Therefore, in addition to Japan enterprise companies that felt hurdles in adding payment method due to the cost load, Japan unique Global companies that want to introduce smartphone-based payment and CVS Payment By using PG Multi-Payment Service", it is possible to easily introduce additional payment method to meet consumer needs.

GMO-PG will continue to actively adopt and develop new technologies to support e-commerce and DX for domestic businesses and global companies.

【About PG Multi-Payment Service】

(URL:https://www.gmo-pg.com/service/mulpay/)GMO-PG has been providing Credit card payment, CVS Payment, and buy now pay later since 2008. payment, smartphone-based payment, Online direct debit payment It is a Online Payment Service that can introduce various payment method at once. By making proposals that capture trends and issues specific to industries and business categories by a sales team that is familiar with the industry in charge, it can be used not only for EC but also for business development starting from payment such as online business and DX.

In addition, we offer a full range of security solutions, a high-quality payment processing system that is both fast and stable, customer support that has been awarded three stars, which is the highest rating for response quality in the HDI rating benchmark, and five-star certification, which is proof of an excellent system, and financing options that contribute to growth and operational efficiency. Users can achieve business growth in a safe and secure payment environment.