Online payment No.1 Usage

Credit card payment

Credit card payment is one of the most frequently used online payment payment method and essential for increasing sales.

With GMO Payment Gateway's Credit card payment, you can easily implement high-performance and secure card payment services all at once.

We will support our customers with peace of mind from consultation on the construction of EC sites and online shops to the time of payment introduction.

In addition to the five major international brands (Visa, MasterCard, JCB, AMEX, and Diners), we accept credit cards issued by various credit card companies in Japan.

Challenges like this can be overcome.

It can be solved

- I want to introduce payment to my service

- I want to know the most commonly used payment method

- I want to make BtoB transactions cashless.

5 points where Credit card payment

-

You can leave the complicated paperwork for each credit card company

-

Get attentive customer support to help you run your business

-

You can use the early collection service for sales

-

You can introduce the industry's top-class stable operation and reliable payment service as SaaS

-

You can operate e-commerce in a security environment that complies with international standards

Reasons why we are selected for payment processing services

Merchants with multiple credit card companies contract Since you can leave all the procedures to us, you can eliminate the cost of complicated paperwork and concentrate on designing and building your e-commerce site. In addition, we will support you from the establishment of your website to the operation of your website in all payment method, including Credit card payment, such as reducing the risk of non-collection with "Early Payment Service" for fee collection.

さらに「PGマルチペイメントサービス」なら、クレジットカード決済、コンビニ決済、Pay-easy、口座振替、PayPayや楽天ペイなどのコード決済といった各種決済手段を、追加したいときにいつでも簡単に設定可能。多様化する決済ニーズにお応えします。決済手段だけでなく、継続課金、会費徴収、支払期限設定などの豊富なサービスも一つの管理画面で一元管理。使い勝手をとことん突き詰めた決済サービスです。

We help improve the efficiency of our operations, analyze and examine the cost of payment from the smallest points to the parts related to the whole, and prepare each service so that it leads to reduction.

Business Overview and Credit card payment 3 plans according to your purpose

A dedicated sales representative will guide you. Please feel free to contact us.

| Entry Plan | Standard Plan | Advanced Plan |

|---|---|---|

|

Easy to install despite its high functionality. Recommended for the first Credit card payment Recommended business ・Internet product sales |

You can increase the number of repeat customers with the credit card number registration function. Recommended business ・Internet product sales |

You can get stable sales with the continuous monthly billing function. Recommended business ・Insurance sales |

We will propose the most suitable Credit card payment

Introducing the main model cases from various payment

Entry Plan: payment on a case-by-case basis

This is a method payment by having the purchaser enter the card information each time he / she purchases a product or service.

物品販売でのクレジットカード決済ご利用例

By managing the status, it is possible to prevent events and troubles such as the payment request from the credit card company even though the product has not arrived.

payment each time + provisional/actual operation

- It is possible to manage and change the product status of "authorization" at the timing of the order, and "actual sales" after the product is shipped.

- The "cancellation" and "return" processing at the time of cancellation is also easy.

デジタルコンテンツ販売でのクレジットカード決済ご利用例

Buyers can make payment when purchasing digital content such as music data and game app items. You can immediately provide the service to the purchaser.

payment each time + immediate operation

- Immediately move to "Sales" status at the timing of receiving an order.

- The "cancellation" and "return" processing at the time of cancellation is also easy.

Standard Plan: Membership ID payment support

Member ID registration saves the purchaser the trouble of entering credit card information each time he / she makes a purchase. We can expect an increase in sales by retaining buyers and turning them into repeat customers.

物品販売でのカード決済ご利用例

This saves the purchaser from having to enter personal information such as name and credit card information each time he / she purchases, preventing the basket from dropping or leaving, and at the same time increasing the repeat purchase rate.

Member ID + Provisional/Actual Operation

- At the time of initial purchase or application, the credit card is "checked for validity", and if it is valid, a "member ID" is systematically assigned.

- Utilize the status management function of "authorization" when receiving an order and "actual sales" after shipping the product. As with payment operation each time, we will prevent problems with product non-delivery.

デジタルコンテンツ販売でのカード決済ご利用例

Ideal for charging digital content such as frequently purchased game app items. You can save the trouble of entering credit card information and immediately provide the service to the purchaser.

Member ID + Immediate Operation

- At the time of initial purchase or application, the credit card is "checked for validity", and if it is valid, a "member ID" is systematically assigned.

- "Sales" are determined at the timing of receiving orders.

Advanced Plan: account update

Suitable for businesses with monthly billing type. By receiving the prescribed data every month, it is possible to payment while renewing the expiration date of card information (account update), improving the certainty of billing and operational efficiency.

Examples payment usage in monthly billing businesses such as providers, insurance sales, regular flights, and goods-of-the-month delivery service

This saves the purchaser from having to enter personal information such as name and credit card information each time he / she purchases, preventing the basket from dropping or leaving, and at the same time increasing the repeat purchase rate.

account update operation + member ID payment

- At the time of initial purchase or application, the credit card is "checked for validity", and if it is valid, a "member ID" is systematically assigned.

- At the time of billing and continuation, "account update" and "sales" processing will be performed.

Security environment

payment from the previous payment until after, safe and secure payment will provide the environment.

We also support credit card security guidelines.

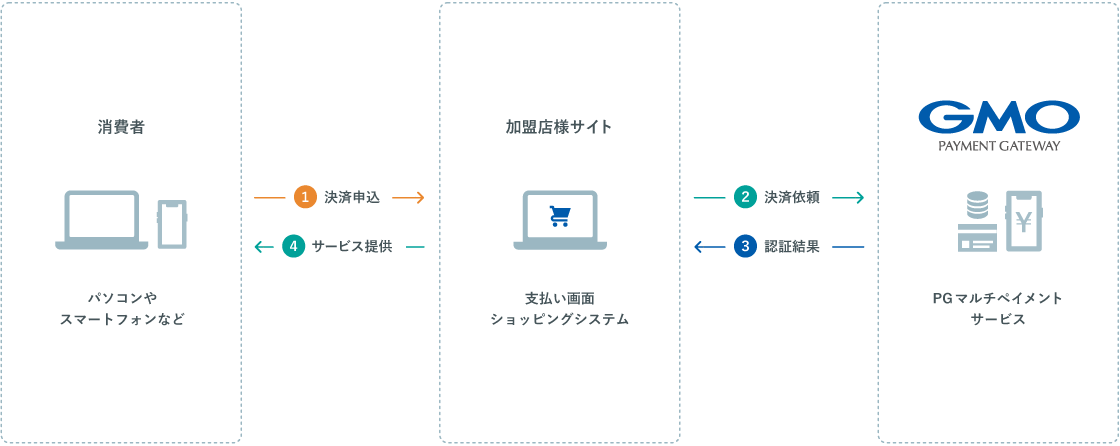

Service operation flow

はじめに「PGマルチペイメントサービス」を導入いただき、その後そのプラットフォーム上にクレジットカード決済を導入いただきます。

「PGマルチペイメントサービス」は、高機能で簡単導入を実現する「SaaS」として、多様な決済機能を統合した総合決済サービスです。加盟店審査や加盟店契約といった手続きだけでなく実際の導入から運用までを当社がワンストップにご提供するため、スムーズな決済サービスの導入が可能です。

Acceptable credit card companies

You can introduce Credit card payment of major international brands all at once.

In addition to the five major international brands (Visa, MasterCard, JCB, AMEX, and Diners), we accept credit cards issued by various credit card companies in Japan Japan.

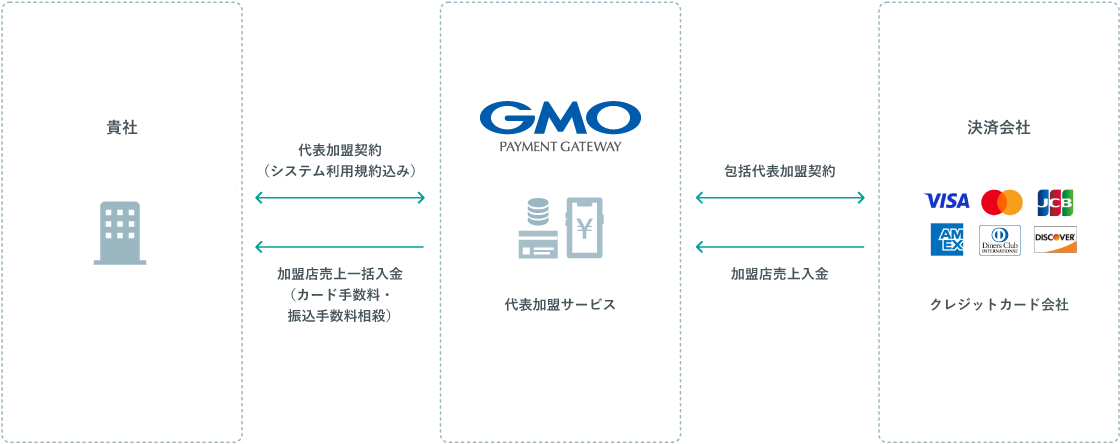

A service that can be used by multiple credit card brands with contract only with your company

支払い手段として複数のクレジットカードブランドを利用できるようにするには、事業者様が導入したいクレジットカードブランドの数だけ、直接クレジットカード会社と契約する必要があります。弊社の「代表加盟サービス (加盟店契約一括サービス)」をご利用いただくと、事業者様と弊社間のみの一契約で、複数のクレジットカードブランド加盟店との契約が可能となり、貴社におけるクレジットカード売上の管理を効率化できます。

It is recommended for businesses that are starting new online shops and Internet mail-order sales, and businesses that want to Credit card payment

- Only by contract with us, you will be able to use multiple card brands

- Deposit dates and fees are unified, making it easier to manage deposits and withdrawals

- By using Optional Services, you can make payments faster

Representative membership contract

Notes

About merchant screening

This service is a merchant contract agency service for Internet mail order. Depending on the products handled and the screening of credit card companies and collection agencies, it may not be available, and the credit card brands and payment method that can be used may be limited.

*Please contact us for details.

About payment option Credit card payment

ご利用いただけるお支払方法は「一括払い」です。ご要望により「リボ払い」・「分割払い」を提供いたします。

* Depending on the products handled by the business, we may not be able to meet your request. If you have a credit card company and a Direct Contract and wish to use the contract in combination with our representative member contract, please note that we will apply the payment option available at our representative member contract.

About payment

Please note that you will be responsible for any transfer fees to financial institution incurred when depositing sales proceeds. If the amount of cancellation is greater than the amount of sales, you may be asked to pay us.

Fraud Credit card payment occurs

In the unlikely event that a third party fraud occurs and the credit card company recognizes that it is a fraudulent transaction, "return of sales" or "refusal of purchase of receivables (chargeback)" may occur. As a countermeasure, we recommend using the personal authentication service: EMV 3-D Secure (3D Secure 2.0), which can minimize the occurrence of fraud.

* VISA / MASTER / JCB are eligible, and other card brands are not eligible.

Flow until service introduction

1. Inquiries and requests for information: YOUR COMPANY GMO-PG

Please contact us by form or phone first. We will send you a free document that summarizes the best service for you. In addition, the person in charge will contact you as soon as possible.

In addition, you can start using the service in a minimum of 3 weeks to 2 months, including the period from application to examination, ID issuance, and incorporation into your system.

payment We also accept detailed consultations and requests regarding services. Please feel free to contact us.

You can use the test environment and download the specifications.

This is an environment in which tests are conducted in advance before introducing "PG Multi-Payment Service".

We provide specifications, manuals, and a set of management screens necessary for various payment processing (test operation).

2. Apply from your YOUR COMPANY

Please submit the following documents when applying.

merchant acquiring service (member store contract package service)

- PG Multi-Payment Service application

- The register of the company (copy)

- Product materials for sale

- Contents of indication based on the Act on Specified Commercial Transactions

- Notification to each competent authority and permit

* If the web page is public, some documents are not required.

* For details, please contact our sales staff.

In case of direct membership contract (when there is a contract with the card company)

- PG Multi-Payment Service application

3. At our company merchant screening ・ RegisteredGMO-PG

If you are using the merchant acquiring service (member store contract acquirer will conduct an examination via our company.

4. GMO-PG provides production environment from our company

acquirer and we will send you the production environment setting contents by e-mail.

5. Test the connection in your production environment YOUR COMPANY

Please perform a connection test in a production environment.

6. Start of operation at your YOUR COMPANY

Please start operation.

* The period until the start of operation will vary depending on the development content of your company.

* PayPal At the time of introduction, some of the installation procedures are different. merchant screening After approval, you will receive a confirmation email from PayPal company, so please enter the verification code and reply. After that, the production environment will be provided.

If you have any questions or consultations about our services, please contact us.

Please feel free to contact us from the following.