2022年11月11日

報道関係各位

GMOペイメントサービス株式会社

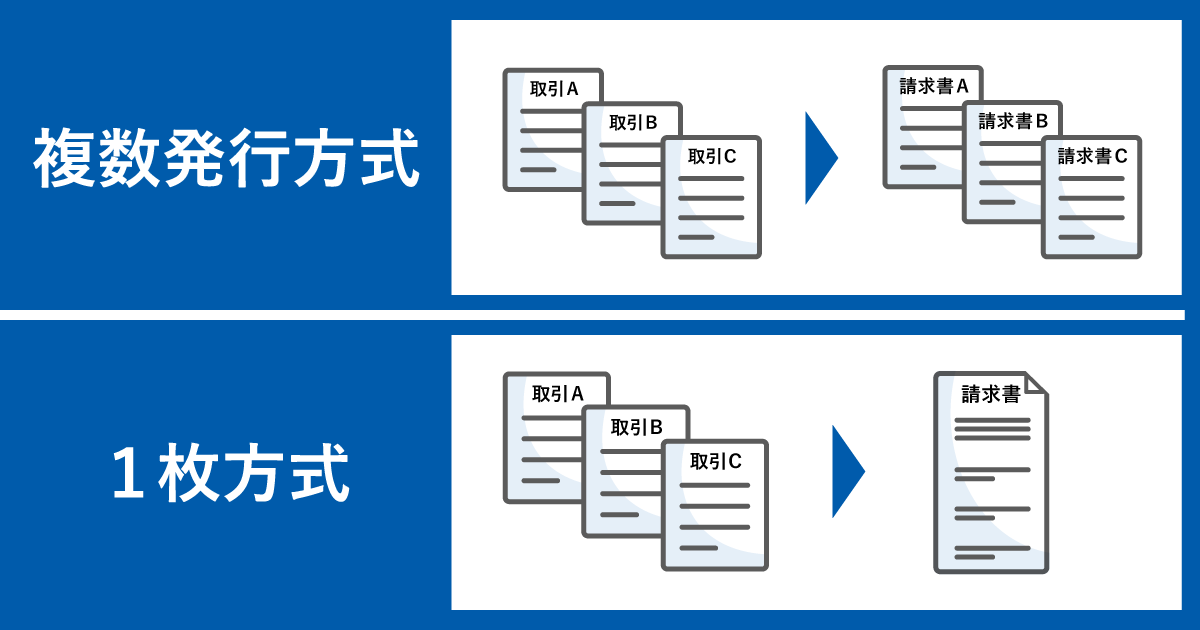

GMOインターネットグループでGMOペイメントゲートウェイ株式会社の連結会社であるGMOペイメントサービス株式会社(代表取締役社長:向井 克成 以下、GMO-PS)は、BtoB取引向け後払い決済サービス「GMO掛け払い」において、インボイス制度(適格請求書等保存方式)に対応する請求書を発行することを決定いたしました。事業者のビジネスやご要望に応じて選択できるよう、「複数発行方式」「1枚方式」の2つのタイプの適格請求書を発行いたします。

【背景と概要】

2023年10月1日より消費税の仕入税額控除の方式としてインボイス制度が開始されます。インボイス制度は、売り手企業が適格請求書発行事業者として登録し要件を満たした適格請求書(インボイス)を発行することで、買い手企業(取引先)が仕入税額控除を受けることができる制度です(※1)。

GMO‐PSはBtoB取引向け後払い決済サービス「GMO掛け払い」において、インボイス制度に対応した請求書を発行するオプションサービス「インボイス発行サービス」の提供を2023年7月(予定)より開始いたします。「インボイス発行サービス」では、適格請求書の必須項目を満たした「複数発行方式」「1枚方式」の2タイプの請求書を発行できるため、「GMO掛け払い」をご利用の適格請求書発行事業者は、自社のビジネスに合わせた適格請求書を選択することが可能となります。

■「GMO掛け払い」で発行する適格請求書について

| 複数発行方式 |

・1取引ごとに税計算を行った金額を記載した適格請求書を発行するものです。 ・「GMO掛け払い」による取引が同じ取引先から複数ある場合、取引数に対応した数の適格請求書を発行します。 ・取引ごとに税計算を行い端数処理をするため、取引時点での提示金額と最終的な請求金額に差異(※2)が発生しません。 ・適格請求書発行時に発行枚数に応じた費用が発生するため、同じ取引先との取引が少ない事業者に適しています。 |

|---|---|

| 1枚方式 |

・同じ取引先とひと月に交わされた取引をまとめて1取引として、税計算を行った金額を記載した適格請求書を発行するものです。 ・「GMO掛け払い」によるひと月の取引が同じ取引先から複数回ある場合も1取引として、一の適格請求書を発行します。 ・インボイス制度では一の請求書につき1回の端数処理を行うため、取引時点での提示金額と最終的な請求金額に差異(※2)が発生する場合があります。 ・同じ取引先とのひと月の取引が多い事業者は、ひと月分の取引を一の適格請求書で発行するため請求書発行費用を抑えることができます。 |

なお、適格請求書発行事業者登録番号については「GMO掛け払い」ご利用の事業者より共有いただき、GMO-PSにて請求書に記載します。BtoBモール型事業者などの場合は、モール出店事業者の登録番号で適格請求書を発行することも可能です。適格請求書はPDFまたは封書(※3)にて発行いたします。

-

(※1)インボイス制度に関する詳細は国税庁「特集インボイス制度」をご参照ください。

URL: https://www.nta.go.jp/taxes/shiraberu/zeimokubetsu/shohi/keigenzeiritsu/invoice.htm - (※2)「税率ごとに区分した消費税額等」に1円未満の端数が生じる場合、一の適格請求書につき、税率ごとに1回の端数処理を行います。その際、取引時点での提示金額と最終的な請求金額に差異が発生することがあります。

- (※3)請求書タイプを「封書タイプ」に設定している事業者のみ、PDFダウンロードに加えて封書で適格請求書が発行いただけます。なお、「ハガキタイプ」を設定している事業者は、PDFにて適格請求書をダウンロードいただけます。

【「GMO掛け払い」について】

(URL: https://www.gmo-ps.com/feature_kb-lp01/ )

「GMO掛け払い」は、GMO-PSが提供するBtoB取引向けの後払い決済サービスです。

法人・個人事業主にかかわらず定期的に利用のあるルート営業のお取引先や、サブスクリプション型サービスをご利用のお客様など、オンライン(EC)・オフライン(対面)を問わず全てのBtoB取引でご利用いただけます(※4)。

与信審査・請求書発行・入金管理・未入金時の督促といった業務をGMO-PSが代行するため、事業者は請求業務の効率化が図れます。さらに、取引先の支払い状況にかかわらず、代金の未回収リスクはGMO-PSが負担し、ひと月分の取引の売掛金を所定日に入金します(※5)。

■「GMO掛け払い」の特長

| 1. リアルタイム与信 | リアルタイムでの与信審査を実装しているため、取引先(買い手企業)を待たせることなく、スムーズな決済で離脱を防ぎます。 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2. 豊富なオプションサービス |

豊富なオプションサービスをご用意しており、自社の運用に合わせて最適にカスタマイズいただけます。 ■主なオプションサービス

|

||||||||||||||

| 3. 業界最低水準の料金 |

決済手数料をはじめ、固定費・請求書発行費用・振込手数料など全てが業界最低水準(※6)です。料金の詳細は、以下のURLをご参照ください。 URL: https://www.gmo-ps.com/feature_kb-lp01/ |

- (※4)「GMO掛け払い」のご利用には、GMO-PSの審査がございます。

- (※5)GMO-PSによる与信審査を通過し、正常に完了した取引が対象となります。

- (※6)GMO-PS調べ(2022年11月11日時点)

【GMOペイメントサービス株式会社について】

GMO-PSは、総合的な決済関連サービス及び金融関連サービスを展開するGMOペイメントゲートウェイの連結会社として、BtoC EC取引向け後払い決済サービス「GMO後払い」とBtoB取引向け後払い決済サービス「GMO掛け払い」を提供しています。リアルタイム与信の提供、業界最低水準の料金、事業者の運用に応じてカスタマイズが可能なシステムなどにより、多くの事業者にご利用いただいています。

今後もインターネット・決済サービスを通じて社会と人々に貢献する企業を目指し、EC事業者・購入者の皆様がさらに安全・便利にご利用いただけるサービスの開発・提供に努めてまいります。

【報道関係お問い合わせ先】

GMOペイメントゲートウェイ株式会社

企業価値創造戦略 統括本部 広報・UX部

GMOインターネットグループ株式会社

グループコミュニケーション部 広報担当 新野

- TEL

- 03-5456-2695

- pr@gmo.jp

【サービスに関するお問い合わせ先】

GMOペイメントサービス株式会社

- TEL

- 03-3464-2392

- g-marketing@gmo-ps.com

【GMOペイメントサービス株式会社】(URL:https://www.gmo-ps.com/)

| 会社名 | GMOペイメントサービス株式会社 |

|---|---|

| 所在地 | 東京都渋谷区道玄坂1丁目14番6号 ヒューマックス渋谷ビル |

| 代表者 | 代表取締役社長 向井 克成 |

| 事業内容 | ■決済処理サービス及びEC周辺サービスの提供 |

| 資本金 | 1億50百万円 |

【GMOペイメントゲートウェイ株式会社】(URL:https://www.gmo-pg.com/)

| 会社名 | GMOペイメントゲートウェイ株式会社 (東証プライム 証券コード:3769) |

|---|---|

| 所在地 | 東京都渋谷区道玄坂1丁目2番3号 渋谷フクラス |

| 代表者 | 代表取締役社長 相浦 一成 |

| 事業内容 | ■総合的な決済関連サービス及び金融関連サービス |

| 資本金 | 133億23百万円 |

【GMOインターネットグループ株式会社】(URL:https://www.gmo.jp/)

| 会社名 | GMOインターネットグループ株式会社 (東証プライム 証券コード:9449) |

|---|---|

| 所在地 | 東京都渋谷区桜丘町26番1号 セルリアンタワー |

| 代表者 | 代表取締役グループ代表 熊谷 正寿 |

| 事業内容 |

■インターネットインフラ事業 ■インターネット広告・メディア事業 ■インターネット金融事業 ■暗号資産事業 |

| 資本金 | 50億円 |