Management StrategyManagement Strategy

(2024年9月期時点)

Target Management Indicators

当社グループは、経営指標として年平均25%の営業利益成長を重視しております。

As a company responsible for online payment and Card Present Transactions infrastructure centered on the e-commerce (EC) market, the Group will create a safer and more convenient e-commerce and cashless environment, and contribute to the improvement of Japan EC ratio, the promotion of DX (digital transformation), and the increase in the cashless ratio. In addition, we will strive to expand our business scale through the development of new businesses, business and capital alliances with business partner companies, the establishment of subsidiary, and overseas business development.

Establishing a Growing Market

Expansion of EC market

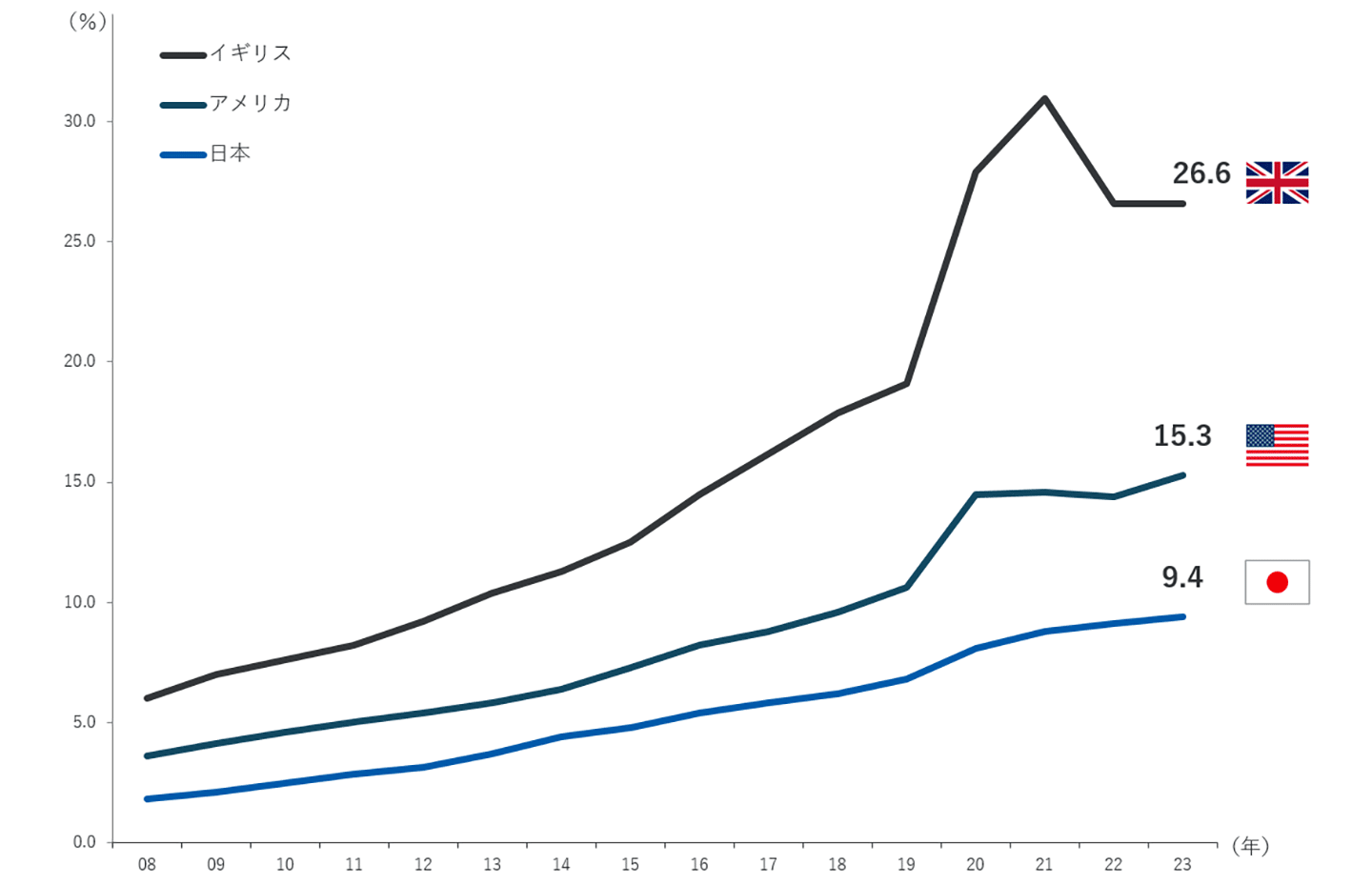

The EC ratio of Japan is still at a low level compared to developed countries in Europe and the United States, and the e-commerce market is expected to expand in the medium to long term due to the development of Japan logistics networks, the penetration of subscriptions into daily life, and the introduction of Online Merges with Offline (OMO).

EC ratio in developed countries *

* 経済産業省「令和5年度 内外一体の経済成長戦略構築にかかる国際経済調査事業(電子商取引に関する市場調査) 」、米国勢調査局 "The 2nd Quarter 2024 Retail E-Commerce Sales Report"、英国国家統計庁 "Retail Sales Index internet sales, October 2024"

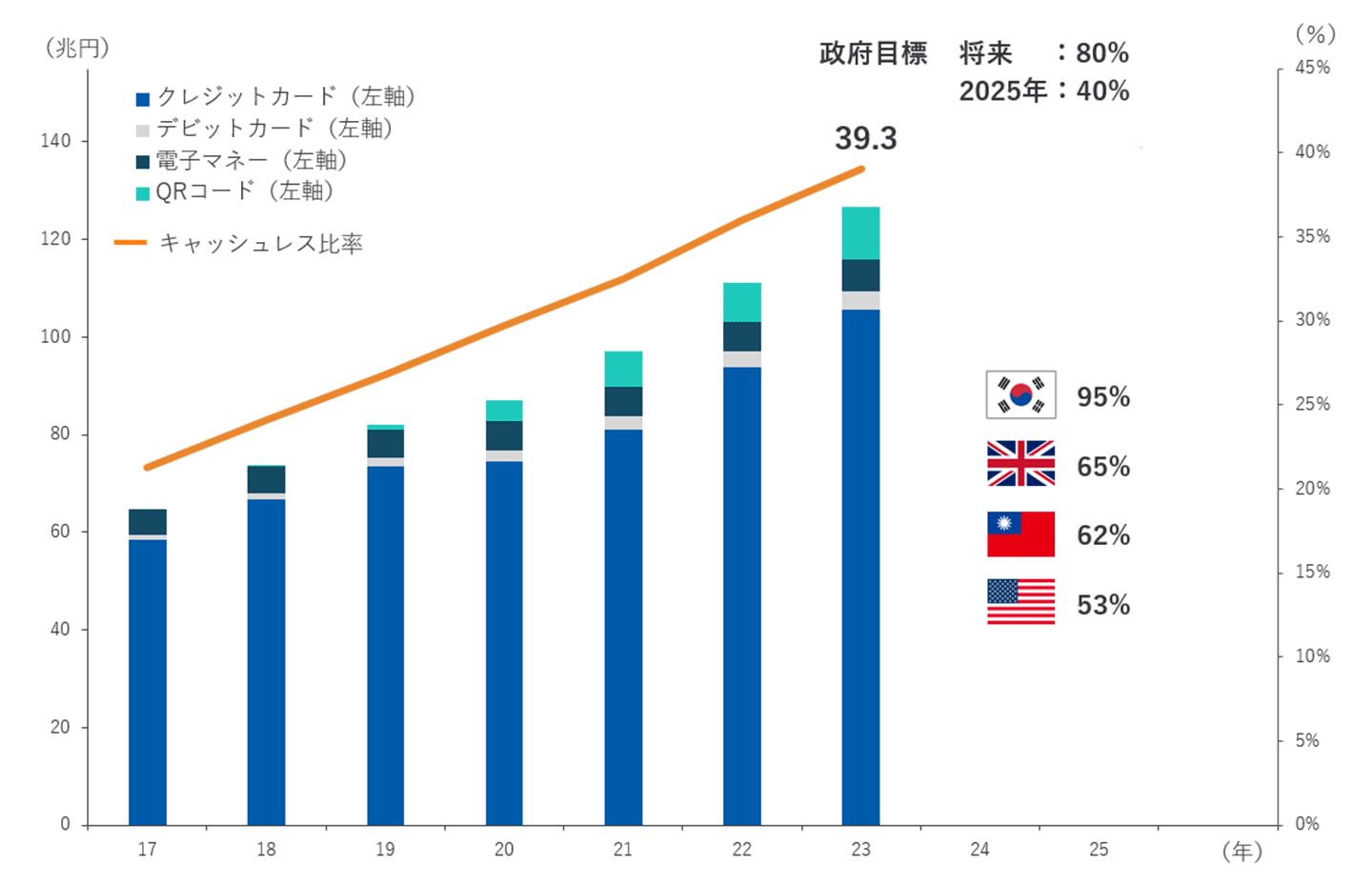

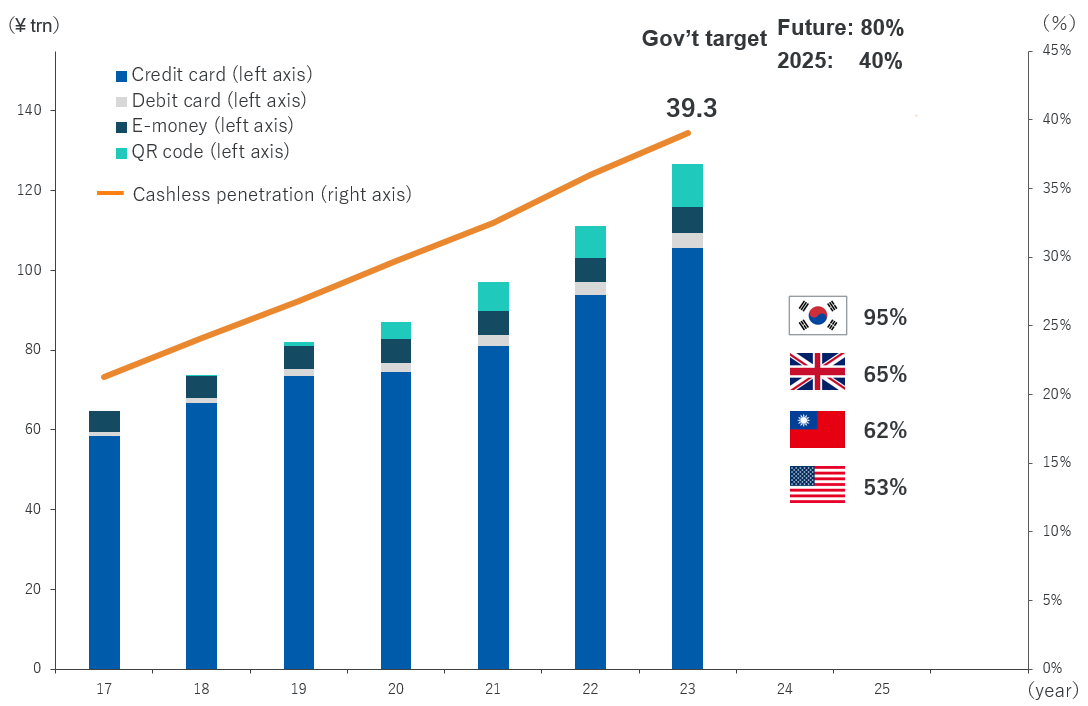

Progress of cashless payments

Japan's cashless payment market continues to expand in response to inbound tourism and government policies. However, the ratio of cashless payment is still at a low level compared to developed countries in Europe and the United States, and there is great room for growth in the medium to long term as a solution to social issues such as population decline and regional revitalization faced by Japan.

Cashless ratio in Japan and overseas (as a percentage of private final consumption expenditure) *1 *2

*1 National Accounts of the Cabinet Office, Credit Statistics of Japan by the Credit Association of Japan, payment Trends by Japan Bank, and Code payment Usage Trend Survey by the Cashless Promotion Council

*2 Japan/South Korea/United Kingdom/United States: Cashless Roadmap 2023, Taiwan: National Development Commission, Taiwan in 2019, South Korea, the United Kingdom, and the United States in 2021, and Japan in 2022 Actual

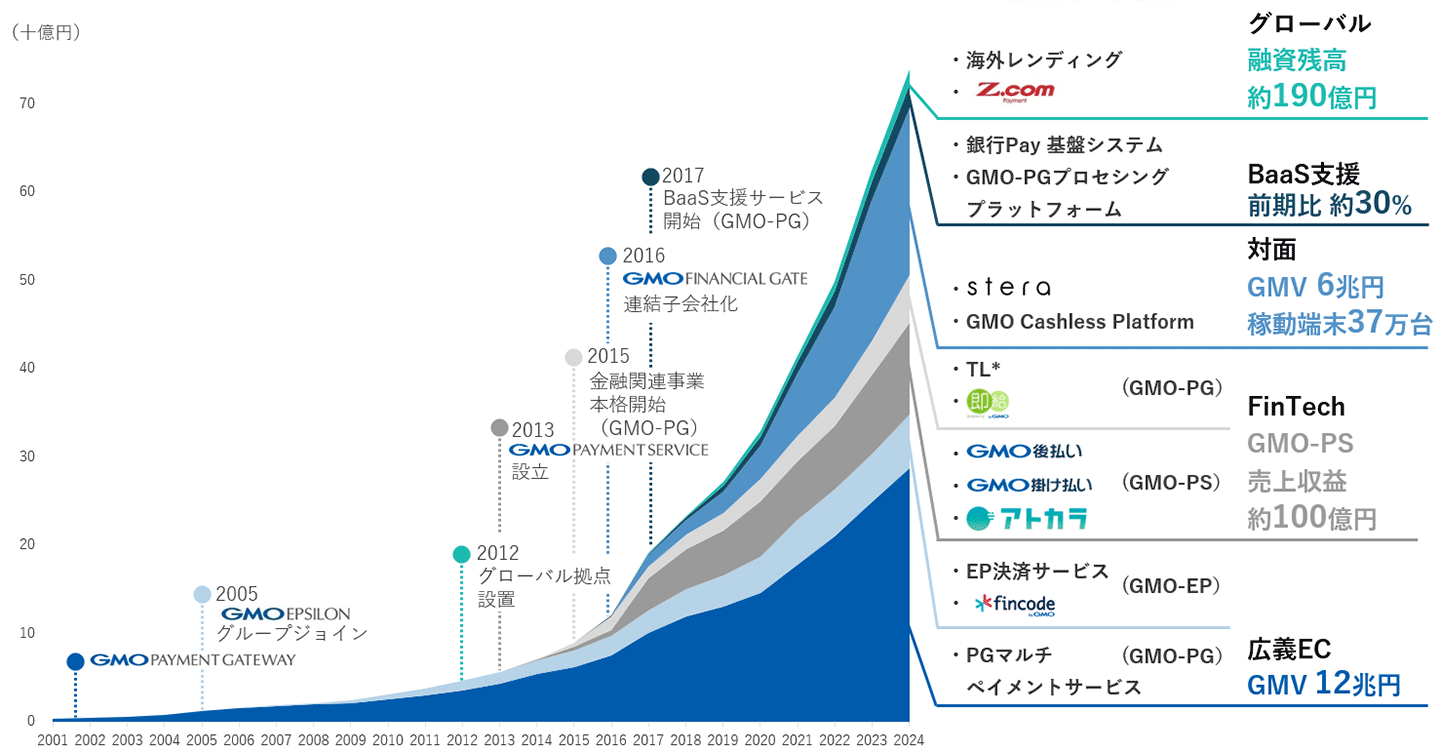

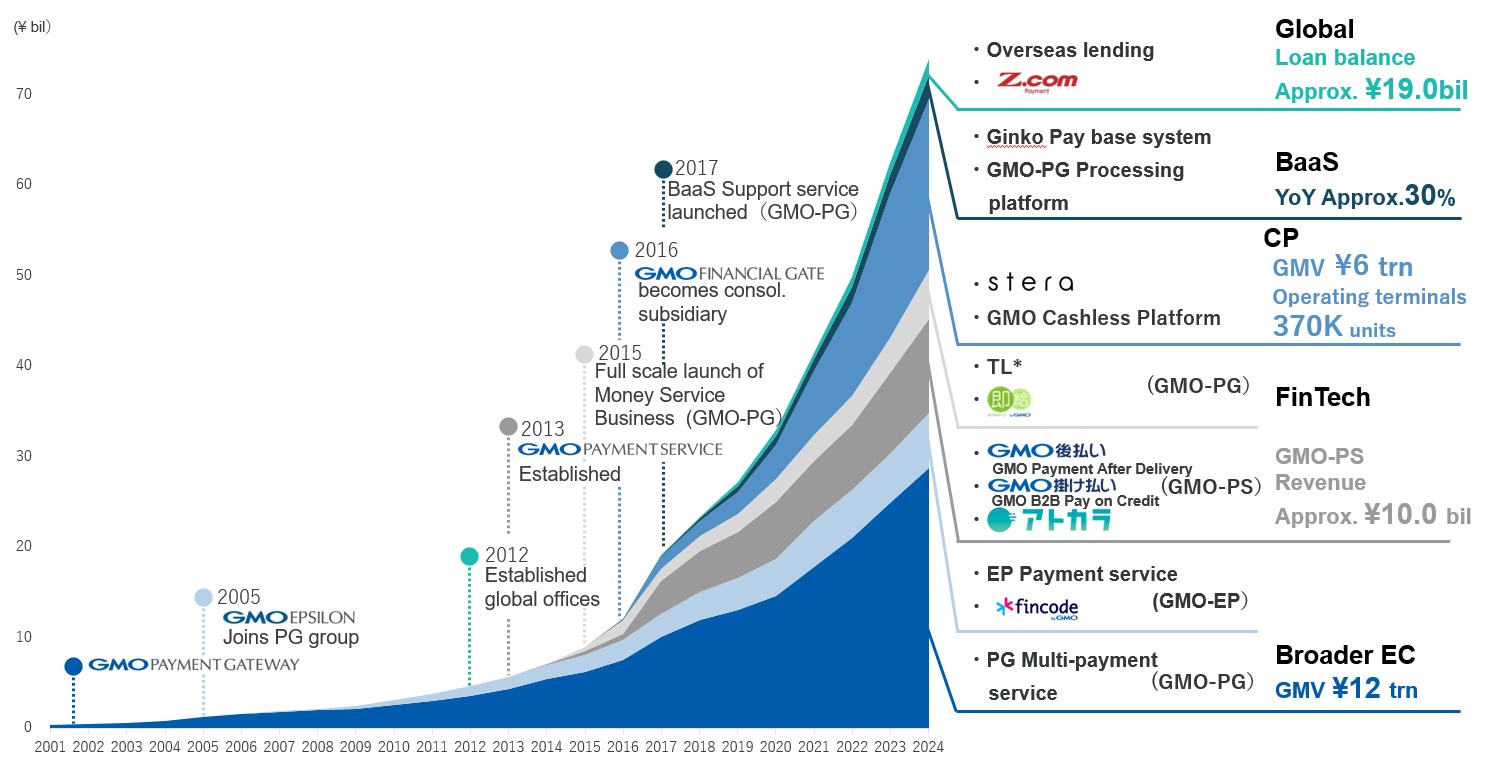

Expansion of business domains

After starting our business exclusively in the credit card business, we have expanded our business domain and developed new markets. We will continue to expand our business domains and create new value.

Sales by Focus Areas revenue *

* Sales revenue before consolidation elimination, TL: transaction lending

GMO Internet Group Group Management Strategy

The GMO Internet Group aims to manage the Group through the "decentralization of authority" and the creation of "group synergies." In other words, in order to respond to the rapidly changing Internet market, each Group company selects an area in which it excels, invests management resources in that area with a focus on it, and manages independently with the aim of becoming No. 1. Among them, GMO Payment Gateway, Inc. plays a role in "payment processing business".

In addition, we are growing while creating group synergies based on the sharing and thorough implementation of "GMO-ism," which is the general term for the GMO Internet Group's corporate motto and Our values.

(As of FY2024)

Management Targets

GMO-PG and its consolidated subsidiaries emphasize an operating profit average growth rate (CAGR) of 25% as a management performance indicator.

As a company vested to build the payment infrastructure for the online (mainly EC market) and offline markets, we will endeavor to create a safe and convenient EC and cashless environment that contributes to raise EC penetration, promote Digital Transformation (DX) adoption and raise cashless penetration in Japan. In addition, GMO-PG and its consolidated subsidiaries will continually strive to scale up by launching new businesses, forging business and capital alliances with other business partners, establish subsidiaries and pursue overseas expansion.

Positioning in Growth Markets

Expansion of EC market

EC market is expected to expand over the medium-to-long term with the development of logistics networks, penetration of subscription services in daily lives and implementation of Online-Merges-with-Offline (OMO), as Japan's EC penetration rates still remains lower than developed countries such as US and Europe.

EC Penetration Rates in Developed Markets *

* METI "FY2023 Global Survey Project Concerning Integrated Domestic and External Economic Growth Strategy Building (E-Commerce market survey)", U.S. Bureau of the Census "The 2nd Quarter 2024 Retail E-Commerce Sales Report", U.K. Office for National Statistics "Retail Sales Index internet sales, October 2024"

Progress of cashless migration

Japan's cashless payment market is on an expansionary path, given the need to cater to inbound tourist and government's policy.

Still, current cashless payment penetration remains low compared to developed countries of US and Europe, and therefore holds growth potential in the medium-to-long term as the means to resolve the social issues faced by Japan such as depopulation and regional revitalization.

Cashless Penetration (ratio of private final consumption) *1 *2

*1 Cabinet Office "System of National Accounts", Japan Consumer Credit Association's Credit Card Statistics, Bank Of Japan's Payment and Settlement Statistics, Payments Japan Association's Code Payment Statistics

*2 Figures for Japan, South Korea, UK and USA are excerpts from Payments Association Japan's "Cashless Roadmap 2023." Figures for Taiwan are from National Development Council and figures.

Actual figures for Taiwan are up to 2019, 2021 for South Korea, UK and USA and, 2022 for Japan.

Expansion of business domains

After commencing its business as a specialized credit card payment processing company, The Company expanded its scope of business and is currently making inroads into markets. The Company will strive to expand its businesses and create new value.

Revenue trend by consolidated subsidiary and/or service *

* Figures represented are before adjustments and eliminations.

Group management strategies of GMO Internet Group

GMO Internet Group aims for group management through "decentralization of authority" and "creation of group synergy.

In other words, to adapt to the rapidly changing internet market, each company within the group selects its area of expertise, focuses its management resources on that area, aims to become No. 1, and operates independently.

Within the group, GMO Payment Gateway, Inc. is responsible for the payment business.

And based on the shared and thorough implementation of "GMOism," which is the company's philosophy and principles within the GMO Internet Group, we are growing while creating group synergy.

VIEW

If you have any questions or consultations about our services, please contact us.

Please feel free to contact us from the following.