Prevent uncollected risks in legal transactions

GMO B2B AR Guarantee

GMO B2B AR Guarantee is a credit management enhancement service to prevent uncollected risks in inter-legal transactions. In the event of non-collection due to bankruptcy or late payment of a business partner, GMO Payment Gateway will guarantee payment accounts receivable of the guarantee payment. ※

* There is a screening prescribed by GMO Payment Gateway for use.

It may not be available depending on the results of the review.

Challenges like this can be overcome.

It can be solved

- I want to receive financial support.

Secure transactions with accounts receivable guarantee.

Why GMO B2B AR Guarantee is Selected

-

Creditworthiness

TSE can be used with confidence by providing services by Prime listed companies.

-

Convenience

At the time of examination, we will not contact or notify our business partners at all, so we do not know that we will guarantee it.

-

speed

If you pass the examination after application, you can start trading immediately.

* There is a screening prescribed by GMO Payment Gateway for use. It may not be available depending on the results of the review.

Five Benefits of GMO B2B AR Guarantee

-

Prevention of Bad Debt Losses

In the event of a bad debt, it may adversely affect the business situation.

By contract this guarantee, it is possible to make up for the loss with the guarantee performance, reduce the collection effort, and prevent the deterioration of cash flow. -

Strengthening and Enhancement of Credit Management

There is a limit to constantly and accurately grasping the credit status of business partners only by conducting an in-house survey.

By using the examination by our company together, it is possible to double check with your company's credit management. -

Loss leveling

When bad debt losses occur, it has a very significant impact on a company's financial results.

By covering the loss with a guaranteed performance, it is possible to level out the shortfall and huge losses to some extent. As a result, it also leads to a leveling of profit levels. -

Improved creditworthiness

By protecting receivables with guarantees, the creditworthiness of our business partners and other stakeholders will be greatly improved.

-

Cash Flow Support

Not only the bankruptcy of the business partner, but also the payment delay due to financial difficulties etc. are covered by the guarantee, so you can concentrate on your sales activities.

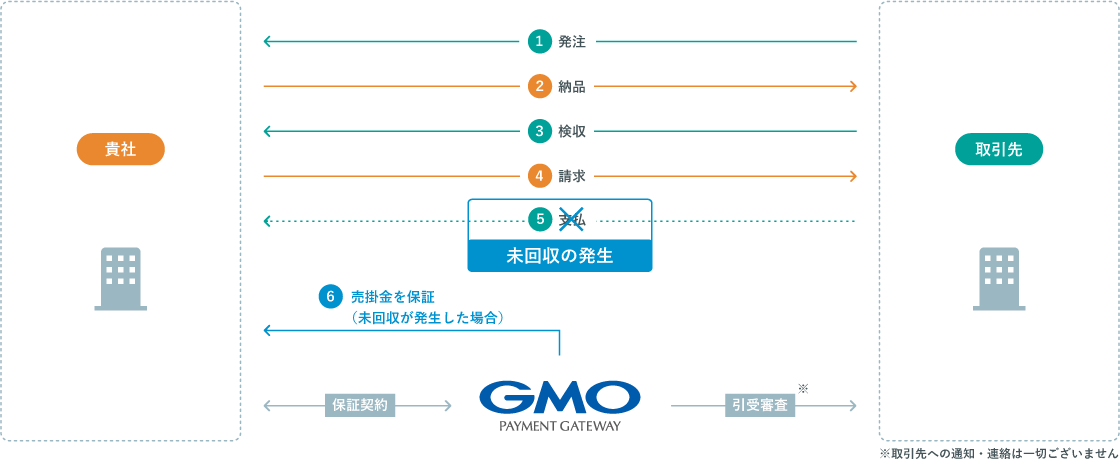

Flow of "GMO B2B AR Guarantee”

GMO B2B AR Guarantee can reduce the risk of uncollected new business partners with a minimum of 2 business days of examination.

Check the plan that is right for your company

contract type

Monthly Subscription Plan

Ideal if you want to guarantee accounts receivable with a fixed low monthly guarantee fee

|

type |

Monthly guarantee fee |

Guarantee upper limit |

Per company |

Target loan |

Of the stocks covered by the guarantee |

contract period |

Guarantee fee payment option |

|---|---|---|---|---|---|---|---|

|

Type S |

JPY 9,800 |

10,000,000 yen |

500,000 yen |

The due date is |

Yes |

More than half a year |

Half year prepayment |

|

Type M |

JPY 29,800 |

30,000,000 yen |

5,000,000 yen |

||||

|

Type L |

JPY 59,800 |

50,000,000 yen |

5,000,000 yen |

Customized Plans

Ideal for large transaction amounts and special schemes that require an account receivable guarantee

|

type |

Guarantee rate |

Guarantee amount |

Number of guaranteed companies |

Target loan |

Of the stocks covered by the guarantee |

contract period |

Guarantee fee payment option |

|---|---|---|---|---|---|---|---|

|

Individual type |

For the guaranteed amount |

10,000,000 yen |

New Accounts |

Accounts receivable with payment due within 180 days |

Yes |

1 year |

Determined through examination |

|

Inclusive |

annual rate 1.0%~ |

5 companies~ |

Only addition is possible |

1 year prepayment |

Case study

Advertising agency business

Started consideration in response to demand for expansion of transactions with customers who exceed the credit limit

In response to the demand for expanding transactions with business partners that exceed the credit limit in accordance with the credit management regulations established internally, we considered this as a response to cases where business partners are unable to respond to other means such as setting up collateral, guaranteeing deposits, or shortening the payment site.

Wholesale business

To strengthen the preservation of companies that may fall into credit instability

It can be used as a reference for credit decisions that cannot be obtained in detail by the research organization, and effective maintenance can be strengthened without relying on human guarantees. You can flexibly consider irregular events while using it.

Useful content

Webinars

To not regret using the accounts receivable guarantee

The details of accounts receivable maintenance services, such as accounts receivable guarantee, vary not only depending on the type of service but also on each company that provides it. In this seminar, we will explain the points about how to choose a receivables maintenance service that will not fail.

Useful materials

What is the means to raise the credit limit?

Have you ever experienced a loss of new contract opportunities due to strict internal credit and a low customer credit limit, or a suspension of transactions due to credit insecurity? In this document, we will show you how to raise the customer credit limit as a hint to grow your business while hedging risks.

FAQ

What sets GMO B2B AR Guarantee apart from the competition?

The following are the differences

- In the case of a new business partner, it is possible to guarantee from one company.

- We have plans according to your trading habits and requirements.

- Guarantees can also be made by business partners who use other guarantor companies.

What kind of companies use it?

It is widely used by companies that generate accounts receivable in business-to-business (BtoB) transactions.

Can I get a warranty from one company?

It is possible to use from 1 company for new business partners and from 3 companies for existing business partners.

How long does it take to be reviewed?

We will reply to you within 2 business days at the earliest after receiving the examination request.

Are there any claims that are not covered by the guarantee?

The following claims are not covered by the guarantee.

- Receivables under the Money Consumption Loan contract

- Violations of the Business Law contract, virtual transactions without substance, claims based on contract with anti-social forces

- payment Claims that have granted or may grant an extension of the due date

How long is the warranty?

Both the monthly flat rate plan and the customized plan will be from the warranty start date to the warranty due date.

What is the guarantee rate?

0.1% to 2.5% per month.

The guarantee fee rate will be presented after examination by our company.What is the amount that can be guaranteed?

In principle, we can accept the total amount of the guarantee up to 10,000 yen ~ 100 million yen.

* It depends on the contents of the examination of the guarantor.When is the payment covered by the warranty?

You can pay not only for bankruptcy (bankruptcy, civil rehabilitation) but also for payment delays.

What documents are required for warranty fulfillment?

Please submit a copy of the documents (invoice, invoices, etc.) that can confirm the contents of the guaranteed claims and the documents (sales books, passbooks, etc.) that show the transaction Actual and payment history for the last year.

What is the schedule for receiving the security payment?

payment will be made within approximately 20 business days, assuming that you have submitted the above required documents.

If you have any questions or consultations about our services, please contact us.

Please feel free to contact us from the following.