2024年12月6日

報道関係各位

株式会社みずほ銀行

GMOイプシロン株式会社

GMOペイメントゲートウェイ株式会社

株式会社みずほ銀行(頭取:加藤 勝彦、以下「みずほ銀行」)、GMOイプシロン株式会社(代表取締役社長:村上 知行、以下「GMO-EP」)およびGMOペイメントゲートウェイ株式会社(代表取締役社長:相浦 一成、以下「GMO-PG」)は、2024年10月31日(木)付けで、企業間決済プラットフォームの構築・提供に関する業務提携契約を締結しました。

新しい企業間決済プラットフォームは、GMO-EPが提供するオンライン決済インフラ「fincode byGMO」を活用して構築し、みずほ銀行とGMO-EPにて推進する予定です。GMO-PGはGMO-EPと相互に連携して構築・推進に向けて助言を行います。

現在、少子高齢化等を背景とした労働人口の減少により、企業は人材不足という大きな課題に直面しています。加えて、インボイス制度・電子帳簿保存法の開始を1つの契機としたデジタル化の潮流、手形・小切手の廃止など企業間取引を取り巻く環境も大きく変化しており、業務プロセスの見直し・効率化が1つの大きなテーマとなっています。

こうした状況への対応は、企業の重要な経営課題であると同時に、デジタル技術や新たな決済手段の活用によって企業価値・競争力を高める大きなチャンスでもあります。

〈みずほ〉は、これまでも法人のお客さまが抱える多種多様な課題の解決に向け支援する取り組み「みずほデジタルコネクト」を通じて、グループ内外の金融・非金融機能を提供し、お客さまの課題解決・成長支援に取り組んできました。一方で、決済を始めとした企業間取引に関するサービスは必ずしも前後の業務プロセスを担うサービスとつながっておらず、サービスの使い分けやデータの受け渡しが新たな業務課題となるケースもあり、さらなる利便性向上に向けた検討を進めてきました。

GMO-EPとGMO-PGは、オンライン化・キャッシュレス化・DXなどを支援する決済を起点としたサービスを提供しています。GMO-EPは事業者にオンライン決済インフラ「fincode byGMO」を提供するなかで、お客さまを取り巻く環境や抱える課題に向き合い、新たな解決・成長支援の方法について検討していました。

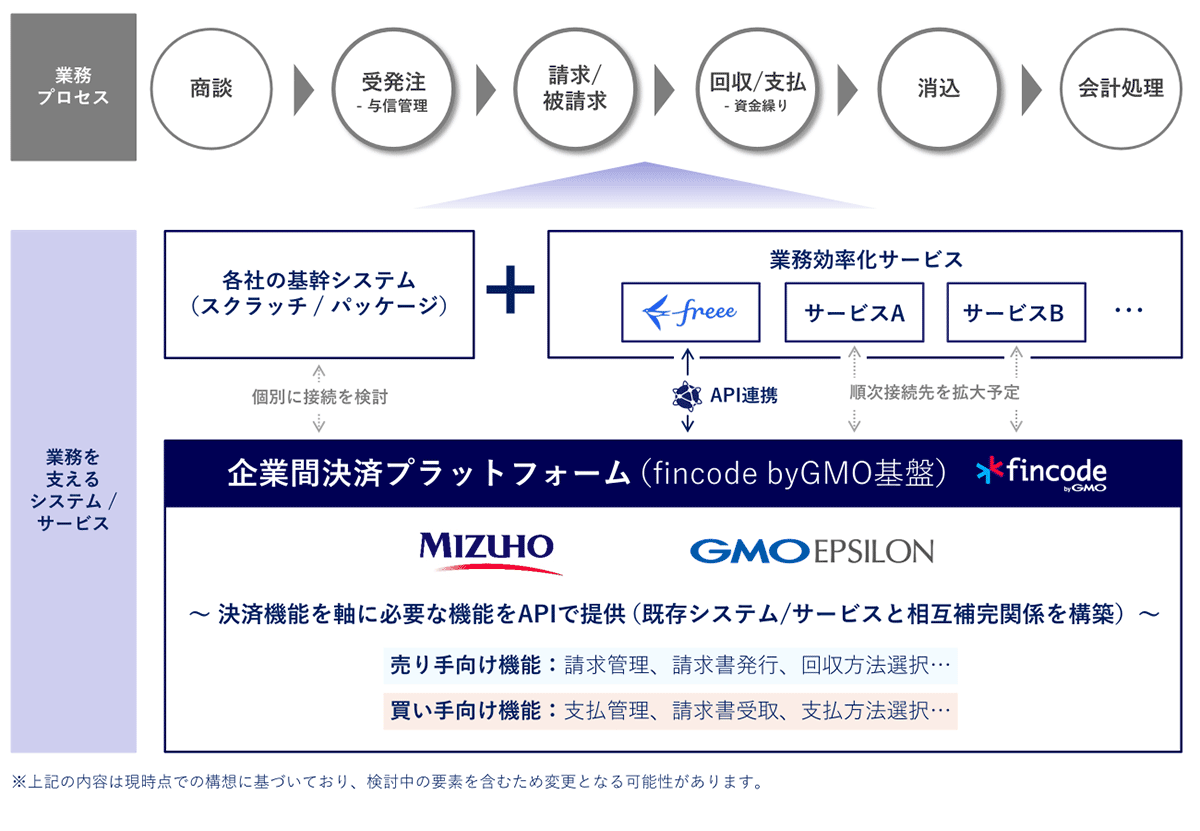

このような背景のもと、業務提携を通じ各社が持つ強みやアセットを活用し、多種多様な業務効率化サービスと決済サービスをシームレスにつなぐ企業間決済プラットフォームを構築・提供することとしました。

本企業間決済プラットフォームは、GMO-EPの「fincode byGMO」を活用し、企業間取引に必要な機能や決済の前後の業務プロセスにかかるサービスとの連携機能を新たに加え、2025年度より提供を開始する予定です。

「fincode byGMO」はシンプルで統一性のあるAPIにより様々なシステムと決済サービスをスムーズに連携でき、今後追加する企業間取引に必要な機能等も同じAPIで提供します。

第一弾として約54万(※1)の事業所をユーザーとして抱えるフリー株式会社(CEO:佐々木 大輔、以下「freee」)と相互連携を行う方向で検討を進めることに合意しました。

このような相互連携の実現により、"受発注や請求"と"決済サービスの利用"の間にある"業務の分断"をなくし、一連の業務プロセスをシームレスに遂行できるようになることを目指します。

今後も本企業間決済プラットフォームは、特定のサービスに限定することなく、様々な業務効率化サービスとオープンに連携することで、利便性の高い決済サービスを広くあまねく提供していきます。

【企業間決済プラットフォームの概要】

今回の業務提携を通じて、双方の持つ決済・金融サービスに関する知見・ノウハウ、高い技術力を有するイノベーション企業とのネットワーク、豊富な顧客基盤を掛け合わせ、お客さまの経営課題の解決、決済を軸とした業務プロセスの変革に挑み、お客さまと社会全体の持続的な発展に貢献します。

- (※1)2024年9月末時点

■みずほデジタルコネクトとは

株式会社みずほ銀行と、みずほリサーチ&テクノロジーズ株式会社がグループ各社やパートナー企業と一体で法人のお客さまのDXを支援する取り組みです。

https://www.mizuhobank.co.jp/corporate/b_support/d_connect/index.html

■「fincode byGMO」について

「fincode byGMO」は、スタートアップの成長に寄り添うオンライン決済インフラです。新サービスのローンチ前後に生じる決済領域の課題を解決するだけでなく、事業フェーズの進展に伴い求められる拡張的な価値をシームレスに提供します。PMF(※2)フェーズでは、「テスト環境の即時提供」「迅速なWeb審査」「開発工数を削減するSDK(※3)・UIコンポーネント(※4)」などにより、短いリードタイムで決済システムの実装が可能となります。また、グロースフェーズでは、REST

API(※5)、その他の拡張的な機能により、「独自の決済フローへの対応」「ユーザー拡大のための決済手段の追加」「サブスクリプションプランの追加」「プラットフォーム型ビジネスモデルへの拡大」といった導入事業者の「次の一手」を支援します。これらの機能を初期費用・月額費用無料、かつ、アカウント維持費用や振込手数料などの「見えづらいコスト」を最大限省いた料金体系で提供することで、導入事業者のコスト管理の負担を軽減し、自社サービスの成長に集中できる環境を提供します。

https://www.fincode.jp/

- (※2)Product Market Fitの略。

- (※3)Software Development Kitの略。「fincode byGMO」ではAPI組み込みを容易にするライブラリを提供しています。

- (※4)クレジットカード情報の入力フォームを生成、提供する機能。

- (※5)Representational State Transfer APIの略。「fincode byGMO」ではリソース指向で理解が容易なREST APIを通じて決済やサブスクリプションなどのデータを操作できます。

【GMOイプシロン株式会社について】

GMOイプシロンは、「Epsilon byGMO」と「fincode byGMO」の2つの決済代行サービスを提供しています。「Epsilon byGMO」は2024年9月末時点で4万店舗以上のEC事業者に利用されており、初期費用・トランザクション処理料(※6)無料で利用できます。「fincode byGMO」は、スタートアップ企業を対象としたオンライン決済サービスで、さまざまなビジネスニーズに対応するように設計されています。迅速な決済システムの導入を可能にし、Eコマースはもちろん、プラットフォーム型やサブスクリプション型のビジネスモデルにも最適です。

また、EC事業者の円滑なキャッシュフローをサポートするべく、売上連動型ビジネスカード「Cycle byGMO」、レンディングや送金サービス等の金融関連サービスも提供しています。

東証プライム上場企業のGMOペイメントゲートウェイの連結会社として、プライバシーマーク認証やPCI DSS、ISMS準拠のセキュリティ基準で安心してご利用いただける環境を提供しています。

- (※6)トランザクション処理料とは、クレジットカードのオーソリゼーション(承認番号取得)や請求等でクレジットカード会社との通信ごとにかかる料金。

【報道関係お問い合わせ先】

GMOインターネットグループ株式会社

グループ広報部PRチーム 山崎

- TEL

- 03-5456-2695

https://www.gmo.jp/contact/press-inquiries/

【本件に関するお問い合わせ先】

GMOイプシロン株式会社

「fincode byGMO」サポートチーム

https://dashboard.fincode.jp/contact/

【GMOイプシロン株式会社】(URL: https://www.epsilon.jp/ )

| 会社名 | GMOイプシロン株式会社 |

|---|---|

| 所在地 | 東京都渋谷区道玄坂1丁目14番6号 ヒューマックス渋谷ビル |

| 代表者 | 代表取締役社長 村上 知行 |

| 事業内容 | ■オンライン販売の決済代行、代金回収代行及びそれらに付帯する業務 |

| 資本金 | 1億5百万円 |

【GMOペイメントゲートウェイ株式会社】(URL: https://www.gmo-pg.com/ )

| 会社名 | GMOペイメントゲートウェイ株式会社(東証プライム市場 証券コード:3769) |

|---|---|

| 所在地 | 東京都渋谷区道玄坂1丁目2番3号 渋谷フクラス |

| 代表者 | 代表取締役社長 相浦 一成 |

| 事業内容 | ■総合的な決済関連サービス及び金融関連サービス |

| 資本金 | 133億23百万円 |

【GMOインターネットグループ株式会社】(URL: https://www.gmo.jp/ )

| 会社名 | GMOインターネットグループ株式会社(東証プライム市場 証券コード:9449) |

|---|---|

| 所在地 | 東京都渋谷区桜丘町26番1号 セルリアンタワー |

| 代表者 | 代表取締役グループ代表 熊谷 正寿 |

| 事業内容 |

■インターネットインフラ事業 ■インターネット広告・メディア事業 ■インターネット金融事業 ■暗号資産事業 |

| 資本金 | 50億円 |