September 24, 2024

GMO Payment Gateway, Inc.

GMO Internet Group, which develops comprehensive payment-related services and finance-related services, GMO Payment Gateway, Inc. (TSE Prime Market: Securities Code: 3769, President & Chief Executive Officer: Issei Ainoura hereinafter referred to as "GMO-PG") As a new optional function of Online Payment Service" PG Multi-Payment Service", We will start providing the identity verification function "Verify Service".

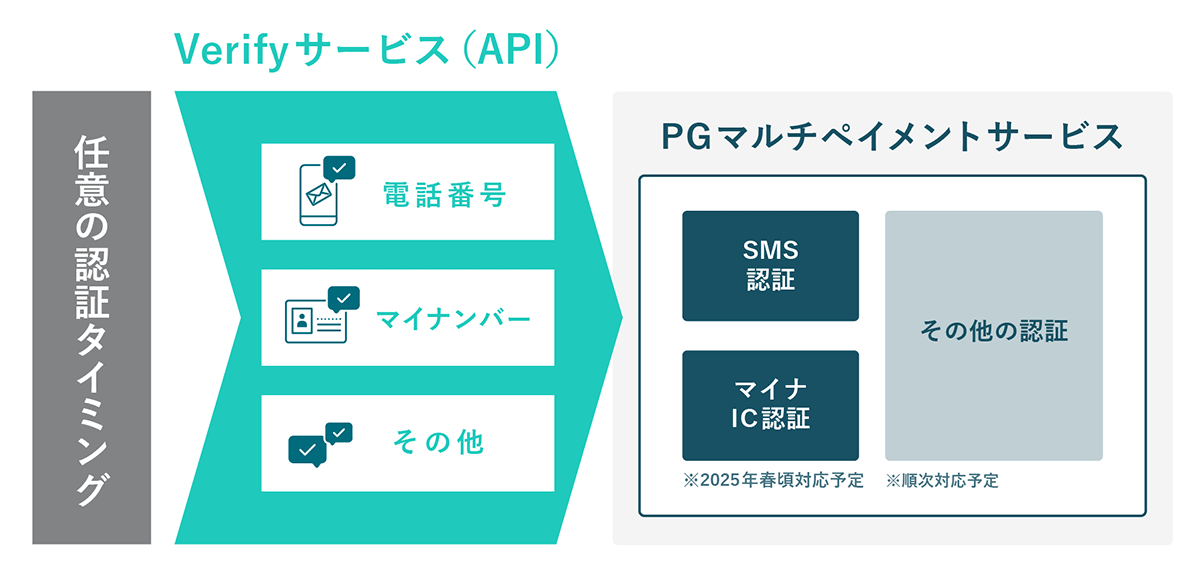

The "Verify Service" is a service that utilizes GMO-PG's proprietary multi-factor authentication function for end users, and by verifying the identity of the user before payment, the approval rate at the time of payment processing is improved and sales can be expected to increase. First of all, we will respond from SMS authentication that notifies the phone number of the one-time password. In preparation for the start of production operation on October 29, 2024 (Tuesday), we will accept applications for use in the test environment from September 25 (Wednesday).

In addition, even businesses that are not "PG Multi-Payment Service" member stores can contract the "Verify Service" alone.

【Background and Summary】

The number of credit card fraud is increasing rapidly, and the amount of fraud damage in 2023 reached a record high of approximately 54.1 billion yen (*1). The largest share of this is the theft of card numbers, with a damage of approximately 50.5 billion yen (*1). Damage caused by card number theft is not limited to the theft of the credit card itself, but also includes fraud due to the theft of information such as credit card numbers.

For this reason, the Credit Card Security Guidelines, which are positioned as practical guidelines for security obligations stipulated in the Installment Sales Act, require EC merchants to introduce multifaceted and multilayered fraud measures depending on the risks such as the products they handle and the extent of fraud damage (*2)。 In addition, the security checklist, which embodies the basic security measures for EC merchants, which will be required not only for new EC merchants but also for all EC merchants from April 2025, also requires the implementation of countermeasures against unauthorized logins at the time of member registration, login authentication, and attribute information change (*2). With the rise of credit card fraud, more robust security is required of e-commerce merchants.

GMO-PG has been expanding its range of security solutions to avoid risks in payment, such as EMV3-D Secure and fraud detection and authentication systems. The Credit Card Security Guidelines revised in March 2024 indicated the concept of "line" to introduce fraud measures for each situation before payment, at payment time, and after payment on e-commerce sites (*2) As a new solution for fraud countermeasures other than payment time, we have decided to start providing the "Verify Service", an identity verification function.

The "Verify Service" performs multi-factor authentication that combines knowledge information (passwords, secret questions, etc.) that only the user knows and personal information (smartphones, IC cards, etc.) at any time, such as when registering as a member on the website, when authenticating logins, and when changing attribute information. Online businesses such as e-commerce merchants can suppress unauthorized access by introducing the "Verify Service", and if the site involves payment, it can reduce the risk of fraud transactions by verifying the identity before the transaction, so it can be expected to improve the approval rate at the time of payment.

- *1 Japan Credit Association, "Credit Card fraud Damage Occurrence" (announced in June 2024)

https://www.j-credit.or.jp/download/news20240709_a1.pdf - (*2) Ministry of Economy, Trade and Industry "Credit Card Security Guidelines have been revised" (March 15, 2024)

https://www.meti.go.jp/press/2023/03/20240315002/20240315002.html

[About the identity verification function "Verify Service"]

(URL:https://www.gmo-pg.com/service/security-verify/)

The "Verify Service" uses the physical item of the user who accesses the website as the authentication key. Multi-factor authentication, which combines knowledge information (passwords, secret questions, etc.) that only the user knows and personal information (smartphones, IC cards, etc.), is performed to verify the identity of the user at the time of member registration, login authentication, and attribute information change under frictionless UI/UX. We will start with SMS authentication, which notifies a one-time password to a phone number, and in the future, we plan to support identity verification using My Number Card (Myna IC authentication) via a "digital authentication app" (*3) in the spring of 2025.

The connection method corresponds to the OpenAPI method, which provides an engineer-like development environment based on the world's standard connection specifications. In addition, the usage fee is a pay-as-you-go system that does not require initial costs or fixed monthly costs, and can be introduced to a wide range of businesses, from startups to enterprise companies.

In order to contribute to the business growth of business operators, GMO-PG will continue to update "PG Multi-Payment Service" with the aim of providing an environment that is easy for engineers to develop and a payment service that improves efficiency and reduces costs in terms of operation, while emphasizing convenience and safety for consumers.

- (*3) Digital Agency "Digital Authentication App to Release" (June 21, 2024)

https://www.digital.go.jp/news/f0d122a1-0608-4e99-b6c6-59461900ca0a

[Press Inquiries]

GMO Payment Gateway, Inc.

Corporate Value Creation Strategy Division Public Relations/UX Design Department

- TEL

- +81-3-3464-0182

https://contact.gmo-pg.com/m?f=767

GMO Internet Group, Inc.

Group Public Relations Department PR Team Yamazaki

- TEL

- +81-3-5456-2695

https://www.gmo.jp/contact/press-inquiries/

[Contact for inquiries regarding services]

GMO Payment Gateway, Inc.

Innovation Partners Division

EC Sales Promotion Department payment Planning Section

- TEL

- +81-3-3464-2323

- info@gmo-pg.com

[GMO Payment Gateway, Inc.] (URL: https://www.gmo-pg.com/)

| Corporate Name | GMO Payment Gateway, Inc. (TSE Prime Market Securities Code: 3769) |

|---|---|

| Location | 1-2-3 Dogenzaka, Shibuya-ku, Tokyo Shibuya Fukurasu |

| Representative | President & Chief Executive Officer Issei Ainoura |

| Business Description | ■ Comprehensive payment related services and finance related services |

| Capital | 13,323 million yen |

【GMO Internet Group Inc.】 (URL: https://www.gmo.jp/)

| Corporate Name | GMO Internet Group Co., Ltd. (TSE Prime Market Securities Code: 9449) |

|---|---|

| Location | Cerulean Tower 26-1, Sakuragaoka-cho, Shibuya-ku, Tokyo |

| Representative | Representative Director and Group Representative Masatoshi Kumagai |

| Business Description | ■ Internet infrastructure business ■ Internet advertising / media business ■ Internet finance business ■ Cryptographic assets business |

| Capital | 5 billion yen |