12 Jul 2017

GMO Payment Gateway, Inc.

GMO Internet Group's GMO Payment Gateway, Inc. (TSE partial: Securities Code: 3769, President & Chief Executive Officer: Issei Ainoura hereinafter referred to as GMO-PG), which develops comprehensive payment-related services and finance-related services), and The Bank of Yokohama Co., Ltd. (Representative Director & President: Kenichi Kawamura, hereinafter referred to as The Bank of Yokohama) On Wednesday, July 12, 2017, the three companies, President & Chief Executive Officer: Shohei Mabuchi, hereinafter referred to as "ALMEX"), announced that they will utilize the "smartphone-based payment service linked to bank accounts" developed by GMO-PG and The Bank of Yokohama to link payment with automatic payment machines and smartphone-based payment systems and cash out (*1). We have reached a basic agreement to start deliberations toward the realization of this goal.

*1 A system that allows you to withdraw bank deposits at cash registers and automatic payment machines at retail stores by using a payment method linked to a bank account, such as a debit card or a terminal such as a smartphone.

【Background and Summary】

GMO-PG and The Bank of Yokohama have jointly developed a smartphone-based payment service linked to a bank account (Hamagin) smartphone-based payment service "Hama Pay"), which was launched on Monday, July 3, 2017. Hama Pay" is a The Bank of Yokohama merchant (*2) that allows users who have an account on The Bank of Yokohama to use the service. This is a service that allows you to payment by direct debit immediately from the smartphone app when payment. On the other hand, ALMEX provides automatic payment machines, smartphone-based payment systems, and various reception and reception systems for medical institutions, hotels, restaurants, and golf courses.

GMO-PG, The Bank of Yokohama, and ALMEX have announced that they will be pleased to announce that they have announced that they will be able to use the "Hama Pay" provided by The Bank of Yokohama, the automatic payment machines provided by ALMEX for medical institutions, and the smartphone-based payment system "Sma-pa CHECKOUT" payment We will start considering the realization of cooperation and cash-out.

(*2) Merchants who have entered into a contract agreement with The Bank of Yokohama to use smartphone-based payment services

1. payment Consideration of collaboration

"Hama Pay" will be available as a payment method for the automatic payment machine and smartphone-based payment system "Sma-pa CHECKOUT" for medical institutions provided by ALMEX. Hama Pay" is a service that immediately deducts money from your account, so if you do not have a credit card or debit card, Even if you don't have cash on hand due to a sudden payment such as hospitalization or emergency medical expenses, you will be able to payment immediately on the spot.

2. Consideration of cashing out

With the revision of the Enforcement Regulations of the Banking Act that came into effect in April 2017, "cash-out" using debit cards, smartphones, and other terminals is now allowed in Japan under certain conditions.

In response to this, GMO-PG will build a system to realize a new cash-out service using "Hama Pay" and Almex's automatic payment machines. This will allow cash to be withdrawn from the automatic payment machines installed in hospitals by using the "Hama Pay" smartphone app, even if there is no ATM nearby.

In addition, we will continue to consider this cash-out service so that it can be used not only for hospitals but also for cash withdrawals from automatic payment machines at hotels and golf courses.

[About the smartphone-based payment service provided by GMO-PG]

Since April 2014, GMO-PG has been offering GMO Smart payment, a wallet-free smartphone-based payment service that allows you to complete your card payment at real stores such as restaurants and apparel on a smartphone app. Since these smartphone-based payment services have a high affinity with financial institution, we are also engaged in joint development of smartphone-based payment services and provision of infrastructure systems for smartphone-based payment services according to the needs of financial institution and other services. The platform system for the smartphone-based payment service developed and provided by GMO-PG is the following three types.

| Card payment Usage Type |

It is suitable for issuing credit and debit cards and deploying payment services from smartphones around them. |

|---|---|

| direct debit | It's ideal if you want to offer payment from bank accounts as a smartphone-based payment service. (Patent pending jointly with The Bank of Yokohama: 2016-109869) |

| Uses both | It is a type that allows you to use both credit and debit cards from your smartphone and payment directly connected to your account. |

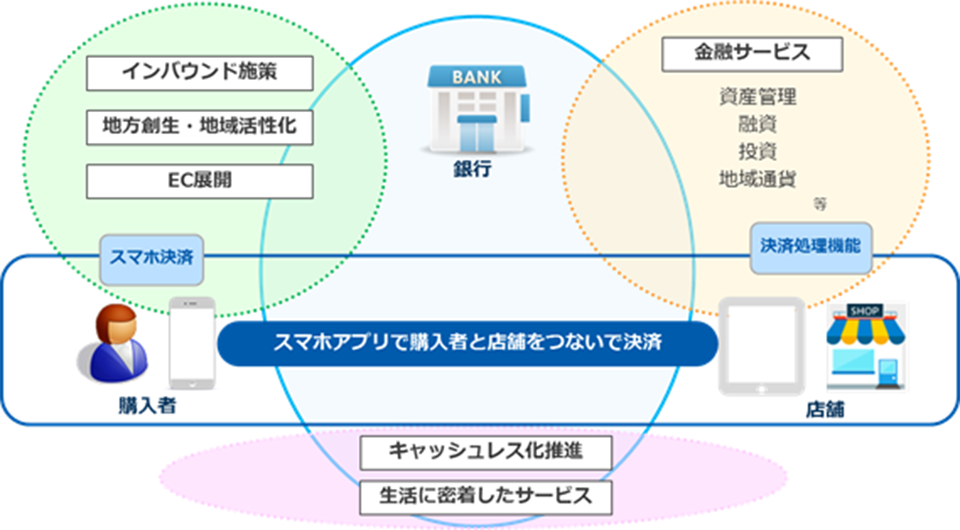

In addition, based on smartphone-based payment services, we provide a combination of linkage with finance services such as assets management, loans, investment, and community currencies, inbound measures such as the introduction of overseas payment, EC development, and regional revitalization mechanisms. As a result, it is possible to build new services according to the company's initiatives, such as the development of FinTech services, the promotion of cashless payments, regional revitalization, and services that are closely related to the lives of users.

In the future, we plan to add a cash-out feature as an option to the smartphone-based payment service.

<GMO-PG's smartphone-based payment Service Deployment Image>

【GMO Payment Gateway】

GMO-PG provides comprehensive payment-related services to 85,123 merchants (as of March 2017 of the GMO-PG Group), including online businesses such as online shops and digital content, businesses that charge monthly fees such as NHK and subscription, and public entity stores such as National Tax Agency and Tokyo.

With a focus on payment services, we provide value-added services such as web advertising services that contribute to improving the sales of merchants, finance-related services such as loans to support the growth of merchants from the financial side, and overseas businesses such as overseas payment services, resulting in an annual Transaction value of approximately 2 trillion yen.

GMO-PG aims to provide a safe and convenient payment for consumers and businesses, and to be the infrastructure for the payment process. As a leading company in the payment industry, we will continue to lead new innovations such as FinTech and contribute to improving the EC ratio of Japan.

【Related Links】

- The Bank of Yokohama『Hama Pay』

- URL : http://www.boy.co.jp/kojin/benri/hamapay/index.html

- GMO Smart payment

- URL : https://www.gmo-pg.com/service/smart-check/

- GMO-PG (Company Profile)

- URL :https://corp.gmo-pg.com/en/

- GMO-PG (Service)

- URL :https://www.gmo-pg.com/en/

[Press Inquiries]

GMO Payment Gateway, Inc. Corporate Value Creation Strategy Division

- TEL

- +81-3-3464-0182

- FAX

- 03-3464-2387

- ir@gmo-pg.com

GMO Internet Group Group Public / Investor Relations

- TEL

- +81-3-5456-2695

- pr@gmo.jp

[Contact for inquiries regarding services]

GMO Payment Gateway, Inc. Innovation Partners Division Smart Pay Business Promotion Office

- TEL

- +81-3-3464-2323

- FAX

- 03-3464-2477

- info@gmo-pg.com

[GMO Payment Gateway, Inc.] (URL: https://corp.gmo-pg.com/)

| Corporate Name |

GMO Payment Gateway, Inc. (TSE First Section Securities Code: 3769) |

|---|---|

| Location | 1-14-6 Dogenzaka, Shibuya-ku, Tokyo Humax Shibuya Building |

| Representative | President & Chief Executive Officer Issei Ainoura |

| Business Description | ■ Comprehensive payment related services and finance related services |

| Capital | 47億1,200万円 |

[GMO Internet, Inc.] (URL: https://www.gmo.jp/)

| Corporate Name | GMO Internet, Inc. (TSE First Section Securities Code: 9449) |

|---|---|

| Location | Cerulean Tower 26-1, Sakuragaoka-cho, Shibuya-ku, Tokyo |

| Representative | President and Group Representative Chairman & Chief Executive Officer Masatoshi Kumagai |

| Business Description | ■インターネットインフラ事業 ■インターネット広告・メディア事業 ■インターネット金融事業 ■モバイルエンターテイメント事業 |

| Capital | 5 billion yen |