October 5, 2016

GMO Payment Gateway, Inc.

GMO Payment Gateway, Inc. (TSE part: Securities code 3769, President & Chief Executive Officer: Issei Ainoura hereinafter referred to as "GMO-PG"), which develops comprehensive payment-related services and finance-related services in the GMO Internet Group, is a The Bank of Yokohama Co., Ltd. (Representative Director & President: Kenichi Kawamura, hereinafter referred to as "The Bank of Yokohama") We will jointly develop a smartphone-based payment service linked to a bank account ("Hamagin" smartphone-based payment service "Hama Pay"), which is scheduled to be launched in March 2017 in collaboration with The Bank of Yokohama.

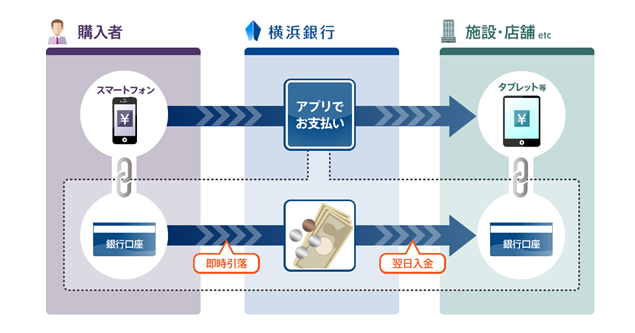

This smartphone-based payment service is linked to a The Bank of Yokohama bank account and allows customers to payment directly by direct debit from a smartphone app, and is the first of its kind for a domestic bank. (Patent pending in collaboration with The Bank of Yokohama: 2016-109869)

【Background and Summary】

Since 2014, GMO-PG has been providing a wallet-free smartphone-based payment service that allows you to complete your card payment at real stores such as restaurants and apparel on a smartphone app (*1)。 Due to the payment mechanism that connects buyers and stores through smartphone apps, we also provide services to financial institution and others because of the high affinity between finance, which is symbolized by the keyword Fintech, and new IT initiatives.

In order to support The Bank of Yokohama 's new initiatives, GMO-PG has decided to jointly develop a smartphone-based payment service that allows payment to be made directly from a bank account instead of a credit or debit card, utilizing the knowledge, know-how, and technical capabilities cultivated through the provision of The Bank of Yokohama smartphone-based payment services.

(*1) Launched in April 2014. Reference URL: https://www.gmo-pg.com/service/smart-check/

[ About the smartphone-based payment service linked to the The Bank of Yokohama account ]

The smartphone-based payment service, which is linked to the bank's account, which The Bank of Yokohama plans to provide from March 2017, is a service that allows users to make payment by direct debit immediately from a smartphone app. Until now, there has been a service that allows users to payment from their smartphones if they Account transfer contract to each member store, but this is the first service for a domestic bank that allows payment to be made immediately on a smartphone at any member store (*2).

It can be used in all situations, regardless of whether it is online or offline, product sales or service, from payment at real stores such as restaurants and apparel, to payment for hospital consultations and cram school tuition, payment at workplaces such as employee cafeterias and school kiosks, and payment at online stores.

| Benefits for users (purchasers) |

|---|

|

| Benefits for the store |

|

(*2) Must be a merchant with The Bank of Yokohama and smartphone-based payment service usage contract.

■Security measures

Since it is a mechanism that is directly connected to a bank account and debited, we plan to install authentication functions such as "one-time password delivery" at the time of new registration, "6-digit password input" at the time of login and payment, and "fingerprint authentication" in order to strengthen the accuracy of personal authentication. In addition, in preparation for the leakage of IDs and passwords, we plan to take solid security measures, such as making it payment unusable if there is access from a device other than the usual one, and requiring the resumption process by the person himself.

[Future development of "smartphone-based payment service linked to bank account"]

GMO-PG will expand the "smartphone-based payment service linked to bank accounts" that it is developing to other regional banks and financial institution. In addition, at stores that use this service, regardless of the financial institution of purchaser's use, payment will be able to use the "smartphone-based payment service linked to a bank account," aiming for service collaboration across regions.

[About the smartphone-based payment service provided by GMO-PG]

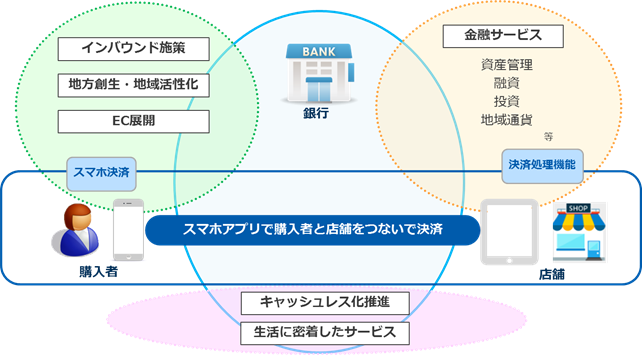

GMO-PG develops and provides smartphone-based payment services to financial institution and other organizations according to the needs of each financial institution, such as the development of smartphone-based payment services and the provision of smartphone-based payment service infrastructure. The smartphone-based payment service platform developed and provided by GMO-PG is of the following three types.

| Card payment Usage Type | It is suitable for issuing credit and debit cards and deploying payment services from smartphones around them. |

|---|---|

| direct debit | It's ideal if you want to offer payment from bank accounts as a smartphone-based payment service. (Patent pending jointly with The Bank of Yokohama: 2016-109869) |

| Uses both | It is a type that allows you to use both credit and debit cards from your smartphone and payment directly connected to your account. |

In addition, based on smartphone-based payment services, we provide a combination of linkages with finance services such as assets management, loans, investments, and community currencies, inbound measures such as the introduction of overseas payment, and mechanisms for e-commerce development and regional revitalization. As a result, financial institution and others will be able to build further services in line with their own initiatives, such as developing Fintech services, promoting cashless payments, regional revitalization, and providing services that are closely related to the lives of users.

<GMO-PG's smartphone-based payment Service Deployment Image>

【GMO Payment Gateway】

GMO-PG provides comprehensive payment-related services to 72,569 merchants (as of June 2016 of the GMO-PG Group), including online businesses such as online shops and digital content, businesses that charge monthly fees such as NHK and subscription, and public entity stores such as the Japan Pension Service and the Tokyo Metropolitan Government.

With a focus on payment services, we provide value-added services such as web advertising services that contribute to improving sales of merchants, finance-related services such as loans to financially support the growth of merchants, and overseas businesses such as the provision of overseas payment services, resulting in an annual Transaction value of more than 1.8 trillion yen.

GMO-PG aims to provide a safe and convenient payment for consumers and businesses, and to become the infrastructure for the payment process. As a leading company in the payment industry, we will continue to lead new innovations such as FinTech and contribute to improving the EC ratio of Japan.

Related URL

- GMO-PG (Company Profile)

- URL : http://corp.gmo-pg.com/

- GMO-PG (Service)

- URL : http://www.gmo-pg.com/

[Press Inquiries]

GMO Payment Gateway, Inc. Corporate Value Creation Strategy Division

- TEL

- +81-3-3464-0182

- FAX

- 03-3464-2387

- ir@gmo-pg.com

GMO Internet Group Group Public / Investor Relations

- TEL

- +81-3-5456-2695

- pr@gmo.jp

[Contact for inquiries regarding services]

GMO Payment Gateway, Inc. Innovation Partners Division Smart Pay Business Promotion Office

- TEL

- +81-3-3464-2323

- FAX

- 03-3464-2477

- info@gmo-pg.com

[GMO Payment Gateway, Inc.] (URL: https://corp.gmo-pg.com/)

| Corporate Name |

GMO Payment Gateway, Inc. (TSE First Section Securities Code: 3769) |

|---|---|

| Location | 1-14-6 Dogenzaka, Shibuya-ku, Tokyo Humax Shibuya Building |

| Representative | President & Chief Executive Officer Issei Ainoura |

| Business Description | ■ Comprehensive payment related services and finance related services |

| Capital | 47億1,200万円 |

[GMO Internet, Inc.] (URL: https://www.gmo.jp/)

| Corporate Name | GMO Internet, Inc. (TSE First Section Securities Code: 9449) |

|---|---|

| Location | Cerulean Tower 26-1, Sakuragaoka-cho, Shibuya-ku, Tokyo |

| Representative | President and Group Representative Chairman & Chief Executive Officer Masatoshi Kumagai |

| Business Description | ■Internet infrastructure business ■Internet Advertising & Media Business ■Internet Securities Business ■Mobile Entertainment Business |

| Capital | ¥5.0 billion |