2016年5月11日

報道関係各位

GMOペイメントゲートウェイ株式会社

GMOインターネットグループで非対面クレジットカード等の決済事業を展開するGMOペイメントゲートウェイ株式会社(東証一部:証券コード 3769、代表取締役社長:相浦 一成 以下、GMO-PG)は、2016年5月26日(木)と2016年6月15日(水)に、「カード情報非保持化(*1)またはPCI DSS(*2)準拠」対策に関する法人EC事業者様向け特別対応セミナーを無料で開催いたします。

本セミナーは、経済産業省が主導する「クレジット取引セキュリティ対策協議会」(事務局:日本クレジット協会)が2016年2月に発表した「クレジットカード取引におけるセキュリティ対策の強化に向けた実行計画(以下、実行計画)」を受けて行うものです。同発表は、クレジットカード取引におけるセキュリティ環境を2020年までに国際水準へと整備するべく、具体的な目標・各主体の役割等を取りまとめたもので、EC事業者においては、2018年3月までに、カード情報漏えい対策として「カード情報非保持化」または「PCI DSS準拠」が求められます。

このたびGMO-PGが実施するセミナーでは、EC事業者様向けにその解説・対策などをご説明いたします。

■お申し込み・詳細情報URL:https://www.gmo-pg.com/seminar/160525/

【背景と概要】

現在日本では、2020年のオリンピック・パラリンピック東京大会の開催に向けて、キャッシュレス決済の普及による決済の利便性・効率性の向上を図るため、クレジットカード取引におけるセキュリティ環境を国際水準へと整備することが求められています。これを受けて、2015年3月には経済産業省やクレジットカード会社など、クレジットカード取引に関する幅広い事業者・関係者が参画する「クレジット取引セキュリティ対策協議会」が発足し、2016年2月には同組織によりクレジットカード取引に関わる各主体の具体的な目標と取り組むべき事項等を取りまとめた「実行計画」が策定されました。

この「実行計画」は、「1.カード情報漏えい対策」、「2.偽造カードによる不正使用対策」、「3.ECにおける不正使用対策」の3項目からなり、各項目でカード加盟店の目標が定められております。このうちの「1.カード情報漏えい対策」では、カード加盟店であるEC事業者は、2018年3月までにカード情報が加盟店のサーバーを通過しない「非通過型決済」の利用によるカード情報非保持化、もしくは国際カードブランド5社によるクレジットカード業界のセキュリティ基準「PCI DSS」に準拠することが求められています。

しかしながら、EC事業者自身がカード情報非保持化やPCI DSS準拠に対応するには、システム開発・運用や社内整備・監査対応などの費用や時間が生じるため難しく、また、具体的に2018年3月までにどのような対策を講じればいいのかといったお問い合わせがGMO-PGにも多数寄せられていました。

GMO-PGでは、これまでに非通過型決済の「トークン決済(*3)サービス」の提供をはじめ、決済前から決済後までの全段階におけるセキュリティ対策をEC事業者の業種・規模に応じて提案しています。そこで、こうしたノウハウを活かし「実行計画」の解説と「カード情報非保持化またはPCI DSS準拠」対策をご説明するべく、特別対応セミナーを開催することといたしました。

【セミナー概要】

| 日時 | ・2016年5月26日(木)13:30~ ・2016年6月15日(水)13:30~ |

|---|---|

| 会場 | 東京都渋谷区道玄坂1-14-6 ヒューマックス渋谷ビル 7F |

| 参加費 | 無料 |

| 募集人数 | 各20名 ※ご応募多数の場合は抽選となりますので予めご了承ください |

| 申込方法 | 下記URLのフォームよりお申し込みください URL:https://www.gmo-pg.com/seminar/160525/ |

| セミナー内容 | ・経済産業省が公表した「実行計画」に備えて何をすべきか ・求められる非通過型決済サービスとは ・PCI DSS準拠のポイント ※各日同内容となります |

| お問合せ先 | GMOペイメントゲートウェイ イノベーション・パートナーズ本部 TEL:03-3464-2323 URL:https://www.gmo-pg.com/seminar/160525/ |

【GMO-PGのセキュリティ対策について】(URL: https://www.gmo-pg.com/service/function/ )

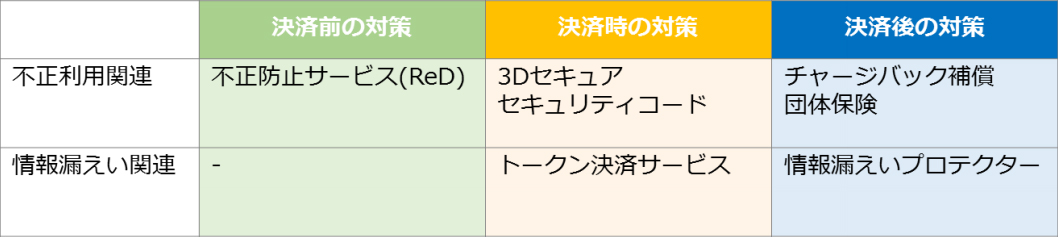

GMO-PGでは、決済時はもちろんのこと、決済前から決済後の各段階において、EC事業者に安心・安全な決済サービスをご利用いただくためのセキュリティ対策や補償サービスを提供しており、各サービスは「実行計画」にも対応しています。「1.カード情報漏えい対策」として「トークン決済サービス」の提供、「3.ECにおける不正使用対策」として「3Dセキュア(*4)」、「セキュリティコード(*5)」の提供なども行っております。

| ■決済前... | 第三者のクレジットカード不正利用を事前に検知する「不正防止サービス(ReD)」 |

|---|---|

| ■決済時... | クレジットカードの不正利用から消費者を守る「3Dセキュア対応」「セキュリティコード対応」 ECサイト側での情報漏えいを防ぐ「トークン決済サービス」 |

| ■決済後... | チャージバック(*6)による加盟店の損害を補償する「チャージバック補償団体保険」 EC事業者からの個人情報漏えいに対して保険金をお支払いする「情報漏えいプロテクター」 |

【GMOペイメントゲートウェイ株式会社について】

GMOペイメントゲートウェイは、ネットショップやデジタルコンテンツなどのオンライン事業者、NHKや定期購入など月額料金課金型の事業者、並びに日本年金機構や東京都等の公的機関など6万7,921店舗(GMOペイメントゲートウェイグループ2016年3月現在)の加盟店に、クレジットカードをはじめとする決済処理サービスを提供しております。消費者と事業者にとって安全性が高く便利な決済を実現し、日本の決済プロセスのインフラになることを目指しております。決済業界のリーディングカンパニーとして、FinTechなど新たなイノベーションを牽引し、日本のEC化率の向上に貢献いたします。

【用語集】

| (*1) カード情報非保持化 | ECサイトのサーバーにおいて、購入者のクレジットカード情報(カード会員名・カード番号・有効期限等)を「保存」「処理」「通過」しないこと |

|---|---|

| (*2) PCI DSS | PCI DSS(Payment Card Industry Data Security Standard)とは、JCB・American Express・Discover・MasterCard・VISAの国際クレジットカードブランド5社が共同で策定した、クレジット業界におけるグローバルセキュリティ基準のこと |

| (*3) トークン決済 | EC事業者が購入者のクレジットカード番号に触れることなく決済できるよう、クレジットカード番号をトークン(乱英数字の文字列)に置き換えて決済処理を行うこと |

| (*4) 3Dセキュア | 「なりすまし詐欺」など、インターネット取引における第三者の不正利用を未然に防ぐことを目的として、VISA・MasterCard・JCBが推奨する、決済時にカード会員の本人認証を行う機能 |

| (*5) セキュリティコード | クレジットカード裏面に印字されている末尾3桁または4桁の数字を指し、カードの磁気情報には含まれないカード所有者のみが分かる情報であるため、偽造カードなどによる第三者悪用を防ぐことができる本人認証の方法 |

| (*6) チャージバック | クレジットカード会員が、第三者による不正利用等の理由により利用代金の決済に同意しない場合、クレジットカード会社が加盟店に対して支払いを拒絶すること |

関連URL

- GMO-PG コーポレートサイトURL

- URL : http://corp.gmo-pg.com/

- GMO-PG サービスサイトURL

- URL : http://www.gmo-pg.com/

報道関係お問い合わせ先

GMOペイメントゲートウェイ株式会社 企業価値創造戦略 統括本部

- TEL

- 03-3464-0182

- FAX

- 03-3464-2387

- ir@gmo-pg.com

GMOインターネット株式会社 グループ広報・IR部 石井・島田

- TEL

- 03-5456-2695

- FAX

- 03-3780-2611

- pr@gmo.jp

サービスに関するお問い合わせ先

GMOペイメントゲートウェイ株式会社 イノベーション・パートナーズ本部

- TEL

- 03-3464-2323

- FAX

- 03-3464-2477

- info@gmo-pg.com

【GMOペイメントゲートウェイ株式会社】(URL: https://corp.gmo-pg.com/ )

| 会社名 |

GMOペイメントゲートウェイ株式会社 (東証第一部 証券コード:3769) |

|---|---|

| 所在地 | 東京都渋谷区道玄坂1丁目14番6号 ヒューマックス渋谷ビル |

| 代表者 | 代表取締役社長 相浦 一成 |

| 事業内容 | ■クレジットカード等の決済代行サービス及び付帯する一切のサービス |

| 資本金 | 47億1,200万円 |

【GMOインターネット株式会社】(URL: https://www.gmo.jp/ )

| 会社名 | GMOインターネット株式会社(東証第一部 証券コード:9449) |

|---|---|

| 所在地 | 東京都渋谷区桜丘町26番1号 セルリアンタワー |

| 代表者 | 代表取締役会長兼社長・グループ代表 熊谷 正寿 |

| 事業内容 |

■インターネットインフラ事業 ■インターネット広告・メディア事業 ■インターネット証券事業 ■モバイルエンターテイメント事業 |

| 資本金 |

50億円 |