分割払い可能な後払いサービス

アトカラ

アトカラはGMOペイメントサービスと三井住友カードがブランド管理をする、分割払いも可能な後払い決済サービスです。

最長36回までの分割払いに対応し、加盟店様の売上拡大に寄与します。利用から請求まで全てWEBで完結できるため、業務負担の軽減にも貢献いたします。

エンドユーザー様は携帯電話番号とメールアドレスのみで簡単に利用が可能。Vポイントが使える後払い決済サービスとして利用拡大が見込まれています。

このような課題を

解決できます

- よく使われる決済手段を知りたい

- 自社サービスに決済を導入したい

アトカラ3つのポイント

-

請求業務の大幅削減・未回収リスクゼロへ

払込用紙不要・利用から支払いまで全てWEB上で完結するため、加盟店様の運用負担を最小限に抑えることが可能です。

エンドユーザー様への代金回収はGMOペイメントサービスが代行し、加盟店様における未回収リスクゼロを実現いたします。 -

売上・購入単価の向上

最大50万円・最長36回までの分割払いに対応しており、中・高価格帯の商材にも好適。

6回払いまでの分割手数料は無料など、柔軟な支払い方法の採用により売上や購入単価・ユーザー利便性の向上に貢献いたします。 -

Vポイントが使える

アトカラは8,600万人※が利用する「Vポイント」と連携する後払い決済サービスで、新規顧客獲得にも寄与いたします。

※2024年4月時点の年間利用者数

ユーザーニーズに応える2種類の利用方法

アトカラでは、事前の会員登録により分割払い※1が可能な会員登録型と、会員登録なしですぐにご利用いただける都度与信型の 2種類の利用方法をご用意しています。

いずれもエンドユーザー様は商品の購入・受け取り後に、購入月分の利用代金をまとめてコンビニ払い・銀行振込・口座振替からお支払いいただくだけ。この手軽さと柔軟な支払いプランにより、エンドユーザー様の購入単価や利便性の向上が期待できます。

|

会員登録型 |

都度与信型 ※2 |

|

|---|---|---|

|

対象年齢 |

満18歳以上 |

|

|

会員登録 |

要 ※会員登録時にクレカ同等以下の情報を取得 |

不要 |

|

利用金額上限 |

最大50万円 ※審査により設定 |

5.5万円 |

|

支払回数※3 |

1・3・4・5・6※・10・12・15・18・20・24・30・36回 ※6回までの利用者分割手数料無料 |

1回 |

|

支払方法 |

コンビニ払い・銀行振込・口座振替 |

|

- ※1 分割払い手数料などに関しては、「アトカラ」HP にてご確認ください。

- ※2 都度与信型の導入可否は別途ご相談させていただきます。

- ※3 コンビニ払い・銀行振込はお支払いに際し、エンドユーザー様にも所定の支払手数料が発生いたします。

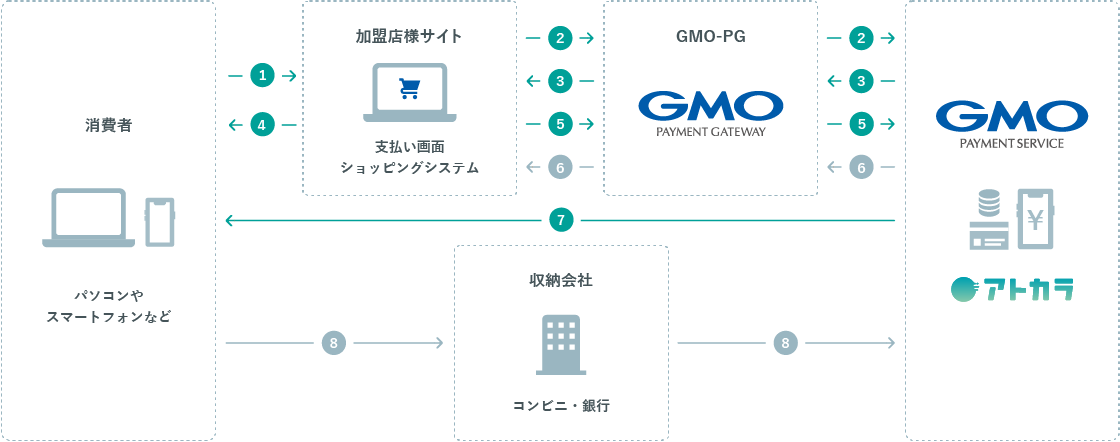

運用フロー

- ...購入情報

- ...入金

- 注文処理

- 取引登録

- 与信結果返却

- 商品出荷・サービス提供(与信OK時)

- 売上確定

- 売上金引渡(入金)

- 請求通知(一カ月分合算)

- 支払い

サービスについての質問・相談は

下記よりお気軽にお問い合わせください。