Fintech (Fintech Seminar) -Understanding Fintech and its background-

~ Seminar Report ~

Seminar outline

Seminar Name

Fintech (Fintech Seminar) -Understanding Fintech and its background-

Date and time

Thursday, November 26, 2015 15: 00-17: 00

Place

Cerulean Tower 11th floor, 26-1 Sakuragaoka-cho, Shibuya-ku, Tokyo

Teacher

Part 1 Money Forward Fintech Research Institute Manager Toshio Taki

Part 2 G.S. Brains Tax Co., Ltd. Representative Employee Tax Accountant / Business Revitalization Specialist Mitsutaka Sakuma

Overview

The word Fintech became a buzzword, and while there were no days when I didn't see it in the media such as newspapers, it was held for those who know the word but want to understand it in detail, and those who understand the background.

[Part 1] "Why Fintech is attracting attention, what will change?"

Money Forward Fintech Research Institute, Toshio Taki, Manager

"Fintech" suddenly became a top keyword in 2015. In the first part, Mr. Manager of Money Forward Fintech Research Institute, gave a lecture on the background and future prospects.

Fintech is a coined word that combines finance and technology, and although it has been used for about 5 to 10 years, mainly on the West Coast of the United States, in Japan, it was used in the policy agenda of a government government study group around February 2015.

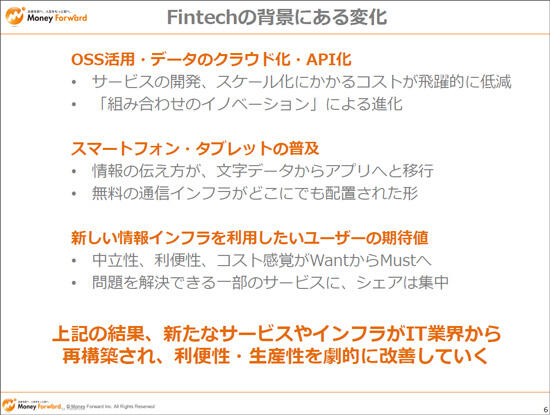

Changes on the technology side are greatly influenced by the background of Fintech, and it is natural that the finance field, which is the information industry, will be affected. Under such circumstances, the players on the technology side until now have been mainly financial institution primary and secondary contractors, but many of the representative players in Fintech are companies that provide services that users can directly contact, and the players on the technology side are changing significantly. The cause of this change is largely influenced by the content described in the above slide.

Part 2: "Fintech from the Perspective of a Tax Accountant Firm ~Solutions to Corporate Management Issues~"

G.S. Brains Tax Co., Ltd. Representative Employee, Tax Accountant, Business Revitalization Specialist, Mitsutaka Sakuma

He gave a lecture on how to interact with existing financial institution, such as improving the efficiency of back office operations through MF cloud accounting.

Existing financial institution is good and mingle by the scale of the revenue from the founding financial institution is not known surprisingly is different.

From its founding to annual sales of 200 million yen, Japan finance Corporation, credit union (union)

From 200 million yen to 500 million yen in annual sales, in addition to the above, the Shoko Chukin Bank and regional banks

Annual sales of 500 million yen or more, Shoko Chukin Bank, regional banks, mega banks

That is a rough guide.

Journalizing work, which tends to be postponed in management, is automated by using MF cloud accounting, and even if there is an error, it will be learned by correcting it, so it is very efficient.