June 25, 2025

GMO Payment Gateway, Inc.

GMO Epsilon, Inc.

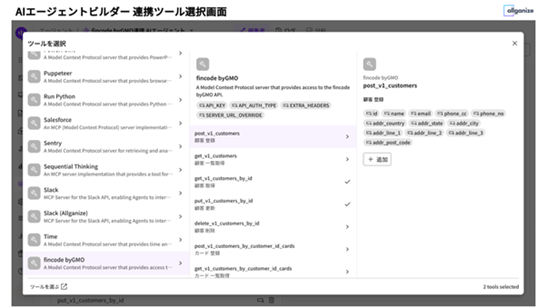

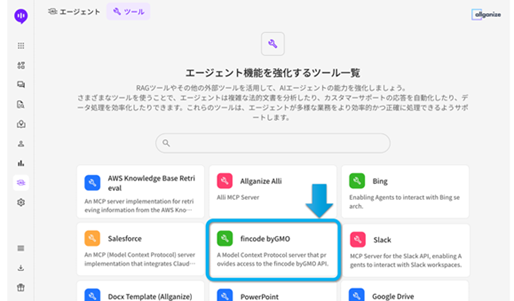

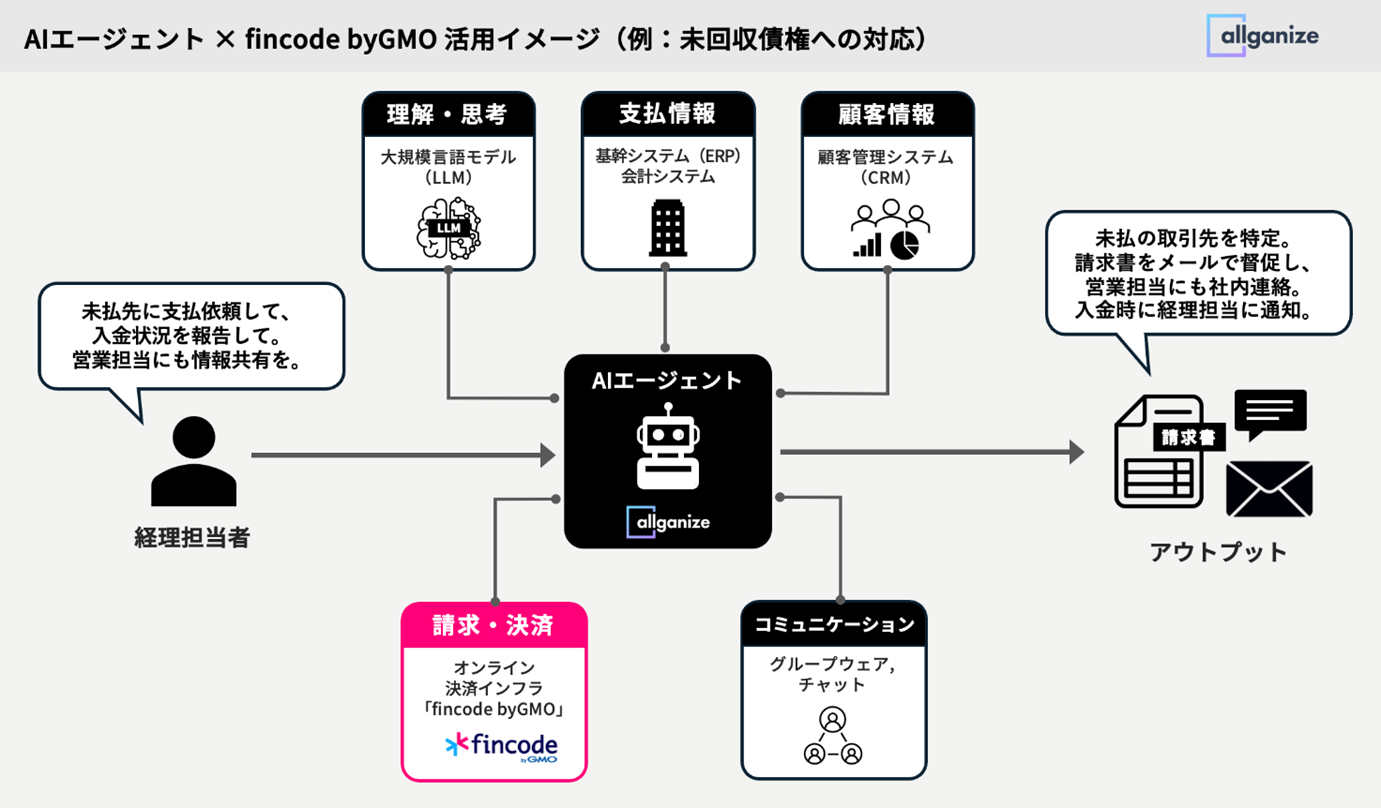

GMO Internet Group develops comprehensive payment-related services and finance-related services GMO Payment Gateway, Inc. (TSE Prime Market: Securities Code: 3769, President & Chief Executive Officer: Issei Ainoura hereinafter referred to as GMO-PG) and the GMO Epsilon, Inc. of the consolidated company (President & Chief Executive Officer: Tomoyuki Murakami hereinafter referred to as "GMO-PG") and the consolidated company. GMO-EP) will be launched on June 25, 2025 (Wednesday) as an online infrastructure of payments for startups to succeed "fincode by GMO" and the generative AI and LLM app platform "Alli LLM App Market" provided by Allganize Japan Inc. (CEO: Yasuo Sato hereinafter referred to as "Allganize"). We have started working with Agent Builder, a tool that allows you to create your own AI agent with no code. Through this collaboration, users of the Alli LLM App Market will be able to directly operate payment functions and link data via MCP (Model Context Protocol) (*1) on an AI agent built in-house, thereby automating and upgrading payment-related operations.

- (*1) A common standard for AI agents to understand the specifications of external services and to generate and execute appropriate requests.

【Background and Summary】

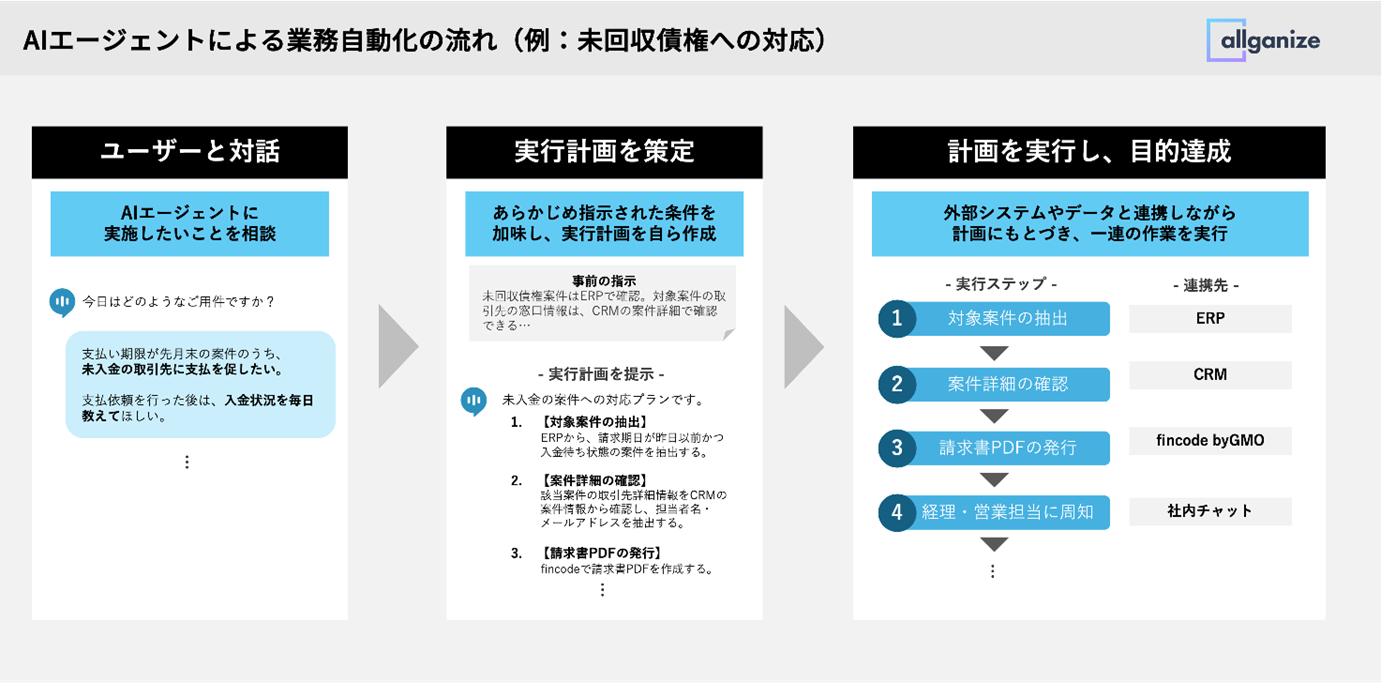

Many companies have introduced SaaS-type services and dedicated tools that differ for each department and business, and the usage environment of business systems has become complex and diverse. Under such circumstances, the use of AI agents that can acquire information and perform processing while interacting with natural language is progressing. With AI agents at the core of operations, the construction of orchestrations that connect internal and external tools across internal and external tools while linking with SaaS and mission-critical systems is spreading.

In response to these trends, GMO-PG is promoting the integration of payment services and AI agents, such as becoming the first payment service provider (PSP) in Japan to support the "MCP" of "fincode byGMO" provided by GMO-EP (*2) in order to realize an payment platform that is optimal for the AI era.

This time, "fincode byGMO" is linked with "Agent Builder", a tool that allows you to create autonomous AI agents in the "Alli LLM App Market" provided by Allganize with no code, and through AI agents built using "Agent Builder", payment, billing, It realizes the automation and sophistication of operations such as data processing.

In the future, GMO-PG will continue to collaborate with domestic and overseas partners with reliability and technical capabilities to connect with a variety of AI agents. As the number one PSP in the AI-native era, we will continue to evolve and provide advanced value to society.

- (*2) Announced on June 19, 2025 "First PSP in Japan, "fincode byGMO" is MCP compatible, making it the optimal payment platform in the AI era"

(URL:https://www.gmo-pg.com/news/press/gmo-paymentgateway/2025/0619.html)

[Overview of cooperation between "fincode byGMO" and "Agent Builder" and examples of use]

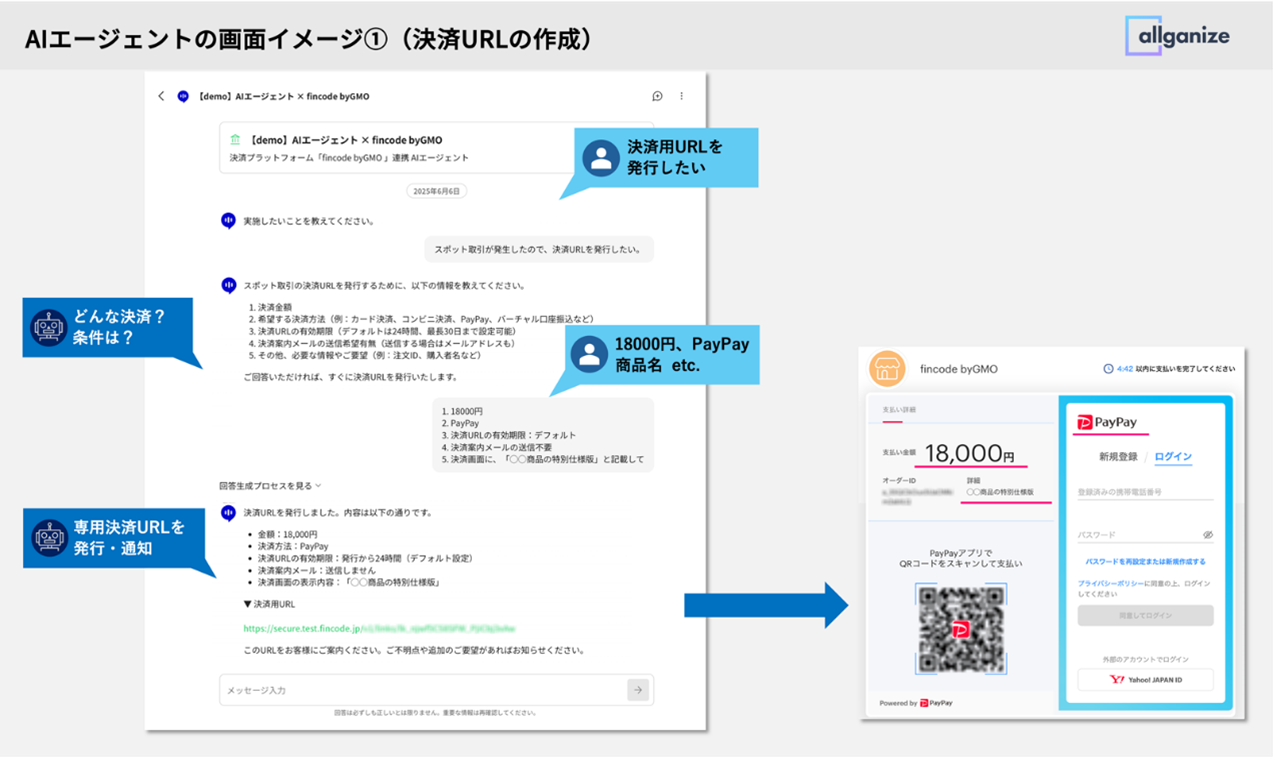

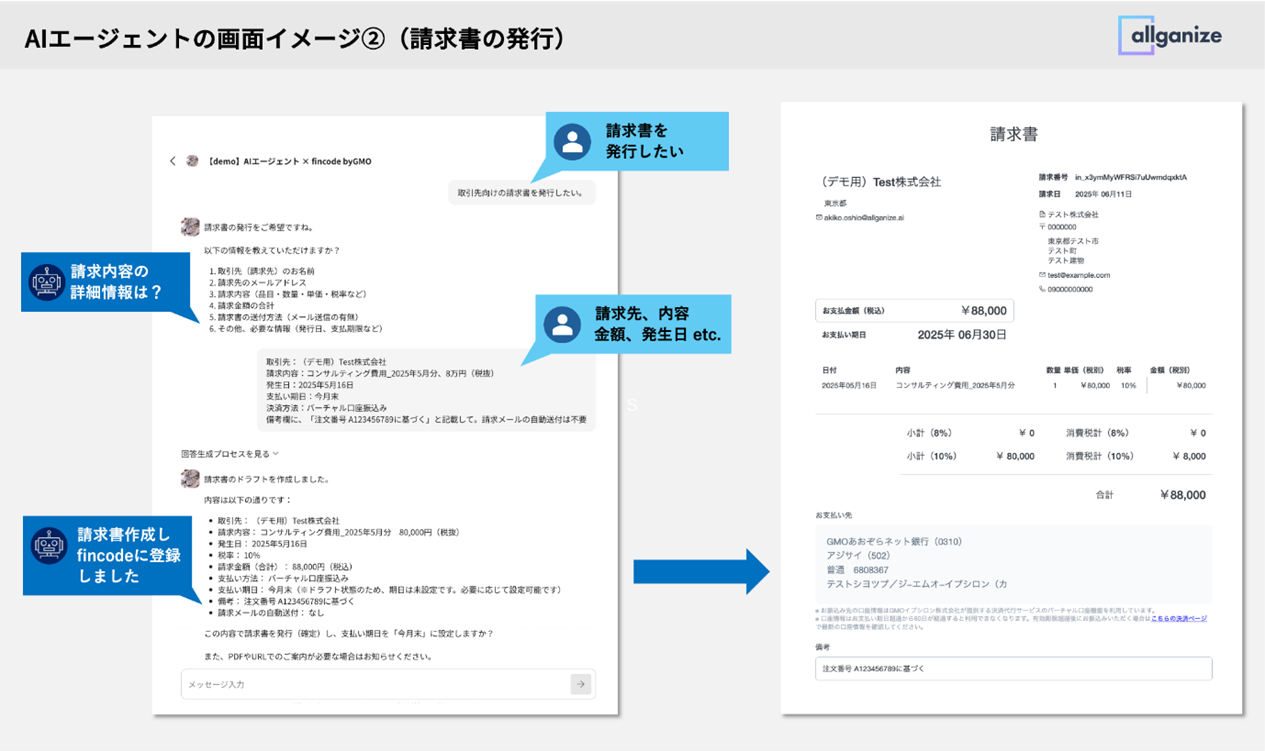

By connecting to the fincode byGMO environment via MCP, All fincode byGMO i LLM App Market users can perform payment-related operations such as issuing links for payment and issuing invoice, as well as registering and outputting data to fincode byGMO, payment through their AI agents.

■Examples of collaborative use

-

・Automation of uncollected receivables

AI agents seamlessly handle a series of tasks, such as listing unpaid cases, checking applicable business partners, reissuing invoice, requesting payment by e-mail, and reporting payment status. Significantly reduce the workload of the back office.

-

Personalized customer experience (e.g., subscriptions)

The AI agent analyzes attributes and preferences and proposes the optimal plan. Online payment links are automatically issued according to the plan, and the entire process from new contract to customer registration is handled at once.

-

- Data-driven marketing strategy planning

AI agents collect customer data from customer management systems, sales management systems, etc., and analyze it together with "fincode byGMO" data. It contributes to the formulation of more accurate marketing strategies.

For more information on the AI agent function of the Alli LLM App Market, please refer to the following URL.

URL:https://www.allganize.ai/ja/agent

【About "fincode byGMO"】

(URL:https://www.fincode.jp/)"fincode byGMO" is an online infrastructure of payments that helps startups grow. Not only does it solve the payment field challenges that arise before and after the launch of a new service, but it also seamlessly delivers the scaled value required as the business phase evolves.

The immediate provision of a test environment, rapid web review, and SDK (*3) and UI components (*4) that reduce development man-hours make it possible to implement the payment system in a short lead time. In addition, through REST APIs (*5) and other extended functions, we support the "next step" of the introduction business, such as "support for unique payment flows," "addition of payment method for user expansion," "addition of subscription plans," and "expansion to a platform-type business model."

By providing these functions with no initial or monthly costs, and a fee structure that minimizes "hidden costs" such as account maintenance fees and transfer fees, we reduce the burden of cost management for introducers and provide an environment where they can concentrate on the growth of their services.

Based on a design concept that takes scalability into consideration, we support the "MCP (Model Context Protocol)" in line with the evolution of UX in the AI era, and are driving a new user experience through the fusion of AI agents and payment.

- *3 Abbreviation for Software Development Kit. fincode byGMO provides a library that makes it easy to incorporate APIs.

- *4 A function that generates and provides a credit card information input form.

- *5 Abbreviation for Representational State Transfer API. fincode byGMO allows you to work with data such as payment and subscriptions through a resource-oriented and easy-to-understand REST API.

【About GMO Epsilon, Inc.】

GMO-EP offers two payment processing services, "Epsilon by GMO" and "fincode byGMO," which are used by more than 40,000 e-commerce companies as of the end of March 2025, and have initial costs and transaction processing fees (*6). It's free to use. fincode byGMO is an online payment service for startups designed to meet a variety of business needs. It enables rapid deployment of payment systems and is ideal for E-commerce, as well as platform and subscription business models.

In addition, in order to support the smooth cash flow of e-commerce businesses, we also provide finance-related services such as the sales-linked business card "Cycle by GMO" and lending and Remittance Service.

TSE As a consolidated company of GMO Payment Gateway, a prime listed company, we provide an environment where you can use it with peace of mind with PrivacyMark certification and security standards that comply with PCI DSS and ISMS.

- *6 Transaction processing fee is a fee charged for each communication with a credit card company for credit card authorization (acquisition of an authorization number) and billing.

[Press Inquiries]

GMO Payment Gateway, Inc.

Corporate Value Creation Strategy Headquarters, Public Relations Department

- TEL

- +81-3-3464-0182

https://contact.gmo-pg.com/m?f=767

GMO Internet Group, Inc.

Group Public Relations Department PR Team Niino

- TEL

- +81-3-5456-2695

https://www.group.gmo/contact/press-inquiries/

[Inquiries about cooperation with AI agents]

GMO Payment Gateway, Inc.

Corporate Planning Department, Corporate Value Creation Strategy Headquarters

- nbc@gmo-pg.com

[Contact for inquiries regarding services]

[GMO Payment Gateway, Inc., Ltd.] (URL: https://www.gmo-pg.com/)

| Corporate Name | GMO Payment Gateway, Inc. (TSE Prime Market Securities Code: 3769) |

|---|---|

| Location | 1-2-3 Dogenzaka, Shibuya-ku, Tokyo Shibuya Fukurasu |

| Representative | President & Chief Executive Officer Issei Ainoura |

| Business Description | ■ Comprehensive payment related services and finance related services |

| Capital | 13,323 million yen |

[GMO Epsilon, Inc.] (URL: https://www.epsilon.jp/)

| Corporate Name | GMO Epsilon, Inc. |

|---|---|

| Location | 1-14-6 Dogenzaka, Shibuya-ku, Tokyo Humax Shibuya Building |

| Representative | President & Chief Executive Officer Tomoyuki Murakami |

| Business Description | ■ Online sales payment processing company, payment collection agency and operations incidental to them |

| Capital | 105 million yen |

[GMO Internet Group, Inc.] (URL:https://www.group.gmo/)

| Corporate Name | GMO Internet Group Co., Ltd. (TSE Prime Market Securities Code: 9449) |

|---|---|

| Location | Cerulean Tower 26-1, Sakuragaoka-cho, Shibuya-ku, Tokyo |

| Representative | Representative Director and Group Representative Masatoshi Kumagai |

| Business Description | Holding Company (Group Management Functions) ■ Group Business Overview Internet Infrastructure Business Internet Security Business Internet Advertising Business Internet finance Business Crypto assets Business |

| Capital | 5 billion yen |