December 22, 2025

J&J Tax Free Corp.

GMO Payment Gateway, Inc.

J&J Tax Free Corp. (President & Chief Executive Officer: Yasuyuki Hiraiwa hereinafter referred to as J&J Tax Free), a group company of J&J Business Development Corp., a joint venture between JTB Corp. and JCB Co., Ltd., and GMO Internet Group's GMO Payment Gateway, Inc. (President & Chief Executive Officer: Issei Ainoura hereinafter referred to as GMO-PG), announced on Friday, November 28, 2025 In anticipation of the "Refunding System" (*1) (the amount equivalent of consumption tax will be refund after the fact) of the tax exemption system for foreign tourists visiting Japan, which is scheduled to come into effect in November 2026, we have concluded a strategic business alliance contract to build a new service that digitizes the refund process.

Through this alliance, we aim to improve the operational efficiency and system compliance of duty-free shops by providing integrated support for refund processing, information linkage, and remittance management in line with the implementation of the "Refund System", and to realize a system that allows foreign tourists visiting Japan to receive refund reliably and promptly.

- (*1) Ministry of Finance "Tax Revision for FY Reiwa 7" (issued in March Reiwa 7)

(https://www.mof.go.jp/tax_policy/publication/brochure/zeisei2025/index.html)

【Background and Summary】

The Japan tax exemption system will be drastically revised from the current "sales at the duty-free price at the time of purchase" to the "refund method" in which the amount equivalent to consumption tax is refund after confirming the take-out at the time of departure, and is scheduled to come into effect on Sunday, November 1, 2026. This system revision is positioned as a mechanism to contribute to the growth of the shopping market for visitors to Japan based on the national policy of promoting a tourism-oriented country and improving the transparency of the tax system.

Based on these government policies, the government has set a target of 60 million foreign tourists visiting Japan and 15 trillion yen in travel consumption by 2030 (*2), and the duty-free market is expected to expand further in the future. Shopping expenses, including duty-free purchases, account for a high proportion of travel spending by foreign visitors to Japan (*3), and are expected to contribute to the revitalization of the local economy in a variety of retail formats such as department stores, drugstores, home appliance sales, and apparel, as well as contributing to the revitalization of the local economy.

On the other hand, with the implementation of the new duty-free system, duty-free shops will be required to further enhance their back-office operations, such as confirming customs judgment results, processing refund, and managing remittances, in addition to accurately recording, sending and storing passport and purchase information of travelers to the National Tax Agency. In order to ensure that the growing inbound demand is captured while responding to the system reform, it is essential to improve the efficiency of tax exemption procedures, including the remittance process.

J&J Tax Free launched the J-Tax Free system in 2013, when many duty-free shops were still creating purchase records by hand, to streamline the tax exemption process, and continues to provide services that respond to the ever-evolving tax exemption system every year. Leveraging our experience and high knowledge of the duty-free system, as well as Actual the reliability of the Group's stable operating base, we have been evaluated by a wide range of duty-free shops nationwide, from major chains in the department stores and home appliances, drugs, and apparel industries to local shopping districts and souvenir shops.

With the transition to the "refund system", in addition to the conventional duty-free shop support, we will also launch multilingual support (24 hours a day/365 days a year) for foreign tourists visiting Japan, contributing to supporting accurate and efficient procedures at duty-free shops, improving the experience value of foreign tourists visiting Japan, and expanding duty-free sales.

GMO-PG is a domestic payment service provider (PSP) with an annual Transaction value of over 21 trillion yen (*4), and provides a wide range of payment-related services to support online, cashless, and DX. In addition, as an Funds Transfer Service Provider (registration number: Kanto Local Finance Bureau License No. 00037), we have a foundation that supports the deposit and withdrawal operations of businesses in an integrated manner by utilizing the Actual and operational know-how we have cultivated while operating Remittance Service in Japan.

By combining these strengths, the new service jointly built by J&J Tax Free and GMO-PG aims to automate remittances and settlement operations with duty-free shops associated with duty-free refund, thereby ensuring proper and efficient operation at duty-free shops and realizing a safe and comfortable duty-free shopping experience for foreign tourists visiting Japan. In order to digitize and improve the reliability of the refund process required by the new tax exemption system, the two companies have entered into this alliance to establish a system to provide safe and secure services to duty-free shops and foreign tourists visiting Japan.

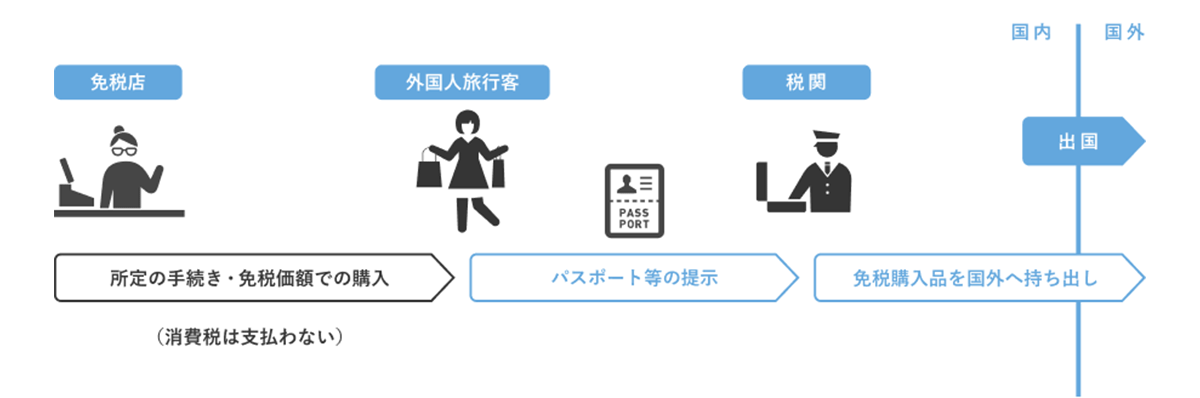

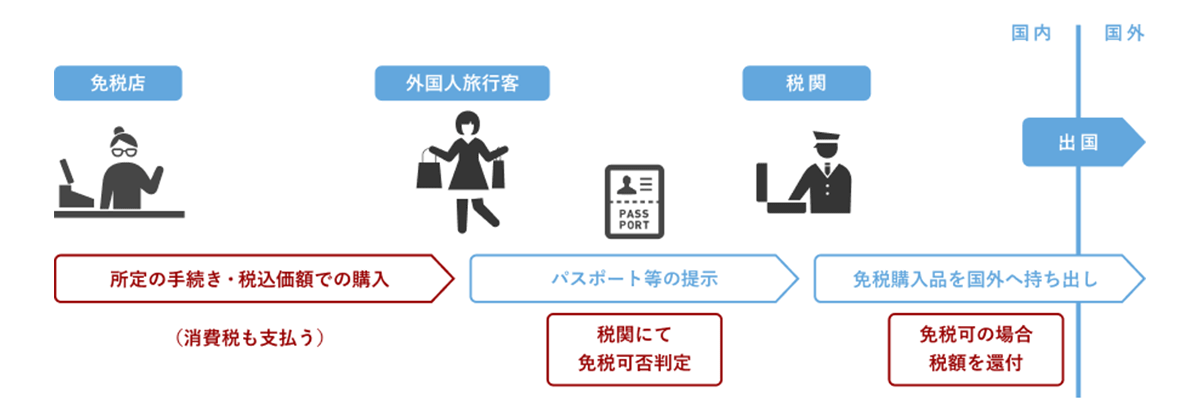

■Reference: Differences between the current system and the refunding method

Current system

Refund method (effective November 1, 2026)

- (*2) Japan Tourism Agency "Basic Plan for Promoting a Tourism-Oriented Nation" (Cabinet decision on March 31, Reiwa 5)

(https://www.mlit.go.jp/kankocho/seisaku_seido/kihonkeikaku.html) - (*3) Japan Tourism Agency "Inbound Consumption Trend Survey (formerly Survey on Consumption Trends of Foreign Visitors to Japan)"

(https://www.mlit.go.jp/kankocho/tokei_hakusyo/gaikokujinshohidoko.html) - *4 Consolidated figures as of the end of September 2025.

[Contents of the business alliance contract]

In order to contribute to the efficiency of tax exemption procedures under the new system and the healthy development of the inbound market, both companies will take on the following roles by leveraging the know-how they have cultivated.

■Role of J&J Tax Free

・Provision of tax exemption systems and services that lead to the optimization of tax exemption procedures

・Duty-free shops related to duty-free procedures ・Operation of support desks for foreign tourists visiting Japan

・Improving the value of the duty-free shopping experience for foreign tourists visiting Japan, providing solutions to expand duty-free sales at duty-free shops, etc.

■Role of GMO-PG

・ refund Provision of functions and integrated management of back-end processing

・Development of functions such as dedicated websites for foreign tourists visiting Japan, etc.

[ About J&J Tax Free Corp.

As a group company of J&J Business Development Corp., a joint venture between JTB Corp. and JCB Co., Ltd., we provide the J-TaxFree system (tax-free system) for department stores, retail stores, shopping centers and shopping streets. Our philosophy is to "contribute to the development and improvement of Japan's inbound environment by developing various solutions related to inbound tourism to Japan, and contribute to the promotion of a tourism-oriented country."

[Press Inquiries]

GMO Payment Gateway, Inc.

Corporate Value Creation Strategy Headquarters, Public Relations Department

- TEL

- +81-3-3464-0182

https://contact.gmo-pg.com/m?f=767

GMO Internet Group, Inc.

Group Public Relations Department PR Team Niino

- TEL

- +81-3-5456-2695

https://group.gmo/contact/press-inquiries/

[Contact for inquiries regarding services]

GMO Payment Gateway, Inc.

Industry Solutions Division

Innovation Strategy Department

Contact Formhttps://contact.gmo-pg.com/m?f=846

[GMO Payment Gateway, Inc.] (URL: https://www.gmo-pg.com/)

| Corporate Name | GMO Payment Gateway, Inc. (TSE Prime Market Securities Code: 3769) |

|---|---|

| Location | 1-2-3 Dogenzaka, Shibuya-ku, Tokyo Shibuya Fukurasu |

| Representative | President & Chief Executive Officer Issei Ainoura |

| Business Description | ■ Comprehensive payment related services and finance related services |

| Capital | 13,323 million yen |

[GMO Internet Group Co., Ltd.] (URL: https://group.gmo/)

| Corporate Name | GMO Internet Group Co., Ltd. (TSE Prime Market Securities Code: 9449) |

|---|---|

| Location | Cerulean Tower 26-1, Sakuragaoka-cho, Shibuya-ku, Tokyo |

| Representative | Representative Director and Group Representative Masatoshi Kumagai |

| Business Description | Holding Company (Group Management Function) ■Group Business Overview Internet Infrastructure Business Internet Security Business Internet Advertising & Media Business Internet finance Business Crypto assets Business |

| Capital | 5 billion yen |