2019年2月12日

報道関係各位

GMOペイメントゲートウェイ株式会社

GMOインターネットグループにおいて、総合的な決済関連サービス及び金融関連サービスを展開するGMOペイメントゲートウェイ株式会社(東証一部:証券コード 3769、代表取締役社長:相浦 一成 以下、GMO-PG)は、三井住友カード株式会社(本社:東京都港区、代表取締役社長:大西 幸彦、以下:三井住友カード)と、次世代決済プラットフォーム事業に関する基本合意をいたしました。

本件について、別紙の通り、GMO-PGおよび三井住友カード、ビザ・ワールドワイド・ジャパン株式会社(本社:東京都千代田区、代表取締役社長:安渕 聖司)の3社による共同発表を行いました。

以上

2019年2月12日

各 位

三井住友カード株式会社

GMOペイメントゲートウェイ株式会社

ビザ・ワールドワイド・ジャパン株式会社

次世代決済プラットフォーム事業に関する基本合意について

三井住友カード株式会社(本社:東京都港区、代表取締役社長:大西 幸彦、以下:三井住友カード)は次世代決済プラットフォーム事業の構築にあたり、GMOペイメントゲートウェイ株式会社(東証一部:証券コード 3769、代表取締役社長:相浦 一成 以下、GMO-PG)およびビザ・ワールドワイド・ジャパン株式会社(東京都千代田区、代表取締役社長:安渕 聖司、以下:Visa)と、それぞれ合意しましたので発表致します。

【基本合意の概要】

本件は、昨年5月から開始しましたSMBCグループとGMO-PGとの提携協議(※)に、世界最大規模のペイメントネットワークを有するVisaが新たに参画し、3社の持つ強みを結集することで、より強力な事業者向け次世代決済プラットフォーム事業の構築を目指すものです。

具体的には、三井住友カードとEC・ネット決済分野のリーディングカンパニーであるGMO-PGは、対面・非対面を問わず、両社の持つ決済プロセシング機能や知見・ノウハウ等を統合し、急速な決済環境の変化にも迅速に対応できる柔軟性・拡張性に優れた「ワンストップペイメントサービス」を共同で開発・提供致します。

また、三井住友カードとVisaは、日本国内での50年を超える関係を礎に、戦略的パートナーとして、Visaの世界水準の不正検知およびプロセシング機能を、三井住友カードと共に我が国の市場特性に合わせ、グローバル水準の安心・安全なキャッシュレス決済環境を整備して参ります。

このように、三井住友カードがGMO-PGおよびVisaと各々合意した戦略提携を組み合わせ、事業者向け次世代決済プラットフォームを包括的なサービスとして提供することで、今後、飛躍的な広がりが予想されるキャッシュレス決済シーンにおいて、事業者のみならず利用者にとっても安心・安全・便利なキャッシュレス決済環境の実現を3社で強力に推進して参ります。

(※)2018年5月8日付 SMFGおよびGMO-PG連名プレスリリース/「キャッシュレス決済推進のための次世代決済プラットフォーム事業に関する新たな提携協議の開始について」ご参照。

https://www.smfg.co.jp/news/j110136_01.html

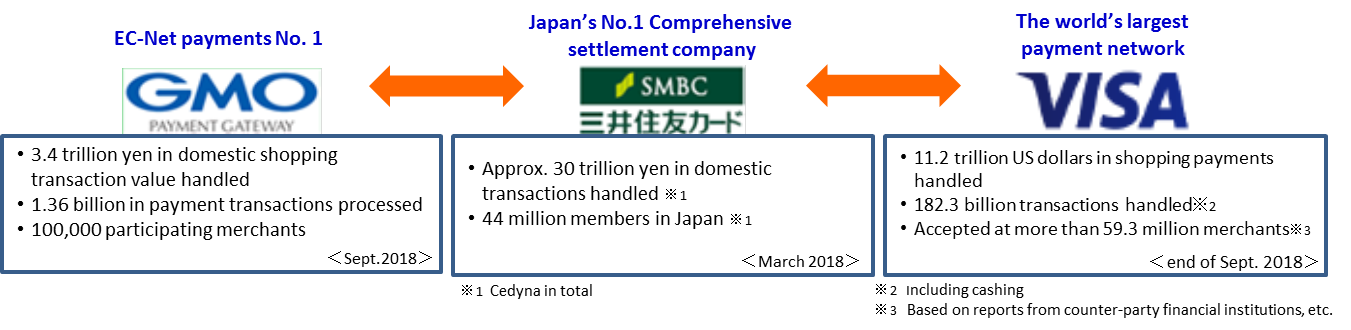

<参考①>各社業容サマリー

【取組の背景】

現在、我が国では、既存のクレジットカード・デビットカード・電子マネー等の普及やインバウンド利用の増加、EC市場拡大に伴うネット決済の広がり等に加えて、モバイルペイメントやQRコードといった店頭での支払方法が多様化しています。また、金融業界以外のプレイヤーによるデータ蓄積・利活用を目的とした独自ペイメントサービスの導入等、キャッシュレス決済市場が複雑化を伴いながら成長しております。

こうした我が国の特殊な環境下において、政府の推進するキャッシュレス化を加速するためには、決済システム全体の複雑さに起因する非効率を解消しつつも、新たなテクノロジーの登場や事業者・利用者双方のニーズの高度化に、柔軟且つスピーディーに応えることができる安心・安全・便利な事業者向け決済プラットフォームを整備する必要があります。

そのような決済プラットフォームに求められる具体的な要件としては、①日本固有の状況とも言える決済手段の多様化にワンストップで対応できること、②事業者のオムニチャネル化ニーズに応え、対面・非対面双方にシームレスに対応できること、③事業者に世界水準のセキュリティと信頼性の高い決済機能を提供できること、④事業者のマーケティングの高度化や利用者向けのパーソナライズされたサービス開発に資するデータ利活用が可能なこと、等が挙げられます。

このような要件を満たすには、金融、IT、マーケティングを融合したハイブリッドな業種・業態別のソリューションを、効率的に提供できる体制を構築することが必要であり、それを実現するためには三井住友カード、GMO-PG、Visaの3社の強みを結集することが最善の選択肢であるとの結論に至りました。

【事業者向け次世代決済プラットフォームの概要及び運営】

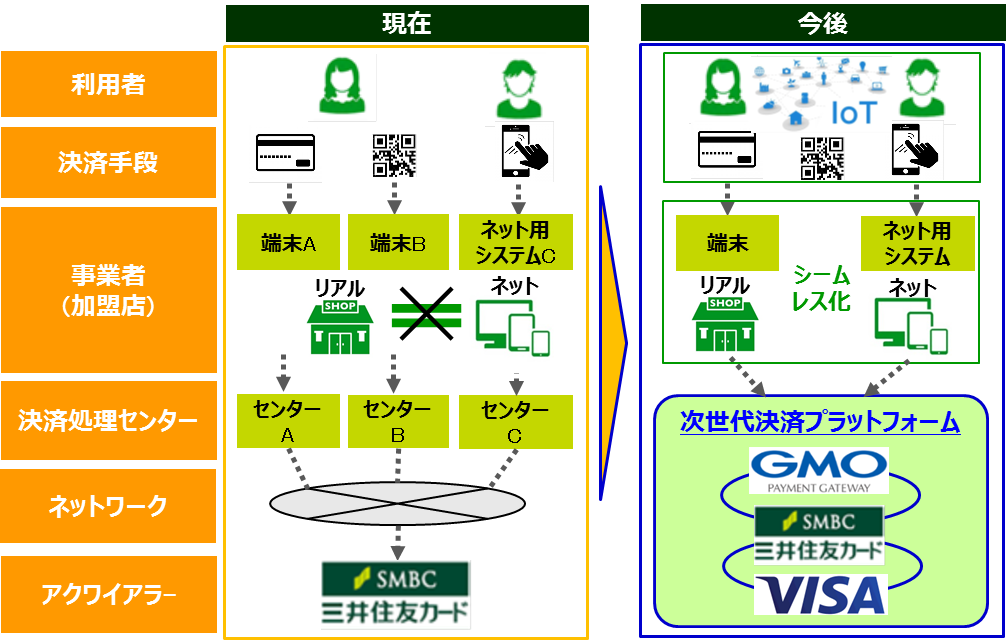

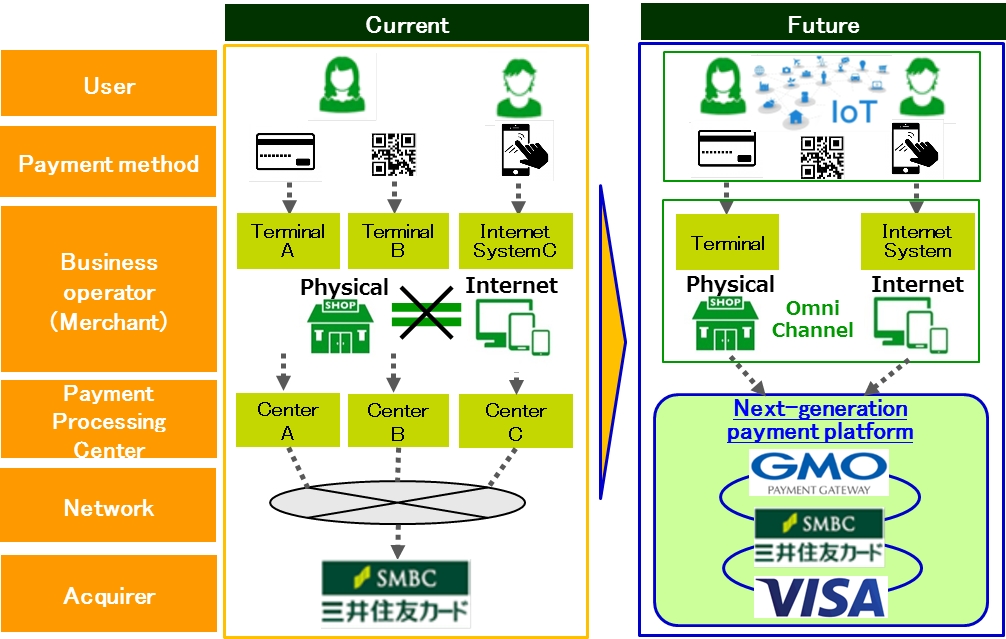

キャッシュレス決済利用時の情報は、決済の種類やブランド等により異なる決済処理センターへ伝送され、後続処理に必要な加工等が施された後、複数の異なるネットワークを経由してアクワイアラーやイシュアーに連携されることで、最終的な決済を実現する仕組みとなっています。

GMO-PGは、中核事業であるオンライン決済サービスにおける営業力やシステム開発力、顧客サポート力などを背景に構築してきた「PGマルチペイメントサービス」を基に、三井住友カードと共に、決済情報をワンストップで処理する「事業者向け決済処理センター機能」を提供致します。

Visaは、世界200以上の国と地域で提供するグローバルペイメントネットワークを背景に、三井住友カードと共に、日本特有のキャッシュレス決済環境を踏まえた事業者向けネットワーク機能の整備を担います。

尚、三井住友カードは、アクワイアラーとしての役割を担うとともに、この2つの機能を一体化させることで事業全体の取り纏めを行い、積極的なIT投資の継続を通じて、最新性・優位性を確保し、利用者ならびに事業者ニーズへの対応力を強化して参ります。

<参考②>事業者向け次世代決済プラットフォーム構築イメージ

【提供予定のソリューションサービス概要】

本プラットフォームで提供を予定している主なソリューションサービスは以下の通りです。

(ワンストップ対応の実現)

様々なキャッシュレス決済手段に対応できるワンストップペイメントサービスを提供して参ります。クレジットカードやデビットカード、電子マネー等、既に浸透している決済手段の受入れはもとより、主要QR・バーコード決済やインバウンド需要にも対応した多通貨決済、更には各種ポイントサービスを活用した決済等も順次提供して参ります。また、新たな決済手段の登場に対しても、3社の知見・ノウハウ等をフル活用の上、迅速かつ柔軟な対応を行うことで、事業者のキャッシュレス決済環境の最新化を支援して参ります。なお、こうした多様な決済手段に対応したオールインワン決済端末のリリースも2019年中に予定しております。

(オムニチャネル化への対応)

消費者の決済シーンの多様化に対応するため、ワンストップペイメントサービスの一環として、対面・非対面どちらにもシームレスに対応可能な仕組みを提供し、事業者のオムニチャネル化をサポートして参ります。具体的には、対面・非対面双方での決済データを一元的に管理できるダッシュボード機能の提供を予定しております。これにより、取引チャネルの別を問わず、事業者は利用者のニーズに応じたきめ細かい対応を行うことが可能となる等、顧客満足の向上や精度の高いパーソナライズされたマーケティング展開をサポートできるものと考えております。

(世界水準のセキュリティと安定運営)

年々巧妙化・頻発化する不正利用への確実な対応は、決済プラットフォームサービスにとって不可欠な機能と考えております。事業者・利用者ともに安心してお使いいただける安全かつ便利なキャッシュレス決済環境を提供するため、三井住友カードが永年培ってきたセキュリティ対策ノウハウに、Visaがグローバルで展開する不正検知やトークンマネジメントサービス等の機能を融合し、決済情報処理プロセスにおける世界水準のセキュリティを確保して参ります。

また、キャッシュレス決済の浸透や多様化に伴い、少額決済シーンにおけるキャッシュレス利用も急速に広がっており、決済情報処理件数も急増しています。こうしたデータ処理量の大幅増加はシステム運営の負荷が高まりますが、グローバルペイメントネットワークサービスを提供するVisaの知見をはじめ、3社のシステム運営ノウハウを結集することで安定的な決済プラットフォームサービス運営を目指して参ります。

(新たな高付加価値サービスの開発)

我々が提供するこの事業者向け次世代決済プラットフォームサービスをより多くの事業者・利用者にご利用いただくことで、決済データの付加価値が向上し、アクワイアラー事業からデータ利活用事業まで取組むことで、新サービスや事業者のマーケティングサポート機能を開発・拡充していく予定です。また、スケールメリットを活用したプラットフォーム運営の効率化も並行して推進して参ります。

【今後のスケジュール】

必要な準備が整い次第、2019年4月以降順次営業を開始する予定です。

February 12, 2019

GMO Payment Gateway, Inc. (TSE 1st Section: 3769, President and Chief Executive Officer: Issei Ainoura, hereinafter, "GMO-PG") of the GMO Internet Group, which develops comprehensive payment-related services and financial-related services, have reached a basic agreement with Sumitomo Mitsui Card Co., Ltd. (Head office: Minato-ku, Tokyo; President and Representative Director: Yukihiko Onishi, hereinafter, "Sumitomo Mitsui Card") regarding the next-generation payment platform business.

In this matter as per the attached document, GMO-PG, Sumitomo Mitsui Card and Visa Worldwide Japan (Head office: Chiyoda-ku, Tokyo; Representative Director and Country Manager, Japan: Seiji Yasubuchi) jointly announce.

February 12, 2019

Sumitomo Mitsui Card Company, Limited

GMO Payment Gateway, Inc.

Visa Worldwide Japan

Basic agreement regarding the next-generation payment platform business

We are pleased to announce that Sumitomo Mitsui Card Co., Ltd. (head office: Minato-ku, Tokyo; President and Representative Director: Yukihiko Onishi; "Sumitomo Mitsui Card") have reached agreements with GMO Payment Gateway, Inc. (First Section of Tokyo Stock Exchange: 3769; President and Chief Executive Officer: Issei Ainoura; "GMO-PG") and Visa Worldwide Japan (Chiyoda-ku, Tokyo; Representative Director and Country Manager, Japan: Seiji Yasubuchi; "Visa") in the development of next-generation payment platform business.

[Summary of the basic agreement]

This agreement adds the participation of Visa, provider of the world's largest payment network, to partnership talks* which began last May between the SMBC Group and GMO-PG. The three companies will collaborate to build a stronger merchant payment platform business by combining their strengths.

Specifically, Sumitomo Mitsui Card and GMO-PG, a leading provider of EC and online payment service, will integrate the two companies' payment processing capabilities and know-how to jointly develop and offer a "one-stop payment service" with superior flexibility and scalability that can handle both face-to-face and non-face-to-face payments, and can respond quickly to rapid changes in the payment environment.

In addition, based on their strategic partnership of over 50 years in Japan, Sumitomo Mitsui Card and Visa will connect Visa's world-class fraud detection and processing capabilities with the special characteristics of acquiring in Japan to establish a cashless payment environment with world-class safety and security.

Sumitomo Mitsui Card's agreements with GMO-PG and Visa will create a strategic alliance which will provide a next-generation acquiring payment platform for business operators as a comprehensive cashless payment service, a field which is expected to grow dramatically in the future. This will enable the three companies to make a strong push for the implementation of a secure, safe and convenient cashless payment environment for both merchants and users.

*Please refer to the SMFG and GMO-PG joint press release dated May 8, 2018, "Announcement of the entry into discussions on forming an alliance on the next generation payment platform business to promote cashless payments".https://www.smfg.co.jp/news_e/e20180508_01.html

<Reference (1)> Summary of each company's business

[Background of the initiative]

Currently in Japan, in addition to the current penetration of credit cards, debit cards, and electronic currency, the increasing use of cashless payments in inbound tourism, and expansion of Internet payments in conjunction with EC market growth, storefront payment methods are diversifying with the use of QR code and mobile payments. The cashless payment market is also becoming more complex, with the entry of independent payment services from players outside the financial industry whose goal is the accumulation and use of data.

In Japan's unique environment, in order to accelerate the move to cashless payments being promoted by the government, it is necessary to eliminate the inefficiencies caused by the complexity of the overall settlement system, while creating a safe, secure, and convenient acquiring payment platform for business operators that is capable of responding quickly and flexibly to the emergence of new technologies and the increasingly sophisticated needs of both business operators and users.

The specific requirements of such a settlement platform include, (1) the ability to provide one-stop support for the diversification of payment methods that could be said to be unique to Japan, (2) the ability to seamlessly support the omni-channel needs of businesses for handling both face-to-face and non-face-to-face payments, (3) the ability to provide businesses with world-class security and highly reliable payment capabilities, and (4) the ability to utilize data to develop personalized services for users and improve the marketing capabilities of business operators, etc.

To meet these requirements requires that we build a system that can efficiently provide hybrid solutions that combe finance, IT, and marketing according to the business type and industry. We have come to the conclusion that the best way to achieve this is to combine the strengths of Sumitomo Mitsui Card, GMO-PG, and Visa.

[Outline and operations of the next-generation merchant payment platform for businesses]

Information generated when a cashless payment is made is sent to a different payment processing center depending on the type of payment and card brand. After processing required for later payment processing, the information is connected to acquiring and issuing companies though multiple networks to complete the final settlement.

GMO-PG, together with Sumitomo Mitsui Card, will provide one-stop processing of payment information through their "settlement processing center functionality for businesses," based on the company's capabilities in marketing, system development, customer support, etc., developed in building the "PG Multi Payment Service" which is their core business.

With a global payment network operating in more than 200 countries and regions around the world, Visa, together with Mitsui Sumitomo Card, will be responsible for establishing network functionality for businesses, based on Japan's unique cashless payment environment.

In addition to fulfilling the role of acquirer, Sumitomo Mitsui Card will coordinate the overall project by integrating these two functions, and will continue to invest aggressively in IT to ensure that the system is up-to-date and of high quality, and to strengthen our ability to respond to the needs of users and businesses.

<Reference (2)> Structure of the next-generation merchant payment platform for businesses

[Outline of planned solution services]

The main solution services we plan to provide on this platform are as follows.

(Implementation of one-stop support)

We will provide a one-stop payment service with the capability to support a variety of cashless settlement methods. In addition to accepting payment methods that are already well established, such as credit cards, debit cards, and electronic money, we will also continue to provide settlement services for major QR and bar-code payments, multi-currency payment settlements to support inbound tourism, as well as payments using various types of point services. We will also make full use of the three companies' experience and know-how to respond quickly and flexibly to the emergence of new payment methods and support businesses in handling the latest updates to the cashless payment environment. We also plan to release an all-in-one settlement terminal with support for these various payment methods sometime during 2019.

(Omni-channel support)

To respond to the diversification of the consumer payment environment, our one-stop payment service will provide mechanisms that can handle both face-to-face and non-face-to-face payments to provide omni-channel support for businesses. Specifically, we plan to offer a dashboard that can centrally manage settlement data for both face-to-face and non-face-to-face transactions. We believe that this will support improved customer satisfaction and the development of high-precision personalized marketing, enabling business operators to provide detailed support for their customers' needs, regardless of the transaction channel.

(World-class security and stable operations)

We believe that reliable functionality to combat unauthorized use, which is becoming more frequent and more sophisticated every year, is essential for a payment platform service. In order to provide a secure and convenient cashless payment environment that both business operators and customers can use with confidence, we will combine the security know-how that Mitsui Sumitomo Card has cultivated over many years with Visa's global fraud detection and token management capability to ensure world-class security in our payment information processing services.

In addition, with the penetration and diversification of cashless payments, their use in small-sum transactions is increasing rapidly, with a corresponding increase in the volume of payment processing requests. Although such a dramatic rise data volume causes increased load on system processes, we will endeavor to operate a stable settlement platform service by combining Visa's experience in operating a global payment network with the other two companies' system management know-how.

(Development of new high-value-added services)

Bringing our next-generation payment platform services to more and more business operators and users will increase the added value of the transaction data, and we plan to develop and expand new services and marketing support for businesses by handling the entire process from the acquirer business to data utilization. At the same time, we will also leverage economies of scale to drive efficient platform management.

[Upcoming schedule]

Once the necessary preparations are completed, we plan to begin operations gradually, starting from April 2019.