2017年10月23日

報道関係各位

GMOペイメントゲートウェイ株式会社

GMOインターネットグループにおいて、総合的な決済関連サービス及び金融関連サービスを展開するGMOペイメントゲートウェイ株式会社(東証一部:証券コード 3769、代表取締役社長:相浦 一成 以下、GMO-PG)は、日本通信株式会社(東証一部:証券コード 9424、代表取締役社長:福田 尚久 以下、日本通信)提供の、EC・通販事業者のカード情報非保持化に対応する、クレジットカード決済時のカード情報入力専用タブレット端末・回線を、2018年1月を目処に取扱開始いたします。

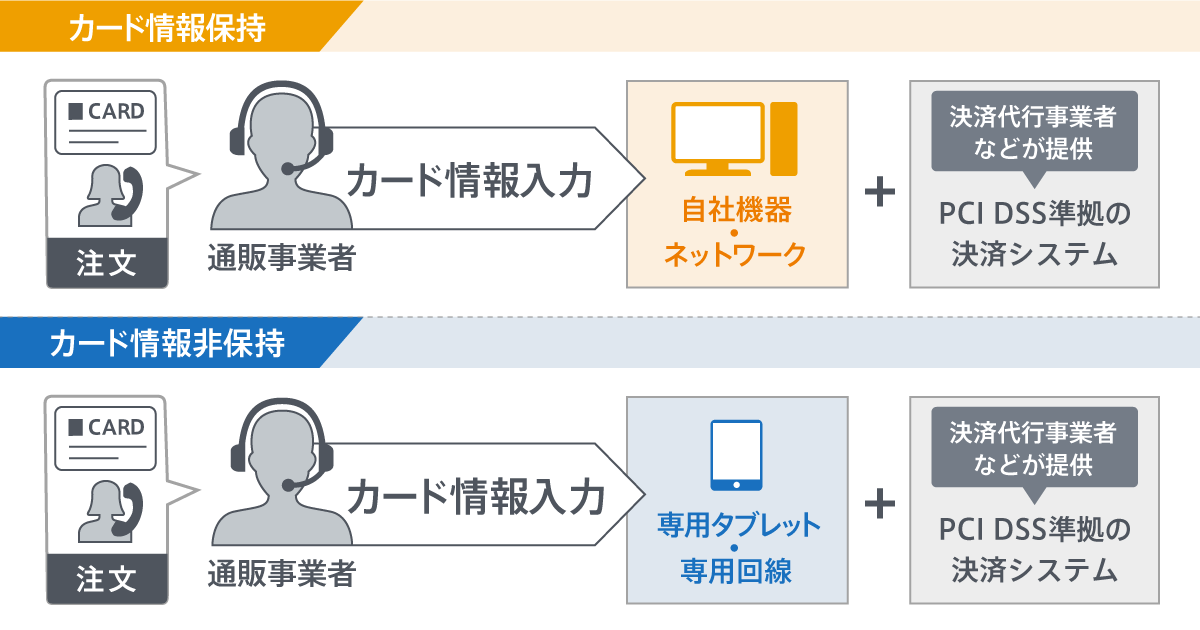

クレジットカード決済を取り扱うEC・通販等の非対面取引事業者(加盟店)は、2018年3月までにカード情報非保持化(*1)またはPCI DSS(*2)の準拠が求められています。電話・FAX・はがき等の手段で注文を受け付けるEC・通販事業者が、カード情報非保持化に対応する場合、一定の条件(*3)に合致した専用タブレット端末を使用してカード情報を入力し、さらにPCI DSSに準拠した決済システムを利用する方法があります。

GMO-PGは、従来提供している「非通過型決済(*4)」と合わせて、新たに専用タブレット端末・回線も取り扱うことで、非対面加盟店のカード情報非保持化を包括的に支援してまいります。

(*1)加盟店が保有する機器・ネットワークにおいて、消費者のクレジットカード情報(カード会員名・カード番号・有効期限等)を「保存」「処理」「通過」しないこと。

(*2)PCI DSS(Payment Card Industry Data Security Standard)とは、JCB・American Express・Discover・MasterCard・VISAの国際クレジットカードブランド5社が共同で策定した、クレジット業界におけるグローバルセキュリティ基準のこと。

(*3)「実行計画2017」では、カード情報非保持化の対応策の一つとして、カード情報入力時に「加盟店自社で保有している機器ではない」「社内ネットワークと接続がない」「決済代行事業者等がセキュリティ条件を設定または設定指示している」という条件に合致する専用タブレット・回線を使用すること、と整理されています。

(*4)非対面加盟店が購入者のクレジットカード番号に触れずに決済できる、カード情報非保持化を実現する決済システムのこと。

【背景と概要】

昨今日本では、2020年のオリンピック・パラリンピック東京大会の開催に向けて、キャッシュレス決済の普及による決済の利便性・効率性の向上を図るため、クレジットカード取引におけるセキュリティ環境を国際水準へと整備することが求められています。こうした中、各加盟店にカード情報のセキュリティ対策を義務付ける等の措置を盛り込んだ「割賦販売法の一部を改正する法律」が、2018年6月までに施行予定となっており、この実務指針として、「クレジット取引セキュリティ対策協議会(*5)」より「実行計画2017(*6)」が発表されています。

この「実行計画2017」では、EC・通販等でクレジットカードを取り扱う非対面取引事業者(加盟店)に対して、2018年3月までに、「非通過型決済」によるカード情報非保持化、もしくはPCI DSSの準拠を求めています。このうち電話・FAX・はがき等で注文を受ける場合、消費者のカード情報を紙媒体で保存することは"カード情報非保持"となるものの、オペレーターが自社保有のパソコン等へカード情報を入力することは"カード情報の保持"に該当するため、カード情報非保持化に対応するには、カード情報の入力時にPCI DSSに準拠した外部事業者のサービス(自動音声応答(IVR)決済システム、専用タブレット端末・回線、カード情報入力業務のBPO等)の利用と、PCI DSSに準拠した決済代行事業者等の決済システムの利用が必要となります。

そこでこの度GMO-PGは、EC・通販事業者のカード情報非保持化を包括的に支援するべく、従来提供している「非通過型決済」に加え、新たに日本通信が提供する専用タブレット端末・回線を、2018年1月を目処に取扱開始することといたしました。

(*5)クレジット取引に関わる幅広い事業者及び経済産業省が参画して2015年3月に設立

(*6)2017年3月8日公表「クレジットカード取引におけるセキュリティ対策の強化に向けた実行計画 -2017-」

【GMO-PGが取り扱う専用タブレット端末・回線について】

この度GMO-PGが取り扱う、日本通信のクレジットカード決済時のカード情報入力専用タブレット端末・回線は、EC・通販事業者が電話・はがき等で注文を受ける際に、消費者のカード情報を入力しているパソコンを本専用タブレット端末に置き換えるだけで、現状の受付オペレーションの大きな変更なく、カード情報の非保持化が実現できるものです。

カード情報の入力・決済は、GMO-PGが提供する決済システムの管理画面に直接遷移し、通信も日本通信が提供する専用回線で行われるため、入力したカード情報は社内ネットワークを通過することはありません。また、カード情報の非保持化に必要となるセキュリティ条件を満たした設定が完了している専用タブレット端末を提供するため、追加のシステム開発も必要ありません。

【GMO-PGの「実行計画2017」に対する取り組みについて】

(URL: https://www.gmo-pg.com/service/mulpay/security/execution/)

GMO-PGでは、「実行計画2017」で策定された内容に対し、EC事業者・通販事業を行う加盟店のカード情報非保持化を実現する「トークン決済(*7)」や「リダイレクト(リンク)型(*8)」の決済システム提供をはじめ、多面的・重層的な不正使用対策の提供やセミナー等の啓蒙活動などを行っております。

(*7) クレジットカード番号をトークン(乱英数字の文字列)に置き換えて決済処理を行うもの

(*8) 購入者によるカード情報入力以降は、決済代行事業者のサーバー上に遷移して決済処理を行うもの

【日本通信株式会社について】

日本通信は 1996年5月24日、モバイルが実現する次世代インターネットを活用して日本の次世代経済の基盤を構築する総務省の方針を実現する会社として設立されました。日本通信のビジネスモデルはのちにMVNOと命名され、2009年3月、総務省の携帯市場のオープン政策のもとNTTドコモとの相互接続を実現しました。これにより「格安SIM」が生まれ、携帯事業者以外から携帯通信(SIM)が買える市場が誕生しました。次は、携帯電話以外の産業が、自社サービスにモバイルを組み込み、産業全体がモバイルを活用し成長する番です。MVNO ルールメーカ、世界初のMSEnablerとしての強い技術ビジョンと高い遂行力によって、日本発の経済創出の一翼を担うべく次世代プラットフォームの構築に取り組んでいます。東京、米国コロラド州およびフロリダ州、アイルランドダブリンに拠点を置き、東京証券取引所市場第一部に上場(証券コード:9424)しています。日本通信のコーポレートガバナンスのポリシーとして、社外役員が過半数で、全社外役員は独立役員です。

【GMOペイメントゲートウェイ株式会社について】

GMO-PGは、ネットショップやデジタルコンテンツなどのオンライン事業者、NHKや定期購入など月額料金課金型の事業者、並びに国税庁や東京都等の公的機関など8万8,425店舗(GMO-PGグループ2017年6月末現在)の加盟店に総合的な決済関連サービスを提供しています。

決済サービスを中心に、加盟店の売上向上に資するweb広告サービス等の付加価値サービスや、加盟店の成長を資金面からサポートする融資等の金融関連サービスの提供、海外決済サービスの提供をはじめとする海外事業などを行い、年間決済処理金額は2兆円を超えております。

GMO-PGは、消費者と事業者にとって安全性が高く便利な決済を実現し、決済プロセスのインフラになることを目指しています。今後も決済業界のリーディングカンパニーとして、FinTechなど新たなイノベーションを牽引し、日本のEC化率の向上に貢献してまいります。

【関連URL】

- 日本通信URL:

- URL : http://www.j-com.co.jp/

- GMO-PG コーポレートサイトURL :

- URL : https://corp.gmo-pg.com/

- GMO-PG サービスサイトURL :

- URL : https://www.gmo-pg.com/

【報道関係お問い合わせ先】

GMOペイメントゲートウェイ株式会社 企業価値創造戦略 統括本部

- TEL

- 03-3464-0182

- FAX

- 03-3464-2387

- pr@gmo-pg.com

GMOインターネット株式会社 グループ広報・IR部 石井・島田

- TEL

- 03-5456-2695

- pr@gmo.jp

【サービスに関するお問い合わせ先】

GMOペイメントゲートウェイ株式会社 イノベーション・パートナーズ本部

- TEL

- 03-3464-2323

- FAX

- 03-3464-2477

- info@gmo-pg.com

【GMOペイメントゲートウェイ株式会社】(URL: https://corp.gmo-pg.com/ )

| 会社名 |

GMOペイメントゲートウェイ株式会社 (東証第一部 証券コード:3769) |

|---|---|

| 所在地 | 東京都渋谷区道玄坂1丁目14番6号 ヒューマックス渋谷ビル |

| 代表者 | 代表取締役社長 相浦 一成 |

| 事業内容 | ■総合的な決済関連サービス及び金融関連サービス |

| 資本金 | 47億1,200万円 |

【GMOインターネット株式会社】(URL: https://www.gmo.jp/ )

| 会社名 | GMOインターネット株式会社(東証第一部 証券コード:9449) |

|---|---|

| 所在地 | 東京都渋谷区桜丘町26番1号 セルリアンタワー |

| 代表者 | 代表取締役会長兼社長・グループ代表 熊谷 正寿 |

| 事業内容 | ■インターネットインフラ事業 ■インターネット広告・メディア事業 ■インターネット金融事業 ■モバイルエンターテイメント事業 |

| 資本金 | 50億円 |