November 28, 2025

GMO Epsilon, Inc.

GMO Epsilon, Inc. (President & Chief Executive Officer: Tomoyuki Murakami hereinafter referred to as "GMO Epsilon"), a consolidated company of GMO Payment Gateway, Inc. (hereinafter referred to as "GMO-PG") in the GMO Internet Group, has launched a new "fincode invoice card pay" on Thursday, November 27, in addition to "fincode business card", which has been available since September 2025 as an optional feature of the online infrastructure of payments "fincode by GMO" for startups to help startups succeed.

GMO Epsilon provides an environment where adopters can design their own timing of deposits and withdrawals and flexibly control cash flow by providing "fincode business card" that allows them to utilize sales proceeds without waiting for payment, and "fincode invoice card pay" that allows them to extend the due date from payment to withdrawal through Credit card payment.

【Background】

Many startups in Japan are working on business growth with a limited number of people and a high sense of speed. Therefore, payment functions that are not the core of a service or product are required to be "quick to implement", "easy to implement", and "simple pricing structure". Against this backdrop, GMO Epsilon has been providing "fincode byGMO," an online infrastructure of payments that solves the payment field issues of startups, leveraging the knowledge and development capabilities in payment that GMO-PG has cultivated as a group, since May 2022.

In order to ensure that startups and other businesses can seize opportunities without slowing down their business growth, we have added "fincode invoice card pay" in addition to "fincode business card" as an optional feature of "fincode byGMO". By optimizing the timing of deposits and withdrawals, it prevents funds from being stagnant and provides a platform that allows you to execute the investments and payment necessary for growth with agility.

【Overview】

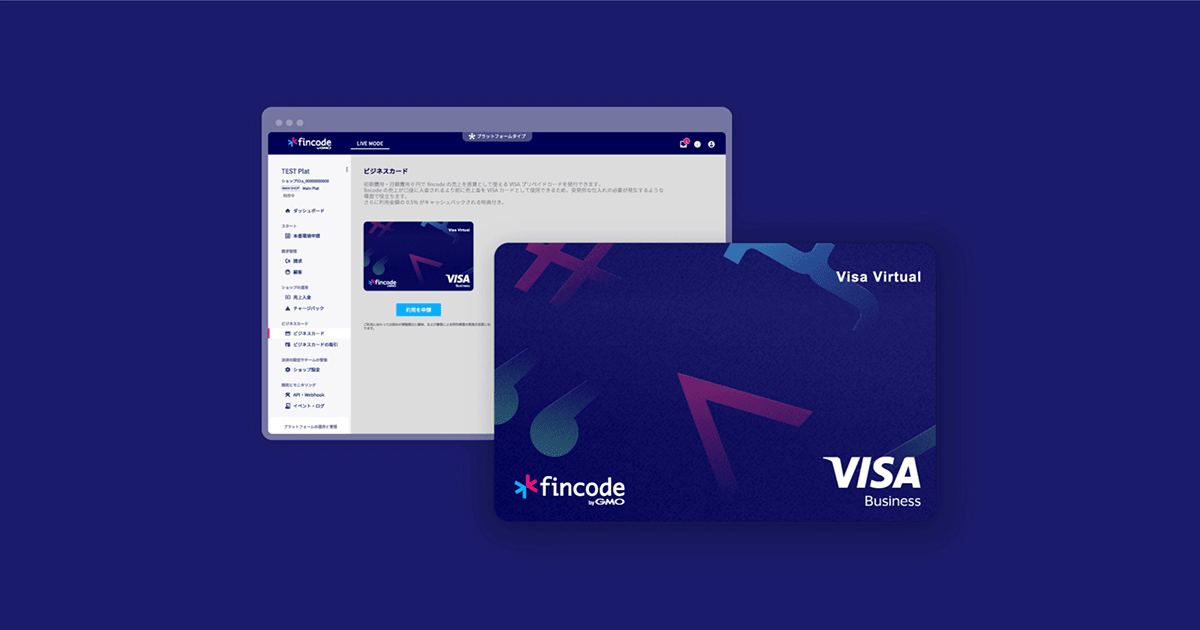

■「fincode business card」

This is a sales-linked Visa-branded virtual card (*1) that can be used for card payment without waiting for the payment date of the sales amount by automatically renewing the usage quota according to the amount of sales. There are no annual fees, issuance fees, and monthly fees, and there is also a bonus of cashback of 0.5% of the card usage amount.

You can immediately check the issuance (*2), suspension, and usage history of the card from the "fincode byGMO" management screen, and it also supports the issuance of multiple cards (*3). In addition, as a payment option, we have adopted a method of offsetting the sales proceeds of "fincode byGMO" (*4), and the sales Actual You can use the amount set according to the

By introducing fincode business card, businesses (*5) can minimize the time lag between receipt of sales proceeds and payment expenses, and flexibly respond to various business-related payment, such as additional orders in the event of unexpected sales, business trip expenses, equipment purchases, and advertising during busy seasons. It eliminates the constraints of "not being able to payment until funds come in" that many businesses, including startups, have, have, and provides an environment where they can promote their businesses without missing out on business opportunities.

■「fincode invoice card pay」

It has a mechanism that allows invoice payment to be made with Visa and Mastercard brand credit cards (*6). By choosing Credit card payment, businesses (*7) can create more space between payment and debits, and can flexibly manage cash flow.

To use it, upload your invoice and enter your credit card information to apply. The review is completed in approximately 2 business days from the application, and if it passes, the transfer process will be carried out to the account of the business partner. This makes it easier for businesses to understand when to pay and smoothly conduct daily accounting operations.

A release campaign will be held from November 27, 2025 (Thursday) to December 23, 2025 (Tuesday).

- *1 A "virtual card" is a method that provides the card number, expiration date, Security Code, etc. digitally without issuing a physical card, and is mainly used for online card payment.

- *2 Screening will be conducted at the time of application for service use. The application will be reviewed in as little as 2 business days, and the card will be issued after the review is completed.

- *3 This card is only issued as a virtual card. No physical cards are provided.

- *4 If the sales proceeds are insufficient, you may be charged separately.

- *5 Available to businesses (companies and sole proprietors).

- *6 The usage limit is based on the credit card allowance. In addition to credit cards, debit cards are also accepted.

- *7 Available to corporations.

[About the "fincode invoice card pay" release campaign]

| Target company | A business that has a fincode buyer account and has been approved after the prescribed review by GMO Epsilon (*7). |

| Description | For transactions that have been applied for during the period of November 27, 2025 (Thursday) ~ December 23, 2025 (Tuesday), the fincode invoice card pay fee will be set at 2% instead of the regular fee of 3% (*8). |

| Precautions | The content of this campaign is subject to change or termination without notice. After the campaign ends, a regular fee of 3% will apply. |

- *8 The minimum fee per transaction is 1,000 yen (tax-free).

【About "fincode byGMO"】

(URL:https://www.fincode.jp/)"fincode byGMO" is an online infrastructure of payments that snuggles up with the growth of startups. It not only solves the payment field challenges that arise before and after the launch of a new service, but also seamlessly delivers the scalable value required as the business phase progresses.

By providing an immediate test environment, rapid web review, and reducing development man-hours, we have made it possible to implement payment systems with short lead times. In addition, through REST APIs (*11) and other extended functions, we support adopters in their "next move", such as "supporting unique payment flows", "adding payment method to expand users", "adding subscription plans", and "expanding into a platform-based business model".

By providing these functions with no initial and monthly fees, and a fee structure that minimizes "hard-to-see costs" such as account maintenance costs and transfer fees, we reduce the burden of cost management for operators and provide an environment where they can focus on the growth of their own services.

Based on a design concept that considers scalability, it supports "MCP (Model Context Protocol)" in line with the evolution of UX in the AI era, and is leading a new user experience through the fusion of AI agents and payment.

- (*9) Abbreviation for Software Development Kit. fincode byGMO provides libraries that make it easier to incorporate APIs.

- *10 Function to generate and provide a form for entering credit card information.

- *11 Abbreviation for Representational State Transfer API. fincode byGMO allows you to manipulate data such as payment and subscriptions through a resource-oriented, easy-to-understand REST API.

【About GMO Epsilon, Inc.】

We provide startups, tech companies, and SME businesses with online payment services fincode byGMO and Epsilon by GMO to help them grow their businesses.

" fincode byGMO" is an online infrastructure of payments designed for startups. In addition to E-commerce, it supports various business models such as platform and subscription types, and can be implemented in a short period of time. In June 2025, it became the first PSP in Japan to support "MCP (Model Context Protocol)" (*12) and continue to evolve, enabling collaboration with AI agents. Epsilon byGMO is a payment processing services that allows you to introduce a variety of payment method at once, with no initial cost or transaction processing fee (*13). It eliminates the hassle of individual contract and helps e-commerce businesses expand their sales opportunities.

We also support the cash flow improvement and growth of businesses through finance-related services such as Cycle by GMO, a sales-linked business card, lending, and Remittance Service.

As a consolidated company of TSE Prime-listed GMO payment gateways, GMO Epsilon provides a safe environment with Privacy Mark certification and PCI DSS and ISMS compliant security standards.

- (*12) Announced on June 19, 2025, "For the first time in Japan, "fincode byGMO" supports MCP, making it the optimal payment platform in the AI era"

(URL:https://www.gmo-pg.com/news/press/gmo-paymentgateway/2025/0619.html) - *13 Transaction processing fee is a fee charged for each communication from the credit card company for credit card authorization (acquisition of an authorization number) and billing.

[Press Inquiries]

GMO Payment Gateway, Inc.

Corporate Value Creation Strategy Headquarters, Public Relations Department

- TEL

- +81-3-3464-0182

https://contact.gmo-pg.com/m?f=767

GMO Internet Group, Inc.

Group Public Relations Department PR Team Niino

- TEL

- +81-3-5456-2695

https://group.gmo/contact/press-inquiries/

[Contact for inquiries regarding services]

[GMO Epsilon, Inc.] (URL: https://www.epsilon.jp/)

| Corporate Name | GMO Epsilon, Inc. |

|---|---|

| Location | 1-14-6 Dogenzaka, Shibuya-ku, Tokyo Humax Shibuya Building |

| Representative | President & Chief Executive Officer Tomoyuki Murakami |

| Business Description | ■ Online sales payment processing company, payment collection agency and operations incidental to them |

| Capital | 105 million yen |

[GMO Payment Gateway, Inc.] (URL: https://www.gmo-pg.com/)

| Corporate Name | GMO Payment Gateway, Inc. (TSE Prime Market Securities Code: 3769) |

|---|---|

| Location | 1-2-3 Dogenzaka, Shibuya-ku, Tokyo Shibuya Fukurasu |

| Representative | President & Chief Executive Officer Issei Ainoura |

| Business Description | ■ Comprehensive payment related services and finance related services |

| Capital | 13,323 million yen |

[GMO Internet Group Co., Ltd.] (URL: https://group.gmo/)

| Corporate Name | GMO Internet Group Co., Ltd. (TSE Prime Market Securities Code: 9449) |

|---|---|

| Location | Cerulean Tower 26-1, Sakuragaoka-cho, Shibuya-ku, Tokyo |

| Representative | Representative Director and Group Representative Masatoshi Kumagai |

| Business Description | Holding Company (Group Management Function) ■Group Business Overview Internet Infrastructure Business Internet Security Business Internet Advertising & Media Business Internet finance Business Crypto assets Business |

| Capital | 5 billion yen |