2018年11月29日

報道関係各位

GMOイプシロン株式会社

GMOインターネットグループでGMOペイメントゲートウェイ株式会社の連結会社であるGMOイプシロン株式会社(代表取締役社長:新井 悠介 以下、GMO-EP)は、介護・医療の情報サービスを提供する株式会社エス・エム・エス(代表取締役社長:後藤 夏樹 以下、SMS)のグループ会社である株式会社エス・エム・エスフィナンシャルサービス(代表取締役:岡田 亮一 以下、SMSフィナンシャルサービス)と提携し、本日2018年11月29日(木)より介護経営データを用いた新しい与信モデルでのレンディングサービスを提供開始いたします。

GMO-EPは、同日よりSMSフィナンシャルサービスが「カイポケ経営支援サービス(以下、カイポケ)」(※1)利用法人向けに提供開始する、中小の介護事業者向けトランザクションレンディング紹介サービス「カイポケローンコネクト」の融資提携先となり、レンディングサービスを提供します。

【背景と概要】

昨今の介護業界では、介護サービスへの需要が増加する一方で、競争激化や人材確保難などにより介護事業者を取り巻く環境は厳しく、事業運営や事業拡大に必要な資金調達ニーズは高まっています。しかしながら、一般的に融資を受ける際には決算書の提出や担保が必要となることがあり、さらに審査には数週間もの時間を要することから、迅速な融資を受けづらい現状があります。

一方、GMO-EPは、「イプシロン決済サービス」をご利用のEC事業者(加盟店)向けに、日次の決済データ(トランザクションデータ)を元に与信判断を行う「GMOイプシロン トランザクションレンディング」を2015年3月から提供しており、このノウハウを活かして、様々なデータを活用したレンディングサービスの展開に力を入れています。

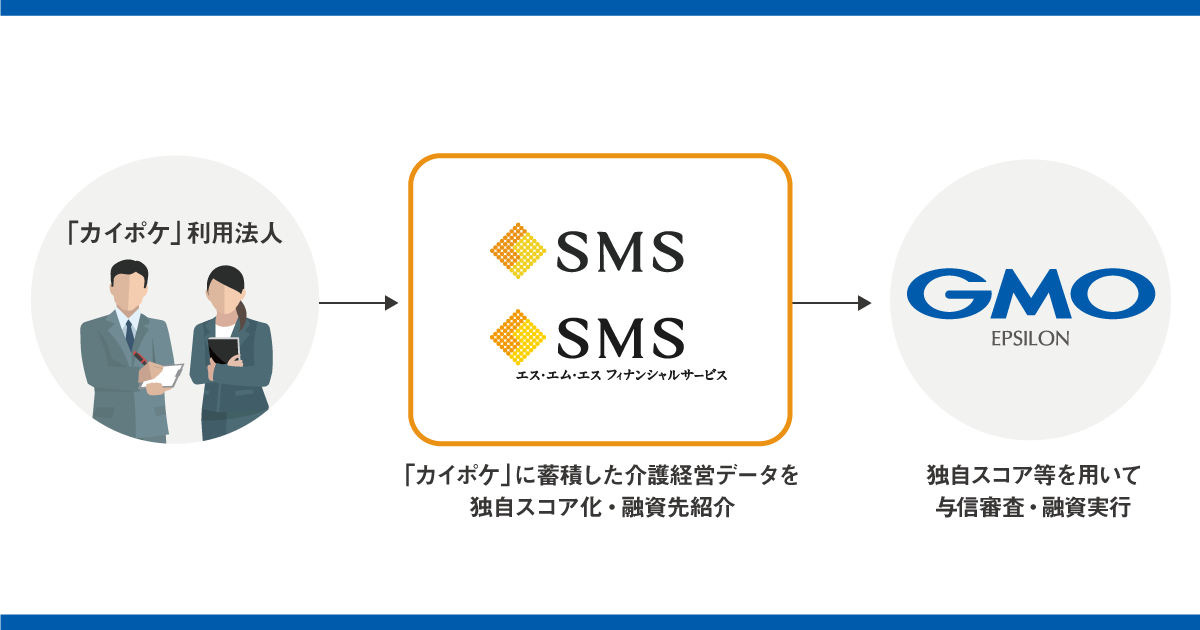

そこでこのたびGMO-EPは、これまで培った与信判断における知見とノウハウを、介護業界でも活用しレンディングサービスを提供するべく、介護・医療の情報サービスを提供するSMSのグループ会社であるSMSフィナンシャルサービスと提携し、介護経営データを用いた新しい与信モデルのレンディングサービスを提供いたします。

GMO-EPは、SMSフィナンシャルサービスが「カイポケ」上で提供する、中小の介護事業者向けトランザクションレンディング紹介サービス「カイポケローンコネクト」の融資提携先となり、「カイポケ」利用法人向けにレンディングサービスを提供いたします。

【「介護経営データを用いたレンディングサービス」について】

本サービスは、SMSフィナンシャルサービスが提供する中小の介護事業者向けトランザクションレンディング紹介サービス「カイポケローンコネクト」の融資提携先としてGMO-EPが提供する、「カイポケ」利用法人向け融資サービスです。GMO-EPは、SMSが「カイポケ」の介護経営データから算出した独自スコア等を用いて与信審査を行い、融資を実行します。「カイポケ」利用法人は、決算書や担保・保証人を用意することなく、お申し込みから最短5営業日で迅速に融資を受けることができ、年次の決算が締まる前の資金調達も可能となります。

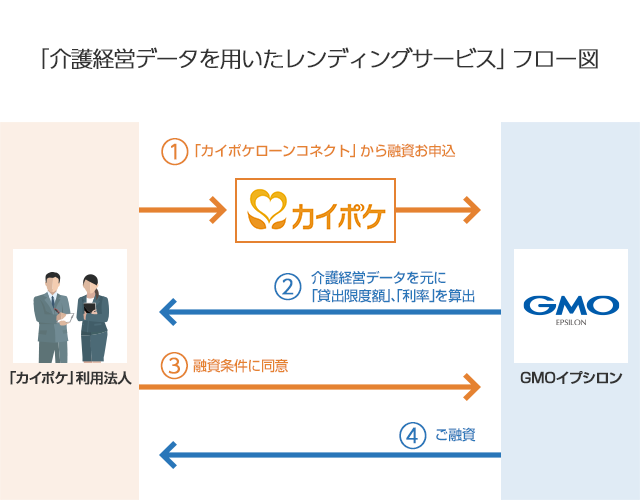

■申し込みから融資実行までの流れ

| 1) | 融資を希望する「カイポケ」利用法人は、「カイポケ」上から「カイポケローンコネクト」にアクセスし、希望する融資金額や担当者情報等を入力し、審査を依頼します。 |

| 2) | GMO-EPは、SMSより連携された、介護経営データからSMSが算出した独自スコア等を用いて、与信審査を実施。融資金額や利率を算出し、メールで審査結果を通知します。 |

| 3) | 「カイポケ」利用法人は、GMO-EPの発行する融資サービス専用管理画面から、融資条件を含む詳細結果をご確認のうえ、同意いただける場合は、融資サービス専用管理画面からご契約へと進めていただけます。その際は決算書や担保等は不要です。 |

| 4) | お申し込みから最短5営業日で、GMO-EPが融資を実行します。 |

■貸付条件

| 融資金額 | 30万円~5,000万円 |

|---|---|

| 融資利率 (実質年率) | 3.5%~13.5% |

| 遅延損害金 (実質年率) | 20.0% |

| 返済方法(※2) | 口座振替(27日振替) |

| 返済方式 | 元利均等返済 |

| 返済回数 | 6ヶ月/6回 |

| 保証人・担保 | 不要 |

| 必要書類(※3) |

・登記簿謄本(履歴事項全部証明書) ・印鑑証明書 ・融資担当者の身分証明書の写し ・預金口座振替依頼書 |

(※3)その他、状況に応じて別途書類を提出いただく場合がございます。

【株式会社エス・エム・エスについて】

2003年創業、2011年東証一部上場。「高齢社会に適した情報インフラを構築することで価値を創造し社会に貢献し続ける」ことをミッションに掲げ、高齢社会を介護・医療・キャリア・ヘルスケア・シニアライフ・海外と捉え、「高齢社会×情報」を切り口にした40以上のサービスを開発・運営しています。

SMSが提供する「カイポケ」は、ICT活用による介護事業者の経営・業務の効率化や働き方改革をサポートするクラウドサービスです。介護業務以外の間接業務を削減する業務支援機能、勤怠・給与・労務や会計などの経営・運営支援機能を提供し、介護事業者が目指す理想の介護サービス実現を支援します。現時点で約40のサービス・機能を展開しており、会員数は、全国約23,000事業所となります。

【株式会社エス・エム・エスフィナンシャルサービスについて】

株式会社エス・エム・エスフィナンシャルサービス は2014年の創業以来、エス・エム・エスグループが多くのノウハウを持つ介護・医療分野で金融ソリューションを提案しております。エス・エム・エスが展開する介護事業者向け経営支援サービス「カイポケ」から得られるデータを活用し、貸し手・借り手の双方の無駄を排除した介護保険給付費の「カイポケ早期入金サービス」等を展開しています。

【GMOイプシロン株式会社について】

GMO-EPは、初期費用やトランザクション処理料(※4)が無料の決済代行サービスを提供する事業者です。2018年9月末時点で、3万2,878店舗にのぼるEC事業者にご利用いただいております。

GMO-EPとご契約いただくだけで、決済業者ごとにシステムを構築する必要なく、クレジットカード決済からコンビニ決済、ウォレット決済、スマートフォンキャリア決済等、さまざまな決済手段及び配送サービスを一括で利用することができるほか、購入者から回収した商品代金や配送の運賃精算も一括して行うため、手間やコストを大幅に省くことが可能です。また、EC事業者の円滑なキャッシュフローをサポートするべく、レンディングや送金サービス等の金融関連サービスも提供しています。

東証一部上場企業であるGMOインターネットグループの一員であり、個人情報保護ではプライバシーマークの付与を受け、システムのセキュリティ基準はPCI DSSとISMSに準拠するなど、お客様が安心してご利用いただける環境となっております。

【関連URL】

- 「カイポケ」

- URL : http://ads.kaipoke.biz/

- SMS URL

- URL : https://www.bm-sms.co.jp/

- SMSフィナンシャルサービス

- URL : https://www.smsfs.co.jp/

- GMO-EP

- URL : https://www.epsilon.jp/