環境(Environment)Environment

気候変動への対応(TCFD提言に基づく情報開示)

当社は、決済業界のリーディングカンパニーとして、現金を不要とするキャッシュレス化や振込用紙をペーパーレス化する請求のデジタル化等の決済サービスを推進しております。また、決済データを処理するデータセンター電力への実質再生可能エネルギー導入やサプライヤーエンゲージメントを推進し、当社事業やサプライチェーンのGHG排出量削減に取り組んでおります。このような環境に配慮した事業運営を通じてお客様及び社会の環境負荷軽減に努め、脱炭素社会への転換、持続可能な社会の実現を目指します。

2023年1月には、TCFD(気候関連財務情報開示タスクフォース)提言への賛同を表明いたしました。今後も、TCFD提言に基づき、気候変動に関する情報開示の拡充を図ってまいります。

ガバナンス

取締役会における気候変動問題の責任者は企画業務を管掌する取締役副社長であり、すべての環境関連の課題を当社の経営戦略や経営目標に反映させる責任を負っています。代表取締役社長、取締役副社長を含む経営陣で、気候変動を含むサステナビリティ活動に関する方針の議論、計画の審議や進捗レビューを行い、取締役会へ業務進捗を報告しており、そこで受けたフィードバックに基づき、施策を推進しています。また、取締役会は、リスク管理委員会で議論・検証した結果について定期的に報告を受けることにより、全社に関わる気候関連問題及び事業への影響、その対応状況等について、モニタリングを行っています。

戦略

TCFD提言が推奨するシナリオ分析の手法により、将来の気候変動が当社事業に影響を及ぼし得るリスク・機会を特定しています。IPCCやIEA等のシナリオを参考に、当社を取り巻く自然環境や社会環境の変化を想定したシナリオを設定し、気候変動に関するリスク・機会を特定しました。

想定シナリオ

1.5℃シナリオ

・脱炭素社会への移行による、CO2排出量削減に向けた動きの急速な進行

・カーボンプライシング等の規制強化

・ステークホルダーの環境意識の高まりに基づくニーズの変化

4.0℃シナリオ

・気候変動対策の法規制等の強化が進まないことによる、地球温暖化の進行

・気温上昇による自然災害の激甚化、海面上昇や異常気象の増加

気候変動に関するリスクと機会

|

分類 |

リスク・機会 |

期間 |

対応策 |

|

|---|---|---|---|---|

|

移行リスク |

政策・ |

・炭素税の導入による事業コストの増加 |

中長期 |

・主要データセンター電力への実質再生可能エネルギー導入 |

|

市場・ |

・環境負荷軽減への顧客ニーズを充足出来ないことによる、事業機会の喪失 |

中長期 |

||

|

評判 |

・気候変動問題への対応が不十分と見做されることによるステークホルダーからの評価低下、採用コストや資金調達コストの増加 |

短中期 |

・ESGに関する情報開示の推進 |

|

|

物理リスク |

慢性 |

・平均気温の上昇に伴うデータセンターの空調負荷上昇による電力コストの増加 |

中長期 |

・データセンターの効率性向上 |

|

・平均気温の上昇に伴う風水害や伝染病の蔓延による業務への影響 |

中長期 |

・被災を受けにくいデータセンターの立地選定 |

||

|

急性 |

・異常気象・自然災害によるデータセンターの倒壊やデータの消失、人的損害の発生による業務・サービスの停止 |

短中期 |

||

|

機会 |

市場・ |

・環境に配慮した経営への社会的要請の高まりから、当社が提供する、オンライン化やキャッシュレス化、ペーパーレス化を推進するサービスへの需要の増加 |

中長期 |

・DX支援など現戦略の遂行 |

|

評判 |

・気候変動問題への積極的な関りによるステークホルダーからの評価や企業価値の向上 |

短中期 |

・ESGに関する情報開示の推進 |

|

リスク管理

近年、気候変動問題が深刻さを増す中、当社のサービスにおいても電力エネルギー消費に伴うCO2排出などにより、地球資源と気候に影響を与える可能性があります。当社ではリスク管理委員会の活動を通して気候変動を含む災害リスクへの統合的な検討及び対応を行っております。

当社では気候関連リスクを全社的なリスク管理に組み込み、効果的かつ効率的に実施するために、四半期に1回の頻度でリスク管理委員会を開催しております。リスク事象を金額基準での影響度及び発生頻度の2つの尺度でそれぞれ6段階に分けて数値評価しており、想定されるリスク並びに一般的なリスクを社内の一定の役職者にて全社横断的に評価・選定した上で、一定の水準を超えるリスク事象を重大なリスクと捉え、各部門において対応策を検討・実施しております。

当該フローで検討・実施された重大リスクの対応策は社外専門家の意見も踏まえて担当部署にて検討を行い、リスク管理委員会において点検・議論を行った上で、取締役会に報告しております。

指標と目標

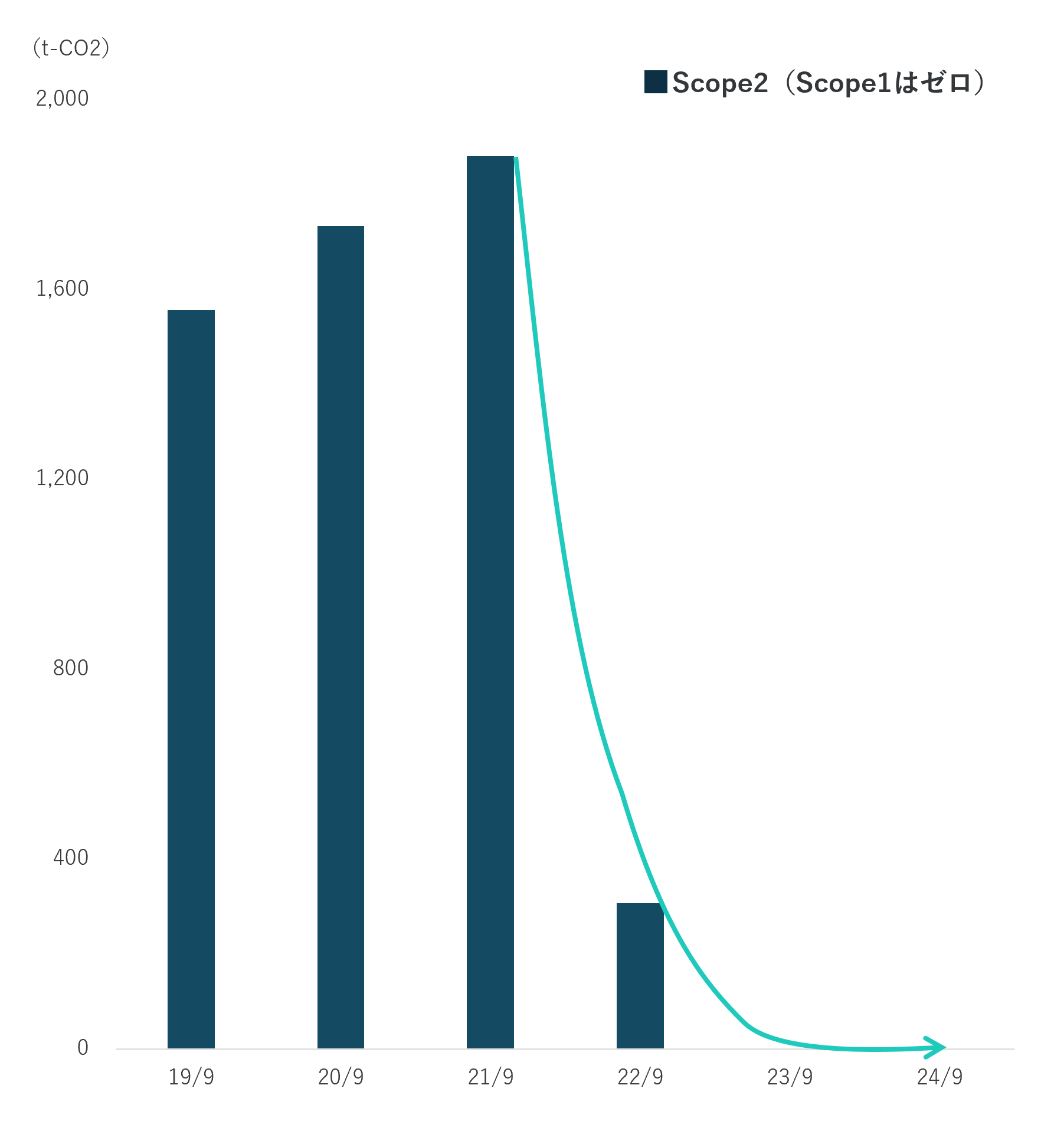

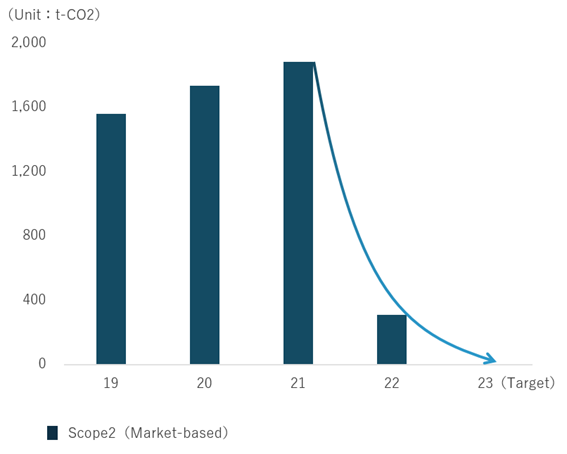

当社は、持続可能な社会の実現に貢献すべく、GHG排出量の削減に向けた取り組みを推進しております。2022年9月期に、当社事業における電力の大半を消費する主要データセンターの電力に実質再生可能エネルギーを導入し、2023年9月期に他のデータセンターやオフィスも含めた自社オペレーションのGHG排出量(Scope1、2)を実質ゼロにする目標を達成しました。2030年9月期に向けても、GHG排出量(Scope1、2)実質ゼロを継続してまいります。

当社サプライチェーン由来のGHG排出量(Scope3)においては、2030年9月期までに、決済端末新規稼動台数1台当たりのScope3排出量(カテゴリ1、11)を2021年9月期比で55%削減する目標を設定しました。当該目標は、パリ協定に準じた目標値となります。

目標達成に向けて、GHG排出量(Scope3)の大半を占める対面決済の提供に必要となる決済端末製品の購入並びに製品の使用に係るGHG排出量(カテゴリ1、11)、及びソフトウェア開発に係るGHG排出量(カテゴリ2)の削減に向けたサプライヤーエンゲージメントに取り組んでいます。

具体的には、決済端末製造メーカーに対して、端末製造に係るGHG排出量や対面決済時の消費電力の適切な測定並びに削減に向けた対話を実施しております。

同様に、取引先のシステム開発会社に対して、ソフトウェア開発に係るGHG排出量(カテゴリ2)の適切な測定並びに削減に向けた対話を実施しております。

2024年5月、当社のGHG削減目標が、科学に基づく気候目標の設定を企業に促す世界的な団体「SBTイニシアチブ」から「1.5℃目標」と整合した目標であることの認定を受けました。これにより当社のGHG削減目標が、2020年以降の温室効果ガス排出削減等のための新たな国際的な枠組みとして採択されたパリ協定における、世界の平均気温上昇を産業革命前と比べ1.5℃に抑えるとする「1.5℃目標」に対して科学的に整合するものと実証されました。

今回認定を受けた目標

・Scope1、2:2030年9月期まで継続的にGHG排出量実質ゼロを達成

・Scope3:2030年9月期までに決済端末新規稼動台数1台当たりのGHG排出量*を、2021年9月期比で55%削減

*当社におけるScope3の大半を占める決済端末製品にかかわる、購入した商品・サービス(カテゴリ1)および、販売した製品の使用(カテゴリ11)が該当。

GHG排出量

|

(単位:t-CO2) |

2019年9月期 |

2020年9月期 |

2021年9月期 |

2022年9月期 |

2023年9月期 |

2024年9月期 |

|

|---|---|---|---|---|---|---|---|

|

Scope1*1 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

Scope2*2 |

マーケット基準 |

1,559 |

1,736 |

1,883 |

308 |

0 |

0 |

|

ロケーション基準 |

- |

- |

- |

929 |

1,032 |

1,190 |

|

|

Scope3*3 |

- |

- |

24,015 |

22,462 |

23,616 |

22,209 |

|

|

カテゴリ1: |

- |

- |

15,178 |

10,240 |

15,846 |

16,030 |

|

|

カテゴリ2:資本財 |

- |

- |

5,181 |

8,439 |

2,044 |

1,487 |

|

|

カテゴリ3:燃料及び |

- |

- |

対象外 |

41 |

0 |

187 |

|

|

カテゴリ4: |

- |

- |

15 |

15 |

14 |

491 |

|

|

カテゴリ5: |

- |

- |

0 |

13 |

9 |

8 |

|

|

カテゴリ6:出張 |

- |

- |

92 |

104 |

107 |

111 |

|

|

カテゴリ7:雇用者の通勤 |

- |

- |

156 |

183 |

189 |

195 |

|

|

カテゴリ8: |

- |

- |

対象外 |

対象外 |

対象外 |

対象外 |

|

|

カテゴリ9: |

- |

- |

11.2 |

対象外 |

対象外 |

8 |

|

|

カテゴリ10: |

- |

- |

対象外 |

対象外 |

対象外 |

対象外 |

|

|

カテゴリ11: |

- |

- |

3,344 |

3,418 |

5,405 |

3,514 |

|

|

カテゴリ12: |

- |

- |

対象外 |

対象外 |

対象外 |

177 |

|

|

カテゴリ13: |

- |

- |

対象外 |

対象外 |

対象外 |

対象外 |

|

|

カテゴリ14: |

- |

- |

対象外 |

対象外 |

対象外 |

対象外 |

|

|

カテゴリ15:投資 |

- |

- |

35 |

9 |

2 |

1 |

|

*当社主要各社のデータセンターならびにオフィスの電力消費量より集計

*1 Scope1:企業が自ら排出するGHG排出量

*2 Scope2:購入した電力・熱等の間接的なGHG排出量

*3 Scope3:当社の活動に関連する他社のGHG排出量

GHG排出量推移

第三者保証

GHG排出量の報告内容に対する信頼性確保のため、ソコテック・サーティフィケーション・ジャパン株式会社による第三者保証を受けています。

・Scope1,2,3(2024年9月実績)

省エネルギーに対する取り組み

データセンター

当社は、電力効率の高いCPUの選択、サーバーアーキテクチャ、サーバーの仮想化、ラックの位置、空調の空気の流れを取り入れることで、効率的な電力消費とスペース利用の効率化を図っています。また、2022年9月期より、実際の電力消費量を測定し、正確な電力消費量を認識するように運用を改善しました。

オフィスビル

オフィス内の照明・空調については時間により自動OFFにするなどの制御管理、また外気システムを導入し冷温された空気のロスが少なくなるよう省エネに繋げています。冬場は外気冷房システムにより、外気温度が室内温度設定より高い場合に空調機からではなく、外気を取り入れることにより空調機の電力を抑えるなどの工夫も行っており省電力化による環境負荷の低減を図っています。

社会の脱炭素への貢献

環境負荷の低いキャッシュレスの推進

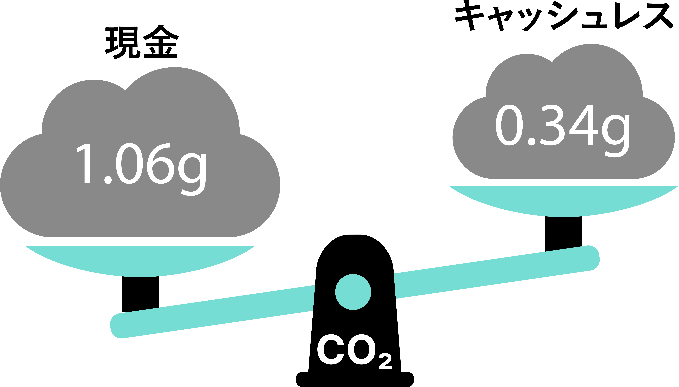

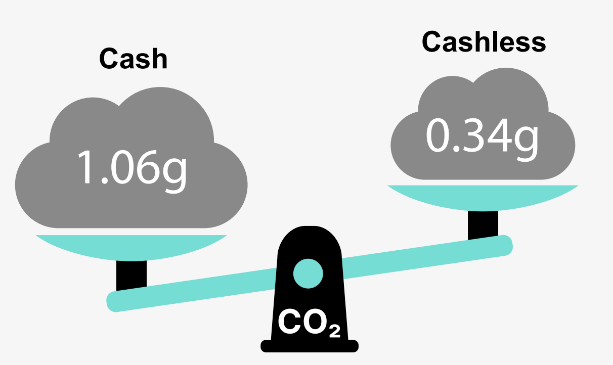

キャッシュレスの推進を通じて、当社事業からのGHG排出量にとどまらず、社会全体のGHG排出量削減に貢献してまいります。現金による決済では、紙幣・硬貨・ATM等に係る製造、決済・利用、廃棄の各プロセスにおいて、CO₂が排出されております。当社が会員として所属する一般社団法人キャッシュレス推進協議会より公表された分析では、現金決済に比してキャッシュレス決済のCO₂排出量は約3分の1という試算結果であり、キャッシュレス利用の方が環境負荷が低いことが確認されております。イギリスやオランダでも同様にキャッシュレス推進によりCO₂排出量を削減できるとの研究結果が公表されております。

キャッシュレス・ロードマップ2023/一般社団法人キャッシュレス推進協議会より

千円あたりの支払いにおいて、キャッシュレスのCO2排出量は0.34g

今回の「キャッシュレス・ロードマップ2023」では、様々な公表データを活用し、キャッシュレスと現金の利用における二酸化炭素排出量を試算しました。

十分なデータのない中での試算となりましたため、必ずしも正確な値とは言えませんが、少なくとも今回の試算においては、千円のお支払いにおいて、現金利用に関する二酸化炭素排出量が「1.06g」となるのに対し、キャッシュレス利用においては「0.34g」との結果を得ることができました。今回の試算により、日々のお支払いにおいてキャッシュレス利用の方が環境負荷は低いことが確認できました。これにより、キャッシュレスをご利用いただくことが、より環境に優しい行動であることが確認できました。

現金とキャッシュレスの

二酸化炭素排出量の比較(千円あたり)

(出典) キャッシュレス・ロードマップ2023/一般社団法人キャッシュレス推進協議会

未来の森を育てる、J-クレジット取得

2024年10月、当社は株式会社栃毛木材工業(以下、栃毛木材工業)より、森林J-クレジットを取得しました。森林Jクレジットとは、間伐などの森林の適切な管理を行うことによるCO2吸収量をクレジットとして国が認証したものです。

栃毛木材工業は、栃木県内に複数の山林を所有し、環境に配慮した手入れをし、定期的に枝落とし、間伐を行い、健全な山林の育成を行っております。

森林J-クレジットの取得を通じて、栃毛木材工業の持続可能な森林経営を支援し、環境保全に貢献してまいります。

GMO-PGの自然資本への貢献 -森林由来クレジット創出の現場を訪問

生物多様性

ペーパーレス化の推進

当社は、請求書等のデジタル化により、加盟店のペーパーレス化を支援しています。

対面領域における環境負荷に配慮した業務運営

・各決済端末利用時に、使用されるレシート(ロール紙)における再生紙の利用

・レシート(ロール紙)の削減につながる売上票の電子保管サービスの提供

Response to climate change (information disclosure based on TCFD recommendations)

As the leading company in the payment industry, the Company promotes payment services such as cashless migration to make cash payments unnecessary, digitalization of invoices to achieve paperless payment slips, etc. In addition, initiatives are underway to reduce GHG emissions in the Company's own businesses as well as in the supply chain by implementing what is effectively renewable energy for electricity used in data centers that process the payment data and through supplier chain engagement activities. The Company aims to realize a sustainable and decarbonized society by working to reduce the environmental burden of our customers and society through business operation that are environmentally mindful.

In addition, the Company has endorsed TCFD recommendations on January 2023 and will work to expand its information disclosure regarding climate change based on TCFD recommendations.

Governance

The executive vice president, overseeing planning and operations, bears responsibility for climate change issues at the Board and to reflect/incorporate all environment related issues to the Company's management strategy and management targets. The management team including the president and executive vice president carries out deliberations on policies related to sustainability activities, reviews the progress, evaluates plans, reports the progress to the Board and compiles measures to reflect the feedback received. In addition, the Board receives periodic reports from the Risk Management Committee on its discussions, verifications and findings to help the Board monitor the responses and impact of climate related issues on the overall Company.

Strategy

Based on scenario analysis methods recommended by the Task Force on Climate Related Financial Disclosures (TCFD), the Company identifies those potential risks and opportunities arising from future climate change. By referring scenarios presented by the Intergovernmental Panel on Climate Change (IPC) and International Energy Agency (IEA), we have identified the climate change related risks and opportunities based on scenarios related to changes in natural and social environments.

Estimated scenario

1.5℃ scenario

• Rapid progress in the reduction of CO2 emissions arising from the transition to a decarbonized society

• Regulatory tightening from carbon pricing, etc.

• Changes in needs from heightened environmental awareness by stakeholders

4.0℃ Scenario

・Exacerbation of global warming caused by the lack of progress in strengthening laws and regulations on climate changes.

・Increase in abnormal weather, rise in sea levels and occurrence of catastrophic natural disasters caused by the rise in temperature.

Risks and Opportunities Associated with Climate Change

| Classification | Risks and opportunities | Timeline | Initiatives | |

|---|---|---|---|---|

| Transition risk | Policy, laws/ regulations |

・Increase in cost of business from implementation of carbon tax | Medium-to long term | ・Implementation of what is effectively renewable energy Market, at major data centers |

| Market, services |

・Loss of business opportunity from inability to fulfill the client's needs for reducing environmental burden | Medium-to long term | ||

| Evaluation | ・Increase in fund procurement cost, recruitment cost and negative evaluation from stakeholders from being regarded as insufficiently responding to climate change issues | Short-to medium term | ・Promote ESG-related information disclosure | |

| Physical risk | Chronic | ・Increase in electricity cost from higher burden on air-conditioning caused by the rise in average temperatures | Medium-to long term | ・Improve efficiency at data centers |

| ・Impact to operations from spread of infectious diseases and wind/water disasters due to rise in average temperatures | Medium-to long term | ・Select data center locations less impacted by natural disasters ・Redundancy configuration of systems, dispersion and multiplexing of data centers ・Compilation of business continuity plans (BCP) |

||

| Acute | ・Suspension of operations and services due to personnel loss, data loss and/or damage to data centers caused by abnormal weather and natural disasters | Short-to medium term | ||

| Opportunity | Market, services |

・Increase in demand for the Company's services that enables online, cashless and paperless migration due to the increase in social demand for environmentally conscious management | Medium-to long term | ・Pursue current strategy of DX support |

| Evaluation | ・Rise in corporate value and improved evaluation from stakeholders from aggressive involvement to tackle climate change problems | Short-to medium term | ・Promote ESG-related information disclosure | |

Risk Management

Recent years have seen a worsening of climate change issues, and services offered by the Company may also be impacting the climate and natural resources through CO2 emissions from electric power consumption. To combat this issue, the Risk Management Committee comprehensively undertakes an assessment of and response to natural disaster risks, including climate change.

The Company convenes the Risk Management Committee once every quarter to implement measures effectively and efficiently by incorporating climate related risks into the overall risk management. Risk incidents are classified into six categories according to the quantitative evaluation based on two metrics of monetary impact and frequency of occurrence. The foreseeable risks and general risks are evaluated and selected across the Company by employees above a certain position. Of those, risk incidents that exceed a certain threshold are designated as material risk, and each Division must consider and implement responses.

Consideration and response to the material risk is further deliberated by the relevant Division after incorporating the opinions of external experts. This is examined and debated at the Risk Management Committee and reported to the Board.

Indicators and Targets

The Company is promoting initiatives to reduce GHG emissions to contribute to realizing a sustainable society. In FY2022, the Company implemented what is effectively renewable energy for its major data centers that consume the bulk of electricity in the business. As a result, the Company achieved what is effectively zero GHG emissions from its own operations, including offices and all other data centers (Scope 1 and 2) in FY2023. The Company intends to maintain its effective zero GHG emission up to FY2030.

In order to tackle GHG emissions from the supply chain, the Company has established a target to reduce Scope 3 (Category 1 and 11) emissions for newly operating payment terminals by 55% per terminal by FY2030 against the baseline of FY2021. This target aligns with the Paris Agreement.

The Company is undertaking engagement with the supply chain to reduce GHG emissions related to the purchase and usage of payment terminals (Scope 1 and 11), which are essential to provide CP payments and account for the bulk of Scope 3 emissions, as well as GHG emissions related to software development (Category 2).

More concretely, the Company is engaging with payment terminal manufacturers to implement appropriate measurement and reduction of GHG emissions during manufacturing and electric power consumption during the usage of the terminals.

Similarly, the Company is engaging with system development companies to appropriately measure and reduce GHG emissions (Category 2) related to software development.

In May 2024, the Company's GHG emissions reduction target was certified as aligned with the 1.5 deg. Celsius scenario of SBT Initiative, the global organization that enables corporates to set targets based on climate science. This verifies that the Company's GHG emissions reduction targets are scientifically aligned to the 1.5 deg. Celsius scenario to limit the rise in global temperature to 1.5 deg. Celsius compared to pre-Industrial levels, as ratified by the new international framework of the Paris Agreement on greenhouse gas emissions reductions beyond 2020.

Targets certified by SBT Initiative

・Scope 1 + 2: To maintain an effectively zero GHG emissions continuously up to Fiscal Year ending September 2030.

・Scope 3: Reduce GHG emissions by 55% per terminal for newly operating payment terminals by Fiscal Year ending September 2030 compared* to Fiscal Year ending September 2021.

* Refers to Category 1 (purchased goods and services) and Category 11 (use of sold products) emissions that are related to payment terminals which accounts for the bulk of Scope 3 emissions.

GHG Emissions

|

(Unit:t-CO2) |

FY2019 |

FY2020 |

FY2021 |

FY2022 |

FY2023 |

FY2024 |

|

|---|---|---|---|---|---|---|---|

|

Scope1*1 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

Scope2*2 |

Market-based |

1,559 |

1,736 |

1,883 |

308 |

0 |

0 |

|

Location-based |

- |

- |

- |

929 |

1,032 |

1,190 |

|

|

Scope3*3 |

- |

- |

24,015 |

22,462 |

23,616 |

22,209 |

|

|

Category1: |

- |

- |

15,178 |

10,240 |

15,846 |

16,030 |

|

|

Category2: |

- |

- |

5,181 |

8,439 |

2,044 |

1,487 |

|

|

Category3: |

- |

- |

N/A |

41 |

0 |

187 |

|

|

Category4: |

- |

- |

15 |

15 |

14 |

491 |

|

|

Category5: |

- |

- |

0 |

13 |

9 |

8 |

|

|

Category6: |

- |

- |

92 |

104 |

107 |

111 |

|

|

Category7: |

- |

- |

156 |

183 |

189 |

195 |

|

|

Category8: |

- |

- |

N/A |

N/A |

N/A |

N/A |

|

|

Category9: |

- |

- |

11.2 |

N/A |

N/A |

8 |

|

|

Category10: |

- |

- |

N/A |

N/A |

N/A |

N/A |

|

|

Category11: |

- |

- |

3,344 |

3,418 |

5,405 |

3,514 |

|

|

Category12: |

- |

- |

N/A |

N/A |

N/A |

177 |

|

|

Category13: |

- |

- |

N/A |

N/A |

N/A |

N/A |

|

|

Category14: |

- |

- |

N/A |

N/A |

N/A |

N/A |

|

|

Category15: |

- |

- |

35 |

9 |

2 |

1 |

|

* Note: Compiled from electric power usage at offices and data centers of major GMO-PG consolidated companies

*1 Scope 1: Direct emissions from owned or controlled sources

*2 Scope 2: Indirect emissions from the generation of purchased electricity, heating and cooling, etc.

*3 Scope 3: All other indirect emissions that occur related to the Company's activities

Trend of GHG Emissions

Third Party Certification

In order to ensure the reliability of GHG Emission, the Company has obtained an independent third-party certification from SOCOTEC Certification Japan.

・Scope1,2,3(FY2024)

Energy Conservation Initiatives

Data centers

The Company is implementing various strategies to improve power consumption efficiency and optimize space usage, such as selecting energy-efficient CPUs, optimizing server architecture, virtualizing servers, positioning racks effectively, and managing airflow for cooling. Also, we improved our operations in the fiscal year ending September 2022 to accurately measure and recognize actual power consumption.

Office building

A control management system that automatically turns off the air conditioning and the lighting in the office based on the hours, and an outdoor air-cooling system that minimizes the loss of warm or cold air have been adopted, leading to the conservation of energy. In winter, with an outdoor air-cooling system, the power consumption of air-conditioning systems is controlled by bringing in outside air (not from air-conditioning systems) when the outside air temperature is higher than indoor temperature settings, conserving power and reducing environmental impact.

Contributing to Society's Decarbonization

Promoting cashless, a low environmental footprint payment

The Company will contribute not only to reducing GHG emissions from its businesses but also to reduce GHG emissions for overall society by promoting cashless migration. Cashbased payments emit CO2 at each step of the process, from the printing / minting of paper bills and coins, manufacture of ATMs, etc., to the payment, usage and disposal of cash.

The analysis disclosed by Payments Japan Association to which we belong as a member showed a calculation result that CO2 emissions for cashless payments is one-third that of cash payments, confirming that cashless usage has a smaller environmental impact. Similarly, research done in the UK and Netherlands also showed that promoting cashless migration can reduce CO2 emissions.

Cashless Roadmap 2023 released by Payments Japan Association

CO2 emission for cashless for a ¥1,000 payment is 0.34 grams

The latest Cashless Roadmap 2023 presented an estimation of CO2 emission for cash and cashless payments by utilizing various publicly available data.

Although these values may not be accurate given that the estimates were calculated without all data being available, it was possible to estimate that the CO2 emissions for a ¥1,000 payment is 1.06 grams for cash use compared to 0.34 grams in the case of cashless use. This estimation confirms that using cashless in daily life has a lower environmental impact. As a result, this confirms that cashless usage is a more environmentally friendly behavior.

Comparison of CO2 emission for cash and cashless (for ¥1,000 use)

(Source) Payment Japan Association, "Cashless Roadmap 2023."

Acquired J-Credit to foster the future of forests

The Company acquired forest J-Credits from Tochimou Wood Industry in October 2024. Forest J-Credit is a government certified credit for CO2 absorption through the proper management of forest land by means of logging, etc. Tochimou Wood Industry owns several forested mountains in Tochigi Prefecture and maintains a healthy forest environment through periodic pruning, logging and other environmentally friendly means.

With the acquisition of forest J-Credit, the Company intends to contribute to environmental conservation and support Tochimou Wood Industry's sustainable forest management.

Biodiversity

Promote paperless migration

The Company supports the merchant's migration to paperless operations by providing services to digitalize invoices.

Business operations that consider environmental impact in Card Present transaction

・Use of recycled paper for receipts (roll paper) when using each payment terminal

・Provision of electronic slip service as an alternative to receipts (rolled paper)

VIEW

サービスについての質問・相談は

下記よりお気軽にお問い合わせください。