ガバナンスGovernance

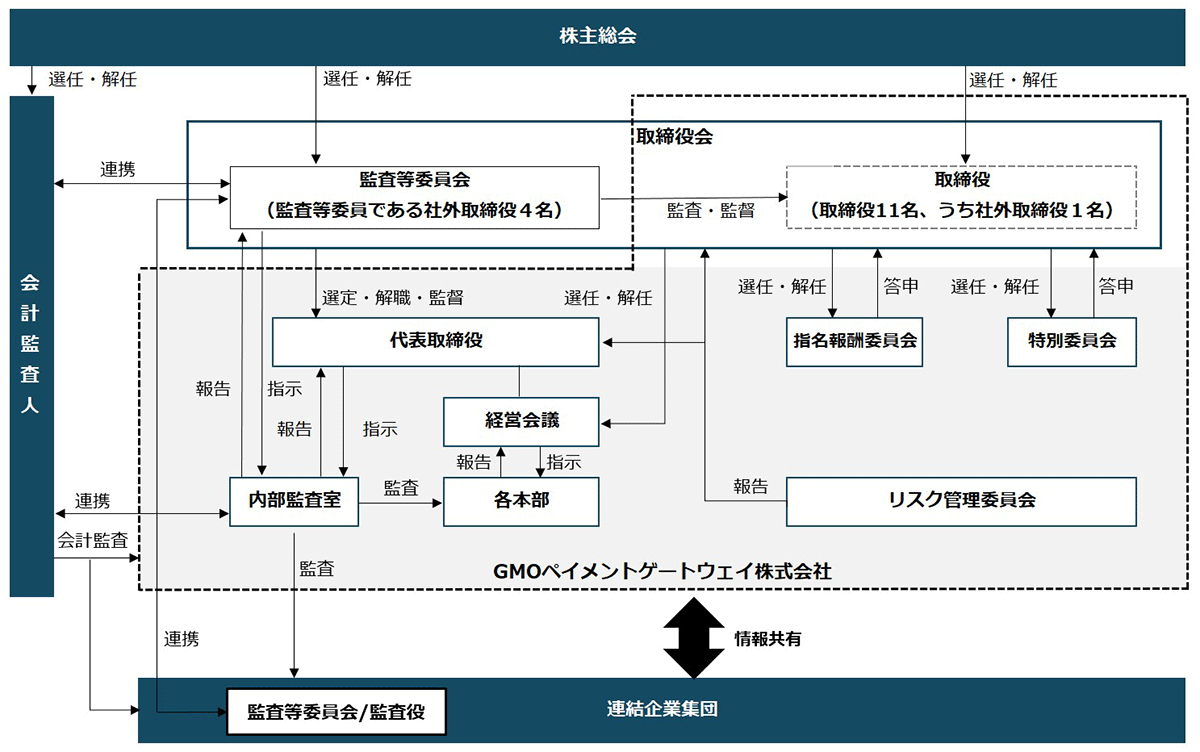

コーポレート・ガバナンス

コーポレート・ガバナンス

当社経営理念のもと、その実現を効果的、効率的に図ることができるガバナンス体制を構築いたします。当社のコーポレート・ガバナンスに関する基本的な考え方は、経営の効率性と適法性を同時に確保しつつ、健全に発展するために必要な経営統治体制の整備や施策を実施することであり、経営上の最も重要な課題の一つと位置付けております。

コーポレート・ガバナンス体制図

・取締役会

取締役会は、取締役15名(うち、社外取締役5名)で構成され、代表取締役が議長を務めております。毎月1回の定例開催と必要に応じて臨時開催される取締役会において法定事項及び経営上重要な事項について決定すると共に、取締役の職務執行を監督し、意思決定の透明性、効率性及び公平性の確保に努めております。また、取締役の経営責任をより明確にし経営環境の変化に迅速に対応できる経営体制を構築するため、監査等委員であるものを除く取締役の任期を1年としております。なお、監査等委員である取締役の任期は2年としております。

・監査等委員会

監査等委員会は、監査等委員である社外取締役4名で構成されております。監査等委員会は、監査等委員会規則に基づき、各監査等委員が、取締役会はもとより、重要な会議へ出席し、業務及び財産状況等の調査を分担して行うと共に、内部監査室に対して必要な指示を行うこと及び報告を受けることなどにより、監査を行っております。

・経営会議

経営会議は、監督と執行の分離による経営監督機能を強化するための重要な業務執行の意思決定機関で、代表取締役を含めた一部の取締役及び執行役員で構成され、原則として毎月1回以上開催しております。経営会議は取締役会で定められた基本方針に基づいて業務執行に関する重要事項を審議し、適切かつ迅速な意思決定と効率的な業務執行に資するために実施しております。

・指名報酬委員会

指名報酬委員会は、取締役(監査等委員であるものを除く。)等の指名及び報酬に関する任意の委員会で、取締役5名(うち、社外取締役3名)で構成されており、その委員長には社外取締役を選任しております。取締役会の諮問機関として客観的かつ公正な視点から、取締役等の選任方針、各候補者、役員報酬制度、報酬額、代表取締役の後継者の計画等について審議し、必要に応じて取締役会等への答申を行っております。

・内部監査室

当社は、内部監査室を設置し、3名の専任スタッフがグループの重要リスク及び内部統制に関する監査を実施しております。具体的には、当社が定める「内部監査規程」に基づき、社内各部門及び子会社を対象として、法令や定款、社内規程に基づき適法・適正に業務が行われているか内部監査を実施し、その結果を取締役会及び代表取締役に報告すると共に、監査等委員に説明しております。

・リスク管理委員会

当社グループ全体のリスク管理を効果的かつ効率的に実施するためにリスク管理委員会を設け、当社グループ全体で取り組みを推進しております。

・特別委員会

特別委員会は、取締役会の諮問機関として、独立役員である社外取締役5名で構成される委員会であり、少数株主の利益保護を図り、取締役会のガバナンス強化を図るため、支配株主と少数株主との利益が相反する重要な取引・行為について審議・検討を行っております。

ガバナンスの継続的な改善

・取締役の選任方針及び指名手続

取締役の候補者の選任については、取締役がその役割・責務を実効的に果たすための知識・経験・能力を備え、取締役会の多様性(国籍・性別・年齢)と適正規模を両立させる形で構成されるよう留意しております。取締役候補者は、この方針に従って選定し、指名報酬委員会の審議を経た上で、取締役会に上申され、決定されます。

・社外役員の独立性基準について

監査等委員である者を含む社外取締役を独立役員として指定するにあたっては、その独立性を判断するため、当社が独自に定めた「社外役員の独立性基準細則」を満たした者を独立役員として指定しております。

・取締役会の実効性評価

当社は、年1回、取締役会の実効性についての分析・評価を実施し、取締役会の機能の向上に努めております。

具体的には、取締役全員へのアンケート等の客観的・定量的な手法を取り入れつつ、取締役会の実効性に関する評価を行い、取締役会の構成や運営面にとどまらず、機関設計や各取締役の指名・報酬等の幅広い観点から実効性が適切に確保されるように努めております。

同時に、更なる機能強化を目指し、評価の過程で明らかとなった取締役会に係る課題については、継続的に改善策を立案し、実践を図っております。

2024年9月期における取締役会の実効性評価は、取締役15名(うち社外取締役5名)を対象にアンケートを実施し、回答結果の取りまとめ並びに分析を実施いたしました。

その結果、当社の取締役会については、現状、経営方針及び重要な業務執行の決定、業務執行状況の報告が適宜行われ、業務執行に対する適切な監督ができており、その実効性が確保されているものと評価しております。なお、分析及び評価の過程において、「後継者育成計画の監督の充実」並びに「内部統制・リスク管理に関する報告・議論の充実」「取締役のトレーニング機会の提供」等の課題が指摘されましたので、継続的に改善に向けた取り組みを行います。

・役員の報酬

役員報酬の妥当性と決定プロセスの透明性を担保するため、取締役会等の諮問機関として社外取締役を委員長とする指名報酬委員会を設置しております。取締役(監査等委員であるものを除く。)の報酬(賞与等を含む)は指名報酬委員会での審議を経た上で、取締役会により決定しております。

取締役の個人別の報酬等の内容の決定にあたっては、指名報酬委員会が決定方針との整合性を含めた多角的な検討を行っているため、取締役会も基本的にその答申を尊重し決定方針に沿うものであると判断しております。また、監査等委員である取締役の報酬は経営に対する独立性・客観性を重視する観点から固定報酬のみで構成され、各監査等委員である取締役の報酬額は監査等委員会の協議によって決定されます。

なお、更なるサステナビリティ経営の高度化に向け、2022年9月期より担当役員の個人別目標に、ESG指標を組み入れております。

取締役スキルマトリックス

| 氏名 | 地位 | GMOイズムの 実践*1 |

企業 経営 |

IT・ セキュリティ |

リスク 管理 |

法務 | 財務・ 会計 |

決済代行 事業 |

金融 | グローバル | 投資 (M&A) |

ESG・ サステナ ビリティ |

取締役会 への出席率*2 |

監査等委員会 への出席率*2 |

指名報酬委員会 への出席率*2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 相浦 一成 | 代表取締役社長 | 〇 | 〇 | 100% | - | - | |||||||||

| 熊谷 正寿 | 取締役会長 | 〇 | 〇 | 66% | - | - | |||||||||

| 村松 竜 | 取締役副社長 | 〇 | 〇 | 〇 | 〇 | 〇 | 100% | - | - | ||||||

| 礒﨑 覚 | 取締役副社長 | 〇 | 〇 | 〇 | 〇 | 〇 | 100% | - | 100% | ||||||

| 安田 昌史 | 取締役 | 〇 | 〇 | 〇 | 88% | - | 100% | ||||||||

| 山下 浩史 | 取締役 | 〇 | 〇 | 94% | - | - | |||||||||

| 新井 輝洋 | 取締役 | 〇 | 〇 | 〇 | 88% | - | - | ||||||||

| 稲垣 法子 | 取締役 | 〇 | 〇 | 〇 | 88% | - | - | ||||||||

| 川﨑 友紀 | 取締役 | 〇 | 〇 | 94% | - | - | |||||||||

| 島原 隆 | 取締役 | 〇 | 〇 | 〇 | 〇 | 94% | - | - | |||||||

| 甲斐 文朗 | 取締役 | 〇 | 〇 | 〇 | 〇 | 88% | - | - | |||||||

| 肱黒 真之 | 取締役・ 監査等委員 |

〇 | 〇 | 〇 | - | - | - | ||||||||

| 岡本 和彦 | 取締役・ 監査等委員 |

〇 | 〇 | 〇 | 〇 | 100% | 100% | 100% | |||||||

| 外園 有美 | 取締役・ 監査等委員 |

〇 | 〇 | 100% | 100% | 100% | |||||||||

| 大川 治 | 取締役・ 監査等委員 |

〇 | 〇 | 〇 | 100% | 100% | - |

*1 GMOイズムとは、「スピリットベンチャー宣言」をはじめとするGMOインターネットグループにおける社是・社訓の総称です。

*2 2024年9月期における取締役会開催数:18回 監査等委員会開催数:15回 指名報酬委員会開催数:2回

従業員持株会制度を通じた経営参画意識の向上

当社では、「全員社⻑主義」の考え方のもと、パートナー(従業員)一人ひとりが経営層と同じ視点を持って事業活動に取り組み、持続的成⻑を実現しています。パートナーの更なる経営参画意識の向上また資産形成の援助を目的として、従業員持株会制度を導入しています。

パートナーは当社株式を少額より継続して購入可能であり、拠出⾦額に対して10%の奨励⾦を支給しています。2024年9月末時点 の従業員持株会への加入率は約34%であり、パートナー各自が株主の皆様と価値を共有し企業価値の更なる向上に努めております。

IR活動によるエンゲージメントの推進

コーポレート・ガバナンスの目的を実現するため、株主や投資家の方々に対する経営情報の適時開示(タイムリー・ディスクロージャー)及び投資家向け広報(インベスター・リレーションズ)活動を通じ、より透明性のある経営を行ってまいります。

2024年9月期の活動実績(2023年10月1日~2024年9月30日)

| 活動 | 回数 |

|---|---|

| 決算発表・説明会 | 4回 |

| 1on1ミーティング | 約490回 |

| 証券会社主催カンファレンス参加 | 9回 |

| 海外IRロードショー | 1回 |

| グループMTG含む面談延べ社数 | 約640社 |

リスクマネジメント

リスク管理体制の整備状況

当社は事業運営における様々なリスクに対し、最適かつ経常化されたコストで適切な事前対策を行うことによって事業の継続と安定的発展を確保するため、リスク管理体制を整備しております。

具体的には、当社の定める「リスク管理規程」に基づき、当社各本部及び各社毎の長を委員とするリスク管理委員会を設置し、四半期に一回以上開催する当該委員会においてリスクのアセスメント、対策の検討及び実行、実行状況のモニタリングを実施しております。当該委員会では、腐敗防止等のコンプライアンスに関するリスク、気候変動等も含む災害対策に関するリスク、システムセキュリティに関するリスク等、多岐にわたるリスクを網羅的に評価・管理しております。

また、当社取締役会は、当該委員会で議論・検証した結果について定期的に報告を受けることにより、当社全体のリスク管理に関するプロセスの適切性・有効性を監督しております。

なお、上記取り組みにより、2024年9月期に重大な不正・不祥事は発生しておりません。

情報セキュリティ

基本的な考え方

当社は、日本の決済プロセスのインフラを目指し、消費者と事業者にとって安全で便利な決済の実現に貢献することを使命としております。この使命に則った企業活動を営むにあたり、当社固有の情報資産を活用する一方、情報資産を外部の脅威から保護することは、経営の最重要課題であるとの認識に立ち、情報セキュリティ対策に取り組んでおります。

具体的には、不正な手段によるコンピュータへの侵入・コンピュータウイルス・サイバー攻撃等を防ぐため、外部・内部からの不正侵入に対するセキュリティ対策、24時間のシステム監視態勢、並びに社内規程の整備運用等により然るべき対応を図っております。

また、年度毎に教育・啓蒙活動をスケジュール化し、しっかりと対策が組織内に根付くよう運用管理しております。情報セキュリティ対策徹底への啓蒙動画や情報セキュリティマネジメントシステム(ISO27001)として規定する当社のセキュリティルールを中心に、基本方針やルールの目的及び手順について理解を深め確実に遵守するための研修を、入社時に加え定期的に実施するなど教育を徹底しています。また、専門的知識を有する人員を内部監査室へ配置、リスク管理委員会には外部専門家が参加し、リスクアセスメントの実効性を高めております。

情報セキュリティにおけるリスクと対応策

①システムダウン及び情報セキュリティについて

・リスク 自然災害または事故・外部からの不正な手段によるコンピュータへの侵入・コンピュータウイルス・サイバー攻撃等による通信ネットワークの切断やアプリケーションの動作不良、また予期せぬクレジットカード会社等決済事業者のシステムダウンや当社システムの欠陥により、サービスが停止するリスク

・対応策 リスク回避のため、外部・内部からの不正侵入に対するセキュリティ対策、24時間のシステム監視態勢、システム構成の冗長化、保険への加入並びに社内規程の整備運用等により然るべき対応を適宜図っております。

②加盟店等からのカード情報の流出について

・リスク 当社の加盟店等からクレジットカード情報が漏洩し、加盟店等に賠償負担する支払い能力がない場合に、当社が連帯責任としてクレジットカード再発行手数料等を賠償するリスク

・対応策 当該リスクを軽減するため、当社では、クレジットカード情報を加盟店等ではなく当社が保持するサービスの促進、及び情報を保持する加盟店等の管理強化などを行っております。

③個人情報の流出の可能性及び影響について

・リスク 当社の管理下にあるデータベースで保管されるクレジットカード番号や、氏名・住所・電話番号・メールアドレス等の個人情報等の重要な情報が外部に流出するリスク

・対応策 当社では一般社団法人日本クレジット協会へ加入し、同協会で義務化されている個人情報保護指針に基づく個人情報管理の運用を実施しているほか、プライバシーマークを取得するなど万全な体制を整備しております。一方、当社はリスク管理を効果的かつ効率的に実施するためにリスク管理委員会を設け、四半期に1回以上委員会を開催し、検討したリスク管理の状況を適宜、代表取締役、取締役会及び監査等委員会に報告しております。

リスク管理体制強化の一環として情報セキュリティにかかる以下の各種認証を取得しております。

・ISO27001の適合認証を取得

当社事業所全てを対象範囲として、情報セキュリティ管理のグローバル・スタンダード基準とされるISO/IEC 27001:2022(国内規格JIS Q 27001:2023)への適合認証を取得しております。

・プライバシーマークの取得

個人情報の取り扱いに関しては、日本工業規格「JIS Q 15001:2017 個人情報保護マネジメントシステム-要求事項」に適合して、個人情報について適切な保護措置を講ずる体制を整備している事業者等を認定するプライバシーマークを取得しております。

・PCI DSSに完全準拠

当社のサービスは、JCB・AmericanExpress・Discover・MasterCard・VISAの国際クレジットカードブランド5社が共同で策定した、クレジット業界におけるグローバルセキュリティ基準PCI DSSVer4.0.1に完全準拠しております。全てのお客様に、安全なクレジットカード決済とともに安心をお届けいたします。

コンプライアンス

コンプライアンス

当社では、コンプライアンスの対象をa.法令等、b.倫理・社会規範、c.諸規程・規則、手続等、d.経営ビジョン等と捉え、法令の遵守を含めた「社会的要請への適応」(いわゆるフルセットコンプライアンス)であるとの認識のもと、全パートナーに対してコンプライアンス遵守意識の向上を図っております。

「コンプライアンス管理規程」及び「不祥事件に関する社内細則」にてコンプライアンス違反を含む不祥事件やそのおそれがある際は、速やかにコーポレートサポート本部に報告し、コーポレートサポート本部は取締役会等に報告・連携の上、必要な事項の調査、解決に向けた必要かつ適切な対応の実施及び再発防止策の作成・周知徹底を行うことを定めております。

また内部監査室は年間の監査計画のもと、関連法令・定款及び社内規程等の遵守状況を確認し、改善を要求する状況が確認された場合には是正措置を講じた上、是正状況についても引き続き確認を行ってまいります。社内においてコンプライアンス違反と思われる事例が発生した場合については、通常の指揮命令系統に基づく報告体制のみならず、内部通報制度を構築・運用しております。

なお、2024年9月期に 腐敗に関連する罰金、罰則、和解等に係るコストを含むコンプライアンス違反等に関するコストは発生しておりません。

行動規範

当社では、法令遵守や企業・社員倫理の維持向上に関して重要性を認識し、行動規範として取り纏め、繰り返しパートナー(従業員)に対して周知徹底、及び励行を行っております。

当社は、コンプライアンスとは法令遵守、企業・社員倫理の維持向上のみならず、いわゆる「社会的要請への適応」も含むというフルセットコンプライアンスの意で捉えております。これらを実践するために社内規則を遵守し、風通しの良い職場環境と円滑なコミュニケーションを通じて問題の発生を未然に防ぐよう図っております。一方、仮に問題が発生した場合には、直ちに上長を含む関係者へ報告・相談をし、適切で効果的な改善策をスピーディーに施す体制も併せて整備しております。またリスク管理委員会では、行動規範に反する行為を含めコンプライアンスに関するリスクを評価し、取締役会はリスク管理委員会における検証結果の報告を受けることにより、行動規範を含む社内規則の整備・運用状況の有効性を監督しております。

このような取り組みのもと、当社パートナーは、本行動規範を日常の行動の指針として捉え、社会人としての良識と責任を持った言動をとってまいります。

腐敗防止

基本的な考え方

当社は、「役職員行動規範」において、独占禁止法等の遵守、利益相反行為、公務員またはこれに準ずる者及び外国公務員またはこれに準ずる者への贈答・接待の禁止、取引先に対する社会通念を超える贈答・接待の禁止、法令を遵守した献金・寄付、マネー・ロンダリング等防止のための取組など腐敗防止に関する事項を規定しております。

腐敗防止に対する取組み

当社は、当社との取引を行おうとする加盟店について、公序良俗に照らして問題のある業務を営んでいないかの確認を含めた加盟店管理審査を実施しております。

当社の取締役会は、コンプライアンス担当役員よりコンプライアンス施策の実施状況や結果について定期的に報告を受け、グループ全体のコンプライアンスを監督しております。

当社は、機密性・公正性・客観性を担保した内部通報窓口を社内及び社外に設置しております。

コンプライアンスに関する当社の理念や経営陣からのメッセージを全従業員向けに継続的に周知し、定期的に読み合わせや議論を実施することでコンプライアンス風土の醸成を図っています。また、「コンプライアンス管理規程」にてコンプライアンス経営の意義および重要性等の周知徹底及び教育について定めており、定期的な研修の実施とフォローアップを行っております。

なお、2024年9月期 に腐敗防止に係る社内規程違反による懲戒処分及び懲戒解雇の対象者はいませんでした。

政治寄付

当社は政治献金を行っておりません。

税務方針

税務方針

基本的な考え方

当社は、経営理念「社会の進歩発展に貢献する事で、同志の心物両面の豊かさを追求する」のもと、公正な納税を通じて、各国の経済及び地域社会の発展に貢献します。事業活動を行う各国・各地域の税務に関連する法令に基づき、適切に申告・納税を実施します。また、正当な事業活動の範囲内において利用可能な優遇税制の活用等、税務コストの適正化に努めます。税法の趣旨を逸脱した優遇税制の利用や、事業実態を伴わない過度な税務プランニング及びタックスヘイブンを不当に利用する恣意的な租税回避措置は行いません。

税務ガバナンス

当社の税務ガバナンスの責任は、コーポレート業務を管掌する取締役副社長が担っており、その統括・指導の下、経理財務統括部長のもと経理部門が税務実務を行っています。税務リスクの検討においては、外部アドバイザーへの助言を得ております。税務に係る重大な問題が生じた場合は、取締役会へ報告します。

国別納付税額(2024年9月期)

| 国 | 納税額 |

|---|---|

| 日本 | 144.1 |

| アメリカ | 2.0 |

| その他(東南アジア・インドなど) | 1.1 |

*法人税等を集計

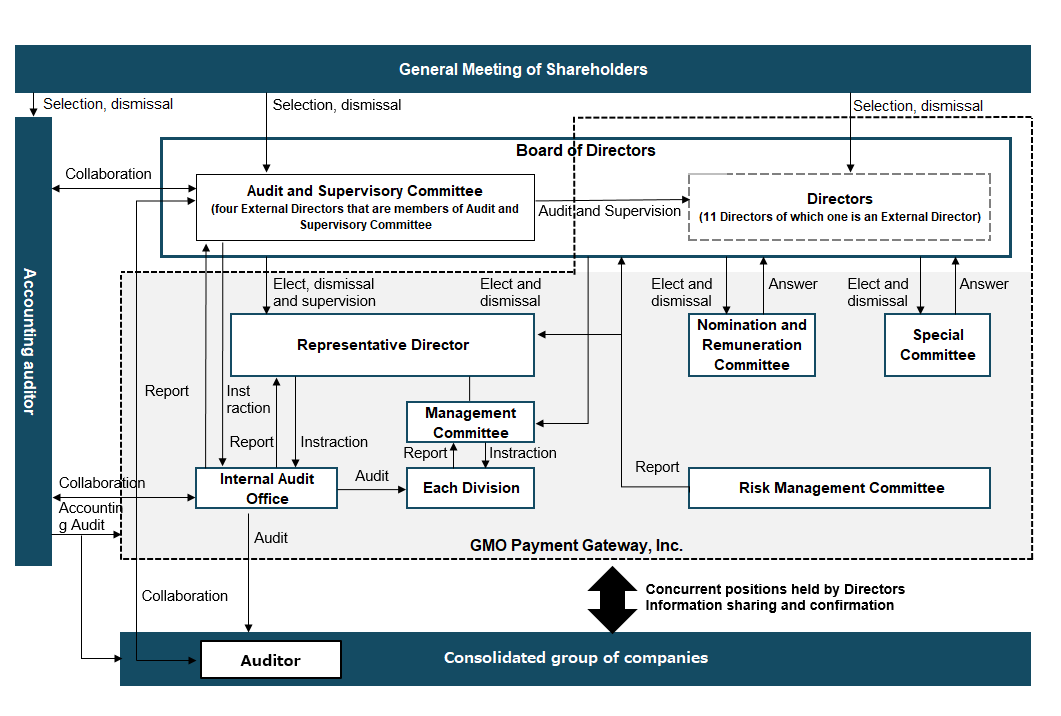

Corporate Governance

Corporate Governance

Based on the management principle, the Company implements governance systems that can effectively and efficiently realize this principle. The Company's basic view on corporate governance is to implement measures and develop necessary management oversight systems for sound progress while simultaneously securing the legal compliance and efficiency of management, and corporate governance is positioned as one of the highest priority management issues.

Corporate Governance Structure

・The Board of Directors

The Board of Directors is comprised of 15 Directors (including 5 external directors) . The Representative Director functions as the chairperson of the Board. The Board convenes its regular session once every month and can hold extraordinary sessions when necessary to resolve important management and legal issues. In addition, the Board supervises the execution of duties of Directors, and endeavors to secure the fairness, efficiency and transparency of the decision-making process. Furthermore, the term of office of a Director excluding members of the Audit and Supervisory Committee is one year, in order to establish a management system that can respond agilely to the changes in the business environment and clearly define the Director's management responsibility. Moreover, the term of office of a Director who are members of the Audit and Supervisory Committee is two year.

・Audit and Supervisory Committee

The Audit and Supervisory Committee consists of four External Directors. Based on the Rules of the Audit and Supervisory Committee, each member must share and partake in the task of attending the Board of Directors meetings and other important meetings as well as share in conducting investigations of operations and financial condition, etc. In addition, the Audit and Supervisory Committee carries out supervision through such activities as receiving reports and issuing instructions when necessary to / from the Internal Audit Office.

・Management Committee

The Management Committee is the decision-making body for the execution of important business operations in order to strengthen the management oversight function through the separation of supervision and execution. The Management Committee is comprised of the Representative Directors and some Directors and Executive Officers, and convenes once a month or more, in principle. The Management Committee is formed to facilitate the efficient execution of operations, and make timely and appropriate decisions through deliberations on important matters related to the execution of operations carried out in accordance with the Basic Policy of the Board.

・Nomination and Remuneration Committee

The Nomination and Remuneration Committee is a voluntary body covering matters pertaining to nomination and remuneration of Directors (excluding member of the Audit and Supervisory Committee). The Nomination and Remuneration Committee is comprised of five Directors (of which, three are External Directors) and is chaired by an External Director. The Nomination and Remuneration Committee acts as an advisory body to the Board of Directors and make proposals to the Board of Directors whenever necessary, on matters concerning appointment policy of Directors, screening of candidates, Director's remuneration system, remuneration amount, and succession plans for the role of Representative Director by carrying out fair and objective deliberations.

・Internal Audit Office

The Company establishes the Internal Audit Office which is comprised of three dedicated staff member that conduct the audit of material risks and internal controls of GMO-PG and its consolidated companies. Specifically, the Internal Audit Office conducts internal audits of each department of the Company and its consolidated subsidiaries to ascertain whether operations are compliant and conducive with legal regulations, Articles of Incorporation, internal rules, in accordance with the Rules on Internal Audit. The findings are reported to the Representative Director and also explained to the Audit and Supervisory Committee.

・Risk Management Committee

The Company establishes a Risk Management Committee that undertakes risk management for the overall GMO-PG and its consolidated companies in an effective and efficient manner.

・Special Committee

The Special Committee acts as an advisory body to the Board of Directors and consists of five external directors vested with the responsibility to deliberate on important transactions and actions with conflict of interest between controlling and non-controlling shareholders.

Continual Improvement of Governance

・Selection Policies and Nomination Procedures of Directors

The selection of Directors makes due consideration of Directors who are equipped with the knowledge, experience and skill to effectively carry out their role and responsibility and will be mindful to achieve the appropriate size and diversity of the Board. Candidate for Directors will be selected on these policies and following the deliberations at the Nomination and Remuneration Committee, will be formally proposed to the Board for the decision.

・Independence Standards for External Directors

In making the decision for designating External Directors including members of the Audit and Supervisory Committee as independent Directors, the Company designates as independent Directors those who fulfill the proprietary standards set forth in the Independence Standards and Rules for External Directors.

・Evaluating the Effectiveness of the Board

The Company strives to improve the effectiveness of the Board by incorporating evaluation and analysis once a year at the Board meeting, carried out primarily by the Audit and Supervisory Committee.

More concretely, the Company works to ensure the Board's effectiveness based on a broad perspective that is not limited to the composition and operations, but also including the organizational design, nomination and remuneration by incorporating objective and quantifiable methods, such as questionnaires completed by all Directors.

Concurrently, the issues revealed in the evaluation process are continuously addressed through formulating and executing on improvement measures, in order to further enhance the Board's functioning.

・Director's Remuneration

In order to secure the transparency of the remuneration determination process and the appropriateness of the remuneration, the Company establishes the Nomination and Remuneration Committee that acts as an advisory body to the Board of Directs and is chaired by an External Director. The remuneration (including bonus and other remunerations) for Directors (excluding members of the Audit and Supervisory Committee) is decided by the Board of Directors following due deliberations by the Nomination and Remuneration Committee.

The remuneration for each individual Director is decided by the Board and is deemed to basically align with the report and determination policy set forth by the Nomination and Remuneration Committee, following the Committee's multi-faceted considerations including the consistency with the policies adopted. Furthermore, the remuneration of Directors who are members of the Audit and Supervisory Committee consist only of a fixed remuneration amount in the interest of securing independence and objectivity from management, and the fixed remuneration amount is decided through discussions in the Audit and Supervisory Committee.

Furthermore, in order to further advance sustainability management, ESG indicators have been incorporated into the individual target of the Director in charge from FY ending September 2022.

Directors' Skill Matrix

| Name | Position | Practice of GMO-ism*1 | Corporate Management | IT/Security | Risk Management | Legal Affairs | Treasury and Accounting | Payment Processing Business | Finance | Global | Investment (M&A) |

ESG/ Sustainability |

Attendance rate for Board meeting*2 | Attendance rate for Audit and Supervisory Committee*2 | Attendance rate for Nomination and Remuneration Committee*2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Issei Ainoura | President and Chief Executive Office |

〇 | 〇 | 94% | - | - | |||||||||

| Masatoshi Kumagai | Chairman and Director |

〇 | 〇 | 100% | - | - | |||||||||

| Ryu Muramatsu | Director, Executive Vice President |

〇 | 〇 | 〇 | 〇 | 〇 | 100% | - | - | ||||||

| Satoru Isozaki | Director, Executive Vice President |

〇 | 〇 | 〇 | 〇 | 〇 | 100% | - | 100% | ||||||

| Masashi Yasuda | Director | 〇 | 〇 | 〇 | 100% | - | 100% | ||||||||

| Hirofumi Yamashita | Director | 〇 | 〇 | 100% | - | - | |||||||||

| Teruhiro Arai | Director | 〇 | 〇 | 〇 | 94% | - | - | ||||||||

| Noriko Inagaki | Director | 〇 | 〇 | 100% | - | - | |||||||||

| Yuki Kawasaki | Director | 〇 | 〇 | 100% | - | - | |||||||||

| Takashi Shimahara | Director | 〇 | 〇 | 〇 | 〇 | 94% | - | - | |||||||

| Fumio Kai | External Director | 〇 | 〇 | 〇 | 〇 | 100% | 100% | - | |||||||

| Kazutaka Yoshida | External Director, Audit and Supervisory Committee | 〇 | 〇 | 〇 | 100% | 100% | 100% | ||||||||

| Kazuhiko Okamoto | External Director, Audit and Supervisory Committee | 〇 | 〇 | 〇 | 〇 | 94% | 94% | 100% | |||||||

| Yumi Hokazono | External Director, Audit and Supervisory Committee | 〇 | 〇 | 100% | 100% | 100% | |||||||||

| Osamu Ohkawa | External Director, Audit and Supervisory Committee | 〇 | 〇 | 〇 | - | - | - |

*1 GMO-ism refers to GMO Internet Group, Inc.'s collective corporate motto consisting of "Venture Spirit Declaration," "55-Year Plan," in addition to the "Rules for Senior Manager" and "Laws of Winning."

*2 Number of Board meetings convened: 17; Number of Audit and Supervisory Committee meetings convened: 19; Number of Nomination and Remuneration Committee meetings convened: 2

Raising Awareness of Participation in Management through the Employee Stock Ownership Plan

Based on our ideology of "Everyone is the President," we aspire to foster all partners (employees) to incorporate the same perspective as the management team in carrying out business activities to realize sustainable growth. The Company establishes the Employee Stock Ownership Plan to further raise awareness of participation in management by the partners and to aid in their asset accumulation.

Partners can purchase the Company's shares from small installments, and the Company provides a 10% incentive payment for such share purchases. As of the end of September 2023, the participation rate in the Employee Share Ownership plan is 35%. Each partner continues to strive to raise the corporate value by sharing the same values as our general shareholders.

Engagement through IR Activities

The Company carries out timely disclosure of management information and investor relations (IR) activities for shareholders and other investors to enhance the transparency of management in order to achieve the aims of corporate governance.

Summary of Activities for FY2022 (from October 1, 2022 to September 30, 2023)

| Activity | Number of Events |

|---|---|

| Financial results announcements and briefings | 4 times |

| One-on-one meetings | Approx. 400 |

| Participation in broker conferences | 15 times |

| Number of meetings including group meetings | Approx. 590 |

Risk Management

Status of Risk Management Structure

In order to tackle the various risks associated with business operations, the Company has developed a risk management structure to secure stable growth and business continuity by optimizing and deploying costs required to carry out preemptive measures on a permanent basis.

Specifically, the Risk Management Committee has been established, comprised of the heads of divisions at GMO-PG and its consolidated companies, to carry out risk assessment, the formulation and execution of countermeasures, as well as monitoring. This Committee comprehensively evaluates and manages various risks including compliance risks such as anti-corruption, natural disaster-related risks including climate change and risks associated with system security, among others.

The Board of Directors supervises the effectiveness and appropriateness of corporate-wide risk management based on periodic reports on the discussions and evaluations of the Committee.

Note that, due to the above initiatives, there have been no scandals nor material wrongdoing during FY2023.

Information Security

Basic View

The Company's mission is the realization of a secure and convenient cashless payment for consumers and business operators by aiming to become the infrastructure of Japan's payment process. In conducting corporate activities aligned with this mission, the Company is engaged in information security measures based on the awareness that protection of information assets from external threats is the highest management issue as well as in utilizing the proprietary information assets.

Specifically, necessary measures are in place such as internal rules, 24-hour system surveillance and security measures against malicious infiltration both from within and outside the Company to prevent cyber-attacks and computer viruses and other malicious infiltration of computers.

Additionally, yearly educational and awareness-raising activities are scheduled to ensure that these measures take root.

Thorough education is periodically conducted at the start of employment using compliance training programs to ensure a deeper understanding of procedures, the purpose of security rules, basic policies and rules stipulated under the information security management system (ISO27001). These are combined with awareness raising videos on information security measures. Additionally, improving the effectiveness of risk assessment is also carried out by inviting external experts to participate in the Risk Management Committee and by assigning employees with specialized knowledge to the Internal Audit Office.

Risks and Responses to Information Security

①System Failure and Information Security

・Risk : Risk of service disruptions caused by unforeseen system failures on the part of payment providers (such as credit card companies) and/or weaknesses in the Company's systems that result in the disruption of communication networks and the malfunctioning of applications caused by cyberattacks, computer viruses, and/or unauthorized computer access from an external source or natural disasters or accidents.

・Response : The following requisite and appropriate responses are enacted to mitigate risks, such as security measures against unauthorized access from external and internal sources, a 24-hour surveillance structure, duplication of system configuration, insurance policy enrollment, and development of internal rules on operations.

②Credit Card Information Breach at Merchants

・Risk : Risk of joint liability to cover the indemnity cost of reissuing credit cards when the merchant, etc., does not have the capacity to fulfill the obligation in the event of information leakage of credit card information occurring at the merchant.

・Response : In order to mitigate this risk, the Company undertakes strengthened management of merchants that store such information as well as promotes services where the credit card information is stored by the Company and not by the merchant.

③Potential Breach of Personal Information and Its Impact

・Risk : Risk of external leak of database information managed by the Company that contains personal information such as credit card information, names, addresses, telephone numbers, and email addresses.

・Response : The Company has implemented a solid system that qualifies for the PrivacyMark in order to ensure against this risk. In addition, as a member of the Japan Consumer Credit Association, personal information management operations are implemented in accordance with the Personal Information Protection Policy. Furthermore, the Company established the Risk Management Committee to implement effective and efficient risk management. The Risk Management Committee convenes once every quarter and reports its findings on risk management to the representative directors, Board of Directors, and Audit and Supervisory Committee.

The following certifications for information security have been certified as measures to strengthen the risk management structure.

・Acquired accreditation for compliance for ISO27001

Acquired accreditation for compliance for ISO/IEC 27001:2022(JIS Q27001:2023), the global standard for information security management applicable to all of the Company's business locations

・Acquired PrivacyMark certification

In recognition of the appropriate measures to safeguard personal information, the Company received the PrivacyMark certification that signifies compliance with the Japanese Industrial Standard for personal information protection, JIS Q15001:2017.

・Fully PCI DSS Compliant

The Company's services are in full compliance with version 4.0.1 of the PCI DSS global security standard for the credit card industry, which was jointly formulated by the five global credit card brands: JCB, American Express, Discover, MasterCard and Visa. As such, we are delivering peace of mind to all of our customers, in addition to securing credit card payments.

Compliance (Legal Compliance)

Compliance

The Company considers the scope of compliance that includes: a) laws and ordinances, b) ethics and social norms, c) rules, regulations, and procedures, and d) management vision. The Company works to raise the compliance mindset of all partners based on the awareness of "adapting to the demands of society" (known as the full-set compliance), which includes adherence to related government laws and ordinances.

Under the Rules of Compliance Management and Internal Rules Regarding Misconduct, all incidents of misconduct including compliance violations that occurred or is likely to occur must be reported to Corporate Support Division promptly, and the Corporate Support Division is stipulated to carry out necessary investigation and implement the required and appropriate response for resolution, as well as formulate and disseminate the preventative measures, with due reporting and collaboration with Corporate Support Division.

The Internal Audit Office reviews the state of compliance with ordinances, articles of incorporation, company rules and other such regulations based on the yearly Audit and Supervisory Plan. Corrective measures are undertaken if a circumstance is found to require improvement as well as follow-up to ensure these corrective measures are enforced. If an incident where a compliance violation is suspected occurs, the Company has developed and operates a whistleblower system in addition to the normal reporting system based on chain of command.

Note that no costs related to compliance violations, including penalties, fines and settlement payments related to corruption, have been incurred in FY2023.

Code of Conduct

The Company acknowledges the importance of compliance with laws and regulations, improving and maintaining corporate and employee ethics which is compiled into the Code of Conduct and carries out regular awareness-raising and other efforts to partners (employees).

The Company's intention encompasses the full set of compliance which is not limited to compliance to laws and regulations, improving and maintaining corporate and employee ethics but also to 'adaptation to social demands.' In order to put this into practice, the Company strives to preemptively prevent the occurrence of any problems through compliance with internal rules and an open and smooth communication in the work environment. On the other hand, in case a problem arises, the issue is reported and consulted with the line manager and there are systems in place to enable a speedy, effective and suitable improvement measures.

With the help of such initiatives, partners of the Company are entrusted to act in a responsible and sensible manner and internalize the Code of Conduct as a guiding principle of their daily behavior.

Anti-Corruption

Basic View

The Company's Code of Conduct for Directors and Employees stipulates related anti-corruption clauses including compliance with Act on Prohibition of Private Monopolization and Maintenance of Fair Trade (the Anti-Monopoly Act), acts of conflicts of interest, prohibition of gift-giving or entertainment of public officials or those deemed to be as well as overseas public officials or those deemed to be, prohibition of gift-giving and entertainment in excess of socially acceptable levels to business counterparts, measures on anti-money laundering and other similar acts and, contributions and charitable donations that abide with laws and ordinances.

Anti-Corruption Initiatives

The Company carries out the merchant management assessment on merchants that are likely to enter into a commercial transaction with the Company, to assess whether the business of the merchant is offensive to public order and standards of decency.

The Board of Directors monitors the compliance of GMO-PG and its consolidated companies by receiving regular reports on the compliance initiatives and its implementation from the officer in charge of compliance.

The Company has established a whistle-blower reporting system internally and externally that ensures confidentiality, fairness and objectivity.

The Company continuously works to disseminate the Company's principles and messages from top management that are related to compliance and foster a compliance culture through periodically reading aloud and debates. In addition, the Company conducts regular training and follow-up sessions in order to educate and thoroughly disseminate the significance and importance of compliance management as per the Rules on Compliance Management.

Note that there were no individuals subject to disciplinary action or dismissal due to violations of the Code of Conduct related to anti-corruption during FY2023.

Political Donations

The Company does not make political donations.

Tax Policy

Tax Policy

Basic View

Under the management principle to "By contributing to society, we pursue both spiritual and material prosperity for our partners." the Company contributes to the economy and local community of that jurisdiction through the fair and full payment of taxes. The Company appropriately files and pays the taxes based on the relevant laws and regulations on taxation of that country/region in which the business activity takes place. In addition, the Company will endeavor to optimize its tax cost through the use of tax incentives and benefits within the scope of legitimate business activities. The Company will not engage in arbitrary tax avoidance measures to make unreasonable and unjust use of tax havens and excessive tax planning on non-existent businesses, nor abuse tax incentives in a manner not aligned with the purpose stated in the relevant tax law.

Tax Governance

The Executive Vice President of the Company, overseeing corporate operation, bears responsibility over tax governance, and the Accounting Division carries out the taxation operations under the management and instructions from the General Manager of Accounting & Finance Management Department. Consideration of taxation risks is carried out with the advice from external advisors. Occurrence of material problems related to taxation is reported to the Board of Directors.

FY2023 Tax Payment by Country

| Country | Tax Payment |

|---|---|

| Japan | 95.5 |

| U.S | 0.1 |

| Other (Southeast Asia, India, etc.) | 0 |

* Compiled figures for corporate taxes, etc.

VIEW

サービスについての質問・相談は

下記よりお気軽にお問い合わせください。