自動音声応答で安全な決済を実現

IVR決済サービス

IVR決済サービスとはコールセンターで注文を受ける際に、自動音声応答(IVR)を利用することでクレジットカード情報に触れることなく決済を行うサービスです。

電話受注におけるクレジットカード情報非保持化が実現できます。

※IVR決済サービスはクレジットカード決済のオプション機能です

このような課題を

解決できます

- 自社サービスに決済を導入したい

- よく使われる決済手段を知りたい

- セキュリティ対策をしたい

IVR決済サービスのメリット

-

オペレーターがクレジットカード情報に触れることなく決済が可能

人為的な情報漏えいリスクの低減

-

自社のPCサーバ・ネットワーク上での、クレジットカード情報の非保持・非通過を実現

クレジットカード取引に関わる事業者が実施すべきセキュリティ対策を定めた「クレジットカード・セキュリティガイドライン」に対応。

-

API活用による基幹システムとの連携

受注情報と決済データの連携を容易に実現

-

PCI DSS(※)に準拠したセキュアな環境下でのご提供

(※)PCI DSS(Payment Card Industry Data Security Standard)とは、JCB・American Express・Discover・MasterCard・VISAの国際クレジットカードブランド5社が共同で策定したクレジット業界におけるグローバルセキュリティ基準のこと。

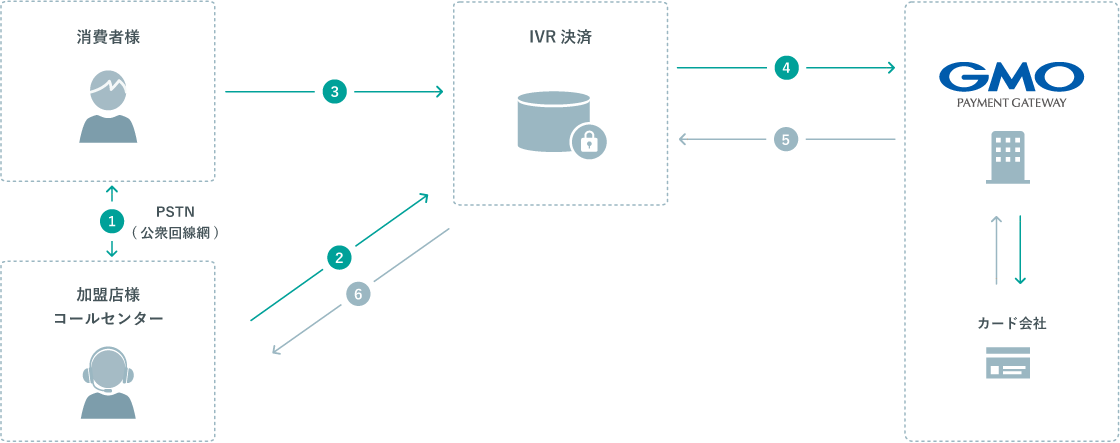

IVR決済サービスフロー

受電後、オペレーターがIVRへ転送することで、クレジットカード情報入力が開始されます

- 電話応対

エンドユーザーからの受電対応、注文内容、支払い方法確認 - 決済情報を入力しIVRへ転送

API連携済み基幹システムもしくはIVR管理画面に受注情報を入力、オペレーターがIVRへ転送 - カード情報等入力

カード番号、有効期限、セキュリティコードのプッシュ入力 - カード決済実行

オーソリ / カード登録の実行 - カード決済結果返却

- カード決済結果返却

(オペレータの結果確認)

IVR決済サービスの主な機能

-

オペレーター通話戻し機能(標準)

IVR決済サービス(自動音声応答)でカード決済完了後、お客様とオペレーターとの会話が可能になります。決済後にお客様と会話した後終話することで、カード決済完了後のフォローアップが可能になります。

-

API連携機能(標準)

API連携機能を活用することで、受注システムの受注情報とIVR決済サービスで決済実行した決済情報を自動連携することが可能になります。

サービス導入までの流れ

お見積、お申込書、利用規約のご提示 GMO-PG

GMO-PGより加盟店様へ個別のお見積をご提示させていただきます。

お申込書の提出 貴 社

契約に必要な書類(申込書)を弊社へご提出いただきます。

IVR決済サービス環境設定 貴 社 GMO-PG

既にクレジットカード決済の利用がある、もしくはクレジットカード決済審査通過を条件に環境設定いたします。

本番環境のご提供(毎月1日/毎月15日) GMO-PG

お申込書受領およびクレジットカード審査通過のタイミングにより変動いたします

本番環境テスト 貴 社

本番環境を利用して疎通テストおよびオペレーター運用確認

本番運用開始 貴 社

IVR決済サービスの注意点

-

ご利用条件

IVR決済サービスのご利用にはPGマルチペイメントサービス クレジットカード決済のご契約および本番審査通過が必要です。

-

ご提供タイミングとご請求

本番環境利用開始日は毎月1日と15日の2回となります。

本番環境ご提供日から月額固定費の請求が発生します。*日割分割請求はございません。 -

回線(同時着信数)

5回線ベストエフォート型

-

動作環境

Web

- IE 11以降(※Edge対象外)、Chrome 最新版、Firefox 最新版※TLS1.2に対応していること

IVR

- プッシュ信号(DTMF)が送出可能な電話機・PBX等を利用し、日本国内からの利用に限る

- 三者間通話が可能なPBX

サービスについての質問・相談は

下記よりお気軽にお問い合わせください。