スピーディな資金調達でビジネス拡大へ

GMO-PG

トランザクション

レンディング

当社の決済サービスをご利用の加盟店様向けに提供させていただく融資(レンディング)サービスです

このような課題を

解決できます

- 資金面のサポートを受けたい

GMO-PG トランザクションレンディングの特長

- 最短3営業日で融資実行可能

- ご契約はメールで完結、外出不要

- 第三者保証人、担保は不要

- 繰上返済手数料は不要

お申込基準

PGの決済サービスをご利用の加盟店様

※公共系団体/財団法人、個人事業主は対象外とさせていただいております。

サービス概要

|

融資金額 |

100万円~3,000万円 |

|---|---|

|

ご融資利率 |

年利2.00%~15.00% |

|

返済方法 |

①元金均等返済 |

|

融資期間 |

元金均等返済:1年以内 |

|

返済回数 |

12回以内 |

|

保証人担保 |

第三者保証人・担保等は不要です |

|

遅延損害金(実質年率) |

年利18.00% |

|

必要書類 |

借入人の登記簿謄本、印鑑証明書、ご担当者の運転免許証のコピー等 |

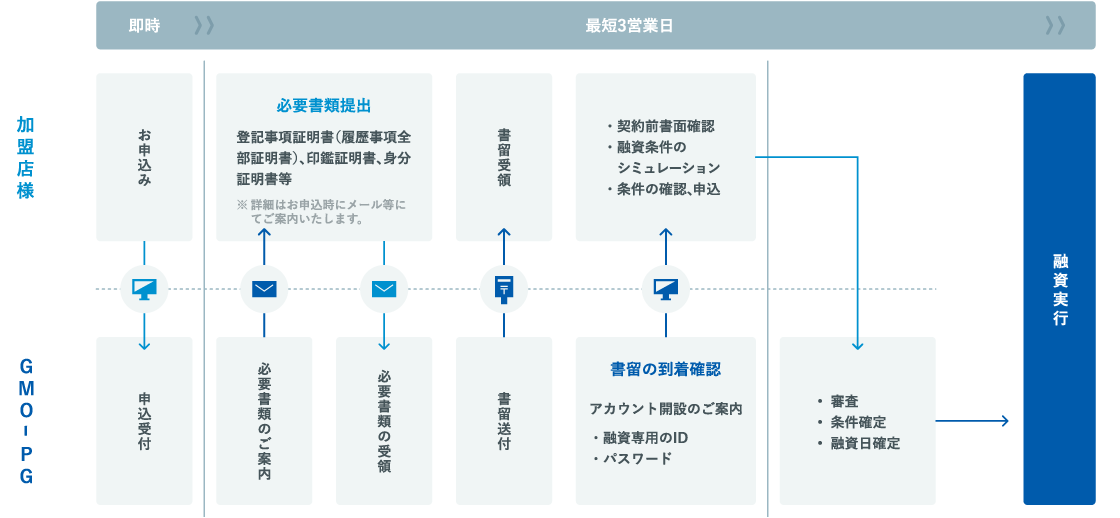

融資お申込フロー

※ご融資条件は、審査によりご希望に添えない場合がございます。

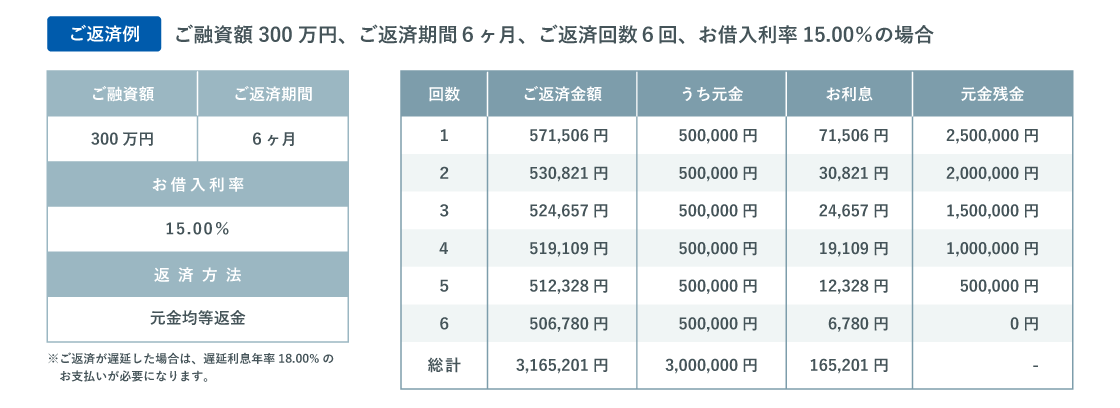

ご返済計画(例)

融資アカウント開設に必要な書類

必要書類全5点(融資ご担当者が代表者以外の場合は、全6点)

※口座振替依頼書、委任状以外はメールのご返送にて承ることが可能です。

-

融資アカウント開設申込書

-

口座振替依頼書(※要原本)

- 弊社決済サービス契約時にご登録頂いている口座をご記入ください。

- 右上に「融資用」と記載のある用紙

-

登記簿謄本(履歴事項全部証明書)<発行日から6ヶ月以内>

-

印鑑証明書<発行日から6ヶ月以内>

-

運転免許証、マイナンバーカード、パスポート、在留カード等(※)のいずれか1点

- 弊社到着時点で有効期限内のもの

- 現住所の記載があるものに限ります。

- 裏面、他ページに現住所の表示がある場合は、裏面、他ページのコピーも必要です。

(※)官公庁発行書類で、氏名、住所、生年月日の記載があり、顔写真が貼付されているもの。

上記以外の書類をご希望の場合は、ご相談ください。

-

委任状(※弊社所定書式、要原本)

代表者以外の方が、融資実務を担当される場合に必要となります。

よくあるご質問

申込方法を教えてください

お申込みフォームよりご連絡ください。審査に必要な書類等をご連絡差し上げます。

アカウント開設後は直ぐ融資してもらえますか

お申込金額、融資条件が合えば、最短3~5営業日後にお振込いたします。

期日前返済ができますか、その時の手数料はいくらでしょうか

できます。手数料は無料です。

担保は必要でしょうか

無担保・無保証です。

返済はどのようにすればよいのでしょうか

原則として、弊社決済サービス契約時にご登録頂いている銀行口座から、毎月26日に自動引落しさせていただきます。

お問い合わせ先

融資サービスセンター

E-mail:gmoyuushi@gmo-pg.com

TEL :03-5784-3610(平日9:00~17:00)

事業主体者

GMOペイメントゲートウェイ株式会社

東京都渋谷区道玄坂一丁目2番3号渋谷フクラス14F

貸金業登録番号:東京都知事(7)第30802号

■貸付条件をご確認いただき、計画的なご利用をお願いいたします。

返済等でお悩みの方は

日本貸金業協会貸金業相談・紛争解決センター

0570-051-051

(受付時間9:00~17:00 休:土、日、祝日、年末年始)

サービスについての質問・相談は

下記よりお気軽にお問い合わせください。