世界で採用される不正防止サービス

不正防止サービス(ReDShield)

世界中で不正取引防止に実績のあるセキュリティサービスです。導入することで、エンドユーザー様の決済に対し、加盟店様が保持する「ユーザ情報」と「注文内容」を精査し、不審な取引を見分けることができます。

クレジットカード決済をより安心・安全にご利用いただくためにご用意しているオプションサービスです。

このような課題を

解決できます

- セキュリティ対策をしたい

不正防止サービス(ReD Shield)のメリット

- 判定結果を参照することで、チャージバックリスクの軽減に寄与します。

- 不正対策にかかる運用負荷を、システム化により軽減します。

- PGマルチペイメントサービスに標準実装しているので、開発負担等の導入費用が軽減でき、お手軽に導入可能です。

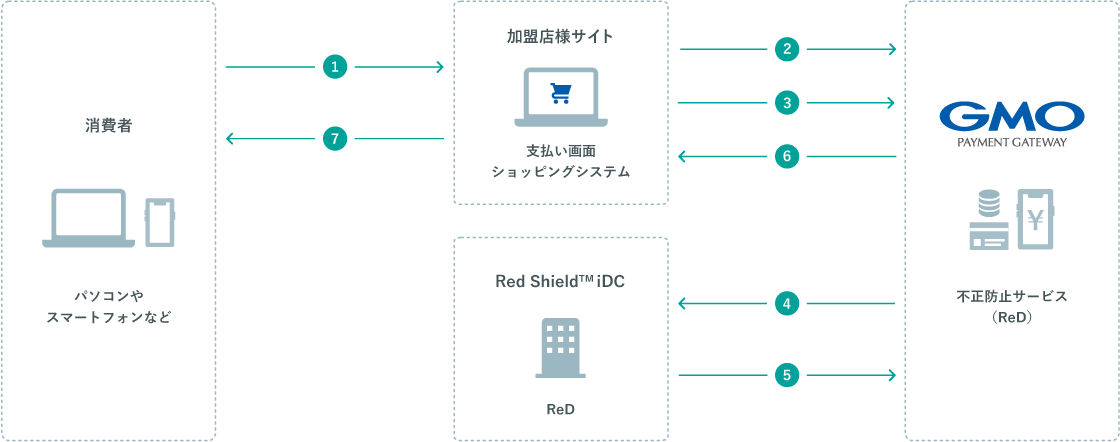

サービス運用フロー

カードトランザクションをリアルタイムで判定。

取引すべきか否かの判定結果を、許容リスクに沿ってACCEPT/CHALLENGE/DENYで返答します。

- ...購入情報、不正審査実行、判定結果通知

- 購入

- カード決済実行(EntryTran,ExecTran)

- 不正審査実行(ExecFraudScreening)※②の取引情報を指定

- 顧客情報にカード情報を紐付けて送信

- 判定結果を返信 ACCEPT/CHALLENGE/DENY

- 判定結果を返信 ACCEPT/CHALLENGE/DENY

- 判定結果を元に商品発送を判定

【運用例】

ACCEPT→取引OK

CHALLENGE→調査の上、取引実行判断

DENY→取引NG

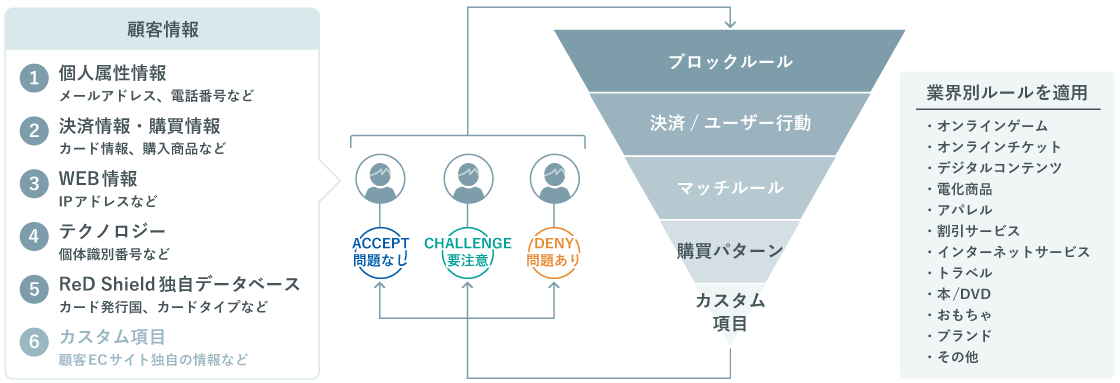

不正防止の仕組み

6種のユーザ情報を基に、5段階のルールレイヤーでフィルタリングすることで、カードトランザクションをリアルタイムに審査(ACCEPT/CHALLENGE/DENYを判定)します。

プラン概要

PGマルチペイメントサービスにおける不正防止サービス(ReD Shield)では、より多くの加盟店様に簡易的にお使いいただけるBasicと、特定加盟店様に特化した上位モデルEnhancedの2プランからお選びいただけます。

|

Basic |

Enhanced |

||

|---|---|---|---|

|

対象加盟店 |

・チャージバック比率が上昇傾向 |

・チャージバック比率が1%超 |

|

|

プラン概要 |

判定結果返却 |

API |

API |

|

不正判定ルール |

共通(ベストプラクティス)ルール |

ショップ毎の独自(カスタム)ルール |

|

|

管理画面提供(※) |

無 |

有 |

|

|

ご留意点 |

導入直後に一定成果を得ることを期待できますが、個別に不正判定ルールをチューニングしたり不正判定ルールを開示することはできません。 |

個別に不正判定ルールをチューニングすることが可能ですが、精度の高い判定結果を得られるまでには半年程度の時間を要します。 |

|

※ご契約ショップ毎に費用発生いたします。

注意点

- 不正取引の防止を100%保証するサービスではございません。

- 本サービスのご利用はPGマルチペイメントサービスのクレジットカード決済ご契約ショップに限ります。

参考)不正判定ルール例

1. グローバルルールについて

- ハイリスク国(カード発行国/請求先国/送付先国/アクセス元)

- ハイリスクメールドメイン

- ハイリスクISP

- ブラックリスト各種(メールアドレス/電話番号/デバイス/住所/カード等)

2. 共通ルールについて

■物販

物販は商品発送前にチェックできるため、原則CHALLENGE判定します。

- 海外発行カード利用

- 同一のカード番号に対して複数のカード名義を利用

- 同一のカード番号が複数のメールで利用

- 同一のデバイスから多数のカード利用又はオーソリ認証

- 同一のメールアドレスから複数の住所に送付

- 同一のメールアドレスが多数のデバイス、複数のユーザID、複数の氏名で利用

- 同一のカード番号で、複数の有効期限を利用

- 同一の電話番号から複数の注文

- 同一のデバイスから複数のメールアドレスやユーザIDによる利用

- 日本語環境以外のデバイスからアクセス

- 同一のメールアドレスから複数のIPアドレス利用

- ハイリスク商材など含まれる注文(Enhancedユーザ限定で事前登録が必要)

- 転送会社利用

- 請求先の国とアクセス元の国、カード発行国が不一致(※)

- 同一カード、同一デバイス、同一メールアドレスに対して発送国が複数(※)

- 発送先の国、請求先の国、カード発行国とアクセス元の国が不一致(※)

※海外発送加盟店様向け

■物販以外

デジタルコンテンツ販売等は即時判断が必要なため、原則DENY判定します。

- 同一のカード番号が複数のメール、複数のデバイスで利用

- 同一のメールアドレスが多数のデバイス、複数のユーザID、複数の氏名で利用

- 同一のカード番号で、複数の有効期限を利用

- 同一のメールアドレスから複数の住所に送付

- 同一のデバイスから多数のカード利用又はオーソリ認証

- 同一の電話番号から複数の注文

- 同一のデバイスから複数のメールアドレスやユーザIDによる利用

- 同一のカード番号に対して複数のカード名義を利用

- 同一の電話番号から複数の請求先住所

3. 業界別ルールについて

- 同一カード番号から複数回注文

- 同一カード番号から単独・複数注文で合計金額を超過

- 同一メールアドレスから複数回注文

- 同一ユーザIDから単独・複数注文で合計金額を超過

- 同一メールアドレスから単独・複数注文で合計金額を超過

- 同一デバイスから単独・複数注文で合計金額を超過

サービスについての質問・相談は

下記よりお気軽にお問い合わせください。