全自動・リアルタイムで不正を検知

Forter

Forterは、ユーザーの行動解析、不正ノウハウ、ならびに機械学習をもとにした独自プラットフォームで取引を判定する不正検知システムです。OK/NG判定を全自動、かつ取引時にリアルタイムで提供可能なため、不正取引を目検する必要がなくなります。

導入による承認率の向上とチャージバック率低減を契約によりお約束するため、費用対効果が目に見える不正検知システムであることが特徴です(チャージバックコストをForterが負担するオプションも提供可能)。

このような課題を

解決できます

- セキュリティ対策をしたい

Forterが解決できる課題

-

不正被害

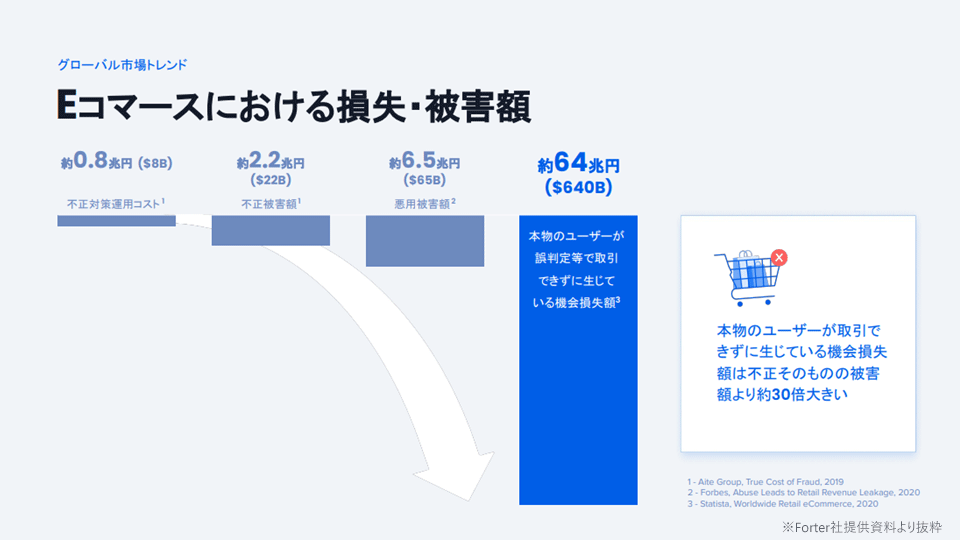

・チャージバックの損害を受けてからルールをアップデートするため、イタチごっことなり、損失が抑制出来ない(例:ルール潜り抜け)

-

機会損失

・不正抑止による正規取引のかご落ち(例:EMV 3-Dセキュア(3Dセキュア2.0))、もしくは誤判定による売上機会の損失。

・ユーザーへの追加認証や取引保留による発送の遅れ -

運用コスト

・怪しい取引の目検業務負荷ならびに業務の属人化。不正ルール設定・更新の業務負荷。

-

悪用被害

・アカウント複数開設によるプロモーション悪用、限定品の転売被害、返品乱用など

・その他、アカウント乗っ取りやカードテスティング被害

Forterの概要

-

不正被害の低減

ユーザーの行動解析を活用した特許取得の機械学習モデルにより、正規ユーザーと不正者を高精度で判定します。

正規ユーザーに摩擦・認証を与えずかご落ちを最小化(売上アップ)、また不正者を的確にブロックすることで不正被害を低減します。 -

機会損失の低減

EMV 3-Dセキュア(3Dセキュア2.0)と並用することで取引リスク&イシュア毎に3Dセキュアの実施有無を動的に制御し承認率を最大化します。

-

不正対策業務負荷の低減

取引は原則OK/NG判定をリアルタイムで返します。疑わしい取引の目視確認が不要になることで、目検工数や属人化といった業務負荷を削減し運用を完全自動化。また、ルール更新などの業務運用も不要になります。

-

悪用被害その他の改善

アカウント複数開設によるプロモーション悪用、限定品の転売被害、返品乱用などの悪用被害に関するリスク判定も提供可能。事業者の業態や個別課題に則したモデルを構築し、個別ニーズに対応します。

導入効果を契約で保証

- ご検討に当たり現状の損失(チャージバック率)、承認率(コンバージョン率)等をヒアリングいたします。

- 専門アナリストの分析によるForter導入後の効果シミュレーションをご案内します。

- Forter導入後の承認率の向上とチャージバック率の低減を契約によりお約束します。チャージバック補償ありの場合、チャージバックはForterが負担します。

シミュレーション① チャージバック補償有

承認率が8%増えることで1.8億円の売上が増加。Forterがチャージバック損害を負担し、目視が不要になることで、コストが380万円削減します。

|

Forterを利用しない |

Forterを利用する |

ForterのROI |

|

|---|---|---|---|

|

年間売上 |

20億円 |

21.8億円 |

1.8億円 |

|

チャージバックコスト |

600万円(0.3%) |

0円 |

380万円 |

|

運用コスト |

250万円 |

0円 |

|

|

不正対策コスト |

800万円 |

1,270万円 |

シミュレーション② チャージバック補償無

承認率が8%増えることで、1.8億円の売上が増加。

Forterが承認率をお約束することで導入前からチャージバックのコストは微減、目視が不要になることで、コストを200-300万円削減します。

|

Forterを利用しない |

Forterを利用する |

ForterのROI |

|

|---|---|---|---|

|

年間売上 |

20億円 |

21.8億円 |

1.8億円 |

|

チャージバックコスト |

200万円 |

0-100万円 |

200-300万円 |

|

運用コスト |

500万円 |

0円 |

|

|

不正対策コスト |

200万円 |

600万円 |

※Forterのコストをイメージしやすくするためのシミュレーションであり、各数字は仮です。

サービスについての質問・相談は

下記よりお気軽にお問い合わせください。