2025年10月14日

報道関係各位

GMOペイメントゲートウェイ株式会社

GMOインターネットグループにおいて、総合的な決済関連サービス及び金融関連サービスを展開するGMOペイメントゲートウェイ株式会社(東証プライム市場:証券コード 3769、代表取締役社長:相浦 一成 以下、GMO-PG)は、2025年10月14日(火)より、オンライン総合決済サービス「PGマルチペイメントサービス」に、Forter, Inc.(Co-Founder & CEO:Michael Reitblat 以下、Forter社)が提供する世界規模の取引データにもとづく不正検知サービス「Forter(フォーター)」を実装します。

本実装により、クレジットカード決済のフローに「Forter」のリアルタイム判定を活用します。日本国内カード会社の承認ロジックとEMV 3-Dセキュア(3DS)の運用に則り、日本市場に最適な形で、リスクに応じた取引ブロックから3DS自動適用までをワンフローで実行します。これにより事業者は、「離脱(カゴ落ち)低減」「カード決済承認率の向上」「不正抑止」を同時に実現できます。

GMO-PGは本実装を基盤に、不正対策を単なる「守り」にとどめず、事業者の売上機会を最大化する「攻め」の施策へ転換します。

【背景】

日本国内のキャッシュレス決済拡大に伴いクレジットカード不正利用も増加し、2024年の被害額は5年前の2019年と比較し約2倍の555.0億円に達しました(※1)。セール集中時における盗用番号の有効性を探る少額の連続試行(カードテスト)の紛れ込み、転売目的の高頻度・大量購入、なりすましによるデジタル商材や高額品の購入など、オンラインのクレジットカード決済特有のリスクが顕在化しています。さらに昨今、不正者は生成AIやAIエージェントなど進化するAI技術での不正行為の効率化・自動化を進めており、不正利用被害は今後も拡大することが懸念されます。

こうした状況を踏まえ2025年4月に義務化された3DSは、なりすましを抑止する効果がある一方で、追加認証等によりカゴ落ちを招く恐れがあります。フリクションレス(認証免除)の場合はカゴ落ちを防ぐことができますが、不正通過リスクが残るため、適切な運用設計と不正検知の併用が求められます。

また、不正対策が不十分であれば、不正利用疑いによる取引ブロックが増加して承認率が低下します。逆に過剰であれば、正規取引の誤検知が増加し、結果として売上機会を失うことになります。事業者には「不正抑止」と「承認率の向上」の両立が必要です。

-

(※1)2025年9月5日発表 日本クレジット協会「クレジットカード不正利用被害の発生状況」

URL: https://www.j-credit.or.jp/information/statistics/

【不正検知サービス「Forter」実装の特長】

「Forter」は、世界30万社超の導入実績と年間50兆円規模の取引データ(※2)にもとづく機械学習を強みとする不正検知サービスです。約6,000のパラメータと18億超のアイデンティティを活用し、完全自動かつリアルタイムの判定で誤検知を抑えつつ不正を検知します。日本国内の導入企業では、平均10ポイントの承認率向上が確認されています(※2)(※3)。

GMO-PGは2023年より、Forter社への顧客紹介を通じて導入支援を進めてきました。今回、国内総生産(名目GDP)の約3.4%に相当する年間21兆円超(※4)の決済を取り扱う実装力と運用知見がForter社に高く評価され、両社の関係はより深化し実装レベルでの統合へと発展しました。統合に伴いGMO-PGは、「PGマルチペイメントサービス」のオプションとして不正検知機能を利用できる環境を提供します。事業者はJavaScriptタグの設置と最小限のマッピングで導入が可能となり、チャージバック情報もシームレスに連携されます。

今回「PGマルチペイメントサービス」のクレジットカード決済フローに「Forter」の判定結果を組み込み、APIレベルで一体制御できるようになりました。「Forter」が日本のオンライン決済環境に適したルールで全取引をOK・NGでリアルタイム判定し、3DSをかけるべき取引と免除すべき取引を自動で振り分けます。リアルタイム判定により処理遅延を防ぎ、リスクに応じた3DS自動適用によって不要な追加認証を抑制します。これにより、正規顧客のカゴ落ちを抑え、承認率の向上を実現します。

運用面においても、目視審査やルールチューニングへの過度な依存を減らし、不要な3DS認証や誤検知を抑制します。さらにチャージバック情報の連携まで統合できる(※5)ため、継続的な精度改善にもつながります。

その結果、セールや新商品投入といったピーク時でもスムーズな処理環境を維持しつつ、承認率の向上やチャージバック率の低減、手動審査率の低減といったKPI改善に直結します。

- (※2)Forterの推計値。2025年4月時点。

- (※3)日本国内の導入サイトのうち、導入から6ヶ月以上経過し、承認率が正確に抽出できる先を対象。

(平均単価37,000円、導入後期間平均22ヶ月) - (※4)2025年6月末時点、連結数値。

- (※5)クレジットカード決済の包括加盟店契約を締結している事業者のみ対象となります。

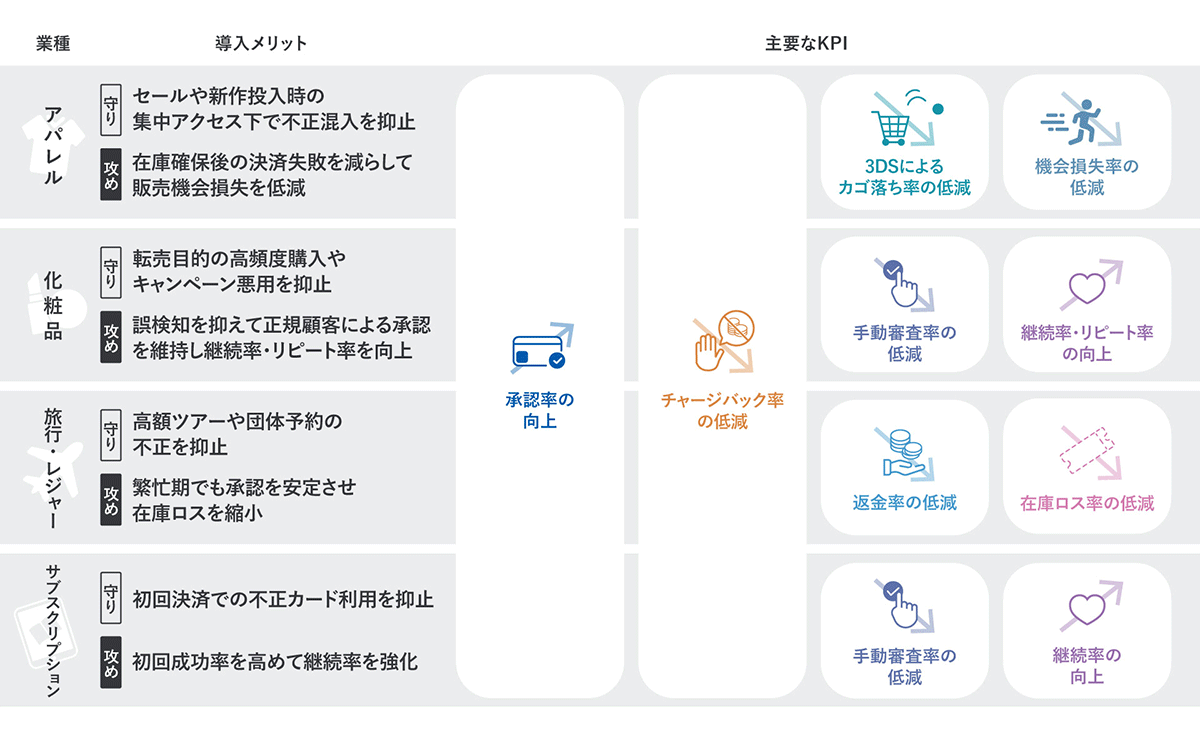

■導入メリット(業種別の一例)

【今後の展開】

GMO-PGでは、事業者ごとの承認率をカード会社別・期間別・金額別など多角的に可視化し、事業者に対しさらなる改善を支援するコンサルティングサービスの提供も検討しています。

また本実装を基盤に、「不正抑止」と「承認率の向上」の両立を日本市場に根付かせ、不正検知を「守り」にとどめず、事業者の売上機会を最大化する「攻め」の施策として定着させてまいります。あわせて、ビジネス拡大の障壁となるセキュリティリスクに対するソリューションをさらに拡充させ、事業者のビジネス規模や課題・状況に応じた提案を行うことで、安心して取引できる環境を整備し、日本のオンライン決済市場の持続的な成長と発展に貢献します。

【報道関係お問い合わせ先】

GMOインターネットグループ株式会社

グループ広報部PRチーム 新野

- TEL

- 03-5456-2695

https://group.gmo/contact/press-inquiries/

【サービスに関するお問い合わせ先】

GMOペイメントゲートウェイ株式会社

インダストリーソリューション本部

- TEL

- info_ppg@gmo-pg.com

- 03-3464-2323

【GMOペイメントゲートウェイ株式会社】(URL: https://www.gmo-pg.com/ )

| 会社名 | GMOペイメントゲートウェイ株式会社(東証プライム市場 証券コード:3769) |

|---|---|

| 所在地 | 東京都渋谷区道玄坂1丁目2番3号 渋谷フクラス |

| 代表者 | 代表取締役社長 相浦 一成 |

| 事業内容 | ■総合的な決済関連サービス及び金融関連サービス |

| 資本金 | 133億23百万円 |

【GMOインターネットグループ株式会社】(URL: https://group.gmo/ )

| 会社名 | GMOインターネットグループ株式会社(東証プライム市場 証券コード:9449) |

|---|---|

| 所在地 | 東京都渋谷区桜丘町26番1号 セルリアンタワー |

| 代表者 | 代表取締役グループ代表 熊谷 正寿 |

| 事業内容 |

持株会社(グループ経営機能) ■グループの事業内容 インターネットインフラ事業 インターネットセキュリティ事業 インターネット広告・メディア事業 インターネット金融事業 暗号資産事業 |

| 資本金 | 50億円 |