January 29, 2025

GMO Payment Gateway, Inc.

GMO Internet Group's GMO Payment Gateway, Inc. (TSE Prime Market: Securities Code: 3769, President & Chief Executive Officer: Issei Ainoura hereinafter referred to as "GMO-PG"), which develops comprehensive payment-related services and finance-related services), will be pleased to announce that from January 29, 2025 (Wednesday), the refund of the operator ・In "GMO-PG Remittance Service", which streamlines remittance operations, refund from businesses to users (purchasers and users) ・ We will add a digital gift "QUO CARD Pay" to the method of receiving remittances QUO CARD Pay. It can be used in a wide range of industries regardless of business type.

【Background and Summary】

With the rise in the cashless payment ratio in Japan (*1), convenient payment using smartphones is becoming commonplace.

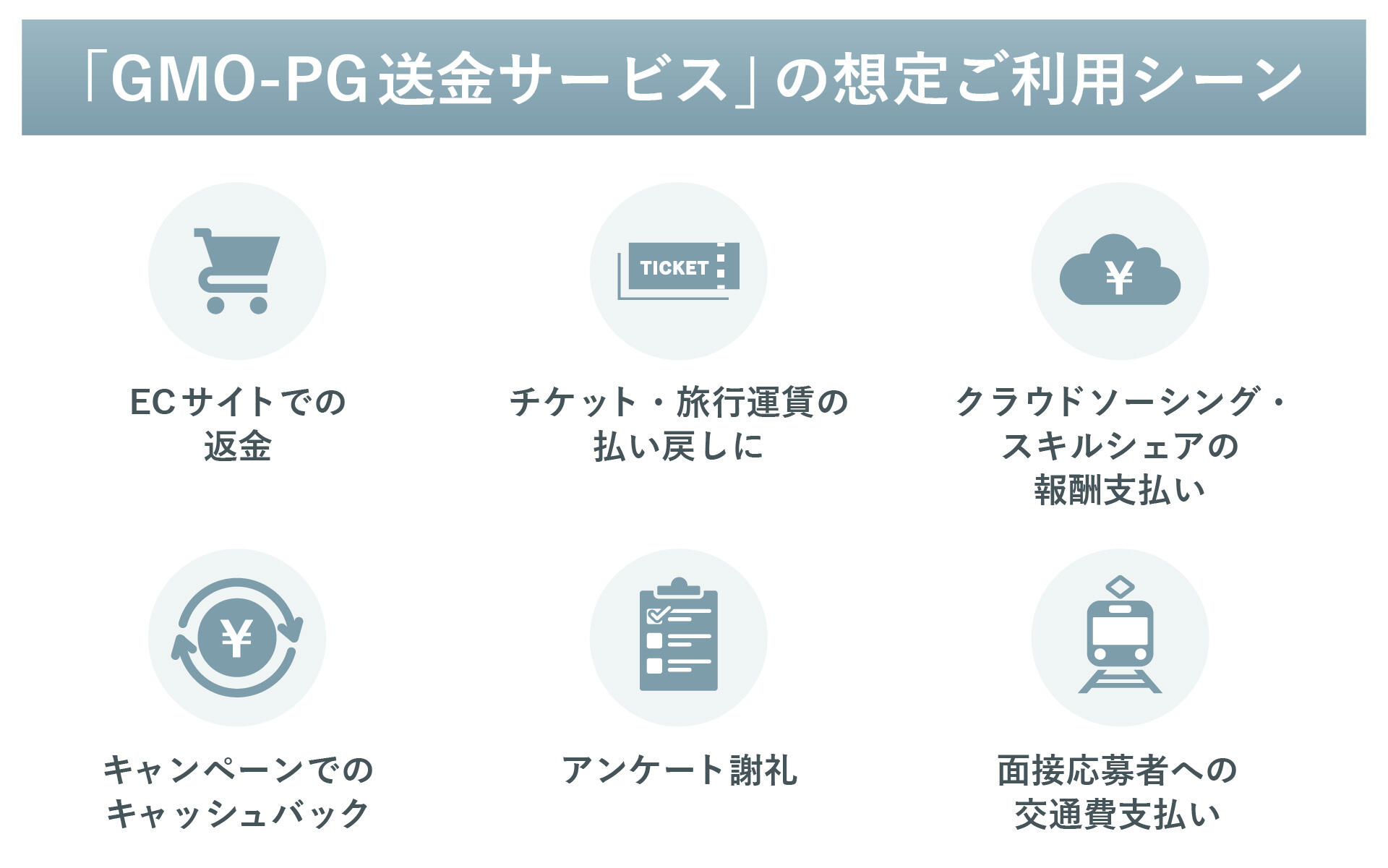

On the other hand, GMO-PG provides "GMO-PG Remittance Service" to businesses that accurately and speedily respond to the complicated work of refund and remittances from businesses to users payment refund. Campaign cashback" and "Transportation expenses for interview applicants payment" are wide-ranging.

GMO-PG is pleased to announce that the user will be able to receive "GMO-PG Remittance Service" at eligible merchants (*2). As QUO CARD Pay a result, businesses using the GMO-PG Remittance Service will be able to offer five receiving methods with the addition of "QUO CARD Pay" to the existing receiving method according to the usage scene and user needs.

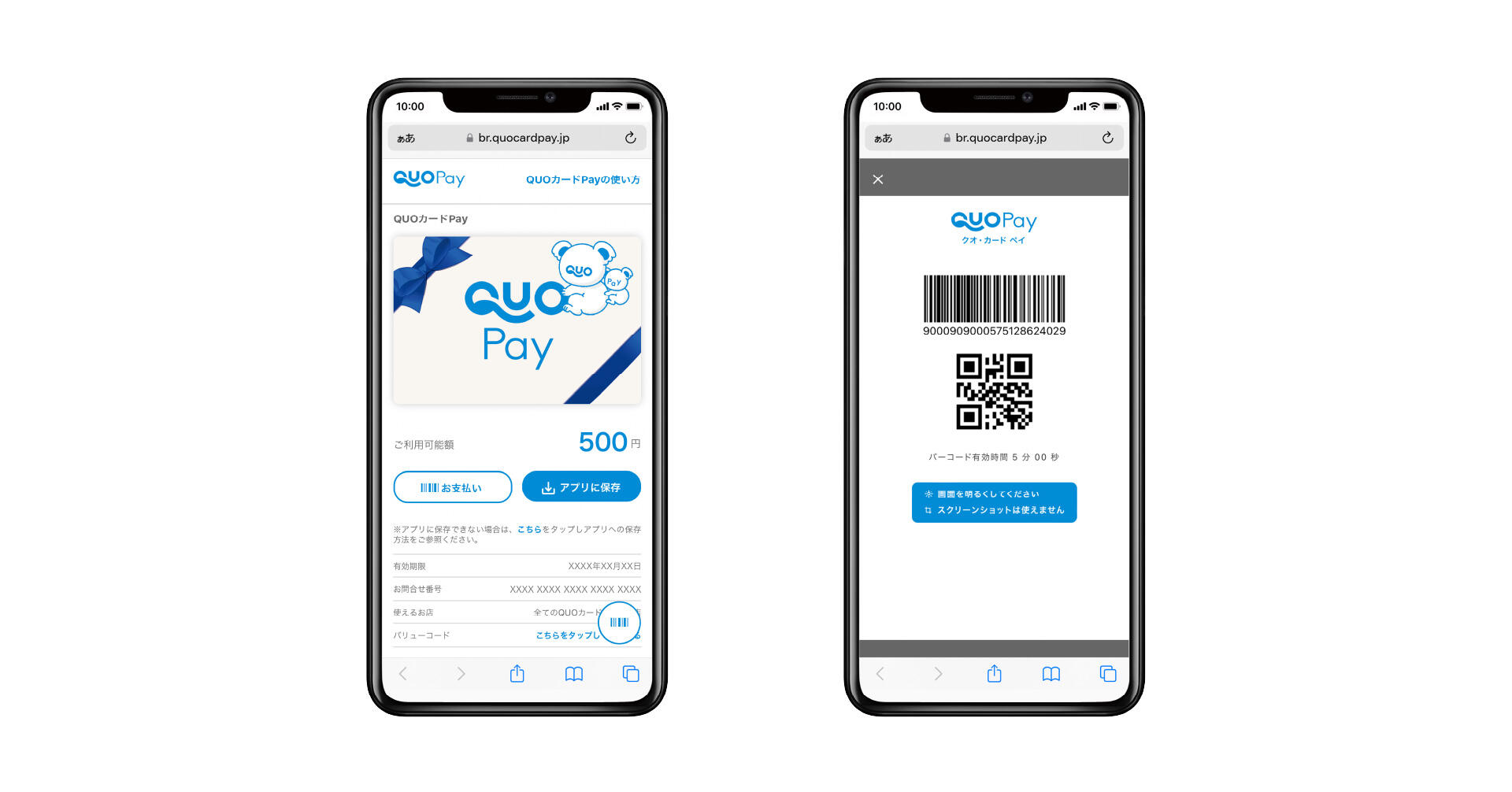

With "QUO CARD Pay", users can use the amount in their balance simply by tapping the URL sent by e-mail or SMS from the business operator or GMO-PG, and presenting the barcode displayed on the browser at the target merchant. Since there is no need for account information, membership registration, or installation of a dedicated app, it can be used by a wide range of users. Therefore, businesses can use it in a wide range of industries, regardless of business form, such as cashback for sales promotion campaigns and use it for marketing measures such as questionnaire rewards.

- (*1) Cashless Promotion Council "Cashless Roadmap 2024"

URL: https://paymentsjapan.or.jp/wp-content/uploads/2024/12/roadmap2024.pdf (December 25, 2024) - *2 For details on eligible merchants, please refer to the "Stores that can be used" page on the "QUO CARD Pay" website

URL: https://www.quocard.com/pay/store/

About QUO CARD Pay

(URL:https://www.quocard.com/pay/)"QUO CARD Pay" is a digital gift provided by QUO CARD Co., Ltd. that can be used and given on smartphones.

QUO CARD Co., Ltd. is the publisher of the "QUO Card" gift card, which boasts a recognition rate of 92.5% (*3) among general consumers QUO CARD Pay. The number of member stores is expanding to a wide range of genres such as fashion and gourmet.

No troublesome information registration! It can be used in 3 steps: "get", "open", and "show"

"QUO CARD Pay" does not require bank account registration, credit card information, name, email address, etc. Since there is no need to download a dedicated app, users can use it immediately after receiving it, and the shortfall can be used in conjunction with cash (*4).

The business operator only needs to send the "QUO CARD Pay" receipt URL by e-mail or SMS, so it can be issued in the shortest possible time.

- (*3) According to Quo Card research. Approximately 40,000 people nationwide are targeted. As of September 2023

- (*4) Some member stores may not be able to payment using cash in combination. For details, please refer to the "Stores that can be used" page on the "QUO CARD Pay" homepage

URL: https://www.quocard.com/pay/store/

【About "GMO-PG Remittance Service" 】

(URL:https://www.gmo-pg.com/service/soukin/)"GMO-PG Remittance Service" is a service for businesses that accurately and speedily respond to complicated operations caused by refund and remittances. By automatically systematizing by linking APIs and uploading files at once from the management screen (it is necessary to obtain information such as email addresses), complicated management work is eliminated, and efficient refund and remittances of businesses are realized. In addition, transfer and remittance fees can be provided at a lower cost than postal money orders and remittance counters of each financial institution. refund ・ There are four other ways to receive money including "Bank transfer", and businesses can refund and remit money in a way that suits the usage scene and user needs. If the operator has prepared multiple refund and remittance methods, the user can select the desired receiving method from the screen provided by the operator or GMO-PG.

"GMO-PG Remittance Service" is a Remittance Service based on the Funds Transfer Service provided by GMO-PG through Funds Transfer Service Provider registration (registration number: Kanto Local Finance Bureau License No. 00037). You can rest assured that the refund funds you receive will be protected in accordance with the Funds payment Act.

[Press Inquiries]

GMO Payment Gateway, Inc.

Corporate Value Creation Strategy Headquarters, Public Relations Department

- TEL

- +81-3-3464-0182

https://contact.gmo-pg.com/m?f=767

GMO Internet Group, Inc.

Group Public Relations Department PR Team Niino

- TEL

- +81-3-5456-2695

https://www.gmo.jp/contact/press-inquiries/

[Contact for inquiries regarding services]

GMO Payment Gateway, Inc.

Innovation Partners Division

Innovation Strategy Department

Business Development Group, Strategic Business Sales Department

- TEL

- +81-3-3464-2323

https://contact.gmo-pg.com/m?f=404

[GMO Payment Gateway, Inc.] (URL: https://www.gmo-pg.com/)

| Corporate Name | GMO Payment Gateway, Inc. (TSE Prime Market Securities Code: 3769) |

|---|---|

| Location | 1-2-3 Dogenzaka, Shibuya-ku, Tokyo Shibuya Fukurasu |

| Representative | President & Chief Executive Officer Issei Ainoura |

| Business Description | ■ Comprehensive payment related services and finance related services |

| Capital | 13,323 million yen |

【GMO Internet Group Inc.】 (URL: https://www.gmo.jp/)

| Corporate Name | GMO Internet Group Co., Ltd. (TSE Prime Market Securities Code: 9449) |

|---|---|

| Location | Cerulean Tower 26-1, Sakuragaoka-cho, Shibuya-ku, Tokyo |

| Representative | Representative Director and Group Representative Masatoshi Kumagai |

| Business Description | ■ Internet infrastructure business ■ Internet advertising / media business ■ Internet finance business ■ Cryptographic assets business |

| Capital | 5 billion yen |