May 8, 2018

Sumitomo Mitsui Financial Group, Inc.

GMO Payment Gateway, Inc.

Sumitomo Mitsui Financial Group, Inc. (our corporate group will hereinafter be referred to as "SMBC Group") and GMO Payment Gateway, Inc. (GMO-PG) have a history of working together, which includes partnership in e-commerce payment processing business on the back of the rapid expansion of online businesses. We are pleased to announce that we have started discussion on establishing of the "next generation payment platform" targeting operates that support cashless payments, aiming to provide high value-added services in the changing payment market.

【Overview】

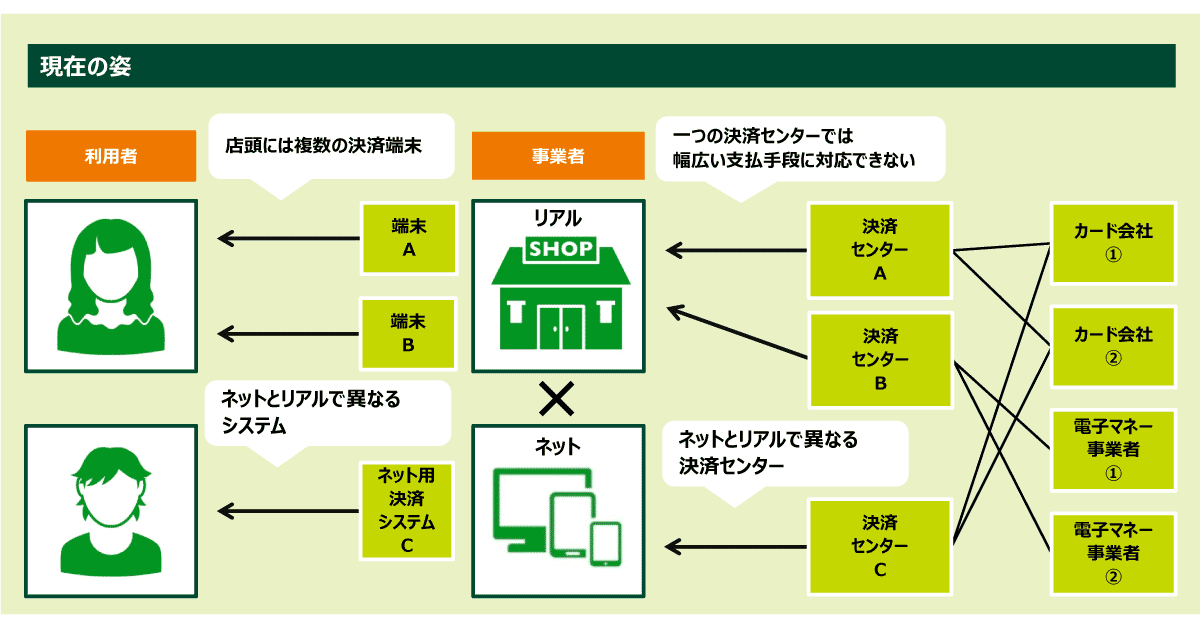

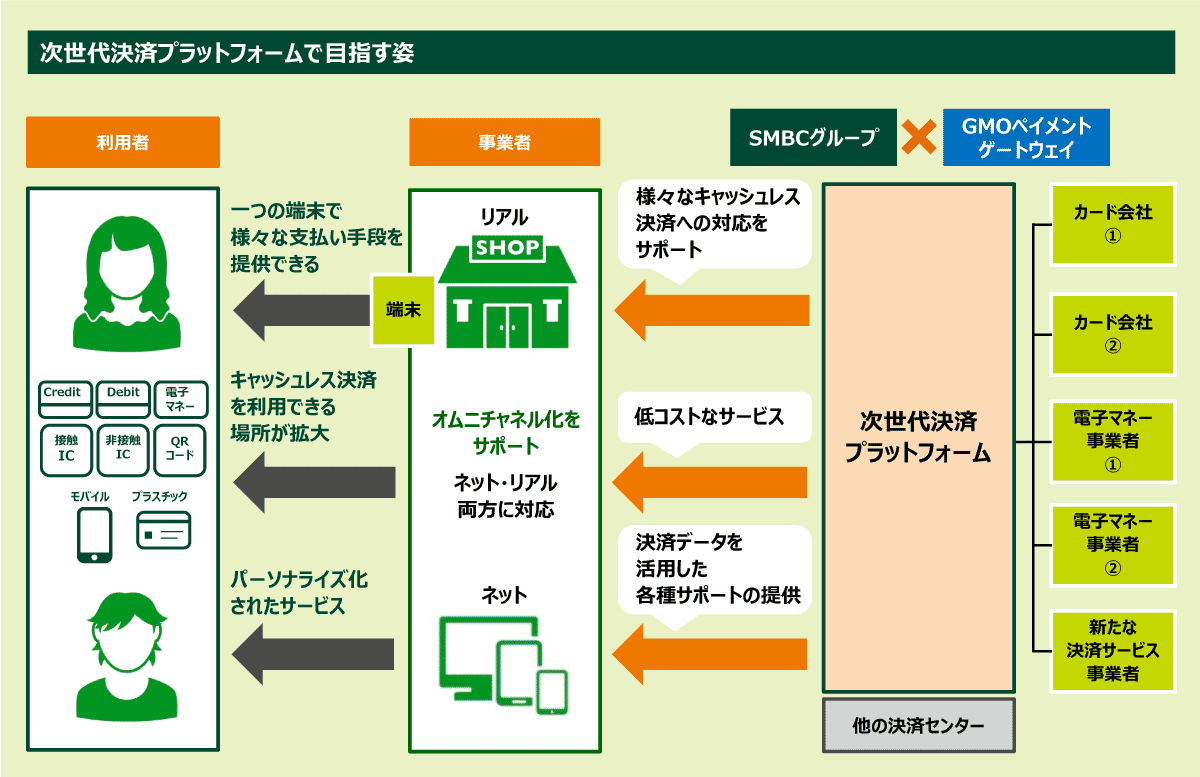

SMBC Group with an edge in card businesses and real world payments, and GMO-PG with an edge in online payments aim to collaborate to build a next-generation payment platform that comprehensively supports both online and real payments and covers various payment methods collectively and seamlessly under this initiative. The idea is to realize an environment in which business operators "just need to connect to a single payment platform to provide various payment methods that respond to various demands at low cost".

We will aim to quickly and flexibly support various payment methods that include emerging QR code payments and "Ginko Pay"*, let alone credit card, e-money, debit card and other traditional payment methods.

We will have intense discussions, and will make an announcement when we reach a basic agreement on the new business.

* Ginko Pay is an immediate direct-debiting service through a smartphone app that links to user's accounts at the banks that use the platform system provided by GMO-PG

【Diagram】

【GMO Payment Gateway】

GMO-PG offers comprehensive payment services and financial services to 86,136 merchants (as of December, 2017), including operators of online shops, operators who collect recurring monthly payments such as NHK, and public organizations such as National Tax Agency and Tokyo Metropolitan Government.

On top of its core payment-related services, the leading company in Japan's payment space provides value added services such as online advertising service that contributes to boost sales of merchants and a loan service which provides working capital to support merchant growth. Its transaction value has reached over 2.5 trillion yen per annum. The company is also expanding its business portfolio that includes solution business to financial institutions, overseas business based on capital alliances with overseas PSPs or payment companies, etc.

【Related Links】

- GMO-PG (Company Profile)

- URL :https://corp.gmo-pg.com/en/

- GMO-PG (Service)

- URL :https://www.gmo-pg.com/en/