2017年10月27日

報道関係各位

GMOペイメントゲートウェイ株式会社

GMOインターネットグループにおいて、総合的な決済関連サービス及び金融関連サービスを展開するGMOペイメントゲートウェイ株式会社(東証一部:証券コード 3769、代表取締役社長:相浦 一成 以下、GMO-PG)は、これまでEC事業者向け決済サービスの提供で培ったノウハウを活かし、金融機関・金融サービス事業者向けに決済ソリューションを一括提供する「GMO-PG プロセシングプラットフォーム」を、本日2017年10月27日(金)より提供開始いたします。

「GMO-PG プロセシングプラットフォーム」では、デビット・クレジット・プリペイド・ハウスカードの発行や加盟店管理・取引処理といった決済事業を展開する際に必要となる様々なシステム・機能をAPI(※)で提供いたします。銀行・カード会社等の金融機関や金融サービスを展開する事業者は、自社の事業展開に必要な決済ソリューションを選択でき、低コスト・短期間・簡単に新たな決済インフラの構築が可能です。また各ソリューションは一つの管理画面で一元管理できるため、運用面でも業務効率化が図れます。

(※)API(Application Programming Interface)とは、サービスやアプリケーションなどソフトウェア同士をつなぐための仕組み。

【背景と概要】

昨今、銀行をはじめとする日本の金融機関は、キャッシュレス社会を創出するべく、新たなビジネスの導入検討や、地方創生に向けた地域活性化を図るための取り組みなどを強化しております。また、新規参入が難しいとされてきた金融領域へ、FinTechという切り口で異なる事業領域から参入し、新しい金融サービスを展開する事例も増えてきております。

しかし、金融機関や金融サービス事業者が新規に事業を立ち上げる場合、事業開始までにスピード感が求められながらも、システムの構築や業務フローの確立に多くの投資や時間を要するのが現状です。

そこでGMO-PGは、これまでEC事業者向けの決済サービスの提供で培ってきた実績・ノウハウを活かし、金融機関や金融サービス事業者が、デビット・クレジット・プリペイド・ハウスカードの発行事業や加盟店契約管理・加盟店精算・カード取引処理の機能を要する加盟店事業といった、新たな決済事業の展開を行う際、低コスト・短期間・簡単に決済インフラを構築できるよう、各種決済ソリューションを一括提供する「GMO-PG プロセシングプラットフォーム」を提供開始いたしました。

【「GMO-PG プロセシングプラットフォーム」について】

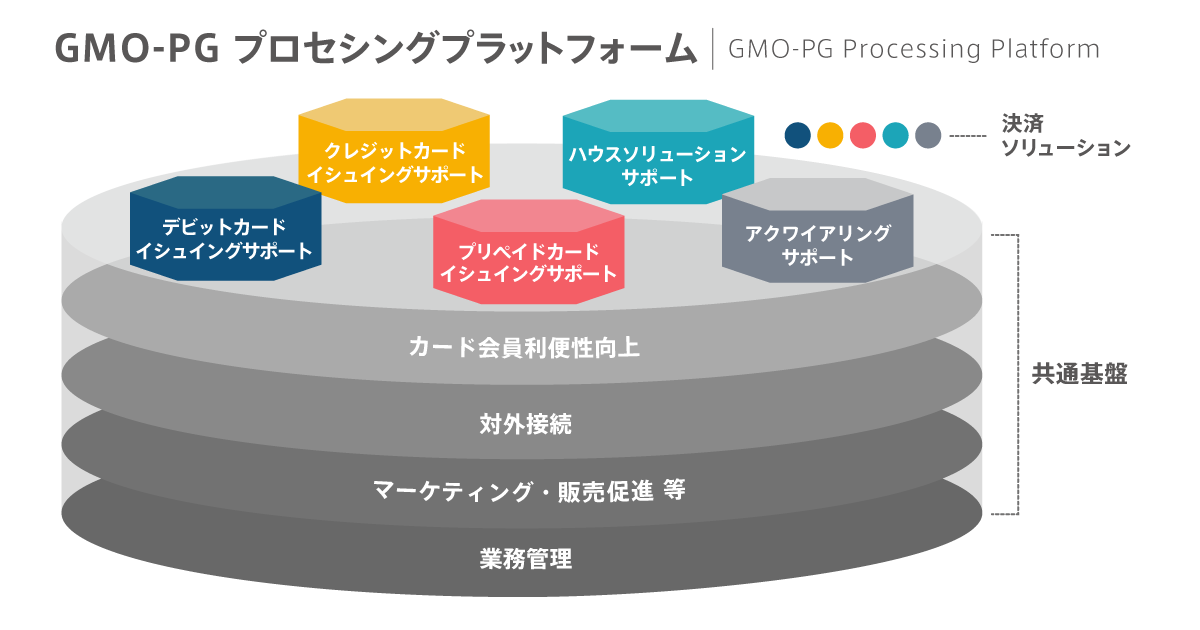

「GMO-PG プロセシングプラットフォーム」では、対面・非対面(EC)を問わず、各種決済処理に対応した、以下5つの決済ソリューションを一括して提供いたします。また、決済事業に付帯する各種業務管理や、対外接続できる共通基盤もご用意しております。

金融機関や金融サービス事業者は、自社の事業展開に必要な決済ソリューション・共通基盤を自由に選んでご利用いただくことが可能です。各ソリューションはAPIで提供するため、低コスト・短期間・簡単に決済インフラの構築を実現することができます。なお、各ソリューションは一つの管理画面で一元管理可能なため、業務の効率化が図れます。

■決済ソリューション

| 1)デビットカードイシュイング*1サポート | 国際ブランド付きのデビットカードの発行およびその取引処理に必要な機能をAPIで提供。 バーチャルカード発行・即時発行・法人カード発行などご要望に応じた対応が可能。 【主な機能】 ・会員管理:申込受付・カード発行、会員マスタ管理、カード会員向けWEBページ(利用条件設定・利用履歴確認等) ・取引管理:オーソリゼーション*2・売上処理、オーバードラフト*3対応、代行オーソリゼーション |

|---|---|

| 2)クレジットカードイシュイングサポート | 国際ブランド付きのクレジットカードの発行およびその取引処理に必要な機能をAPIで提供。 金融機関の既存システムと連携し、スピーディーにクレジットカード発行システムの導入を実現。 【主な機能】 ・会員管理:申込受付・カード発行、会員マスタ管理、カード会員向けWEBページ(利用条件設定・利用履歴確認等) ・取引管理:オーソリゼーション・売上処理、与信枠管理、延滞・遅延損害金管理 |

| 3)プリペイドカードイシュイングサポート | 国際ブランド付きのプリペイドカードの発行およびその取引処理に必要な機能をAPIで提供。 クレジットカード・コンビニ等での各種チャージ対応やポイント連携対応、アプリケーション対応が可能。 【主な機能】 ・会員管理:申込受付・カード発行、会員マスタ管理、カード会員向けWEBページ(利用履歴・残高確認等) ・取引管理:オーソリゼーション・売上処理、残高管理、オーバードラフト対応 |

| 4)ハウスソリューションサポート | 国際ブランドの付帯がないハウス式*4のクレジットカード・プリペイドカードの発行、加盟店管理およびその取引処理を行うにあたり必要な機能をAPIで提供。 【主な機能】 ・会員管理 :申込受付・カード発行、会員マスタ管理、カード会員向けWEBページ(利用条件設定・利用履歴確認等) ・取引管理 :取引データ処理、取引マスタ管理、与信枠・残高管理、不正検知 ・加盟店管理:加盟店マスタ管理、加盟店精算用レポート作成、加盟店向けWEBページ(精算情報・個別取引照会*5) |

| 5)アクワイアリング*6サポート | 加盟店契約管理、加盟店精算業務、各種カードの決済電文処理を行うにあたり必要な機能をAPIで提供。 【主な機能】 ・加盟店管理:加盟店マスタ管理、加盟店精算用レポート作成、加盟店向けWEBページ(精算情報・個別取引照会) ・取引管理 :オーソリゼーション・売上処理、国際ブランド処理、不正検知、動的途上与信*7 |

■共通基盤

| カード会員利便性向上 | カード会員の利便性向上・利用活性化につながるスマートフォンアプリ・WEBページ(利用条件設定、利用履歴確認、口座明細閲覧等)の提供 |

|---|---|

| 対外接続 | 金融機関、国際ブランド、FinTech企業とのAPIや決済ネットワークを通じた接続 |

| マーケティング・販売促進等 | CLO*8・ポイント・クーポンを活用したマーケティングの支援や動的途上与信、不正検知対応 |

| 業務管理 | データベースの保有(会員データ・加盟店データ・各種取引データ)、取引閲覧、各種精算用レポートの作成 |

| *1 | イシュイング: カード会員の募集およびカード発行を行い、カード会員向けにサービス提供とカード利用代金の請求を行う業務のこと |

| *2 | オーソリゼーション: 利用されるカードの有効性確認(解約・紛失等の確認)、口座残高(デビットカード)・利用限度枠(クレジットカード)・チャージ残高(プリペイドカード)内の取引確認等の与信照会を行うこと |

| *3 | オーバードラフト: 銀行口座残高やプリペイドのチャージ残高を超過した利用のこと |

| *4 | ハウス式: カード発行企業が契約している加盟店内での利用に限定されること |

| *5 | 個別取引照会: 取引一件ごとの取引内容の照会のこと |

| *6 | アクワイアリング: 加盟店募集を行い、その加盟店の契約管理及び精算、カード取引の決済処理を行う業務のこと |

| *7 | 動的途上与信: 加盟店にて発生するカード取引の状況から、不正取引が行われていないか判断すること |

| *8 | CLO: Card Linked Offerの略で、カード会員一人ひとりの属性情報や取引履歴等に基づいて、クーポンやポイント等の優待を提供するサービスのこと |

【GMOペイメントゲートウェイ株式会社について】

GMO-PGは、ネットショップやデジタルコンテンツなどのオンライン事業者、NHKや定期購入など月額料金課金型の事業者、並びに国税庁や東京都等の公的機関など8万8,425店舗(GMO-PGグループ2017年6月末現在)の加盟店に総合的な決済関連サービスを提供しています。

決済サービスを中心に、加盟店の売上向上に資するWeb広告サービス等の付加価値サービスや、加盟店の成長を資金面からサポートする融資等の金融関連サービスの提供、海外決済サービスの提供をはじめとする海外事業などを行い、年間決済処理金額は約2兆円を超えております。

GMO-PGは、消費者と事業者にとって安全性が高く便利な決済を実現し、決済プロセスのインフラになることを目指しています。今後も決済業界のリーディングカンパニーとして、FinTechなど新たなイノベーションを牽引し、日本のEC化率の向上に貢献してまいります。

【関連URL】

- GMO-PG コーポレートサイト

- URL : https://corp.gmo-pg.com/

- GMO-PG サービスサイト

- URL : https://www.gmo-pg.com/

【報道関係お問い合わせ先】

GMOペイメントゲートウェイ株式会社 企業価値創造戦略 統括本部

- TEL

- 03-3464-0182

- FAX

- 03-3464-2387

- pr@gmo-pg.com

GMOインターネット株式会社 グループ広報・IR部 石井・島田

- TEL

- 03-5456-2695

- pr@gmo.jp

【サービスに関するお問い合わせ先】

GMOペイメントゲートウェイ株式会社 イノベーション・パートナーズ本部

- TEL

- 03-3464-2323

- FAX

- 03-3464-2477

- info@gmo-pg.com

【GMOペイメントゲートウェイ株式会社】(URL: https://corp.gmo-pg.com/ )

| 会社名 |

GMOペイメントゲートウェイ株式会社 (東証第一部 証券コード:3769) |

|---|---|

| 所在地 | 東京都渋谷区道玄坂1丁目14番6号 ヒューマックス渋谷ビル |

| 代表者 | 代表取締役社長 相浦 一成 |

| 事業内容 | ■総合的な決済関連サービス及び金融関連サービス |

| 資本金 | 47億1,200万円 |

【GMOインターネット株式会社】(URL: https://www.gmo.jp/ )

| 会社名 | GMOインターネット株式会社(東証第一部 証券コード:9449) |

|---|---|

| 所在地 | 東京都渋谷区桜丘町26番1号 セルリアンタワー |

| 代表者 | 代表取締役会長兼社長・グループ代表 熊谷 正寿 |

| 事業内容 | ■インターネットインフラ事業 ■インターネット広告・メディア事業 ■インターネット金融事業 ■モバイルエンターテイメント事業 |

| 資本金 | 50億円 |