2016年8月30日

報道関係各位

GMOペイメントゲートウェイ株式会社

GMOインターネットグループで総合的な決済関連サービス及び金融関連サービスを展開するGMOペイメントゲートウェイ株式会社(東証一部:証券コード 3769、代表取締役社長:相浦 一成 以下、GMO-PG)は、2016年8月30日(火)、マレーシアでモバイル決済・認証・ノーティフィケーション(*1)を一括提供する、MACRO KIOSK Berhad(Goh Chee Ken, CEO 以下、MacroKiosk(マクロキオスク)社)の株式を取得することで合意し、グループ化することといたしました。

MacroKiosk社は、大手銀行・航空会社・コンテンツ会社等に対して、複数のモバイルキャリアとの接続環境や、24時間運用の決済・認証・ノーティフィケーションを一括提供する世界最大級(*2)の企業です。今後GMO-PGは、MacroKiosk社とのシナジーを発揮し、日本のEC事業者における海外進出支援から、東南アジアでの現地銀行・大手企業への決済サービス等の提供まで、東南アジアにおける事業を拡大してまいります。

(*1)ノーティフィケーション:「通知」の意味で、ネットバンキングでの入出金連絡やECサイトの利用履歴など、アクションが生じた際にユーザーのモバイル端末に通知するサービスを指す

(*2)当社調べ

【背景と概要】

マレーシアは、2015年時点で人口3,000万人超、実質GDP成長率は約5%にのぼり、1人当たりのGDP(USドル)は9,766ドル超とASEAN諸国の中でシンガポール、ブルネイに続く3位に入るなど、現在東南アジアで最も活況があり注目されている国の一つです(*3)。

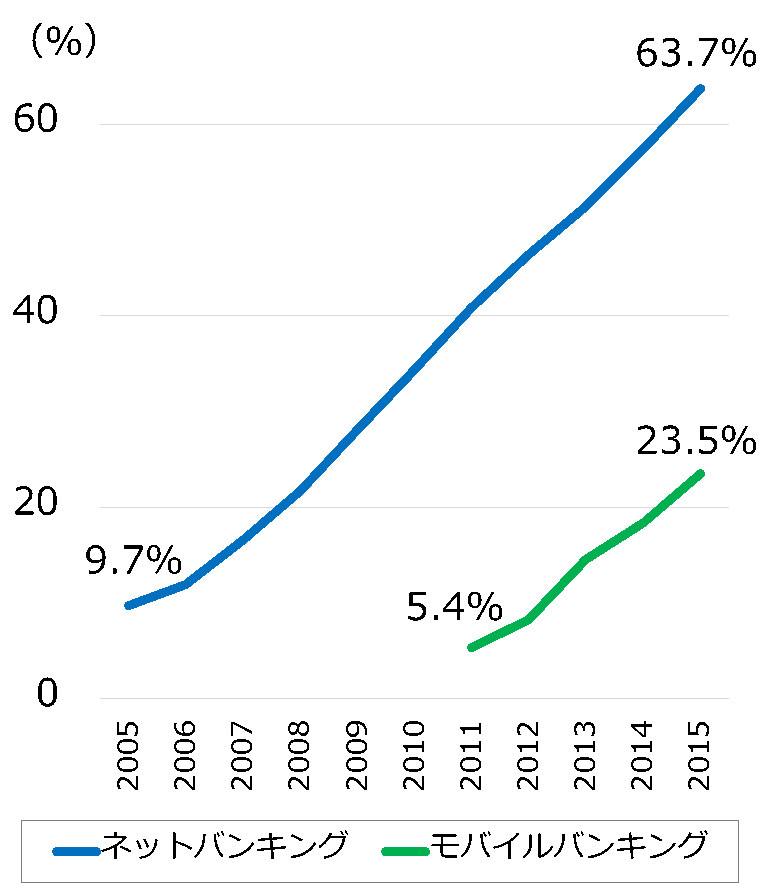

また、マレーシアのネットバンキング普及率は、この10年間で約10%(2005年)から60%を超える(2015年)までになり、近年では、モバイルバンキングの普及も急速に進み、普及率は2011年の約5%から2015年には20%超と伸びるなど、東南アジアの中でも先進的なネットバンキング普及国となっています(*4)。このような中、マレーシアの銀行にとっては、「ネットバンキング・モバイルバンキングサービスを安全・効率的に24時間運用する」ことが重要な課題の一つです。

MacroKiosk社は、こうした課題の解決に必須となる、複数のモバイルキャリアとの接続環境・24時間認証・ノーティフィケーションのノンストップ運用を、サブスクリプションモデル(継続課金)で提供しています。更に、大手航空会社やコンテンツ提供会社に対しても、同様のモバイルキャリア決済・認証・ノーティフィケーションを一括提供しており、本分野では世界最大級の企業となっています。

一方GMO-PGは、シンガポール・香港・台湾・マレーシア・タイの5拠点に現地法人等を設立し、同地域またはその周辺地域に進出する日本のEC事業者向けの海外決済サービス「Z.com Payment」の展開と、現地で有望な決済関連事業者を対象とした決済特化型のファンド「GMO Global Payment Fund」による出資活動の両輪で、シナジーを発揮させながらアジア圏の事業拡大を推進しています。

このたびGMO-PGは、日本のEC事業者の海外進出支援のみならず、東南アジアでの現地銀行・大手企業への決済サービス等の提供へも事業領域を拡げるべく、MacroKiosk社の株式を取得し、グループ化することといたしました。

▼ネットバンキング・モバイルバンキング普及率(マレーシア)(*4)

今後の展開について

今後は、MacroKiosk社のアジア全域における高いプレゼンス・顧客基盤・サービス・人材基盤と、GMO-PGが日本の決済ビジネスで20年以上培ってきた実績・知見・資金力等との相乗効果で、東南アジア全域において様々な決済サービス展開を目指してまいります。

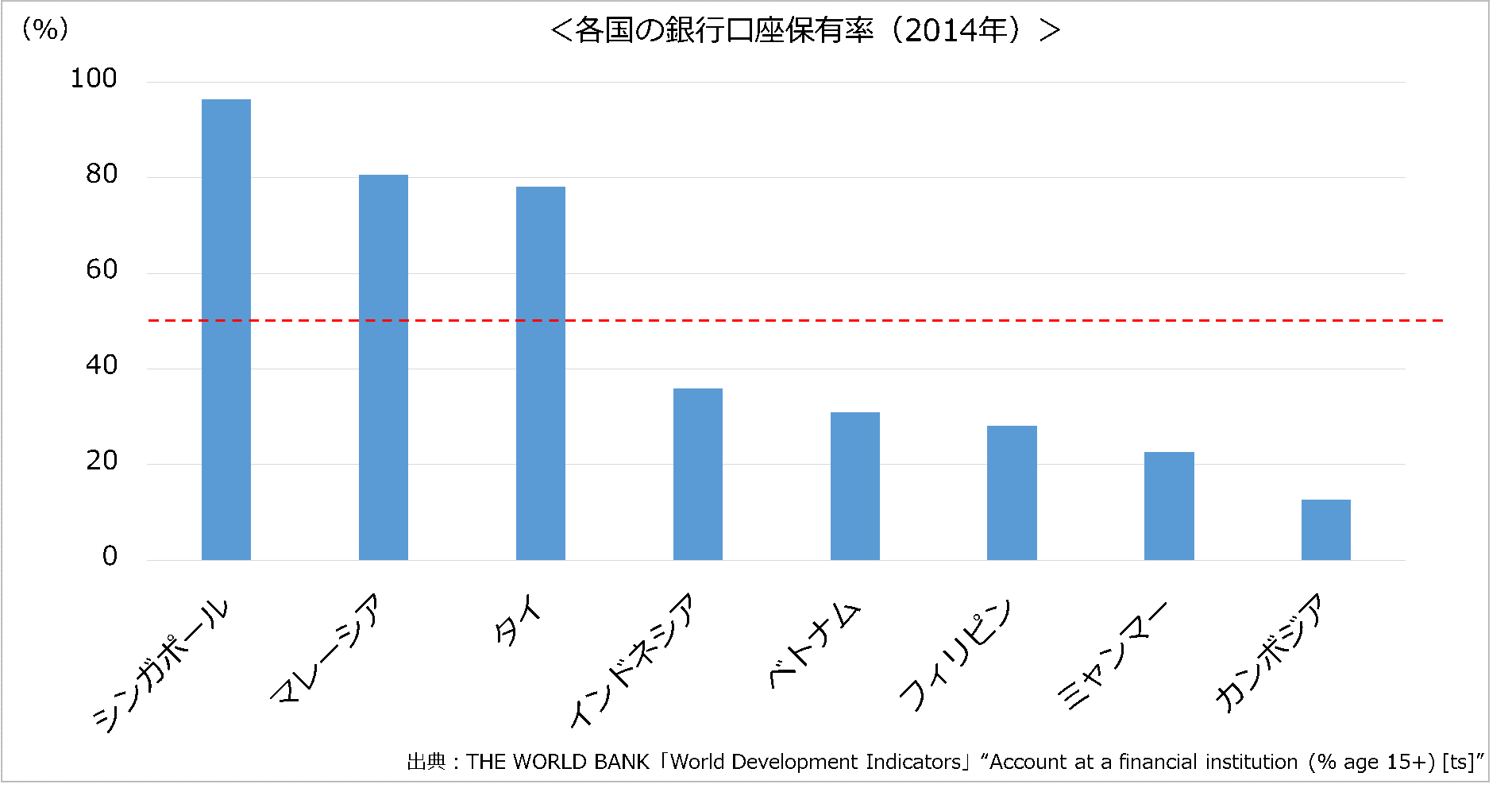

まずは、銀行口座保有率が50%以下(*3)と低いものの、モバイルデバイスの普及が進むインドネシア・ベトナム・フィリピンといった東南アジア地域において、今後のモバイルバンキングの急速な利用増加を見込み、MacroKiosk社の銀行向けサービスを展開いたします。これにより、東南アジア諸国におけるモバイルバンキングの普及と、オンライン決済環境の健全な発展に貢献してまいります。

(*3)出典:THE WORLD BANK「World Development Indicators」

"Population, total/GDP growth (annual %)/GDP per capita (current US$)/Account at a financial institution (% age 15+) [ts]" 最終更新:2016年8月10日

(*4)出典:FINANCIAL STABILITY AND PAYMENT SYSTEMS REPORT 2009,2014,2015

【MACRO KIOSK Berhadについて】

MacroKiosk社は2000年に設立され、銀行・企業向けSMSモバイルソリューション・キャリア課金代行を軸としたビジネスを展開するアジア最大手の企業です。アジア、中東に渡る12カ国・地域に拠点を持ち、世界37カ国、18業種、2,000社以上のクライアント向けにモバイル決済・認証・ノーティフィケーションのサービスを一括提供しております。

また、世界で最も革新的なテクノロジー・ベンチャー企業100社を選出するアワード『Red Herring Top 100 Global』の受賞や、ISO27001 ISMS認証を取得など、国際的に認知された団体・組織からの表彰・認証も受けております。

クライアント業種:

大手銀行や金融機関、航空会社、格安航空会社、コンテンツプロバイダー、ホテルやリゾートなどの総合施設、衛星通信や放送事業者、およびアジア地域の類似多国籍企業と多岐に渡るクライアントにサービス提供しております。

ビジネス展開拠点:

オーストラリア | 中国 | 香港 | インドネシア | マカオ | マレーシア | フィリピン | シンガポール | 台湾 | タイ | アラブ首長国連邦| ベトナム

MacroKioskサイトURL:

www.macrokiosk.com/| 名称 | MACRO KIOSK Berhad |

|---|---|

| 所在地 | The Troika, Tower B, Level 3 19, Persiaran KLCC 50450 Kuala Lumpur, Malaysia |

| 代表者の役職・氏名 | Chief Executive Officer・Goh Chee Ken |

| 事業内容 | SMSモバイルソリューション事業 キャリア課金事業 |

| 資本金 | 5百万 マレーシアリンギット(約125百万円) (1マレーシアリンギット=25円で換算) |

| 設立年月日 | 2000年7月1日 |

【GMOペイメントゲートウェイ株式会社について】

GMO-PGは、ネットショップやデジタルコンテンツなどのオンライン事業者、NHKや定期購入など月額料金課金型の事業者、並びに日本年金機構や東京都等の公的機関など7万2,569店舗(GMO-PGグループ2016年6月現在)の加盟店に総合的な決済関連サービスを提供しています。

決済サービスを中心に、加盟店の売上向上に資するweb広告サービス等の付加価値サービスや、加盟店の成長を資金面からサポートする融資等の金融関連サービスの提供、海外決済サービスの提供をはじめとする海外事業などを行い、年間決済処理金額は1.8兆円を超えています。

GMO-PGは、消費者と事業者にとって安全性が高く便利な決済を実現し、決済プロセスのインフラになることを目指しています。今後も決済業界のリーディングカンパニーとして、FinTechなど新たなイノベーションを牽引し、日本のEC化率の向上に貢献してまいります。

関連URL

- GMO-PG コーポレートサイト

- URL : http://corp.gmo-pg.com/

- GMO-PG サービスサイト

- URL : http://www.gmo-pg.com/

報道関係お問い合わせ先

GMOペイメントゲートウェイ株式会社 企業価値創造戦略 統括本部

- TEL

- 03-3464-0182

- FAX

- 03-3464-2387

- ir@gmo-pg.com

GMOインターネット株式会社 グループ広報・IR部 石井・島田

- TEL

- 03-5456-2695

- pr@gmo.jp

【GMOペイメントゲートウェイ株式会社】(URL: https://corp.gmo-pg.com/ )

| 会社名 |

GMOペイメントゲートウェイ株式会社 (東証第一部 証券コード:3769) |

|---|---|

| 所在地 | 東京都渋谷区道玄坂1丁目14番6号 ヒューマックス渋谷ビル |

| 代表者 | 代表取締役社長 相浦 一成 |

| 事業内容 | ■総合的な決済関連サービス及び金融関連サービス |

| 資本金 | 47億1,200万円 |

【GMOインターネット株式会社】(URL: https://www.gmo.jp/ )

| 会社名 | GMOインターネット株式会社(東証第一部 証券コード:9449) |

|---|---|

| 所在地 | 東京都渋谷区桜丘町26番1号 セルリアンタワー |

| 代表者 | 代表取締役会長兼社長・グループ代表 熊谷 正寿 |

| 事業内容 |

■インターネットインフラ事業 ■インターネット広告・メディア事業 ■インターネット証券事業 ■モバイルエンターテイメント事業 |

| 資本金 |

50億円 |