2015年3月6日

報道関係各位

GMOイプシロン株式会社

GMOインターネットグループでGMOペイメントゲートウェイ株式会社の連結会社であるGMOイプシロン株式会社(本社:東京都渋谷区、代表取締役社長:新井 悠介 以下GMO-EP)は、EC事業者様向けのオンライン融資サービス「GMOイプシロン トランザクションレンディング」を、2015年3月5日(木)より開始いたしました。

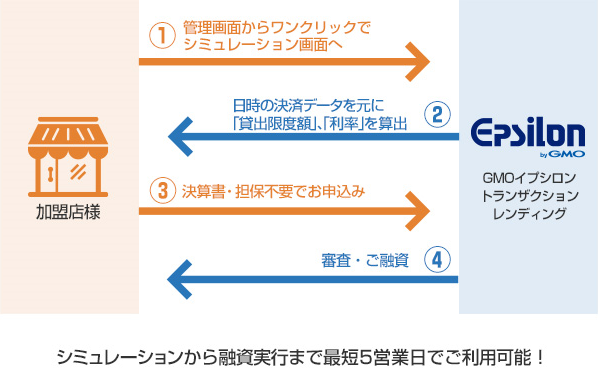

「GMOイプシロン トランザクションレンディング」は、EC事業者の日次の決済データをもとにGMO-EPが与信判断を行い、お問い合わせから最短5営業日で融資が可能な、決済代行業界初のオンライン融資サービスです。GMO-EPの決済代行サービスをご利用のEC事業者は、貸出限度額と利率をワンクリックで算出し、融資条件を確認したうえでお申し込みを行うことができます。

【背景】

近年、日本国内のEC市場規模は、サブスクリプションコマース(定期購入)やインスタントカート、CtoC(個人間の売買取引)など、サービスの多様化を背景に、2013年時点で前年比17.4%増の11.2兆円(*1)と急激な成長を続けています。また、中小企業や個人事業主のEC事業への参入も増加しており、今後はEC事業者間での差別化や、新規参入の足がかりとなる迅速な資金調達に対する需要が高まることが予測されます。

しかしながら、現在の日本国内の法人向け融資は、決算書の提出や担保が必要となるうえ、審査に数週間かかることが一般的なため、迅速な資金調達を求めるEC事業者が融資を受けづらい状況にあります。

一方、海外ではEC事業者の成長資金をサポートするため、ECマーケットプレイスへの出店データや商業統計、企業のソーシャルプロフィールなどを利用して信用力の査定を行う新たなオンライン融資サービスが立ち上がり、融資を受けやすい環境が整ってきております。

このような背景のもと、GMO-EPは、日本のEC事業者に対して迅速な資金調達を実現する、オンライン融資サービス「GMOイプシロン トランザクションレンディング」を開始いたしました。GMO-EPは、担保・保証人不要の融資を実施し、EC事業者の成長をサポートしてまいります。

(*1) 出典:経済産業省「平成25年度電子商取引に関する市場調査」

【「GMOイプシロン トランザクションレンディング」について】

「GMOイプシロン トランザクションレンディング」は、申し込みから最短5営業日で融資が可能なオンライン融資サービスです。GMO-EPの決済代行サービスをご利用のEC事業者に対して、日次の決済データをもとに独自の審査を行うため、お申し込み時に決算書や担保、保証人をご用意する必要はありません。また返済は、申し込みの翌月以降に決済代行サービスを通じてEC事業者に入金される売上金額から、自動で返済される仕組みのため、EC事業者は金融機関に足を運ぶ必要なく、返済漏れの心配をせずに安心して融資サービスを受けることができます。

なお、貸金業法上の貸出の上限金利は15.0%~20.0%ですが、本サービスは最高でも12.0%(年率)のため、小口融資においても低金利でご利用いただくことが可能です。

今後、GMO-EPは、更なるサービスの拡充とEC事業者の円滑なキャッシュフローをサポートしてまいります。

<「GMOイプシロン トランザクションレンディング」のフローイメージ>

<サービス概要>

| ご融資対象 | GMO-EPの決済サービスを利用している法人のEC事業者(*2) |

|---|---|

| ご融資額 | 30万円~5,000万円 |

| 貸出利率 | 3.5%~12.0%(年率) |

| 返済の方式 | 元利均等返済(*3) |

| 返済期間/返済回数 | 6ヶ月(6回~12回) |

| 遅延損害金 | 20.0%(年率) |

| URL | http://www.epsilon.jp/service/lending.html |

(*2)今後は、個人のEC事業者も融資対象となるよう検討中です。

(*3)毎月同額の返済を行う一般的な返済方法。

【金利1%優遇キャンペーンについて】

「GMOイプシロン トランザクションレンディング」のサービス開始を記念して、金利が1%引きとなるキャンペーンを実施いたします。

| 申込期間 | 2015年3月5日(木)~2015年3月31日(火) |

|---|---|

| 対象 | 申込期間内に「GMOイプシロン トランザクションレンディング」をお申し込みいただいたEC事業者(*4) |

| 概要 | 「GMOイプシロン トランザクションレンディング」において、EC事業者の日次の決済データをもとにした与信判断で算出される年利が1%引きとなります。 |

(*4)「GMOイプシロン トランザクションレンディング」のお申し込みには、別途GMO-EPの決済代行サービスの法人契約が必要となります。

【GMOイプシロン株式会社について(URL: http://www.epsilon.jp/ )】

GMO-EPは、初期費用やトランザクション処理料(*5)が無料の決済代行サービスを提供する事業者です。2014年12月末時点で、2万7,122店舗にのぼるEC事業者にご利用いただいております。

GMO-EPとご契約いただくだけで、決済業者ごとにシステムを構築する必要なく、「イプシロン」のクレジットカード決済からコンビニ決済、ウォレット決済、スマートフォンキャリア決済等、さまざまな決済手段及び配送サービスを一括で利用することができるほか、購入者から回収した商品代金や配送の運賃精算も一括して行うため、手間やコストを大幅に省くことが可能です。また、東証一部上場企業であるGMOインターネットグループの一員であり、システムのセキュリティ基準はPCIDSSとISMSに準拠するなど、EC事業者が安心してご利用いただける環境となっております。

(*5) トランザクション処理料とは、クレジットカードのオーソリゼーション(承認番号取得)や請求等で、クレジットカード会社との通信ごとにかかる料金。

報道関係お問い合わせ先

GMOペイメントゲートウェイ株式会社 企業価値創造戦略 統括本部 IR・広報グループ

- TEL

-

03-3464-0182

- FAX

-

03-3464-2387

- ir@gmo-pg.com

GMOインターネット株式会社 グループ広報・IR部 石井・島田

- TEL

-

03-5456-2695

- FAX

-

03-3780-2611

- pr@gmo.jp

サービスに関するお問い合わせ先

GMOイプシロン株式会社

- TEL

-

03-3464-6211

- FAX

-

03-6415-6756

- support@epsilon.jp

【GMOイプシロン株式会社】(URL: http://www.epsilon.jp/ )

| 会社名 |

GMOイプシロン株式会社 |

|---|---|

| 所在地 | 東京都渋谷区道玄坂1丁目14番6号 ヒューマックス渋谷ビル |

| 代表者 | 代表取締役社長 新井 悠介 |

| 事業内容 | ■オンライン販売の決済代行、代金回収代行及びそれらに付帯する業務 |

貸金業登録番号:東京都知事(1)31557号

【GMOペイメントゲートウェイ株式会社】(URL: http://corp.gmo-pg.com/ )

| 会社名 |

GMOペイメントゲートウェイ株式会社 (東証第一部 証券コード:3769) |

|---|---|

| 所在地 | 東京都渋谷区道玄坂1丁目14番6号 ヒューマックス渋谷ビル |

| 代表者 | 代表取締役社長 相浦 一成 |

| 事業内容 | ■クレジットカード等の決済代行サービス及び付帯するサービス |

貸金業登録番号:東京都知事(3)30802号

【GMOインターネット株式会社】(URL: http://www.gmo.jp/ )

| 会社名 | GMOインターネット株式会社(東証第一部 証券コード:9449) |

|---|---|

| 所在地 | 東京都渋谷区桜丘町26番1号 セルリアンタワー |

| 代表者 | 代表取締役会長兼社長・グループ代表 熊谷 正寿 |

| 事業内容 |

■インターネットインフラ事業 |