payment Basics

Article published:

Account transfer Thorough explanation of the introduction procedures and precautions! Recommended services are also introduced

Key points of this article

- Account transfer prevents collection omissions with automatic withdrawal. The best payment for streamlining your billing operations

- The introduction is a direct contract with financial institution or the use of an agency. If you want to introduce it all at once without hassle payment processing company

- Paperless and web-based completion is also possible. Recommended for regular billing such as subscriptions and monthly fees

INDEX

Account transfer is a payment service that automatically debits fees from a customer's bank account. For businesses with regular payment, it can help streamline billing operations and reduce the risk of non-collection.

In this article, we will explain the differences between Account transfer and direct transfer, the steps to implement Account transfer, and what to keep in mind when introducing it.

What is Account transfer?

Account transfer is a payment service where financial institution automatically debits a customer's bank account and transfers it to a business's account. It is widely used for regular payment, such as utility charge, mobile phone bills, and subscription services.

Once the process is completed, the payment will automatically continue thereafter, greatly reducing customer effort. It is also an advantage for businesses to reduce the burden of work such as issuing invoice and confirming payments each time.

You can also read more about Account transfer in the following articles:

What is Account transfer? Explanation of the difference and mechanism from transfer

Difference Between Account transfer and Account Transfer

Account transfer and direct transfer are both payment methods using a bank account, but there are some differences in how they work:

Account transfer automatically continues payment in a single process, whereas in account transfers, the customer must complete the transfer process each time. Also, the person who pays the fee is different. In Account transfer, the business bears the fees, while in account transfers, the customer typically bears the transfer fee.

Account transfer prevents customers from forgetting their payment, making it suitable for businesses that require regular fee collection. It eliminates the hassle of customers going through the direct payment process, making it a convenient payment method.

There are two ways to introduce Account transfer

There are two ways to deploy Account transfer: financial institution and direct contract, and you can use a payment processing company company. Here we will explain the characteristics of each and how to choose one.

Pattern 1: How to contract directly with financial institution

One way to deploy Account transfer is to contract directly with financial institution. The advantage of relatively low transfer fees makes it an attractive option for businesses looking to keep costs down.

However, there is also a disadvantage that the administrative burden increases if you need to deal with multiple financial institution. The process is complicated, but if you have a high number of transactions and often use a specific financial institution, you may experience cost benefits.

Pattern 2: How to use payment processing company company

Another way to implement Account transfer is to use a payment processing company company. payment processing company is a way to contract with multiple financial institution at once through your company. The payment processing company company handles multiple financial institution in one go, significantly reducing the administrative burden. It also has the advantage of unified payment management and the ability to introduce other payment method such as Credit card payment at the same time.

There are no initial or monthly fees, and there are services that only pay payment fees, so the hurdles to introduction are not high. Another major advantage is that we have a full support system and can receive support from screening to operation after implementation.

How to choose the method of introduction

When choosing a Account transfer implementation method, it's important to consider the size of your company, the number of transactions, and the number of financial institution you want to address. If only a few financial institution are sufficient, direct contract is enough, and if you need to deal with multiple financial institution, payment processing company company is the way to go. And if you might be introducing other payment method in the future, you may want to consider using a payment processing company company.

The "PG Multi-Payment Service" provided by GMO Payment Gateway, Inc. (hereinafter referred to as GMO-PG) supports a wide range of payment method and has an implementation support system in place. With a payment foundation with high processing capacity and speed, we help you grow your business.

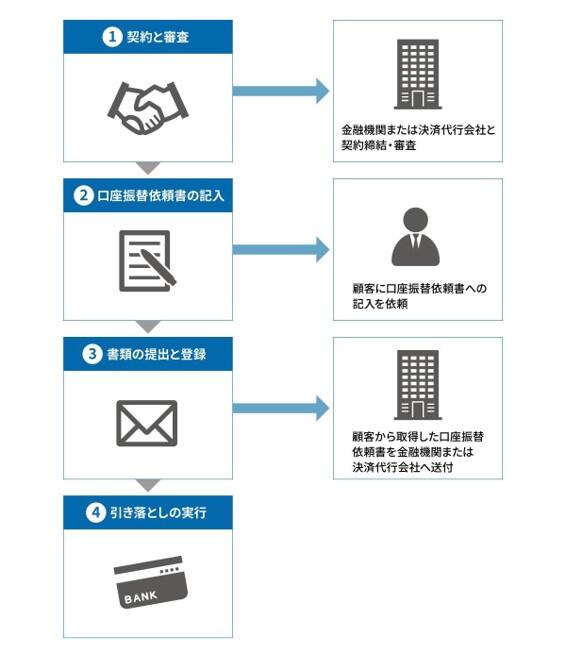

Account transfer Implementation Steps

When deploying Account transfer, there are a few steps you need to take. Here's a step-by-step guide to general Account transfer deployment.

1. contract and Screening

First, you need to sign a contract with a financial institution or payment processing company company and undergo an audit. The screening period can take anywhere from a few weeks to a month, so it is important to have a schedule with plenty of time to spare. The required documents and screening criteria vary depending on the financial institution or payment processing company company, so be sure to check in advance.

2. Account transfer Filling out the request form

Once the contract is complete, ask the customer to fill out the Account transfer request form. You will need information such as bank name, branch name, account number, account name, and notification stamp. Requests are generally submitted on paper in a photocopying format, but there are also agency services that support going online.

In "PG Multi-Payment Service", you can use two application methods: the transfer request form type (debit account registration by paper application) and the Internet complete type (debit account registration by online application). Online application does not require a transfer request form or a seal.

3. Submission and Registration of Documents

Check the Account transfer request form you get from your customer for any inaccuracies and send it to your financial institution or payment processing company company. Send the necessary documents so that the start of the withdrawal is not delayed.

After completing the registration, the first withdrawal date will be confirmed, so don't forget to inform the customer.

4. Execute and confirm the debit

Once registered, it will be debited from the client's account on the specified date. Check the withdrawal result a few days after the transfer date. If the debit failed, you will need to set up a retransfer or contact the customer.

Considerations when implementing Account transfer

There are a few things to keep in mind to ensure a smooth and effective use of Account transfer. Let's take a look at the specifics.

Integration with other payment method and centralized management

When you deploy Account transfer, it's helpful to be able to centrally manage other payment method, such as Credit card payment. If you can't manage it centrally, you will have to perform clearing operations such as payment confirmation and clearing balances such as accounts receivable for each payment method, which can be complicated to manage and increase errors. With payment processing services, you can see multiple payment method in one dashboard, which greatly improves your work efficiency.

Implementation time

When implementing Account transfer, keep in mind that it can take several weeks from application to implementation. If you have a fixed start date for the introduction, it is important to find out how long it will take and respond as soon as possible. In particular, there are cases where screening and document preparation take time, so plan with plenty of time to spare.

Account transfer Digitization of request forms

Account transfer If the request form can be converted into data, it can reduce postage and administrative work. Using a paper Account transfer request form can be costly for mailing and storage, as well as time-consuming checks for errors and inadequacies, but choosing a service that can be completed online can make it easier to manage your customers and shorten the time to registration.

Fees and Fee Structure

Fees and fee structures vary between financial institution and payment processing company companies, so you should weigh them carefully when implementing Account transfer. Rather than comparing fees alone, consider the monthly fee, transaction size and number of transactions, and the services provided.

Account transfer use cases

Account transfer is used in business-to-business payment as well as in various business scenarios where regular payment occur.

For example, for lessons and schools, Account transfer is best for monthly payment. Compared to cash collection with a monthly payment bag, there is no need for confirmation work, and management time can be greatly reduced.

Real estate rental companies also use Account transfer as an efficient way to collect rent. The advantage is that it reduces the paperwork of payment confirmation and saves tenants the trouble of going to payment.

In addition, subscription services allow users who do not have a credit card, such as young people, to payment with just a bank account, which is effective in preventing lost opportunities.

Account transfer payment If you want to introduce a service, you can use "PG Multi-Payment Service"

Implementing Account transfer reduces the risk of uncollected and streamlines billing operations for businesses that experience regular payment. There are two ways to implement it: direct contract with financial institution or using a payment processing company company, and it is important to choose the most suitable method according to the size of the company and the number of transactions.

To reduce Account transfer procedures and administrative tasks, we recommend using a Account transfer agency service. By using Account transfer agency services, businesses can significantly reduce the burden of operations by eliminating the need for customer account management and procedures. GMO-PG supports both transfer request form type and Internet-complete Account transfer agency service, and realizes immediate registration without the need for a seal.

Service Introduction

PG Multi-Payment Service

PG Multi-Payment Service is a payment platform provided by GMO Payment Gateway, Inc., a payment processing company company (PSP, Payment Service Provider). It has been introduced to a wide range of businesses, from startups to small ~ large companies, regardless of industry or size.

It provides a solid infrastructure to support a huge payment of 163,890 stores, an annual Transaction value of 21 trillion yen, and 7.22 billion cases processed (*). In addition, it is fully compliant with the global security standard PCI DSS Ver4.0.1, helping any business to create a secure payment environment.

- Supports payment and subscriptions (subscription and recurring payment) each time

- Connection methods are available to suit your needs (OpenAPI type, Link type Plus)

- HDI International Certified Customer Support Department Gate Provides Generous Support

*As of the end of September 2025, consolidated figures

Author

PX+ by GMO Editorial Department

The PX+ by GMO editorial team is a dedicated media team specializing in the payment and Payment Experience (PX, payment experience) area by GMO Payment Gateway.

payment ・Based on the latest trends and practical know-how related to e-commerce operations and cashless in general, as well as examples of growing companies, we compile and supervise practical and reliable information that is useful for business growth.

Click here for the purpose of "PX+ by GMO" and the list of supervisors.