payment Basics

Article published:

How to Implement buy now pay later payment (BNPL) on Your Ecommerce Site or App? Explanation of how to introduce and benefits

Key points of this article

- We will explain how buy now pay later payment works and the advantages and disadvantages for both businesses and users.

- We will organize important comparison points such as credit speed and maximum amount when selecting a service.

- We present the benefits of reducing the risk of non-collection and improving efficiency, as well as introducing GMO-PG services.

INDEX

In the operation of an e-commerce site, the payment method lineup is an important factor that affects sales. The use of "buy now pay later payment (BNPL: Buy Now Pay Later)" is expanding, especially among those who do not have a credit card or are highly security-conscious. Furthermore, the number of services that can be used not only on e-commerce sites but also for shopping and eating and drinking at physical stores is increasing, and attention is being paid to their convenience.

In this article, we will organize the basics, how to choose, and the process of introduction of buy now pay later payment in an easy-to-understand manner. Please use this as a reference when considering the right buy now pay later payment for your company.

What is buy now pay later payment (BNPL)?

buy now pay later payment is a payment method of paying for goods or services at convenience stores, banks, post offices, etc., after receiving them.

It can be said that it is payment method that users can choose products because they can place orders even if they do not have money on hand at the time of purchase. For businesses, it is easy to expand purchasing opportunities because it can be sold to people who do not use credit cards.

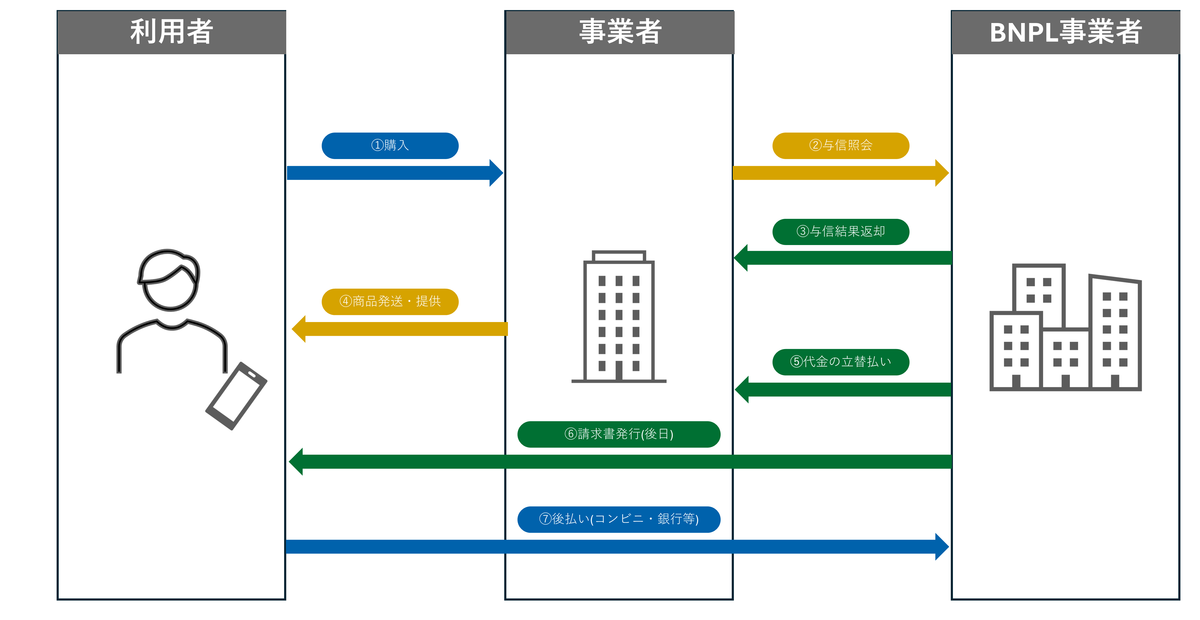

How "real-time credit" works

At the moment of buy now pay later payment, the Payment After Delivery service provider will review whether the payment is capable. In the past, this review took a long time, but now "real-time credit" that uses AI and big data to complete it in a few seconds to tens of seconds has become the mainstream. This makes it possible to complete payment smoothly and with the same feeling as a credit card without making users wait.

From "paper invoice" to "smartphone app"

In addition, the payment method has evolved from "paper invoice" to a type using a smartphone app. As a result, it is becoming more common not only to use on e-commerce sites, but also to show the app's barcode at the cash register at a physical store and instantly make a credit payment to shop on buy now pay later.

Advantages and disadvantages of buy now pay later payment

buy now pay later payment has advantages and caveats for both operators and users. By knowing the characteristics of each before implementation, it will be easier to determine whether it is suitable for your company's operations.

Benefits for businesses

For businesses, buy now pay later payment is attractive because it leads to increased sales and improved operational efficiency. From here, we will organize the specific benefits by item.

Expand your customer base: With buy now pay later payment, you can make purchases from people who don't have a credit card or are reluctant to payment online. With more payment method to choose from, you can deliver your products to users who have been missing out on the past.

In addition, since you can order only from your smartphone, it is easy to connect to a wide range of age groups. As a result, you can expect to attract new customers and increase purchasing opportunities.

Reduced workload and efficiency: buy now pay later payment companies do the payment for issuing credit check and invoice, verifying payments, and more. Since there is no need for the business to perform detailed dunning work, it is easy to reduce daily office work.

If you have less time and effort to manage sales, it will be easier to use your time for product development and marketing that you want to focus on. This ease of operation is one of the reasons why many operators choose buy now pay later.

Prevention of basket dropout: Leaving just before purchase is a common issue in e-commerce. payment If there are few methods, you may be left with no choice but to choose the desired payment.

By having a buy now pay later ready, you can eliminate concerns such as "I don't want to spend money right now" or "I don't want to enter my card information" and increase the possibility that you will proceed to complete the purchase. As a result, it will also lead to an improvement in the closing rate.

Reduced risk of uncollection: In many buy now pay later payment, even if a user's payment is delayed, the payment company will repay the merchant. Since the business does not need to directly collect the money, the risk of not being able to collect the money can be reduced.

Sales stability will increase, making it easier to work on e-commerce operations with peace of mind. It is suitable for businesses that want to sell while ensuring safety.

Disadvantages for businesses

While buy now pay later payment is convenient, buy now pay later payment comes with a cost burden. It is important to check before implementation.

Initial Costs, Monthly Subscription Fees: Payment After Delivery service may require system implementation costs or monthly fees. In some cases, processing fees are incurred on the price of the product, which can affect profit margins.

Businesses with a high proportion of small-value products need to consider the balance with costs before deciding whether to introduce them. It is important to compare the fee structure in advance and choose a service that suits your company's sales structure.

Benefits for users

For users, the ease of the procedure and the ease of choosing the timing of the payment are attractive. Here are some benefits that are actually easy to feel.

No credit card or account registration: buy now pay later payment does not require credit card numbers or bank account registration. Even if you are not comfortable entering personal information, you can place an order by simply entering your address or name.

Even if you are using online shopping for the first time, the procedure is easy to understand and easy to use. It's also a convenient payment method for those who want to reduce the hassle of registration.

Peace of mind that you can pay after receiving the product: Since you can payment after receiving the product, you can reduce the anxiety of "what if it doesn't arrive". It can be said that mail order where the product may not be as expected due to different sizes or colors is a payment method that leads to a sense of security.

By being able to check the actual product before paying, it will be easier to order even from brands and shops that are buying for the first time.

payment Easy to adjust timing: buy now pay later is the process of paying after the invoice arrives. It is characterized by the fact that you can settle according to your own rhythm of life, such as those who want to payment after payday.

You don't have to worry about your account balance immediately, so you can buy without difficulty. Whether you need to make a quick purchase, buy now pay later can be a convenient option.

Disadvantages for users

While buy now pay later has its benefits, there are also things to keep in mind. It is important to check before use.

payment Forgetting may incur late fees or reminder fees: buy now pay later has a set deadline of payment, and late fees may apply if it is delayed. If you forget to manage your invoice, you may also be charged a dunning fee.

In order not to increase the burden, it is necessary to get into the habit of paying on time. Regularly checking your invoice and knowing when it's due can provide peace of mind.

Low spending limits and not suitable for high-payment pay: buy now pay later payment has a usage limit set for each service. If you want to buy an expensive product, you may not be able to choose the payment method because you have reached the limit.

Larger purchases may require alternative means such as credit cards or Bank transfer. It is important to use different payment methods depending on the application.

Some services may charge fees: buy now pay later payment may incur fees depending on the payment method. In particular, some services require a fee for convenience store payment, so you should check before ordering.

In order to avoid unexpected burdens, it is important to read the pre-use instructions carefully. payment It is safe to choose by paying attention to the differences in methods.

The Online Payment Service" PG Multi-Payment Service" provided by GMO Payment Gateway, Inc. (hereinafter referred to as GMO-PG) allows the centralized management of multiple payment method, including buy now pay later payment, and is characterized by "PCI DSS v4.0.1 compliance" for safety and stable operation.

It also has a mechanism to help improve the efficiency of billing operations and reduce the risk of non-collection, making it easy to introduce for businesses that feel uneasy about operations.

How to choose a Payment After Delivery service

When implementing buy now pay later payment, you need to determine whether it fits your business rather than just the fee. buy now pay later Each service has different mechanisms and guarantees, so it is important to choose while organizing which points to compare.

Does it support a wide range of buy now pay later means?

The first thing you want to check when choosing a buy now pay later payment is the type of payment method it supports. The more methods users can choose from, such as convenience store payment, Bank transfer, and post office payment, the lower the hurdle to completing the payment.

With more options, you can accommodate older customers and those who don't have credit cards, reducing missed purchase opportunities. Considering the compatibility with your products and user base, and organizing which payment methods are needed in advance will make the selection smoother.

credit check Speed and approval rate

"Credit speed" is extremely important to prevent "cart drops" at e-commerce and congestion at cash registers in physical stores. Check whether it supports "real-time credit", which completes the review the moment you press the order button, and whether the service has a high review pass rate (approval rate). A long review time can cause users' desire to buy cool.

See available limits

buy now pay later payment has a spending limit that is set for each user. In the case of services with low limits, e-commerce sites that handle high-priced products may not pass authentication and may miss purchase opportunities.

On the other hand, a higher limit allows you to cover a wide range of product categories and expand sales opportunities. Be sure to check whether the price range of your product matches the maximum amount set by the service.

Can it be integrated with existing systems?

When introducing buy now pay later payment, it is also important to be able to integrate with existing e-commerce systems and carts. If you can't integrate, you'll end up with more manual processing and more effort in creating invoice and managing payouts.

If the service supports system integration, order data and settlement processing can be automated, reducing the operational burden. It is safe to check the range of supported cart systems and API integrations before implementation.

Is there a guarantee against non-payment?

If you choose the wrong Payment After Delivery service, you may increase your workload and increase the risk of non-collection. If you want to prioritize both safety and operational efficiency, choosing a reliable payment foundation is crucial.

GMO-PG's PG Multi-Payment Service supports multiple buy now pay later measures and has mechanisms to reduce the burden on businesses, such as non-payment guarantees and real-time screening. If you are considering introducing it, please see the service details and request materials.

buy now pay later payment Implementation Steps

To implement buy now pay later payment, it's important to go through the necessary procedures and settings step by step. After implementation, you can consider changing your plan or adding features according to your operational status to create a more user-friendly payment environment.

Implementing buy now pay later payment begins with a contract process with the service provider. After the application, a review will be conducted, and if approved, the management screen will be issued and initialized.

After that, you can set up the linkage with your company's e-commerce cart and decide in detail how to send the invoice and the payment deadline. Once operational, regularly review the deposit cycle and unpaid incidence rate, and consider reviewing fee plans or adding optional features as needed.

These regular inspections ensure stable operation while reducing the workload.

If you introduce "buy now pay later payment" PG Multi-Payment Service

When considering implementing buy now pay later payment, it's important to compare multiple services and choose a payment foundation that fits your product offerings and customer base.

The "PG Multi-Payment Service" provided by GMO-PG allows the operation of various payment method, including buy now pay later payment, at once, and supports stable operation while reducing the workload of the adopting company. It also supports real-time reviews and outstanding warranties, providing the safety and convenience required by buy now pay later payment.

There are many examples of introductions, and it is possible to design operations according to products and sales types. If you want to check more features and prices, you can also refer to the related pages below.

■Related page: GMO Payment After Delivery service

■Related page: Foot Locker atmos Japan LLC | Case studies

Summary

buy now pay later payment is a payment way to increase sales opportunities while reducing customer anxiety, with the advantage of paying after receiving the product.

For businesses, it helps prevent abandoned baskets and expands the customer base, and users also have a sense of security that they can pay without registering their card information. When introducing the service, it is essential to thoroughly compare service fees, warranty details, and linkage with existing systems.

If you want to make your buy now pay later payment operations smoother, you can reduce the burden of work by choosing a system that allows you to manage your payment together.

PG Multi-Payment Service supports a wide range of payment method, including buy now pay later payment, and provides operational support. If you want to create a payment environment that suits your company, please consider introducing it while using the document request and case introduction page.

Service Introduction

PG Multi-Payment Service

PG Multi-Payment Service is a payment platform provided by GMO Payment Gateway, Inc., a payment processing company company (PSP, Payment Service Provider). It has been introduced to a wide range of businesses, from startups to small ~ large companies, regardless of industry or size.

It provides a solid infrastructure to support a huge payment of 163,890 stores, an annual Transaction value of 21 trillion yen, and 7.22 billion cases processed (*). In addition, it is fully compliant with the global security standard PCI DSS Ver4.0.1, helping any business to create a secure payment environment.

- Supports payment and subscriptions (subscription and recurring payment) each time

- Connection methods are available to suit your needs (OpenAPI type, Link type Plus)

- HDI International Certified Customer Support Department Gate Provides Generous Support

*As of the end of September 2025, consolidated figures

Author

PX+ by GMO Editorial Department

The PX+ by GMO editorial team is a dedicated media team specializing in the payment and Payment Experience (PX, payment experience) area by GMO Payment Gateway.

payment ・Based on the latest trends and practical know-how related to e-commerce operations and cashless in general, as well as examples of growing companies, we compile and supervise practical and reliable information that is useful for business growth.

Click here for the purpose of "PX+ by GMO" and the list of supervisors.