payment Basics

Article published:

How to implement Career payment on your e-commerce site or app? Explanation of how to introduce and benefits

Key points of this article

- We will introduce how Career payment works and the advantages and disadvantages for both businesses and users.

- We will organize points to note such as introduction methods, market prices for costs and fees, and usage limits.

- We will present the features of the services of major carriers and the best solutions that can be implemented in bulk.

INDEX

Many businesses that operate e-commerce sites and online services may be worried that they want to introduce a career payment, but they don't know how it works, costs, and risks.

While the introduction of Carrier payment can be expected to increase purchase rates and reduce the risk of non-collection, there are also points to be aware of.

In this article, we will explain how Career payment works, the introduction process, advantages and disadvantages, limits, and precautions.

What is a career payment?

Carrier payment is a payment method of paying for goods and services by combining them with your monthly mobile phone bill (communication bill). It is mainly used for in-app purchases, online shopping, e-books, etc., and is provided by major carriers such as NTT DoCoMo, KDDI (au), and SoftBank. The main feature is that you only need simple authentication such as ID and password (or biometrics) to complete payment, so you don't need to enter your credit card information.

Carrier payment is a payment method of paying for goods and services by combining them with your monthly mobile phone bill (communication bill). It is mainly used for in-app purchases, online shopping, e-books, etc., and is provided by major carriers such as NTT DoCoMo, KDDI (au), and SoftBank. The main feature is that you only need simple authentication such as ID and password (or biometrics) to complete payment, so you don't need to enter your credit card information.

How payment works

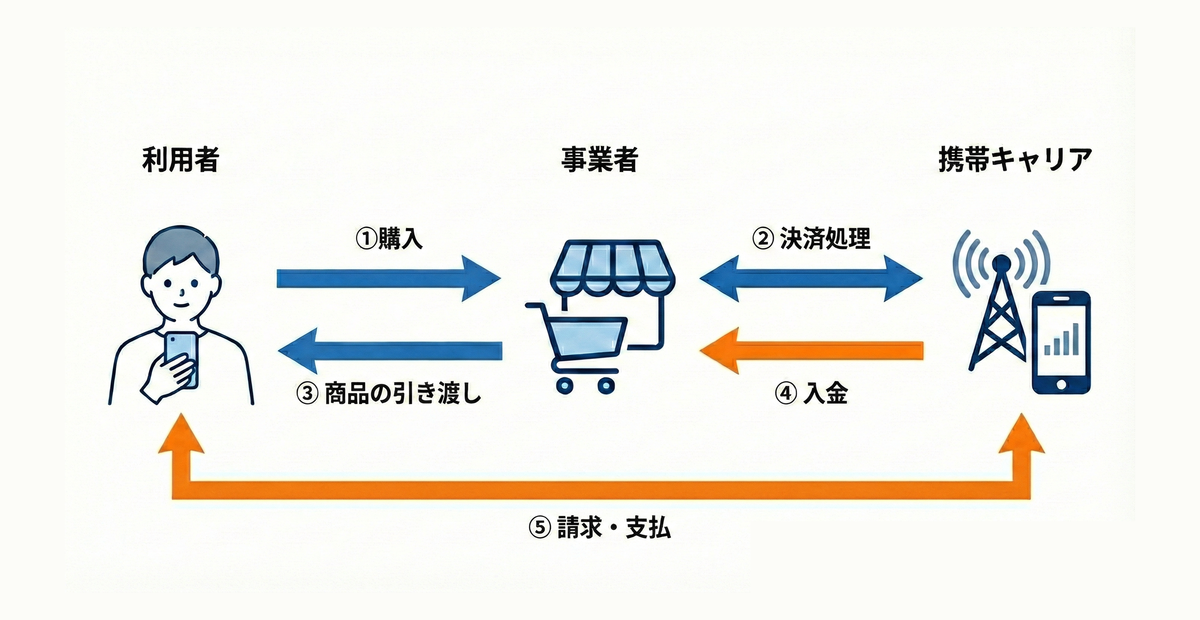

Carrier payment is carried out between three parties: "user", "operator", and "telecommunications carrier", and the process is completed in the following flow.

- When the user purchases a product, they select "Carrier payment" and authenticate with a PIN or other information.

- Each telecommunications carrier temporarily repays the price and deposits it into the operator.

- The user will add it to the mobile phone bill and payment the payment to the telecommunications carrier.

In this way, since the carrier repays the price, it can be said that it is easy for businesses to reduce the risk of unrecovered.

Advantages and disadvantages of introducing Career payment

When considering the introduction, it is important to organize the effects and issues from the perspectives of both the business and the user.

Benefits for businesses

Attracting New Customer Segments: Students without credit cards and younger demographics can also be targeted, potentially leading to the development of new customer segments.

Prevention of cart abandonment: No need to enter a card number, etc., and payment can be completed with a few taps such as ID, password (or biometric authentication). Its strength is that the ease of operation maintains purchase motivation and contributes to increased sales.

Streamlining Payment Management: As mentioned above, carriers collect and deposit payments, reducing the burden of individual payment collection and dunning operations.

Disadvantages for businesses

Fee costs: Carrier payment fees tend to be slightly higher than those for Credit card payment (depending on the product and throughput, a few percent to 10% is a guideline).

Impact of usage limits: Carriers have set monthly usage limits (up to about 100,000 yen, etc.), so they may not be suitable for selling high-value products.

Operational Complexity: When contract with multiple carriers, administrative tasks can be cumbersome due to different payout cycles and refund rules.

Benefits for users

Low hurdles to use: You can use it without a credit card, as long as you have a smartphone, and it is easy to use even for those who are reluctant to enter personal payment method information.

Limit overspending: Rest assured that you'll be shopping within the spending limits set for each carrier, making it easier to manage your spending.

Completed on your phone: Whether you're on the go or on the go, you can smoothly complete payment with just one phone.

Disadvantages for users

High payment may not be available: Not available for purchases over the spending limit.

contract Situational limitations: Depending on the cheap SIM or the line plan you contract (such as a corporate contract or some MVNOs), it may not be available or the terms and conditions may be limited.

How to implement Career payment

There are two ways to introduce carrier payment: "direct contract with each telecommunications carrier" and "using a payment processing company company (PSP)".

Both methods have their own characteristics, and the best option depends on the scale of deployment and operational structure.

1. contract directly with each telecom carrier

This is a method of connecting merchant contract individually with NTT DoCoMo, KDDI, Softbank, etc.

Features: There are no brokerage costs, so you may have lower fees than using a payment processing company company.

Note: Each carrier requires screening and system development, which tends to bloat the number of man-hours and management costs.

2. payment processing company Use the company

payment processing company is a way to contract with a company and introduce multiple carriers at once.

Features: You can deploy payment of the three major carriers in one contract.

Advantages: Since the payment date and management screen are unified, the operational effort can be greatly reduced. Another major advantage is that it can be centrally managed along with other payment method such as credit cards.

Scalability: It is easy to deploy along with other payment method, such as credit cards and electronic money.

Please note: Since you are going through an agency, fees may be adjusted compared to direct contract.

If you're looking to implement a career payment, it's important to understand these features correctly to determine which payment method is best for your product and customer base. If you would like to introduce a career payment or request comparative materials, please use the Online Payment Service" PG Multi-Payment Service" inquiry and request materials.

Market price of installation costs and fees

When implementing Carrier payment, there are multiple costs, including upfront costs, monthly costs, and payment fees. The cost structure varies depending on the contract method and payment processing company company, so it's important to weigh it beforehand.

Approximate initial and monthly costs

The initial cost of a career payment is around 0 yen to tens of thousands of yen. It occurs when system settings and review response are required during installation, but payment processing company Some companies provide it free of charge.

In addition, the market price of the monthly fee is about 0 yen to 15,000 yen, and it is mainly incurred every month as a system usage fee and management fee. It depends on the scope of use of the business scale and payment systems, so it's safe to clarify your pricing plan before implementation. If you use an agency with a free plan, you can proceed with the introduction with a low initial investment.

payment Fee Features and Comparison

Carrier payment 's payment fees are generally around a few percent to 10%, which is slightly higher than credit cards. This is because the cost structure includes risks due to the mechanism in which carriers make advance payments.

In addition, it is important to note that the burden increases depending on the unit price of the product and the volume handled. It's suitable for small-value products or digital content-focused businesses, but consider using it with other payment method for high-cost products.

In addition, there are differences in fee structures and guarantees between payment processing company companies, so it is important to weigh and consider the stability of the service and support system. Let's proceed with the introduction with an emphasis not only on price but also on operational convenience and reliability.

Key Carrier payment Service Features

Three major carriers in Japan offer three types of carriers: NTT DoCoMo's "d Payment", KDDI's "au PAY (au Kantan payment)", and SoftBank's "SoftBank Collective payment".

Although the names are different, both are systems that can be paid together with mobile phone bills, and the common point is that they are easy to use.

d Payment

d Payment (NTT DoCoMo) It may be available to non-DoCoMo users (*Mobile phone bill combined payment is only available to Docomo contract users), and its strength is the linkage with d points.

au Easy payment

This is a service that pays using au ID. It features a wide range of options for payment originals, such as Ponta points, au PAY cards, and WebMoney.

Softbank payment

It is available to SoftBank, Y-Mobile, and LINEMO users. It has a high affinity with PayPay and is also used as a means of charging. If you are introducing a "career payment service", you can use "PG Multi-Payment Service"

For businesses that want to efficiently implement carrier payment, we recommend using "PG Multi-Payment Service".

PG Multi-Payment Service is a comprehensive payment platform provided by GMO Payment Gateway (hereinafter referred to as GMO-PG) Co., Ltd., which can be used to introduce payment of the three major carriers, including NTT DoCoMo's "d Payment", KDDI's "au Easy payment", and SoftBank's "Collective payment".

Since contract and payment management with multiple carriers can be unified, it is possible to build a stable payment environment while minimizing the operational burden. In addition, not only carrier payment but also other payment method such as credit cards, electronic money, and QR code payment can be integrated and managed, which will help improve the convenience of e-commerce sites and apps.

If you want to achieve a smooth introduction, first consider whether it is best for your company through a request for materials or an implementation consultation.

Summary

Carrier payment is a payment method that combines ease and security, and can reach users who do not have a credit card.

On the other hand, there are some points to be aware of before implementation, such as usage limits, fees, and screening mechanisms. By correctly understanding these factors, you will be able to prevent problems after introduction and achieve stable operation.

You can also use an payment processing company company to centralize your contract and payment management, significantly reducing the burden of implementation. The introduction of career payment is an effective measure to support business growth, as it will lead to an expansion of the customer base and an increase in the purchase rate.

With the Online Payment Service and PG Multi-Payment Service provided by GMO-PG, you can not only introduce payment of the three major carriers at once, but also integrate management including credit cards and CVS Payment. If you are a business that aims to maximize sales while minimizing operational effort, please consider it.

Service Introduction

PG Multi-Payment Service

PG Multi-Payment Service is a payment platform provided by GMO Payment Gateway, Inc., a payment processing company company (PSP, Payment Service Provider). It has been introduced to a wide range of businesses, from startups to small ~ large companies, regardless of industry or size.

It provides a solid infrastructure to support a huge payment of 163,890 stores, an annual Transaction value of 21 trillion yen, and 7.22 billion cases processed (*). In addition, it is fully compliant with the global security standard PCI DSS Ver4.0.1, helping any business to create a secure payment environment.

- Supports payment and subscriptions (subscription and recurring payment) each time

- Connection methods are available to suit your needs (OpenAPI type, Link type Plus)

- HDI International Certified Customer Support Department Gate Provides Generous Support

*As of the end of September 2025, consolidated figures

Author

PX+ by GMO Editorial Department

The PX+ by GMO editorial team is a dedicated media team specializing in the payment and Payment Experience (PX, payment experience) area by GMO Payment Gateway.

payment ・Based on the latest trends and practical know-how related to e-commerce operations and cashless in general, as well as examples of growing companies, we compile and supervise practical and reliable information that is useful for business growth.

Click here for the purpose of "PX+ by GMO" and the list of supervisors.