payment Trend Information

Article published:

What is QR code payment (Barcode payment)? Basic knowledge of QR code payment and how to choose the best one

![[Thumbnail] QR code payment.png](https://www.gmo-pg.com/pxplus/journal/images/c912b690a8eef79568a6acde9cee970d.png)

Key points of this article

- Let's thoroughly explain how QR code payment works, its advantages and disadvantages, and market trends. We have covered a comparison of five major companies such as PayPay and Rakuten Pay, as well as a batch introduction in payment processing company. Choose the best service and realize the convenience of going cashless today.

INDEX

Many businesses want to introduce QR code payment (barcode payment), but are worried about which service to choose, how much will the initial cost and fees cost, and how to implement it? The increase in payment method will increase customer convenience, but if you do not properly understand the mechanism and cost of each service, you may incur operational burdens after implementation.

In this article, we will organize the types of QR code payment, implementation costs, advantages and disadvantages, comparison of major services, and the flow to introduction in an easy-to-understand manner. It covers useful information not only for stores (face-to-face) but also for those who are considering introducing it on an e-commerce site (online).

What is QR code payment (Barcode payment)

QR code payment is a cashless payment mechanism that scans QR codes and barcodes with smartphones to perform payment. It can be said that it is characterized by the fact that you can shop without cash, and the introduction burden on the business side is relatively small.

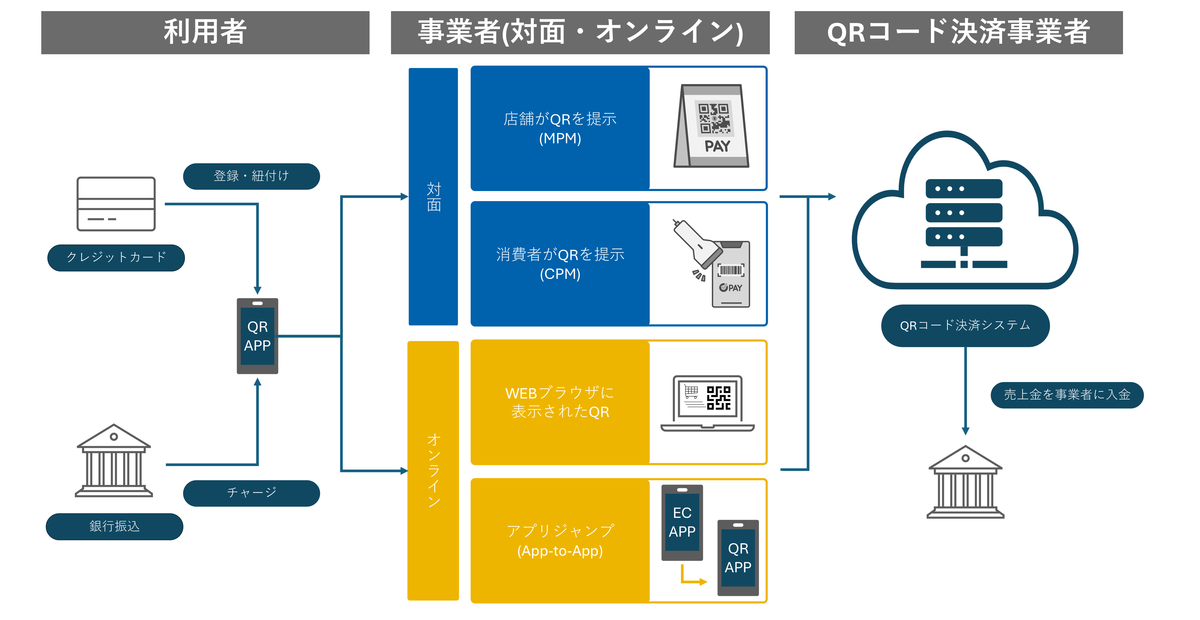

How payment works

The QR code payment system is made up of the cooperation of the user, the business, and the payment company. Customers can add money to the app from their bank account or sign up for a credit card to payment. The merchant sends the payment data at the POS or QR code payment terminal, and the payment company takes care of it. After that, the proceeds are deposited into the business bank's account.

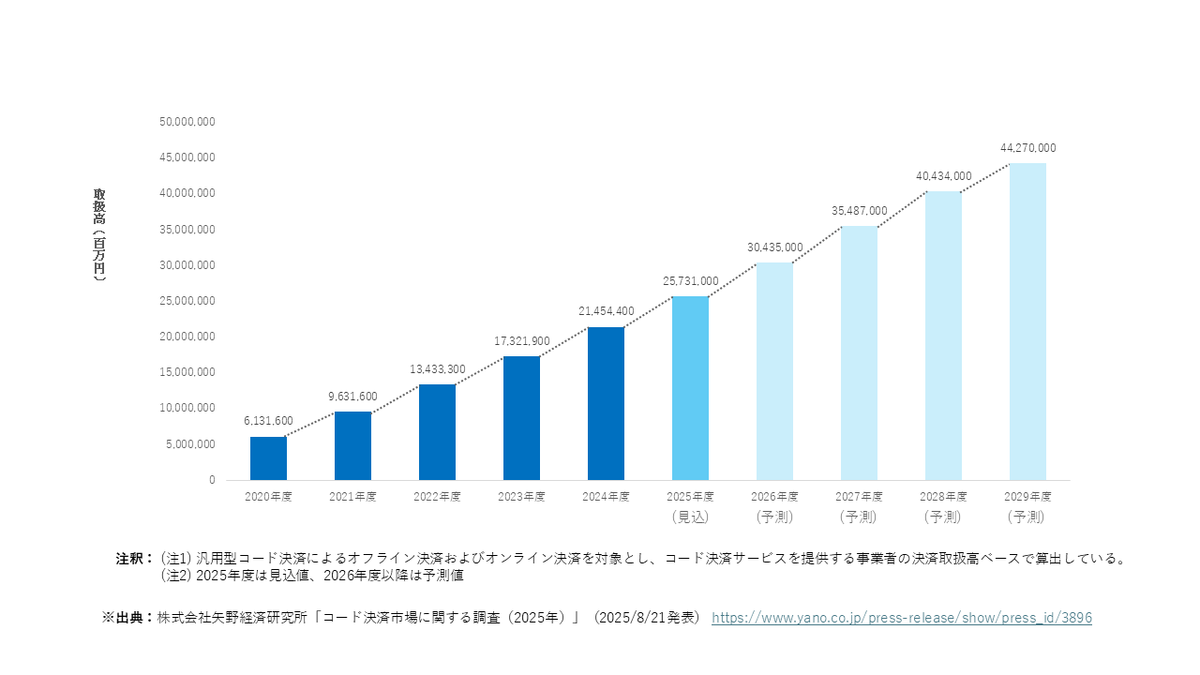

Domestic Code payment Market Trends (*)

The domestic code payment market is expected to increase year by year from approximately 6.1 trillion yen in FY2020 and reach approximately 25.7 trillion yen in FY2025. In addition, the use of code payment is increasing not only in stores but also on e-commerce sites, and it has become the main payment method after credit cards.

The domestic code payment market is expected to increase year by year from approximately 6.1 trillion yen in FY2020 and reach approximately 25.7 trillion yen in FY2025. In addition, the use of code payment is increasing not only in stores but also on e-commerce sites, and it has become the main payment method after credit cards.

The introduction of this section lowers the hurdles to purchase, which leads to increased sales and the prevention of cart dropouts. Adopting Code payment will be an important choice not only for brick-and-mortar stores but also for e-commerce sites.

[For stores] payment Types and characteristics of the method

When introducing it in a store, there are two main types of payment methods: "store scanning method" and "user scanning method".

1. Store Scan Method (CPM)

Store Scan Method (CPM) is a method in which a store scans and payment a QR code displayed on a customer's smartphone.

- Features: Since the amount is entered on the store side and then read, it is less likely to cause input errors and the checkout can proceed smoothly. It is suitable for convenience stores, supermarkets, mass retailers, and restaurant chains that emphasize the rotation of cash registers.

- Note: The initial cost is slightly higher due to the need to deploy a reading terminal and scanner. This method is suitable for stores that value certainty and speed.

2. User Scan Method (MPM)

The User Scanning Method (MPM) is a method in which users scan the QR code presented by the store with their smartphones and payment it.

- Features: Stores only need to prepare a QR code, and the introduction cost is reduced by starting with paper posting. This method is suitable for small stores, individual stores, event stores, and other businesses that want to reduce capital investment.

- Note: When users enter amounts, there is a risk of input errors, time and time for confirmation, and checkout may be delayed during busy times.

[For EC] payment Types and Characteristics of the Method

When implementing on an e-commerce site or smartphone app, there are two main payment methods: the "browser QR display method" and the "app linkage method".

1. Browser QR display method (WEB screen display)

This is a method in which users can payment the QR code displayed on a web browser on a PC or tablet by scanning it with their smartphone camera or payment app.

- Features: This method is mainly designed for shopping on PC sites. Users can complete the payment just by holding their smartphones, eliminating the hassle of entering credit card information and preventing cart drops (leaves).

- Note: If you are browsing the browser with your smartphone alone, you will not be able to read the QR code on your screen, so it is basically an auxiliary method "when using a PC browser".

2. App-to-App

This is a method of automatically launching (jumping) the payment app from the e-commerce site or app on your smartphone and payment it.

- Features: This method is optimized for smartphone-complete shopping. With no need to scan QR codes and a single button to launch the payment app, you can significantly improve the UX (customer experience) for mobile users and increase the closing rate.

- Note: Implementation often requires system development (API integration and SDK integration), and the difficulty of implementation tends to be slightly higher than that of the browser display method.

[Stores and e-commerce common] QR code payment payment methods

There are multiple payment methods for QR code payment, with different timings and mechanisms.

Prepaid

The prepaid (prepaid) type is a method in which you charge cash to the app in advance and pay from your balance.

Since the balance is reduced by the amount used, it is easy to prevent overspending. Some services also have an auto-charge function that automatically replenishes the balance, making it easy to prevent forgetting to recharge.

On the other hand, if you have insufficient balance, your payment will not be completed, so it is essential to check before shopping. Charge limits and payment limits vary from service to service, so it's important to check in advance. It's a payment method that works well with users who want ease of usage management.

Debit (instant payment) type

Debit (instant payment) is a method in which the payment is debited from the registered bank account at the same time as the payment.

The advantage is that the amount spent is reflected immediately, making it easy to manage your household budget and use it within the range of your account balance. Pre-topping is not required, but it is essential to check before using the payment because insufficient account balance will not be established.

This is a payment method for those who want to avoid the hassle of recharging each time, or for users who value keeping track of their spending.

Post-pay (buy now pay later) type

The post-pay (buy now pay later) type is a method in which the QR code payment app and credit card are linked, and the usage is paid together later as a card bill.

Since there is no need to recharge, payment is smooth and you may be able to get points back. However, the card brands that can be linked vary depending on the service, so it is important to check in advance.

It is a good way to combine your monthly payment and users who want to accumulate points efficiently.

Advantages and disadvantages of introducing QR code payment

We will organize it from the perspectives of the business side and the user side.

Benefits of introduction on the business side

Implementation cost and operational efficiency (store): It is easy to reduce the initial cost, and if you start with a paper QR, you can reduce the capital investment. You will reduce the hassle of cash preparation, change mistakes, and cashier tightening, and your work efficiency will increase. It is contactless and hygienic, and is compatible with self-checkout.

Attracting customers and increasing sales (common to stores and e-commerce): It is easy to link with each company's points and campaigns, and you can expect to expand your opportunities to visit the store by responding to visitors to Japan and multiple apps. On e-commerce sites, the hurdles to purchase are lowered, leading to increased sales and prevention of churn.

Disadvantages of introduction on the business side

Operational issues: Static QR (store) requires confirmation of amount entry, and accounting is easy to delay during busy times. In addition, the operation of refund and cancellation is different for each method, and procedure design is required. In addition, as a preparation for the replacement of fake QR and unauthorized access, we will reduce risks by using dynamic QR, CPM methods, and separation of management permissions.

Cost Control: payment fees affect sales, so it's important to manage them in conjunction with the payout cycle.

Benefits for users

You can pay with just your smartphone without a wallet, and the checkout is done smoothly without contact. It is a mechanism that makes it easy to increase the value by double taking points for unique points, coupons, and card linkage.

payment History remains in the app, making it easier to manage your finances. You can choose between prepayment, immediate payment, and buy now pay later, so you can rest assured even if you don't have cash on hand.

Disadvantages on the user side

It depends on the smartphone, communication environment, and battery level, and there is a risk that it cannot be used at checkout. It can be complicated to use apps and balances, and payment failures can occur due to exceeding limits or typing errors.

Threats like fake QR and phishing cannot be ignored either. Use the official app, verify codes, and set up two-factor authentication to limit damage.

QR code payment Cost of Implementation

The cost varies depending on the implementation method and service, but it is characterized by its low cost and ease of getting started compared to other cashless payment. In particular, the user scanning method requires little capital investment on the part of the store and is easy to introduce even in small payment method.

Here, we will organize the breakdown of costs that you should check before implementing in an easy-to-understand manner.

1. Initial cost

The upfront cost of QR code payment is often free or small. In the case of the store user scanning method, it can be used simply by installing a paper QR code or POP, so there is no need to purchase a terminal. On the other hand, the store scanning method requires a reading device, tablet, and Wi-Fi environment, so there is a certain initial cost (there may be free offer campaigns).

2. payment Fees and Running Costs

When using QR code payment, there is a payment fee (around 1-3% of the market price) based on sales. In addition, there may be a transfer fee when making a deposit, which may be free depending on the deposit cycle and the conditions of the designated account. To keep long-term costs down, it's important to compare these and choose a service that suits your company's cash flow.

Key QR code payment Service Features

|

Items |

PayPay |

Rakuten Pay |

dPayment |

au PAY |

Merpay |

|

Operating Company |

PayPay Corporation |

Rakuten Group |

NTT DoCoMo |

KDDI |

Mercari |

|

payment Way |

Store scan/user scan |

Store Scan/User Scan/Self Pay |

Store scan/user scan |

Store scan/user scan |

QR Code/iD payment |

|

Benefits |

PayPay Point redemption, many campaigns |

Strong in granting and using Rakuten points |

d point granting, docomo fee combined payment |

How Ponta points are doubled |

Mercari sales proceeds can be used, and deferred payment is supported. |

|

Benefits of introduction (stores) |

High customer attraction effect/high utilization rate |

Good compatibility with Rakuten economic zone |

Strong daily use with d points |

Promote repeat business with Ponta integration |

High usage rate by Mercari users |

|

Unique features |

Discount Coupon Distribution / municipalities Campaign |

Self-payment function |

Mobile phone bill combined payment |

Ponta Point W |

Use of Mercari sales proceeds, deferred payment |

Major QR code payment services differ in the number of installations, the number of users, and the mechanism of point linkage.

Here, we will organize the characteristics, payment methods, and compatible business formats for the five typical services that are candidates for introduction.

PayPay

PayPay boasts one of the highest number of users in Japan and is used in a wide range of industries such as convenience stores, restaurants, and beauty. It supports both store and user scanning methods, allowing it to be operated according to the size of the store.

Another strength is that there are many regular point return campaigns, making it easy to increase the number of times users payment times. It can be said that it is easy to expect the effect of attracting customers by introducing payment method.

Rakuten Pay

Rakuten Pay is characterized by its linkage with Rakuten Points, and is supported by users who want to accumulate and use points. In addition to store scanning and user scanning, "self-payment" is also available, which allows you to select a store and payment it within the app.

It is highly compatible with the Rakuten Economic Zone, and its introduction is progressing mainly in the retail and service industries.

d Payment

d Payment is a payment service provided by DoCoMo and is available to non-DoCoMo users. It supports the store scan method and the user scan method, and docomo line users can payment it in combination with the mobile phone bill.

payment It is characterized by the fact that you can earn d points by using it and earn more points by presenting d points, making it a payment method that goes well with stores that are frequently used on a daily basis.

au Pay

au PAY is provided by KDDI and is available to non-au users. The payment method supports both store and user scanning methods.

au PAY There is a mechanism that doubles the accumulation of Ponta points when you charge your balance from your card, and it is characterized by its high appeal to users who value point return. It is also available at Rakuten Pay member stores and is a payment service with a wide range of supported stores.

Merpay

Merpay is an payment service that can be used in conjunction with Mercari, and its strength is that it allows you to use Mercari's sales proceeds directly for payment. In addition to code payment, the payment method also supports iD payment, and is characterized by the fact that it can be used nationwide in many situations such as convenience stores and chain stores. In addition, it has a deferred payment function, allowing users to flexibly choose their payment method.

Is the implementation method "direct contract" or "payment processing company"?

There are two main ways to introduce QR code payment: "direct contract with service providers" and "using payment processing services".

Both can be introduced, but there are differences in the burden of screening and contract and the management system. It is important to first understand the characteristics of both and choose the implementation method that suits your company.

1. contract directly with service providers

PayPay and Rakuten Pay are ways to apply individually and undergo review.

It has the advantage that it is easy to choose a flexible plan for each company and to assemble the optimal structure that suits your company and store. On the other hand, each company's contract conditions and procedures are different, which increases the time and effort, and the burden of operation and management tends to increase. Before implementation, you need to consider balancing human resources.

2. Use payment processing services

With a payment processing company company (PSP), you can deploy multiple QR code payment at once, reducing operational hassle.

Businesses do not need to contract or manage individual services, and can check sales status and transaction history on a single management screen.

In addition, since Credit card payment, electronic money, and QR code payment can be handled together, it can be said that it is a good method for businesses that want to expand the scope of introduction.

If you want to deploy multiple QR code payment, payment processing company is the way to go.

There are two ways to respond to multiple QR code payment: "Apply for each service individually" or "Use the multi-payment service of payment processing company company". While individual applications are easy to reduce fees, they require screening and procedures for each business, which increases the operational burden.

On the other hand, if you use a multi-payment service, you can introduce QR code payment, credit cards, electronic money, etc. at once, and the contract and management screen are centralized, simplifying daily operations. However, it is important to understand that the fee is higher than that of individual contract and the cost of a dedicated terminal is required.

[For stores] "GMO Cashless Platform" completed with one terminal

For those who are considering implementing it in a physical store, we recommend the "GMO Cashless Platform" provided by GMO Payment Gateway, Inc. (hereinafter referred to as GMO-PG). It can flexibly integrate with POS registers, payment terminals, self-checkout machines, etc., and can support major domestic and international QR code payment such as WeChat Pay, d Payment, Rakuten Pay, PayPay, Merpay, and au PAY with a unified interface. Since it can be operated collectively on a single terminal, cashier operation is lighter and staff training is not required.

Online General payment" PG Multi-Payment Service"

For those who are considering introducing it in e-commerce, "PG Multi-Payment Service" is recommended. It supports major cashless payment in one place, and its strengths include operability that allows you to check sales and payment status on a single management screen, robust security, and a wide range of support systems. It is an easy-to-use service even for stores that are introducing cashless for the first time.

Summary

QR code payment is a system that allows users to easily payment using their smartphones, and it has spread to many businesses and users. There are many advantages such as non-contact, hygienic, and easy to accumulate points, and it is expected that the number of usage scenarios will continue to increase in the future.

There are two ways to implement it: "direct contract with the service provider" and "using payment processing services".

If you apply individually, you can keep costs down, but the challenge is that screening and management are complicated. payment processing services, on the other hand, allows you to deploy multiple payment method at once, simplifying operations.

If you want to reduce the burden of store operations while still catering to diverse payment, GMO-PG is the Online Payment Service" PG Multi-Payment Service" offered by GMO-PG. It can introduce major QR and barcode payment in one stop, and it can be smoothly integrated with POS and terminals.

Let's create an optimal cashless environment in a way that suits your company's business type and customer base.

Service Introduction

PG Multi-Payment Service

PG Multi-Payment Service is a payment platform provided by GMO Payment Gateway, Inc., a payment processing company company (PSP, Payment Service Provider). It has been introduced to a wide range of businesses, from startups to small ~ large companies, regardless of industry or size.

It provides a solid infrastructure to support a huge payment of 163,890 stores, an annual Transaction value of 21 trillion yen, and 7.22 billion cases processed (*). In addition, it is fully compliant with the global security standard PCI DSS Ver4.0.1, helping any business to create a secure payment environment.

- Supports payment and subscriptions (subscription and recurring payment) each time

- Connection methods are available to suit your needs (OpenAPI type, Link type Plus)

- HDI International Certified Customer Support Department Gate Provides Generous Support

*As of the end of September 2025, consolidated figures

Author

PX+ by GMO Editorial Department

The PX+ by GMO editorial team is a dedicated media team specializing in the payment and Payment Experience (PX, payment experience) area by GMO Payment Gateway.

payment ・Based on the latest trends and practical know-how related to e-commerce operations and cashless in general, as well as examples of growing companies, we compile and supervise practical and reliable information that is useful for business growth.

Click here for the purpose of "PX+ by GMO" and the list of supervisors.