決済トレンド情報

記事公開:

不動産事業者がキャッシュレス決済を導入するメリットとは?初期費用・家賃回収の機会損失と業務コストを劇的に改善

この記事のポイント

- 不動産DXの流れで、キャッシュレス決済が求められる背景と家賃支払いでの普及状況を紹介します。

- 初期費用や家賃の支払いなど、具体的な活用シーンと業務効率化・未収リスク軽減のメリットを詳述します。

- 導入の流れや決済手数料、セキュリティ対策、サービス比較といった実務的な内容をまとめています。

INDEX

不動産会社の担当者の中には、「家賃をクレジットカードで受け付けたい」「入居者の利便性を高めたい」「インバウンド対応としてキャッシュレス決済を導入したい」と悩む方も多いはずです。

この記事では、不動産業界で進むキャッシュレス決済の現状とメリットを整理し、家賃や初期費用をクレジットカードで受け付ける方法や導入手順を詳しく解説します。

さらに、安全性や手数料の仕組み、そして最新サービスの比較まで幅広く網羅。どこから手を付ければよいか迷っている担当者でも、導入に向けて自信を持って進められる実践的な内容となっています。

不動産業界においてキャッシュレス決済が求められる背景

不動産業界では契約や商談のオンライン化が広がっており、入居手続きや家賃の支払いも含めてオンライン化する流れが起きております。

こうした流れを受け、非対面で完結できるキャッシュレス決済の整備が重要になりました。ここからは、その理由を3つの観点から解説します。

電子契約・IT重説の浸透による非対面・オンライン化の進展

2021年に国土交通省がIT重説(重要事項説明)を本格的に導入したことを契機に、不動産取引における電子契約サービスの利用が広がりを見せています。

来店せずに契約を進める形式が一般化する中で、不動産取引全体がオンラインに移行する傾向が強まり、顧客からは契約から手付金や仲介手数料の支払いまでを自宅で完結したいというニーズが強まる傾向にあります。

従来の現金取引では、この非対面・オンライン化の流れに対応することが難しく、決済における課題となっていました。

そのため、キャッシュレス決済は、高まるオンライン完結のニーズに応え、一連の取引をスムーズに進めるための手段として注目を集めています。

オンライン内見・リモート商談の普及による商圏拡大

VR内見やリモート商談といったツールの普及は、不動産会社の商圏を地元に限らず、全国や海外へと拡大させました。この変化により、遠隔地からでも契約や支払いを完了できる仕組みが不可欠になっています。

実際、3D内見やZoom商談により、首都圏の不動産会社が海外居住者へ物件を案内するケースも珍しくありません。遠方の顧客、特に現金払いが難しい海外居住者からは、クレジットカードやQRコード決済など、オンラインで完結できる決済手段を望む傾向が強まっています。

結果として、来店を前提とした従来の支払い方法では対応しきれない場面が増え、オンラインで使える決済手段が選ばれやすい状況が生まれています。

不動産DX・業務効率化の潮流によるキャッシュレス化の加速

不動産DX(デジタルトランスフォーメーション)が広がる中で、業務効率化を推進したい企業が増えており、特に煩雑な入金管理の手間を減らすうえで、キャッシュレス決済は中心的な取り組みの一つとなっています。

家賃や敷金などの入金を従来通り手動で管理すると、確認漏れや作業負担が発生しやすいという課題があります。これに対し、キャッシュレス決済を導入すれば、入金データが自動でまとまり、業務の流れが整理されます。

また、政府もキャッシュレス比率向上の方針を示しており、不動産会社にとって導入を進めやすい環境が整っています。

不動産業界におけるキャッシュレス決済の普及状況

キャッシュレス決済を導入する不動産会社は増えていますが、現金や銀行振込を使う入居者もまだ多い状況と言えます。家賃の支払い方法は習慣に影響を受けやすく、すぐに切り替えられないという声もあります。

ここでは、現在の利用状況と利用者の意向を整理し、普及の進み具合を確認します。

導入は進みつつも、現金・銀行取引が依然主流

不動産業界ではキャッシュレス化が進んでいるものの、家賃などの毎月支払いが中心となる場面では、銀行振込や口座振替が使われるケースが多い状況です。現金以外の方法が増えてきたとはいえ、従来の決済手段が主流と言えます。

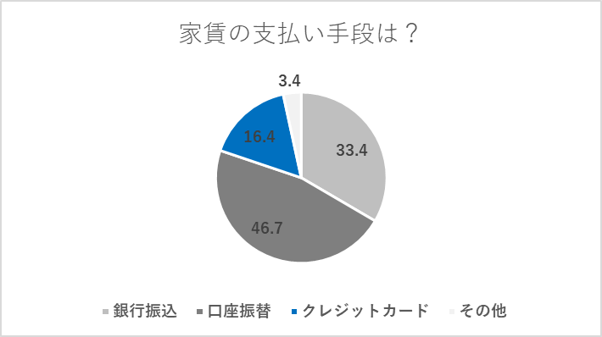

GMOペイメントゲートウェイが2025年7月に行った調査(対象:家賃を自分で支払う居住者1,132名)では、家賃の支払い方法として「口座振替」(46.7%)と「銀行振込」(33.4%)が全体の約8割を占めており、依然として現金や銀行取引が主流です。

一方で「クレジットカード決済」は16.4%にとどまっており、定期的な家賃支払いにおけるキャッシュレス化はまだ限定的であると分かります。

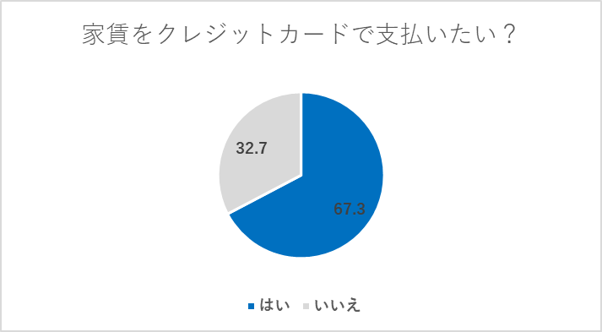

しかし、同じ調査では「今後クレジットカードで家賃を支払いたい」と答えた人が67.3%に達しています。この現在の利用率(16.4%)と将来的な利用希望(67.3%)の大きな乖離が、不動産業界におけるキャッシュレス決済導入の余地が十分にあることを示しています。

不動産事業者におけるキャッシュレス活用シーン

キャッシュレス決済は、初期費用が中心であった契約時の利用に留まらず、家賃などの日常的な支払いにおいても広がりを見せています。これは、非対面で手続きを完了させたいという顧客ニーズの増加に影響を受けています。不動産会社側にとっても、業務効率の向上と顧客満足度の両立につながることから、決済手段としての活用に注目が集まっています。

契約時の初期費用・仲介手数料・退去費用等の支払い

賃貸や売買契約の締結時には初期費用や仲介手数料の支払いが発生します。

契約を非対面で進めるケースが増えたことで、オンラインで決済を終えたいという要望が高まりました。こうした変化から、キャッシュレスで支払いを行う仕組みが重要視されています。

PGマルチペイメントサービスの「リンクタイプ Plus」を利用すると、電子契約が終わった後に決済リンクを送るだけで支払いを依頼できます。

入居者は自宅からスマホやパソコンを使い、クレジットカードなどで簡単に決済できます。遠方の顧客や法人契約とも相性が良く、来店を前提としない契約フローと組み合わせやすい点が特長です。

店舗でのキャッシュレス決済用の端末を導入したいがコストを懸念される場合は、リンクタイプ PlusのQR機能もおすすめです。管理画面で生成したQRコードをあらかじめ紙に印刷しておき、顧客が読み込むだけで様々な決済手段での支払いが可能となります。

店舗数が多く大量の端末を用意できない場合や、退去立ち合い時に費用請求したい場合などにおいて、端末不要かつQRコードだけで支払いを受け付けることができるため、高い利便性があります。

家賃・管理費などの定期支払い

家賃や管理費といった毎月の支払いでもキャッシュレス化が広がっています。入金を自動で処理できるため、未払いの防止や顧客の利便性向上につながるところが評価されています。

PGマルチペイメントサービスでは、クレジットカードの継続課金や口座振替の利用が可能です。入居者の67.3%が家賃をクレジットカードで支払いたいと回答した調査結果もあり、顧客ニーズと合致した取り組みと考えられます(GMOペイメントゲートウェイ調べ)。

管理会社にとっては、入金消込を自動化できることも大きな利点です。人的コストや確認漏れのリスクを抑えることができ、賃貸管理の精度と効率を両立できます。

キャッシュレス決済導入のメリット

キャッシュレス決済を導入すると、入居者の満足度や契約率の向上だけでなく、不動産会社の業務効率にも良い影響があります。支払い手段が広がることで、契約までの流れが滑らかになり、管理業務の負担も抑えられるためです。

ここでは、代表的なメリットを一覧で整理し、詳細を解説します。

|

メリット |

内容 |

不動産会社の効果 |

入居者の効果 |

|

利便性向上 |

時間・場所を選ばず決済が可能 |

非対面での契約・案内がスムーズに |

柔軟な支払方法(分割・リボ)とポイント獲得 |

|

入金管理の効率化 |

入金情報・データの自動連携 |

経理・消込作業の負担とミスを軽減 |

支払い手続きが簡単・シンプルに |

|

成約率向上 |

顧客の決済手段の選択肢が拡大 |

支払いに関する契約離脱を防止 |

自分に合った決済方法を選べて安心 |

|

未収リスクの軽減 |

家賃などの定期支払いを自動処理 |

安定した入金サイクルの確保 |

自動引き落としで支払い漏れを防止 |

メリット1. 入居者の利便性向上

キャッシュレス決済を導入すると、入居者は自宅から手続きできるため、支払いの負担を感じにくくなります。支払い方法が選べるだけでなく、好きなタイミングで決済できることも安心につながります。

初期費用や家賃をクレジットカードで支払う場合、分割払いやリボ払いが利用できるため、まとまった費用を準備しにくい入居者にも優しい仕組みです。振込手数料が発生しない点や、ポイントを貯められる点も好まれる傾向があります。

メリット2. 入金管理の効率化

キャッシュレス決済は、入金管理の手間を抑えたい不動産会社にとって大きな支えになります。

入金情報が自動でまとまるため、確認作業の時間を削減できます。業務負担が軽くなることで、他の対応に時間を使いやすくなる点も魅力です。

オンライン決済を導入すると、入金状況をリアルタイムで確認できます。振込の確認に時間がかかる状況も減り、機会損失を抑えられるでしょう。

メリット3. 成約率向上(売上向上)

キャッシュレス決済は、契約のハードルを下げる役割を果たします。支払いの自由度が高まるため、契約に進みやすい環境を作りやすいと言えます。結果として、成約率の上昇が期待できます。

分割払いやリボ払いなど、柔軟な支払い方法が使える物件では、高額な初期費用が障害になりにくく、検討者が契約に前向きになります。キャッシュレス対応を案内ページや店頭で伝えることで、入居者から選ばれやすくなる点も見逃せません。

メリット4. 未収リスクの軽減

キャッシュレス決済では、家賃などの定期支払いを継続課金や自動処理で対応することが可能です。これにより、入居者側の支払い忘れを防止できると同時に、不動産会社側にとっても未払いの発生を抑えられるという効果があります。

キャッシュレス決済のコストと手数料

キャッシュレス決済を導入する際は、運用に必要な費用を理解しておくことが大切です。特に決済手数料はサービスの使いやすさに影響するため、事前に確認する必要があります。

導入後のランニングコストも含めて比較すると、長く使いやすい決済システムを導入しやすくなります。

決済手数料の仕組み

キャッシュレス決済を使う場合、クレジットカード会社や決済代行会社へ支払う手数料が発生します。負担するのは不動産会社であり、導入する決済サービスによって金額が変わる点を理解しておきたいところです。

決済手数料は一般的に1〜3%ほどと言われています。サービスによっては、導入支援やキャンペーンで手数料が抑えられるケースもあります。

手数料削減のポイント

手数料を抑えるためには、複数の決済代行会社を比較し、自社の契約規模に合うプランを選ぶ姿勢が重要になります。条件を比べることで、運用しやすい選択肢を見つけやすくなるからです。

一括契約に対応したサービスを使えば、複数の決済手段をまとめて導入できるケースがあります。個別に契約するより負担が小さくなる可能性があり、検討する価値は十分にあります。

長期的な費用と利便性を整理し、自社に合う形を見極めることが求められるでしょう。

不動産業のキャッシュレス決済導入方法

ここでは、導入の基本的な流れや選び方を解説するので参考にしてください。

導入の流れと手順

キャッシュレス決済を始める場合、問い合わせから審査を経て運用開始まで段階を踏んで進める形が一般的です。導入手順を理解しておくと、準備が進めやすくなります。

必要書類を提出したあとは、加盟店審査が行われます。この過程を通じ、契約が完了するとシステム設定に進む流れです。

決済端末とオンライン決済の選択

導入する決済方法は、店舗で接客する場合と非対面で契約する場合で選び方が変わります。店舗型では決済端末を置く方式が主流で、対面の場面に向いています。

コードレス端末やスマホ型の決済端末が普及したことで、設置の自由度は以前より高くなりましたが、端末の導入数によるコスト負担や、店舗外に持ち出して使えない可能性が高い点には注意しましょう。

非対面での契約・請求がある不動産会社では、リンク送付で支払えるオンライン決済が扱いやすいと言えます。利用環境や顧客層を踏まえ、自社に合う方法を選ぶ姿勢が大切です。

審査や必要書類のポイント

キャッシュレス決済を使うには、事前の審査を受ける必要があります。信用情報や事業の実績を基に判断が行われるため、必要書類をそろえておくことが欠かせません。

書類の内容を整理しておくと、申し込みが進めやすくなるでしょう。

安全性とセキュリティ対策

キャッシュレス決済を導入するうえで、安全性は不動産会社と入居者の双方にとって重要な要素です。オンラインで支払いを行う場面が増えたため、情報を守る仕組みが整っているかを確認する必要があります。

ここでは、不動産の支払いに関係するセキュリティの考え方を整理します。

不動産決済の安全性確保

不動産契約でキャッシュレス決済を使う際は、情報が安全に処理される仕組みが欠かせません。暗号化やトークン化といった技術を用いることで、カード情報が盗まれるリスクを抑える取り組みが進んでいます。

多くの決済代行サービスは、PCI DSSという国際基準に沿って運用されています。この基準を守ることで、高いレベルの安全性を維持できる仕組みです。

不正利用を見つけるシステムや多要素認証を採用するサービスも増えており、安心して利用しやすい環境が整っています。

非対面決済の安全対策

来店せずに支払うケースが増えたことで、本人確認の精度を上げる対策が強化されています。オンライン決済では、正しい利用者かどうかを確かめる仕組みが重要になるためです。

メールリンク決済では、決済専用のURLを安全に送付し、アクセスした本人が支払いを行います。SMSでの二要素認証を組み合わせる本人確認方法もあり、カードを持つ人と利用者が同じかどうかを確認できます。

関連記事:知っていますか?不動産賃貸業のキャッシュレス化は、入居者・各不動産事業者にメリットあり【不動産業界のDX】

決済代行サービス比較

キャッシュレス決済を導入する際は、どの決済ブランドに対応しているかを確認する必要があります。サービスによって扱える決済方法が異なるため、事前に比較しておくと導入後のミスマッチを防ぎやすくなります。

ここでは、実際に不動産向けに提供されている決済代行サービスを整理します。

※本表に記載されている各社の料金・サービス内容は、各社公式サイト等で公開されている情報を基に作成しています。最新かつ詳細な情報は、必ず各社へ直接お問い合わせの上、ご確認ください。

不動産向け決済代行会社比較

|

サービス名 |

初期費用 |

月額料金 |

カード決済手数料 |

特徴 |

|

GMOペイメントゲートウェイ |

要問い合わせ |

要問い合わせ |

要問い合わせ |

オンライン契約と相性が良い決済機能を提供 |

|

ゼウス |

無料 |

3,000円 |

約3.50% |

幅広い業種で導入されているサービス |

|

イプシロン |

無料 |

2,500円(賃貸向けプラン) |

2.7%〜3.2% |

家賃決済を意識した料金体系 |

|

VeriTrans4G |

要問い合わせ |

要問い合わせ |

要問い合わせ |

多様な決済手段に対応 |

|

アルファノート |

無料 |

0円〜 |

3.24%〜 |

不動産管理会社が使いやすい仕様 |

|

ルミーズ |

要問い合わせ |

要問い合わせ |

要問い合わせ |

カスタマイズ性を重視した設計 |

|

ハウスペイメント |

要問い合わせ |

要問い合わせ |

要問い合わせ |

不動産業界向けの専用機能を搭載 |

|

アットホーム家賃決済サービス |

要問い合わせ |

要問い合わせ |

要問い合わせ |

業務ツールと連携しやすい構造 |

|

BeesRent |

要問い合わせ |

要問い合わせ |

要問い合わせ |

決済と賃貸管理をまとめて運用 |

|

HUBees |

要問い合わせ |

要問い合わせ |

要問い合わせ |

管理業務を効率化しやすい構成 |

不動産会社がキャッシュレス決済を導入する際は、手数料や操作性だけでなく、どのブランドに対応しているかも重要です。導入後のトラブルを減らすためには、サポート体制や運用のしやすさも確認する必要があります。

こうした条件を比べると、自社の契約件数や入居者層に合うサービスを見つけやすくなります。サポートの質や導入実績もサービスごとに違うため、複数社を並べて検討する姿勢が求められるでしょう。

外国人入居者向けインバウンド決済

不動産会社では、海外から日本に来る入居希望者が増えたことで、インバウンド向けの決済に注目が集まっています。現金を持たずに来日する人も多いため、スムーズに支払える環境を整えると契約につながりやすくなるためです。

ここではインバウンド決済の特徴と導入時のポイントを整理します。

インバウンド決済の特徴

インバウンド決済は、外国人入居者が日本国内でスムーズに支払いできる仕組みを指します。

VISAやMasterCardといった国際ブランドに加えて、各国で利用される決済手段にも対応する点が特徴です。Alipay+やWeChat Payを導入すると、慣れた決済方法を使えるため、外国人入居者の安心感が高まります。

海外の投資家が物件購入を検討するケースも増えているため、インバウンド決済への対応は成約率を上げる要素としても期待できます。

導入のメリットと注意点

インバウンド決済に対応すると、外国人の入居希望者へ幅広くアプローチできるようになり、差別化にもつながります。対応ブランドが増えるほど案内しやすくなるため、集客力の向上が期待できます。

一方で、為替レートの変動や決済通貨の管理が課題になるケースがあります。サービスによってルールが異なるため、導入前に確認しておくことが欠かせません。

多様な外国人向け決済手段を導入すると利便性が高まる一方で、法規制やセキュリティの最新情報をチェックしながら運用する姿勢が求められるため、まずは国際ブランドで支払うことができるクレジットカードを導入することがおすすめです。

「決済代行サービス」の導入ならPGマルチペイメントサービス

キャッシュレス決済を導入する不動産会社では、複数の決済手段へ対応できるサービスを選ぶことが重要です。

PGマルチペイメントサービスは、クレジットカード決済に加え、オンライン決済やメールリンク決済など、非対面に適した仕組みをまとめて利用できる点が特徴です。入居者の支払い方法が広がるため、契約までの流れを整えやすくなります。

また、運用に欠かせないサポート体制も整っているため、導入後の管理がしやすい点も特徴です。

初期費用や利用手数料、対応ブランドなどは企業ごとに異なるため、サービス内容を比較しながら最適な導入方法を検討すると良いでしょう。

まとめ

不動産業界では、キャッシュレス決済が入居者と不動産会社の双方にメリットをもたらす存在になりました。来店不要で支払える仕組みが整うと、入居者の負担が減り、業務の効率化にもつながります。

複数の決済方法へ対応できる環境が整うほど、契約までの流れを途切れさせずに進めやすくなります。

一方で、導入時には手数料や審査の手順など、確認すべき点があります。適切なサービスを選ぶことで、こうした課題は解消しやすくなるため、比較しながら進める姿勢が求められます。

資料請求や相談を通じて、自社に合う運用方法を検討すると良いでしょう。

サービス紹介

PGマルチペイメントサービス

PGマルチペイメントサービスは、決済代行会社(PSP, Payment Service Provider)であるGMOペイメントゲートウェイ株式会社が提供する決済プラットフォームです。スタートアップから中小~大手企業まで、業種・規模を問わず幅広い事業者様に導入されています。

連結163,890店舗、年間の決済処理金額21兆円・処理件数72.2億件(※)という膨大な決済を支える強固なインフラを提供。さらに、グローバルセキュリティ基準PCI DSS Ver4.0.1に完全準拠しており、あらゆるビジネスの安全な決済環境を支援します。

- 都度決済および、サブスク(定期購入・継続課金)にも対応

- ニーズに合わせた接続方式をご用意(「OpenAPIタイプ」「リンクタイプPlus」)

- HDI国際認定 取得済みのカスタマーサポート部門が手厚くサポート

※2025 年 9 月末時点、連結数値

執筆者

PX+ byGMO編集部

PX+ byGMO編集部は、GMOペイメントゲートウェイによる、決済・Payment Experience(PX, 決済体験)領域に特化した専門メディアチームです。

決済・EC運営・キャッシュレス全般に関する最新動向や実務ノウハウ、成長企業の事例をもとに、ビジネス成長に役立つ実践的かつ信頼性の高い情報を編集・監修しています。

「PX+ byGMO」の趣意・監修者リストはこちら