Research Report

Article published:

payment method Intention Survey 2025

This article summarizes the latest trends in payment method used in Japan based on data from the "payment method Intention Survey 2025" conducted by GMO Payment Gateway, Inc..

For product sales and service e-commerce, we will introduce the usage status of major payment method such as credit cards and PayPay, market share trends over the past three years, why consumers choose payment, and differences by gender, age, and annual income.

In addition, the report also discusses the impact of "EMV 3-D Secure," which has been mandatory in Credit card payment since April 2025, on the user purchasing experience, and explains with data that while security is enhanced, there are issues such as abandonment (abandoned cart) and difficulty of use.

payment Now that services are becoming more diverse, many businesses may be wondering which one to introduce. In this article, we'll provide tips on choosing the best payment for your user base and offerings, and provide specific perspectives on how to increase sales while preventing missed opportunities.

1. Introduction: The current position of the EC payment market in Japan

As the Japan e-commerce market matures, payment method diversification is transforming into a key strategic component that influences consumer buying behavior and business revenue. The report focuses on four themes to provide in-depth insights into this increasingly complex market:

(1) Comparison of payment trends in product sales e-commerce and service e-commerce

(2) Trends in the share of major services

(3) Criteria for consumers to choose payment method

(4) Impact of EMV 3-D Secure Deployment

The analysis presented in this report is based on data from the payment method Intent Survey conducted by GMO Payment Gateway, Inc. in September 2025.

The survey targets consumers who have purchased products and services on e-commerce sites in the past year, and consists of two categories: "Product Sales" (3,279 samples) and "Service E-commerce and Others" (3,277 samples).

In the next section, we will first compare the actual usage of payment method in the two categories of "product sales" and "services" that represent the e-commerce market, and structurally elucidate the overall picture of the market.

2. Market Overview: Comparative analysis of payment trends in product and service e-commerce

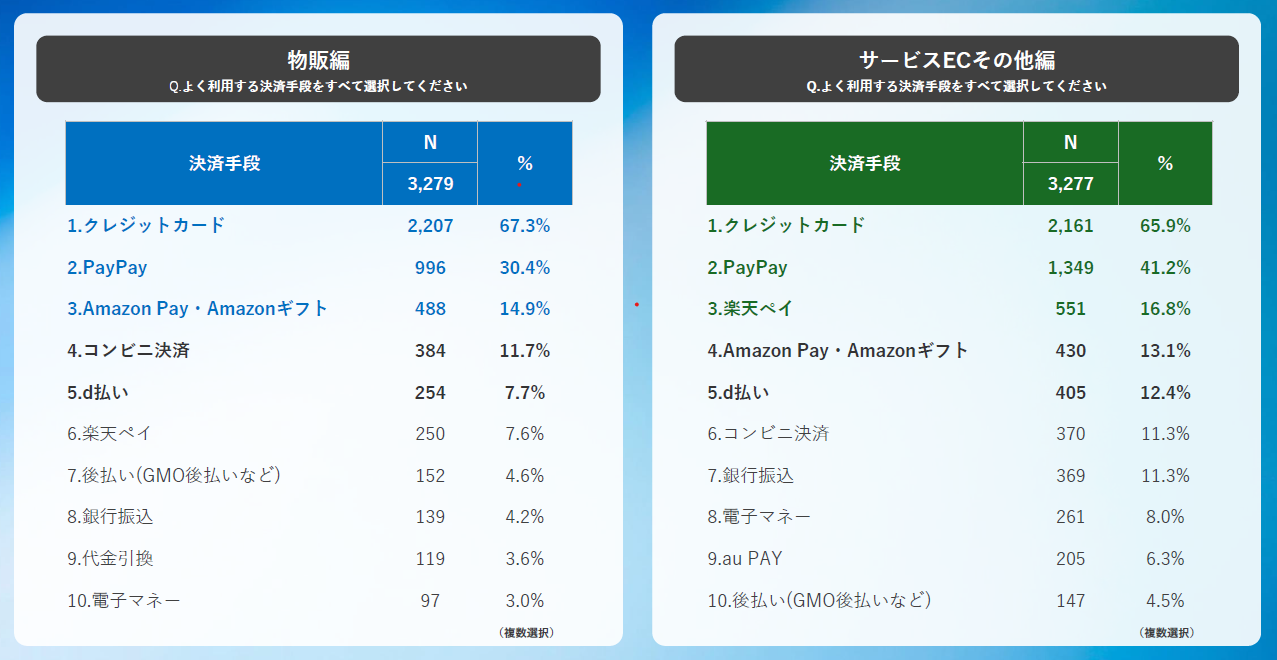

The e-commerce market can be broadly divided into "product sales" that deal with tangible products and "service e-commerce" that includes travel, food delivery, digital content, subscriptions, etc. According to a September 2025 survey, the top 10 payment method usage rates in both categories are:

Source: GMO Payment Gateway, Inc. "payment method Usage Intention Survey 2025"

From the above data, it can be seen that credit cards and PayPay have achieved the position of the two largest payment method in both categories. Credit cards have maintained their top market share since the past, but in recent years, the market has been in a two-strong era due to the rise of PayPay.

Looking at the differences between product sales and service e-commerce categories, we can see the strength of QR code payment in service e-commerce. The usage rate of PayPay is more than 10 points higher than that of product sales EC (30.4%) in service EC (41.2%), and Rakuten Pay and d Payment also show high usage rates in service EC. This suggests that products such as travel bookings, food delivery, and digital content have a high affinity with Pay, which can be completed on a single smartphone, and for businesses, the lack of these payment method can directly lead to lost opportunities.

In contrast, buy now pay later payment (4.6%) and cash on delivery (3.6%) are in the top 10 for product sales e-commerce. The existence of payment method that enables these "post-product confirmation payment" is important in the payment portfolio of product sales e-commerce that deals with tangible products.

In this way, understanding the characteristics of the business category as well as the overall market share is an important point in selecting the right payment method, and ideally it is effective to receive advice from a payment processing company company based on the detailed product genres and internal operations that the company handles.

In the following sections, we will delve into how the shares of these payment method have changed over time, unraveling the dynamics of the market.

3. Key payment Services Share Trend and Growth Analysis (2023-2025)

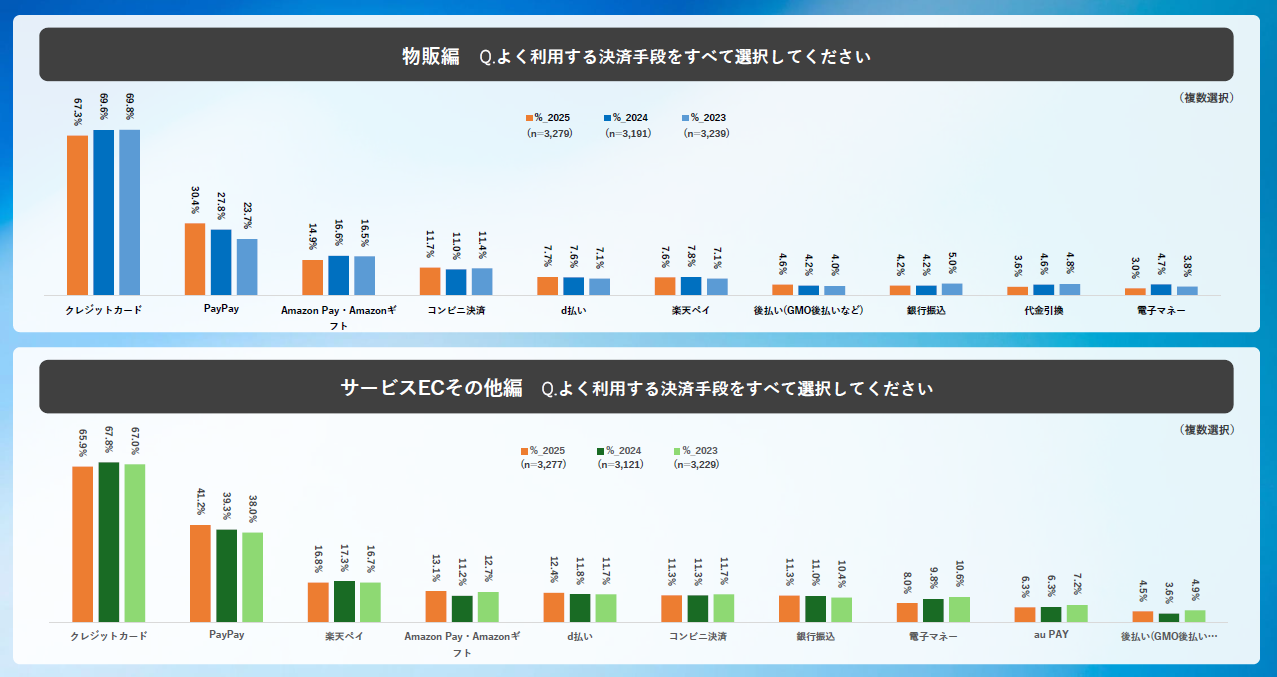

payment To decipher market changes, it is useful to track them over time. Below, you can see the growth trends of key payment services based on utilization data over the past three years.

Source: GMO Payment Gateway, Inc. "payment method Usage Intention Survey 2025"

From these developments, several key trends emerge that indicate a shift in market structure.

Market share redistribution

In both categories, credit card usage remains the top, but there is a gradual decline. On the other hand, the sustained growth of PayPay (+6.7 points over the past three years in the e-commerce sector) is the most significant trend in the overall market. This is not just an isolated event, but suggests a structural shift in the market as PayPay is beginning to take market share from credit cards, especially in high-frequency, low-cost payment scenes. This means that the payment strategy that relies solely on credit cards is increasing the risk of missing out on key growth segments in the market.

Accepting diversifying consumer needs

payment method other than PayPay are also seeing growth in certain areas. In product sales e-commerce, CVS Payment (+0.7 points) and buy now pay later payment (+0.4 points) increased slightly year-on-year, while in service e-commerce, Amazon Pay (+1.9 points) grew. This is proof that consumers are looking for not only a one-size-fits-all payment method, but also a variety of options according to their lifestyles and purchasing scenarios.

Understanding the consumer sentiment behind this market share fluctuation is key to effective payment method selection. In the next section, we will delve into the selection criteria of consumers.

4. Consumer payment method Choices and Context

In order for e-commerce operators to develop an effective payment adoption strategy, it is important to have a deep understanding of not only the amount of utilization but also the "motivations" of consumers for choosing each payment method. Knowing why they choose payment method can help you gain insights that can lead to happier customers and higher conversion rates.

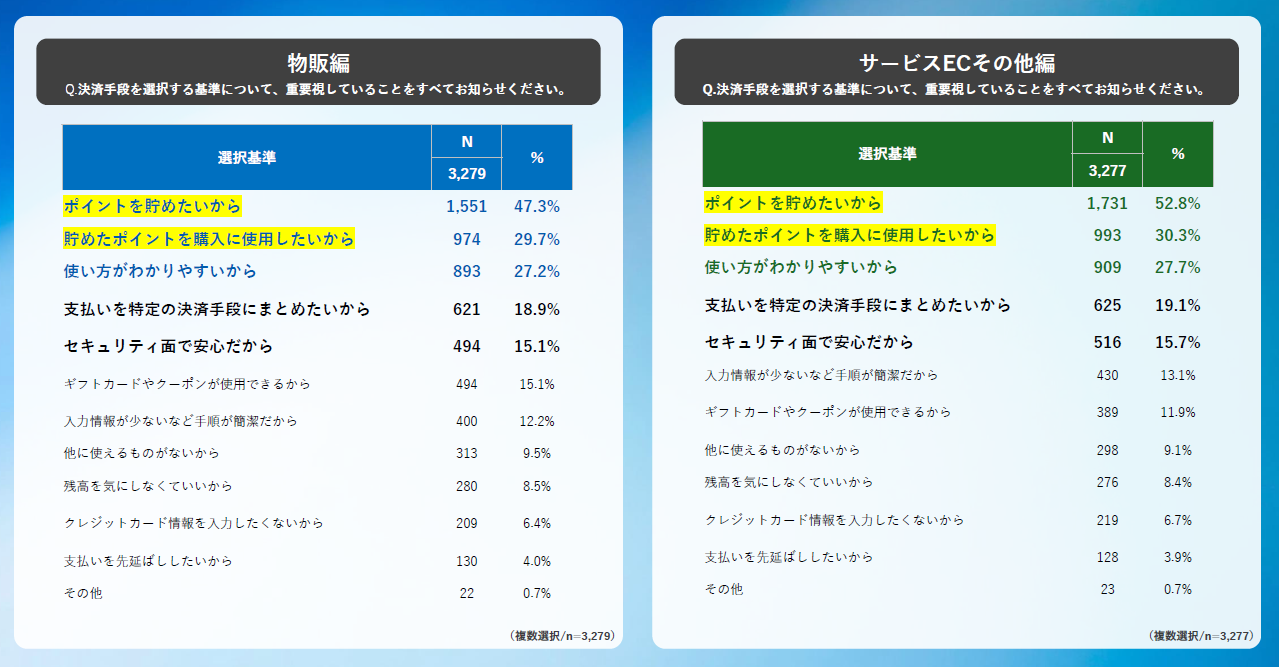

According to the survey, the following factors are common to consumers when choosing payment method for product and service e-commerce.

Source: GMO Payment Gateway, Inc. "payment method Usage Intention Survey 2025"

The overwhelming importance of the point economic zone

◦ Because I want to accumulate points

Product sales e-commerce accounted for 47.3% and service e-commerce accounted for 52.8%, making them the most important reasons in both categories.

◦ Because I want to use the points I have accumulated

With 29.7% for product sales and 30.3% for service EC, these are also extremely supported.

The results clearly show that many consumers view payment not just as a means of payment but as part of the economic activity of "accumulating and spending points."

Convenience and peace of mind are also important selection criteria

◦ Easy to use (product sales: 27.2%, service EC: 27.7%)

◦ I want to summarize payment (product sales: 18.9%, service EC: 19.1%)

◦ Peace of mind in terms of security (product sales: 15.1%, service EC: 15.7%)

These items are prioritized after points, speaking to the critical role of seamless operation and reliability in the payment experience.

Why choose the two major payment method?

Furthermore, as we delve deeper into the reasons why the two major payment method are chosen, the crucial differences in consumer sentiment behind them become vivid.

Why choose a credit card?

The overwhelming majority of respondents said "because they want to combine payment into a specific payment method" (79.1%) and "because they want to accumulate points" (77.6%). This strongly suggests that it is chosen in the context of assets management, such as planned household management or long-term point accumulation.

Why PayPay?

The top five reasons were "I don't want to enter my credit card information" (45.0%), "I want to put off payment" (42.3%), "I don't have anything else to use" (38.7%), "I want to use the points I've accumulated to make purchases" (38.3%), and "I can use gift cards and coupons" (37.9%).

This means that they are chosen as a result of a combination of more contextual motivations: security awareness, buy now pay later needs, lack of choice, and immediate incentives.

These selection criteria are not uniformly applicable to all consumers. In the following sections, we'll delve into how these priorities differ depending on user demographics and explore the path to more refined targeting.

5. Usage of payment method by user attributes

In order to develop a payment strategy that resonates with different user segments for each e-commerce business, it is important to understand the usage of each specific user segment in addition to overall market trends. By analyzing payment method 's preferences by attributes such as age, annual income, and purchase price, you can get suggestions for more sophisticated marketing measures.

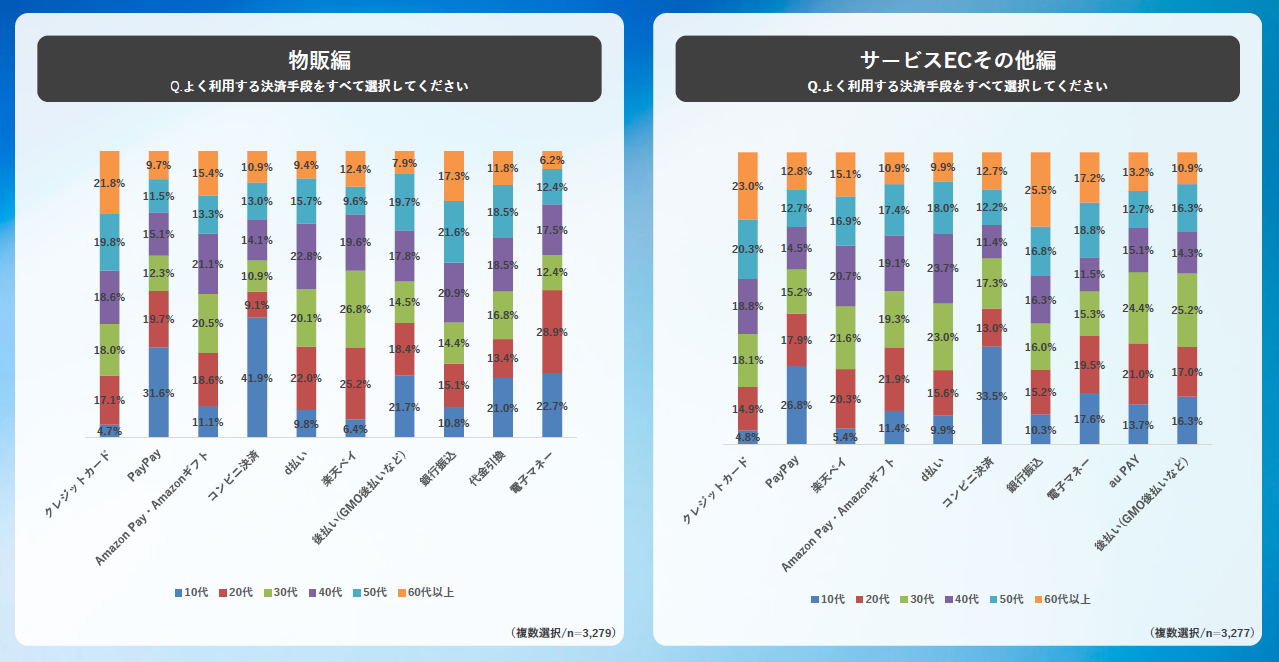

Usage trends by age group

Source: GMO Payment Gateway, Inc. "payment method Usage Intention Survey 2025"

payment trends among young people (teens and 20s): non-credit cards and digital transition

Teenagers in particular tend to have difficulty using credit cards

Credit card composition ratios are in the low percentages among teenagers, the lowest among all payment method.

Credit card alternatives with PayPay

The composition ratio is highest among people in their 20s, and teenagers also show a high composition ratio despite low credit card usage, indicating that PayPay is functioning as an alternative to credit cards.

Alternatives by CVS Payment

CVS Payment users are in their teens and 20s, accounting for about 40% of users, supporting young people who prefer offline payment.

payment characteristics of the elderly (50s and 60s and older): trust and familiarity are top priorities

It is characterized by a large bias towards credit cards and a low percentage of new payment method usage.

High support for credit cards

It shows that credit cards are the most trusted and essential payment method for older people.

Emphasis on face-to-face and customs through cash on delivery and Bank transfer

This is a payment method that exceeds the PayPay, indicating the emphasis on the security of the old-fashioned payment method using cash.

Given the importance of optimizing payment method for user demographics, the next section will focus on the new challenge of security authentication, especially for high-utilization Credit card payment.

6. Impact and challenges of implementing EMV 3-D secure

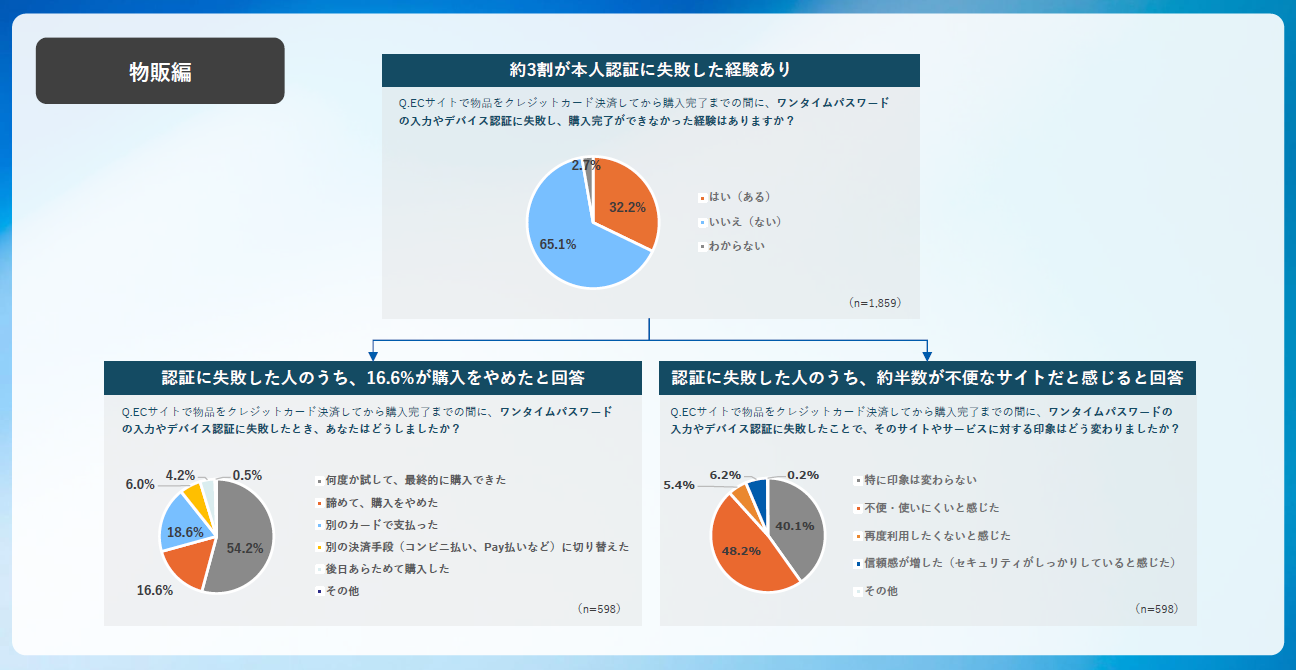

As a measure against credit card fraud on e-commerce sites, the introduction of EMV 3-D Secure (identity authentication service) will be mandatory in principle from April 2025. While security enhancement is essential, there is a risk that this authentication process will create unintentional friction in the user's buying experience (UX), leading to lost opportunities for businesses. In this section, we'll analyze the actual situation based on data.

Source: GMO Payment Gateway, Inc. "payment method Usage Intention Survey 2025"

High authentication failure experience rate

Among users who encountered the identity authentication screen at the time of Credit card payment, about 30% (32.2%) of the product sales e-commerce and just over 30% (38.7%) of the service e-commerce responded that they had experienced authentication failure. This indicates the fact that a number of users are stumbling in the final stages of payment that cannot be overlooked.

Direct loss of opportunity due to authentication failure (abandoned cart)

Among users who failed authentication, 16.6% of product sales e-commerce and 14.3% of service e-commerce eventually gave up on purchasing on the spot. You can see that the side effects of enhanced security are manifesting as lost sales opportunities that should have been obtained.

Risk of damage to brand image

More serious than lost opportunities is the deterioration of the customer experience. Of the users who failed authentication, 48.2% of the users were on product sales e-commerce and 48.8% on service e-commerce, and about half of them answered that they felt that the site was inconvenient and difficult to use. Such negative experiences can significantly reduce customer satisfaction and have long-term negative effects on future repeat purchases and brand loyalty.

This analysis shows that e-commerce operators face the challenge of meeting the security requirements of EMV 3-D secure while minimizing "cart drops" and UX degradation due to authentication failures. There is an urgent need to design an environment to bypass authentication, provide a variety of payment method other than credit cards, and give users alternative options.

Summarizing the analysis so far, the next final section will recommend specific strategies and future market trends that operators should take.

7. Summary: Upcoming EC payment Market Trends and Strategic Implications for Operators

As the report reveals, the Japan e-payment market is a complex landscape with a mix of diversifying consumer behaviors and changing security requirements. In order for businesses to establish a competitive advantage in such a market, it is important to consider strategies based on multiple perspectives, rather than relying on a single indicator of utilization rate.

Based on the analysis so far, we will summarize and recommend strategic actions that e-commerce businesses should take in five points.

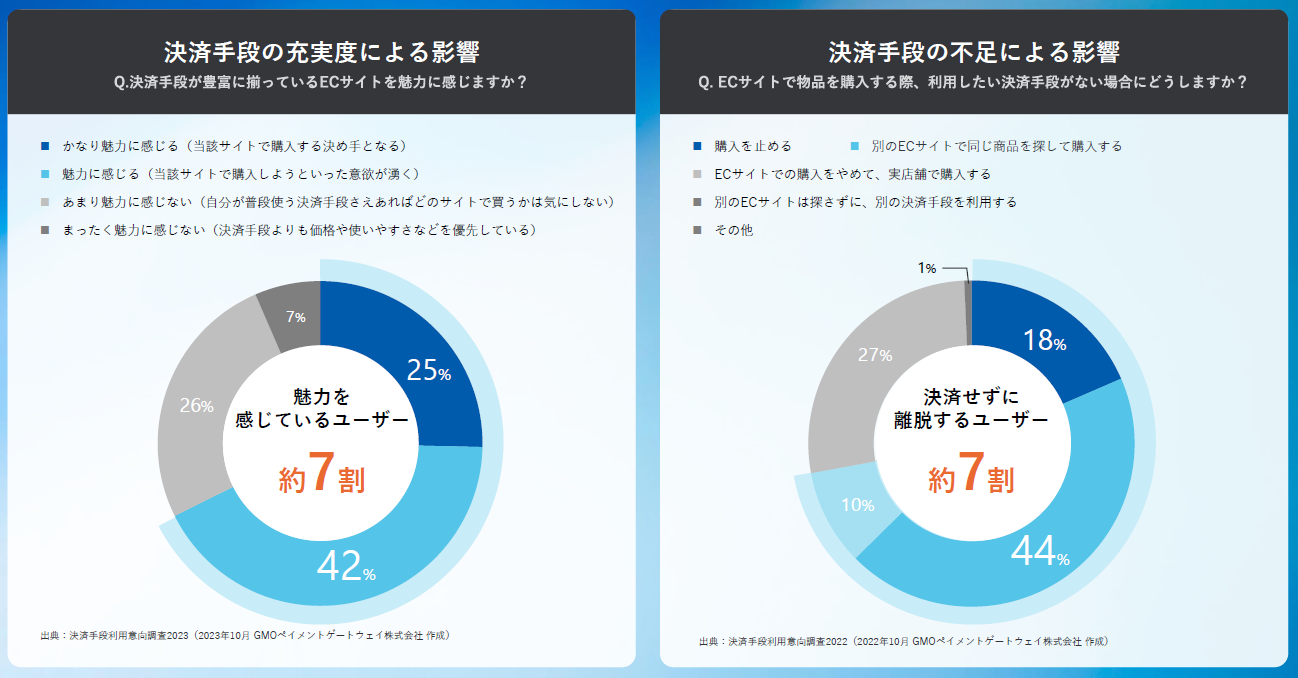

1. Avoid lost opportunities by expanding payment method

The survey shows that about 70% of users abandon a purchase on the site if they don't have the desired payment method, indicating that a lack of payment method is a fatal opportunity loss. In addition to basic Credit card payment, providing a comprehensive supply of fast-growing PayPay, CVS Payment, and buy now pay later that are in deep demand among specific demographics is an absolute basic strategy to prevent "abandoned carts" and maximize sales opportunities.

2. Selecting payment method optimized for your target audience

Rather than deploying all payment method in the dark, it's important to prioritize them according to the characteristics of your business. For example, if your primary target is teenagers, you can use PayPay and CVS Payment. On the other hand, if you're dealing with products that cater to an older age group, you should prioritize the convenience of a reliable Credit card payment. Analyze the characteristics of your customer base and products to build the best portfolio.

3. Strategic use of "point economic zones"

It's clear that the biggest motivation for consumers to choose payment method is "points." Introducing payment method that works with major point services such as Rakuten Points, PayPay Points, and d Points is a powerful weapon to meet the needs of a wide range of customers who want to save and spend. You should also consider customer attraction and sales promotion measures that use the key points as a hook.

4. Seeking the Optimal Balance between Enhanced Security and UX

While the need to strengthen security measures, including the mandatory use of EMV 3-D security, is an inevitable trend, the risk of leaving due to authentication failure must always be kept in mind. In addition to technical innovations to smooth the authentication process, enhancing non-credit card payment method can be one of the effective risk hedging measures. If a user fails to authenticate, they can seamlessly switch to other payment methods, protecting both the customer experience and sales.

5. Selecting a Reliable payment processing company Partner

Meeting all of these complex requirements and building and operating the best payment environment for your company is not easy. Comprehensive support is essential, including the bulk deployment of diverse payment method, robust security, stable systems, and accurate information to respond to changes. Collaboration with payment processing company partners with abundant Actual, high technical capabilities, and generous support systems is the key to the success of your e-commerce business.

For complex e-commerce payment strategies, consult GMO Payment Gateway, a pro at payment

Meeting diverse payment needs, preventing abandoned carts after EMV 3-D secure implementation, and building the best payment portfolio for your customer base can be challenging without expertise.

We at GMO Payment Gateway will recommend the best payment strategy that aligns with your business model and users based on one of the industry's largest adoption Actual and the latest consumer trend data like this article.

Talk to us about payment strategies to prevent lost opportunities and maximize sales for your company.

Research Report

payment method Intention Survey 2025

For product sales and service e-commerce, we will introduce the usage status of major payment method such as credit cards and PayPay, market share trends over the past three years, why consumers choose payment, and differences by gender, age, and annual income.

In addition, the report also discusses the impact of "EMV 3-D Secure," which has been mandatory in Credit card payment since April 2025, on the user purchasing experience, and explains with data that while security is enhanced, there are issues such as abandonment (abandoned cart) and difficulty of use.