- Top

- Service list

- PG Multi-Payment Service

- Option list

- GMO-PG Transaction Lending

GMO-PG Transaction Lending

This is a lending service provided to member stores that use payment

Features of GMO-PG Transaction Lending

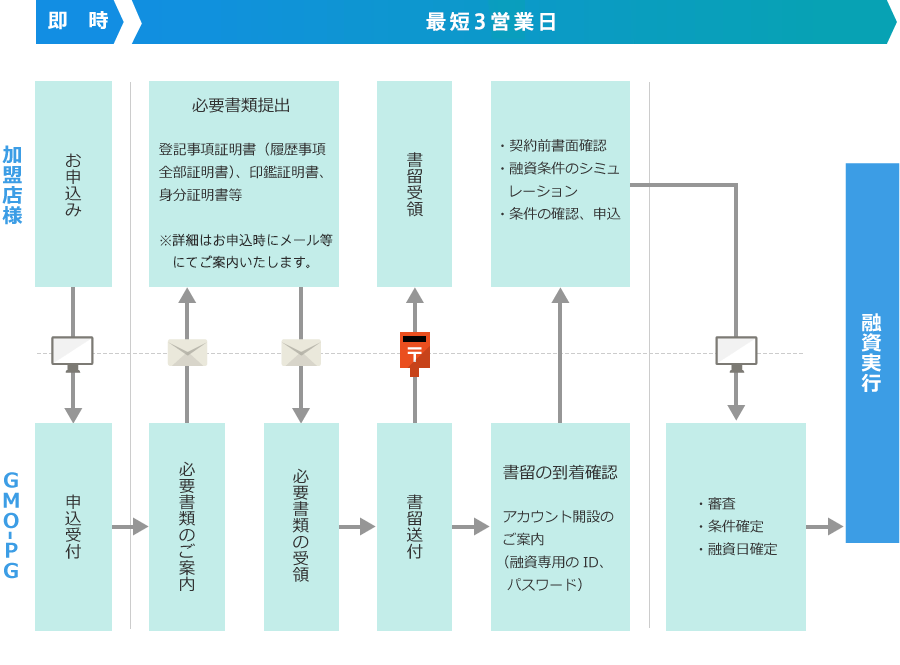

- ・ Loans can be executed in a minimum of 3 business days

- ・ contract is completed by email, no need to go out

- ・ No third party guarantor or collateral required

- ・ No prepayment fee required

Application criteria

Merchants using PG's payment

- * Public organizations / foundations and sole proprietors are not eligible.

Service overview

| Loan amount | 1 million yen to 30 million yen |

|---|---|

| Loan interest rate | Annual interest rate 2.00% -15.00% |

| Repayment method | ① Equal repayment of principal ② Lump-sum repayment of principal |

| Loan period | Equal repayment of principal: within 1 year Lump-sum repayment of principal: within 6 months |

| Number of repayments | Within 12 times |

| Guarantor collateral | No third party guarantor or collateral required |

| Delayed damages (real annual rate) | Annual interest rate 18.00% |

| Required documents | The register of the company borrower's register, a seal certificate, a copy of the driver's license of the person in charge, etc. Details will be announced at the time of application |

Customer success story

Spacey Co., Ltd.

![]()

![]()

Utilize "GMO-PG Transaction Lending" to raise funds in a timely manner according to the growth phase. We talked about the merits of using the service and the effects of its introduction.

もっと詳しくLoan application flow

- * The loan conditions may not meet your request due to the examination.

Repayment plan (example)

Documents required to open a loan account

All required documents 5 points (6 points in total if the person in charge of financing is not the representative)

* Except for Account transfer request forms and power of attorneys, it is possible to return the email.|

1. Loan account opening application |

|

2. Account transfer request form (*original required)・ Please enter the account registered at the time of payment service contract |

|

3. The register of the company (certificate of all history items) <within 6 months from the date of issue> |

|

4. Seal certificate <within 6 months from the date of issue> |

|

5. One of driver's license, Individual Number Card, Passport, Residence Card, etc. (*)<Those that are within the expiration date when we arrive> |

|

6. Power of attorney (* our prescribed form, original required)This is required if someone other than the representative is in charge of the loan business. |

FAQ

1. Inquiries / Request for materials

There is a review for lending. We may not be able to meet your request.

2. Please tell me how to apply

Please contact us from the application form. We will contact you with the necessary documents for the examination.

3. Can I get a loan immediately after opening an account?

If the application amount and loan conditions are met, we will make the transfer in 3 to 5 business days at the earliest.

4. Can I repay in advance and how much is the fee at that time?

I can do it. There is no fee.

5. Do you need collateral?

It is unsecured and unguaranteed.

6. How should I repay?

As a general rule, the payment service contract will be automatically deducted on the 26th of every month.

Inquiry

Loan service center

E-mail:gmoyuushi@gmo-pg.com

TEL :03-5784-3610(平日9:00~17:00)

Business owner

GMOペイメントゲートウェイ株式会社

東京都渋谷区道玄坂一丁目2番3号渋谷フクラス14F

貸金業登録番号:東京都知事(6)第30802号

■ Please check the loan conditions and use it in a planned manner.

Japan Money Lending Business Service Association Money Lending Business Consultation and Dispute Resolution Center

0570-051-051

(Reception hours 9: 00-17: 00 Closed: Saturdays, Sundays, national holidays, year-end and New Year holidays)

This service is applicable when the introduced EC site is operated by a corporation.

If the introductory EC site is operated by an individual, please check here.